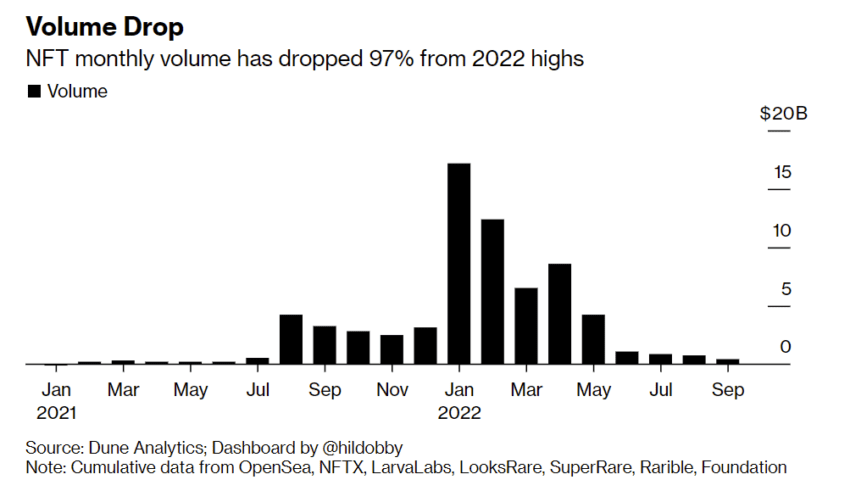

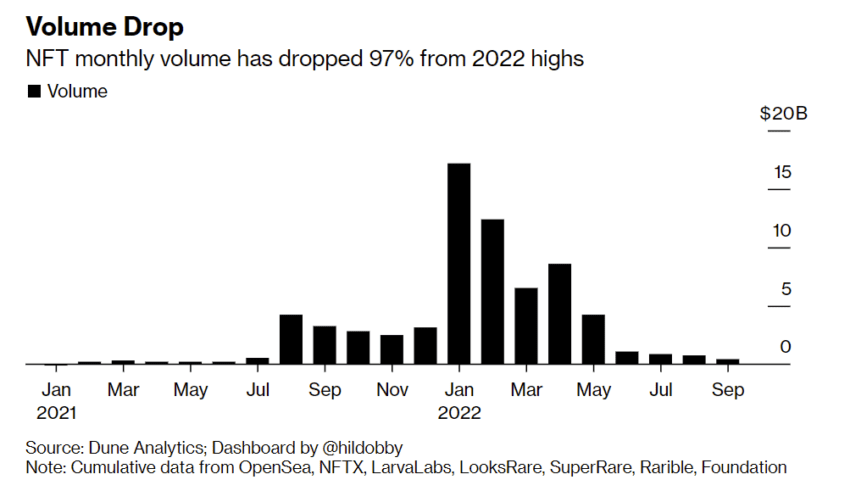

According to data from Dune Analytics, NFT trading volume is on a downward spiral. After reaching an apex of $17 billion in January 2022, Non-fungible tokens trading volume has fallen to around $470 million in September 2022, a whopping 97% drop in just 9 months.

This shows that the wild volatility and upheaval experienced in the financial markets has not only affected cryptocurrencies. The digital art/collectables market has also suffered a decline in terms of growth and adoption.

This trend is eliciting discussions around whether the NFT hype is fading or the possibility that the market is experiencing an adjustment.

NFTs on the decline

Specifically, the Dune Analytics report says that the monthly trade volume dropped to $466 million in September after reaching a high of about $17 billion at the beginning of 2022.

A deeper analysis shows that this crash is in tandem with a five months period of consecutive decline, as the interest in NFTs started to wane. Recall that in August, Technext did an analysis which says there was a 26% decline in the total volume of NFT sales between June and July 2022.

Read here: Global NFT sales volume declined by 26% in the past month

Also, according to data from DApps tracker DappRadar, over the third quarter of 2022, total sales of NFTs amounted to just $3.4 billion. This represents a drop of more than half from the previous quarter’s $8.4 billion, and nearly two-thirds from the first quarter peak of $12.5 billion in total sales.

The sales of NFTs on OpenSea, the largest marketplace for digital collectables plummeted in Q3 2022, a 60% decline compared with the second quarter, according to the data published by market analytics platform Cryptounfolded in October.

Finally, from a mid-January peak of over 900,000, the number of weekly sales of NFTs have also halved, according to data from NonFungible.com. Over the past three months, the number of sales have dropped over 50% to a daily average of just 23,000.

What is the cause of the decline?

Through 2021 to the beginning of the year, NFTs were the talk of the town as almost every other celebrity, artist, and company jumped on the train. The institutional adoption was also fueled by the enthusiasm behind cryptocurrencies that saw total market capitalisation reach $3 trillion when the market was at its peak in November last year.

However, NFT fortunes began to take an unfortunate turn in May as a result of rapidly tightening monetary policy.

Consequently, investment flows were being cut off from speculative assets, contributing to a bigger wipeout in the crypto industry. This saw around $2 trillion leave the market since its peak.

This wipeout of the global crypto market cap is a catalyst for the fall in interest and demand of NFTs.

The individual adoption rate has not improved significantly too as most buyers aren’t buying NFTs to keep for the long time.

Recall that in June, we analysed a survey which found that the vast majority of customers, particularly 64.3% of persons surveyed, only purchased digital collectibles in order to sell them at a higher price and make money. Another 14.7% purchased them in order to “join a community and flex,” while only 12.4% of NFT customers bought them for the sake of collecting digital art, and a very small portion (8.6%) purchased them to access games and tools.

Related post: 64% of traders buy NFTs just to make money

Hence, it shouldn’t come as a surprise that trading volume declined during the second and third quarter of the year, given that more than half of investors purchase NFTs only for the purpose of increasing their financial position and since the broader crypto market was no longer pofitable, they have moved on to other ventures.

Going forward

The NFT market is currently experiencing what can be branded a process of ‘separating the wheat from the chaff’. Those that are in for the bubble are currently being weeded out so the ones in for the tech can remain.

The NFT space would definitely make a comeback but before that can be done, the digital art world has to move on from just ‘worthless ape-themed jpegs’ to real life use cases like tokenisation of assets, arts and properties.

Just like it was reiterated by the speakers at the Technext Coinference 2.0, the largest blockchain gathering in Africa, which was held last week. See the report below: