It’s been a rush of a week and it is another Friday. It is a good time to rest from all that has happened through the week and reflect on the major news reports that have made the waves in the tech domain.

The past months have seen tech giants face the impact of an economic downturn that has crippled their revenue and cut down on their staff strength. Firms like Tesla, Amazon and Apple have been forced to review their hiring policy.

This week, global startups accelerator, Y Combinator announced that it would be slashing the summer 2022 cohort it is funding and training by 40%. The accelerator cited the current economic downturn and venture capital funding as the major cause for reducing its class size. In the same vein, Uber posted a second-quarter loss on Tuesday. Interestingly, the numbers beat analyst expectations of a $382 million in free cash flow for the first time ever.

If you missed these major news and updates, Good news, we got you have been covered with the Global Tech Roundup from across the world for this week.

Let us go:

YC’s 40% reduction

Y Combinator has reportedly cut the number of startups it is training and will possibly fund this summer by about half compared to its winter program, a spokesperson confirmed. YC is citing the current economic downturn and venture capital funding as the major cause of the reduction.

According to the announcement, this decision means that 250 companies will pitch themselves to potential investors in early September at Y Combinator’s virtual demo day, a biannual rite of passage that helped launch DoorDash and Coinbase.

The global increase in inflation, geopolitical crises such as the war in Ukraine, the tightening of monetary policies and the general diminishing of liquidity are eliciting panicky monetary responses from companies, investors and even accelerators in conserving and redirecting their investments and revenue expectations into few potential stocks.

Y Combinator’s Head of Communications, Lindsay Amos, confirmed the reduction, saying that the batch size is still large “relative to the last five years of batches.”

Meanwhile, the organisation recently told tech blog Newcomer that it might see itself supporting 1,000 businesses at a time. For clarity, Amos stated that YC didn’t cut back as a result of complaints or the expense of its expanding check size.

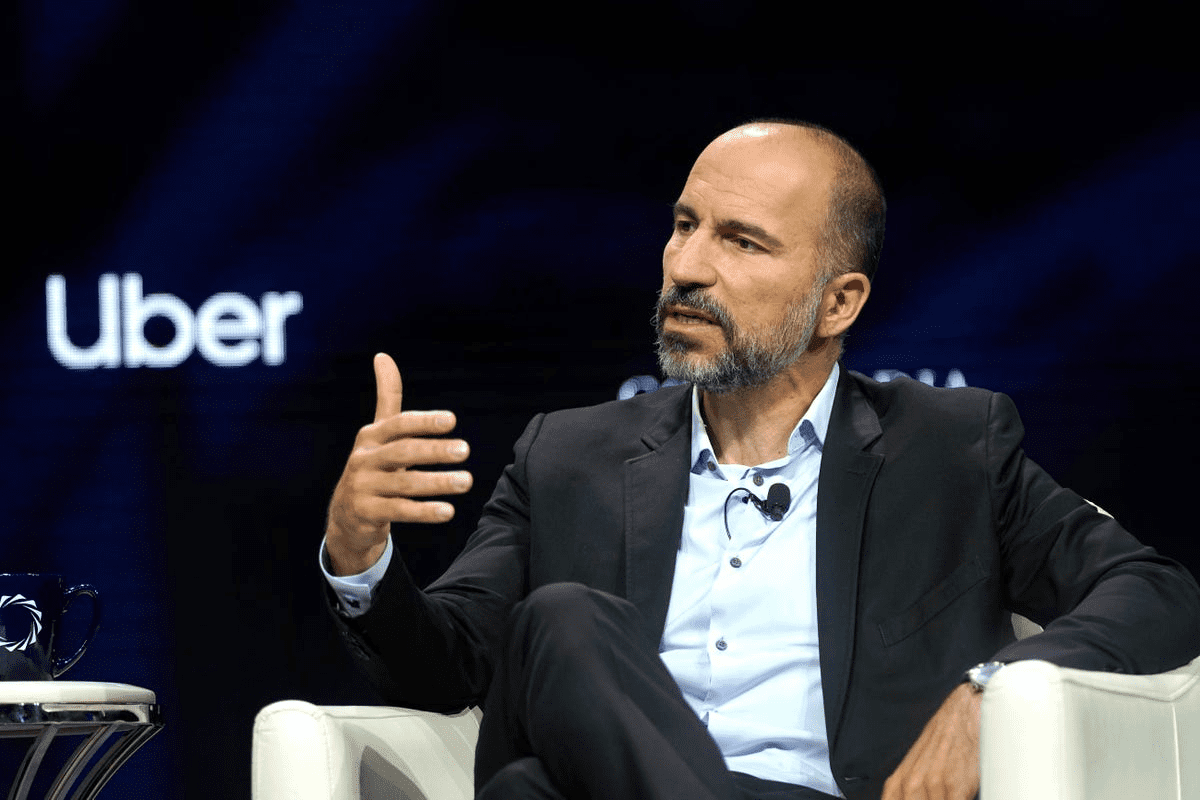

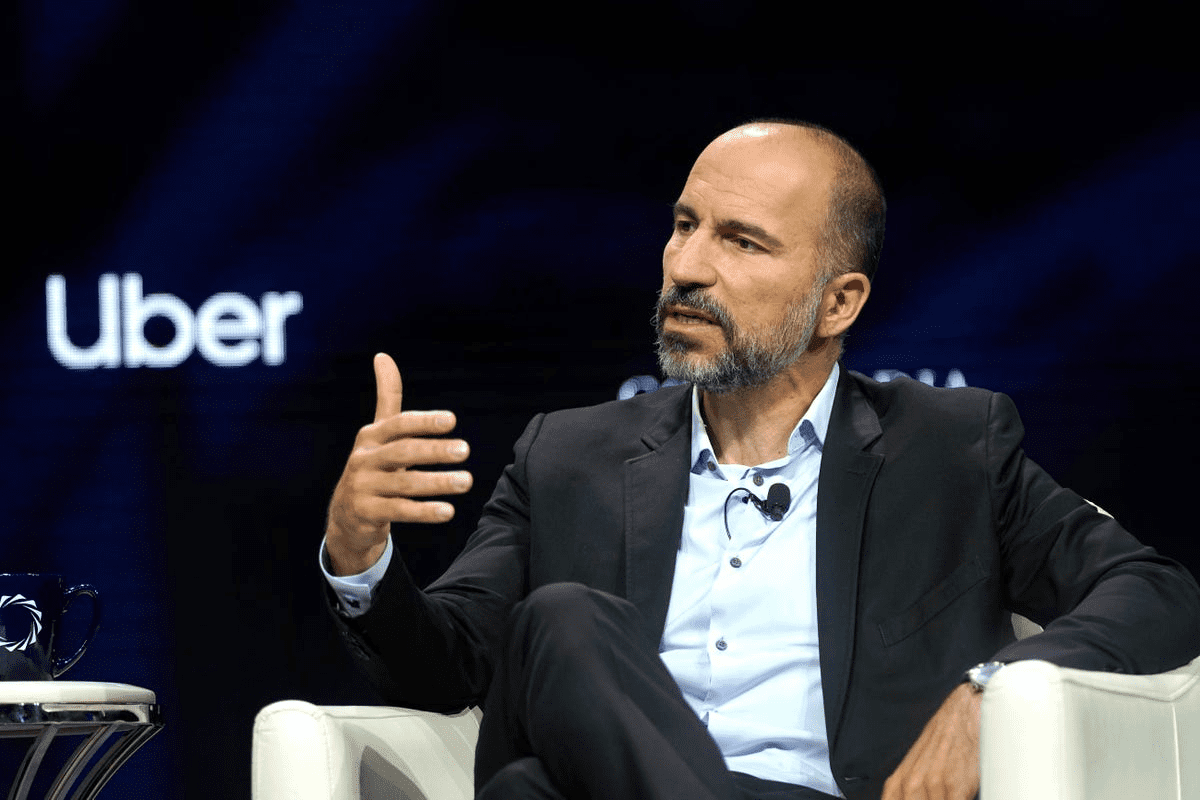

Consecutive losses for Uber, Revenue dwindles

This week, Uber reported a second-quarter loss even after beating analyst estimates for revenue posting $382 million in free cash flow for the first time ever.

Shares of Uber closed the day up 18.9%.

- Loss per share: $1.33, not comparable to estimates.

- Revenue: $8.07 billion vs. $7.39 billion estimated, according to a Refinitiv survey of analysts.

The company reported a net loss of $2.6 billion for the second quarter, $1.7 billion of which was attributed to investments and a revaluation of stakes in Aurora, Grab and Zomato.

But CEO Dara Khosrowshahi said in a prepared statement that Uber continues to benefit from an increase in on-demand transportation and a shift in spending from retail to services.

The company reported adjusted EBITDA of $364 million, ahead of the $240 million to $270 million range it provided in the first quarter. Gross bookings of $29.1 billion were up 33% year over year and in line with its forecast of $28.5 billion to $29.5 billion.

According to CNBC news, the trend continued during the second quarter. Its mobility segment reported $3.55 billion in revenue, compared with delivery’s $2.69 billion. Uber’s freight segment delivered $1.83 billion in revenue for the quarter. Revenue doesn’t include the additional taxes, tolls and fees from gross bookings.

Sheryl Sandberg finally steps down from Meta

in June, we reported that Sheryl Sandberg, one of Silicon Valley’s most successful women and current chief operating officer of Meta (formerly Facebook), announced that she would be stepping down from her role as Facebook’s COO this fall.

Meta has confirmed that its long-standing chief operating officer (COO) Sheryl Sandberg has exited her role days ago (August 1), according to an official filing with the SEC in a filing days ago.

Meta confirmed the transition is now complete. Moving forward, Sandberg will remain a Meta employee through September 30, 2022, after which she will continue purely as a board member.

According to TechCrunch, the switch comes at a torrid time for Meta, having just reported its first-ever quarterly revenue decline. Similarly, the FTC has confirmed that it was suing Meta to block its acquisition of VR fitness studio Within.

In addition, Meta just can’t seem to shake off the Cambridge Analytica data scandal, an episode that involved a U.K. political consulting firm siphoning Facebook data as a means to predict and influence voters’ behaviour through targeted ads.

“Looking forward, I don’t plan to replace Sheryl’s role in our existing structure,” Zuckerberg noted. “I’m not sure that would be possible since she’s a superstar who defined the COO role in her own unique way. But even if it were possible, I think Meta has reached the point where it makes sense for our product and business groups to be more closely integrated, rather than having all the business and operations functions organized separately from our products.”

The travails of Elon Musk continues

The Elon Musk versus Twitter fight is now affecting Goldman Sachs and JPMorgan.

Elon Musk has subpoenaed Goldman Sachs and JPMorgan Chase for details on how the two Wall Street banks advised Twitter on his proposed $44bn buyout of the social media company, which the Tesla chief executive is now seeking to abandon according to Financial Times reports.

Remember our recent Tech Bytes podcast where we delved into the lingering battle between Musk and Twitter, and the possibilities that might occur after litigation procedures?

Recall that our guest believed the initial bid was an impulsive decision by Musk devoid of the usual due diligence required for such a purchase. He believes the actual motivation is probably his desire to sell some of his Tesla stocks.

Hence, he inferred that Elon Musk stands to benefit from the outcome of any legal dispute since Twitter as a company would suffer enormous harm in its revenues and reputation, which would force it to take all reasonable measures to make Musk reach a quick settlement.

Well, now, Musk is looking for any documents and correspondence that Twitter and Goldman Sachs and JP Morgan may have exchanged. He is interested in learning about the banks’ evaluations of Twitter’s financial performance, their conversations with the business regarding a merger, and any evaluations of its value.

Musk also subpoenaed Allen & Co, which advised the social media platform along with Goldman and JPMorgan.

So far, JPMorgan and Goldman have declined to comment, while Allen & Co did not immediately respond to a request for comment. Goldman will earn $80mn from advising Twitter on the deal but only $15mn if the transaction falls through.

JPMorgan stands to make $53mn but will pocket just $5mn if Musk leaves the deal.