High transaction costs and manual processes are the biggest hindrances to the growth of business-to-business (B2B payments) in Africa. This is according to a new report by Duplo, a fintech company dedicated to developing solutions for B2B transactions across Africa.

According to Duplo, the list of the challenging factors was derived from a survey conducted among more than 1,000 business owners from Kenya, Nigeria, South Africa, and Egypt.

According to the report, both challenges (high transaction costs and manual processes) dominated the list of challenges shared with a 50.5% occurrence rate in respondents’ feedback (high transaction cost- 32.1%, manual processes- 18.4%).

The report listed the low speed of business transactions as the next big challenge with an 18.0% report rate. Uncustomised solutions accounted for 13.5% just as unreliable payment methods polled 9.4%.

– The State of B2B

Figures from the report also show that only 2.3% of the respondents in the report are not having any problems with their B2B payments provider. This means that 97.7% of existing B2B platform users face at least one form of challenge using existing services.

Payments in Africa by Duplo

What B2B payment users prefer

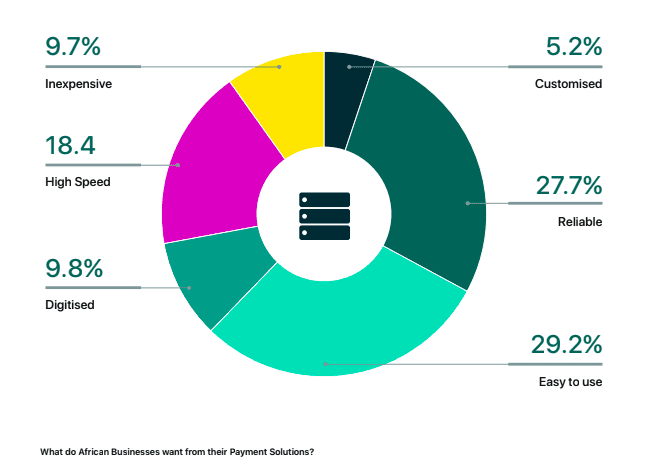

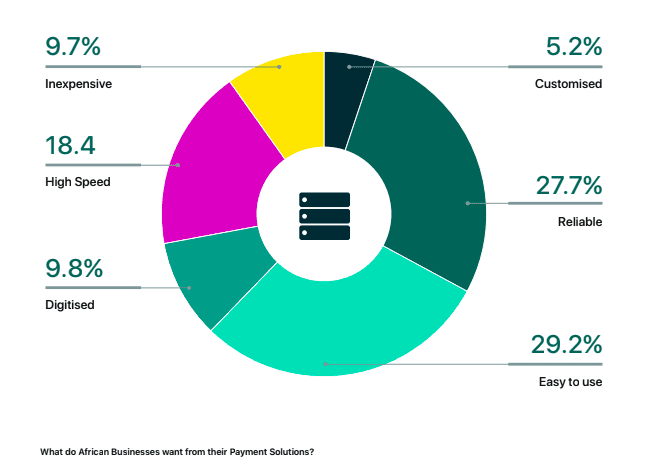

The report also lists a number of the factors that influence the choice of African business owners when deciding what B2B payment to use.

From the statistics gathered, 29.2% of users of B2B platforms indicate that they will stick with service providers that ensured ease of use above all factors. About 27.7% settled for reliability above all other considerations while 18.4% will opt for a service provider that guarantees high speed.

9.8% picked digitised solutions as a priority while 9.7% listed affordable processing cost as a leading point of consideration. Also, 5.2% of the respondents said they would rather pick B2B platforms that provided customised offerings.

But, the picture isn’t all gloomy.

Africa is a unique space for B2B payments. One thing that’s common across the continent’s largest markets is how businesses transact.

There are some interesting patterns that define the landscape across the continent. Industry, size, and other key features shape this. The biggest users of mobile money in Africa are Kenya and Ghana. This influences how these countries process B2B transactions.

Mobile Money is to Kenyans and Ghanaians what Bank Transfer is to Nigerians

The State of B2B Payments in Africa

According to the report, the rate of use of mobile money as a form of B2B payment in Kenya and Ghana stands at 15.5% and 21% respectively.

The story is slightly different in Nigeria where businesses are taking more interest in digital payment options (e-banking, mobile apps and online transfers). This is in line with a report by steady the NIBSS in a recent e-payment volume that suggests that bank transfers and other digitised payments are on their way to replacing cash transactions in the nearest future.

Some analysts believe that the Cash-less policies of Nigeria’s apex bank. the Central Bank of Nigeria (CBN) may have contributed significantly to this growing trend. “All thanks to a strong real-time payment processing infrastructure and solid backing by the government through the introduction of cashless policies in 2012”- the report said.

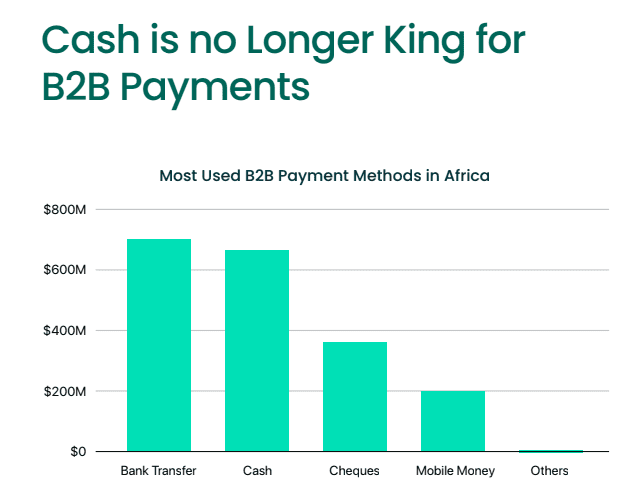

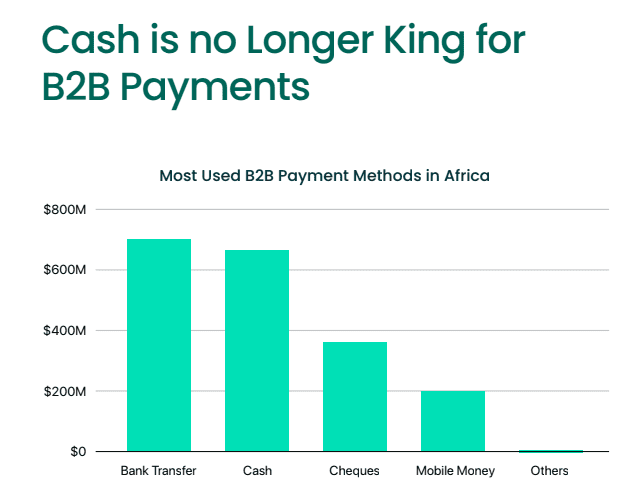

In Africa, Cash is no longer king!

The report also revealed that across Africa bank transfers are fast becoming the most common medium for making and receiving payments between businesses, far more commonly used than cash, cheques, and mobile money together.

85% of respondents chose bank transfers as one of the ways they made payments to other businesses, compared to 60% for cash, 23% for cheques, and 17% for mobile money.

62% of the businesses revealed that they received payments from other businesses via bank transfers, compared to 59% for cash, 32% for cheques, and 15% for mobile money.

Commenting on the importance of the report, Chief Executive Officer and co-founder of Duplo, Yele Oyekola, said, “African businesses, large and small, are the lifeblood of the continent’s economy, and making it easier for more to flow between them should be a priority.

“The data from the report highlights a much-needed transition from cash-based payments but that is just the beginning. There are still various challenges in the payment process that make it difficult for businesses to maximise opportunities to scale their operations. We need to constantly innovate around these challenges to more effectively position African businesses for the growth they need to power economic growth on the continent.”

Bottom line

The drive to eliminate cash as the first option in business-business transactions rests on successful collaboration between a number of key industry players. It is also important to understand the market peculiarities that exist across different countries on the continent. The biggest users of mobile money in Africa are Kenya and Ghana.

As the report suggests, a cashless economy does not mean the total elimination of cash as physical money will continue to be a means of exchange for goods and services in the foreseeable future. It is a financial environment that minimizes the use of physical cash by providing alternative channels for making payments.

This is a growing trend. We are not there yet!