MTN Nigeria’s Payment Service Bank (PSB) MoMo has claimed it has been defrauded over ₦22 billion ($53 million) in a filing against 18 commercial banks after just one month in operation.

The MoMo PSB claims the funds were transferred in error to 8,000 accounts maintained by the 18 banks’ customers.

The PSB made this known through an originating summon dated May 30 by its counsel, Lotanna Chuka Okoli (SAN). It claims that erroneous transfers it made to individual’s bank were its own funds and not that of the customers.

Anthony Usoro Usoro, CEO of MoMo PSB Ltd, stated in an affidavit supporting the originating summons that MoMo PSB Ltd is the legitimate owner of the total amount of ₦22.3 billion that is kept in its MoMo settlement account.

Related story: GTBank gets PSB license for HabariPay, joins MTN, Airtel in race for the unbanked

The MTN bank is asking the court to issue an order mandating that each of the 18 banks separately account for the funds that are still in their customers’ accounts as well as the funds that have been taken out by those same customers and are no longer there.

The suit by MoMo

Anthony Usoro Usoro, the chief executive officer of MoMo PSB, asserted in the lawsuit that the fraud involved 700,000 transactions in all over the course of one month.

The PSB apparently shut down its service on May 24 after becoming aware of the fraud to limit future exposure.

After filing the affidavit supporting the original summons, Anthony Usoro Usoro claimed that money had been mistakenly transferred from its settlement account to other accounts managed by the 18 partner banks on or around this date.

The transfers were due to the fact that the plaintiff suffered system exploitation which led to the said debits. There is no transaction between the plaintiff [MoMo PSB] and the recipient account holders that warranted the transfer of the funds to those accounts.

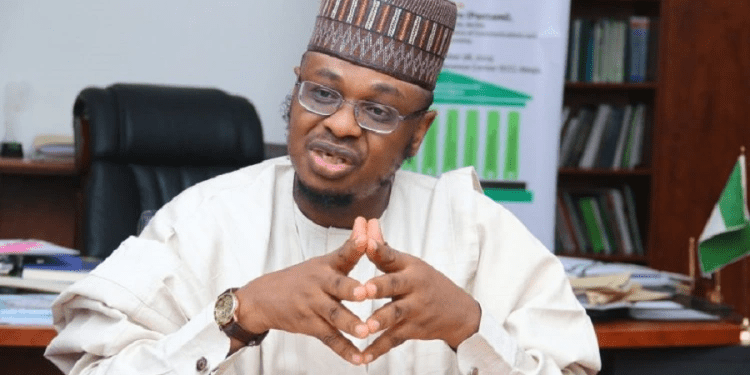

Mr. Anthony Usoro Usoro, MTN MoMo Psb CEO

According to MoMo, the 18 banks must make refunds and provide the necessary information in accordance with the Central Bank of Nigeria’s (CBN) Regulation on Instant (Inter-Bank) Electronic Funds Transfer Services, which was made in accordance with sections 2(D), 33(1)6, and 47(2) of the CBN Act 2007.

Among the affected banks are Access Bank, Ecobank, Fidelity Bank, FirstBank, First City Monument Bank, Guaranty Trust Bank, Heritage Bank, Polaris Bank, Providus Bank, Stanbic IBTC, Standard Chartered, Sterling Bank, SunTrust Bank, Union Bank, United Bank for Africa, Unity Bank, Wema Bank, and Zenith Bank, which have also been listed as defendants in the lawsuit.

MTN’s MoMo is was one of the first PSB operators in the country to be given license to operate in the country, together with Airtel’s SMART CASh and GTCO’s HabariPay.

Also, it is the first PSB to commence operation in the country after it began commercial operations in Nigeria last month.