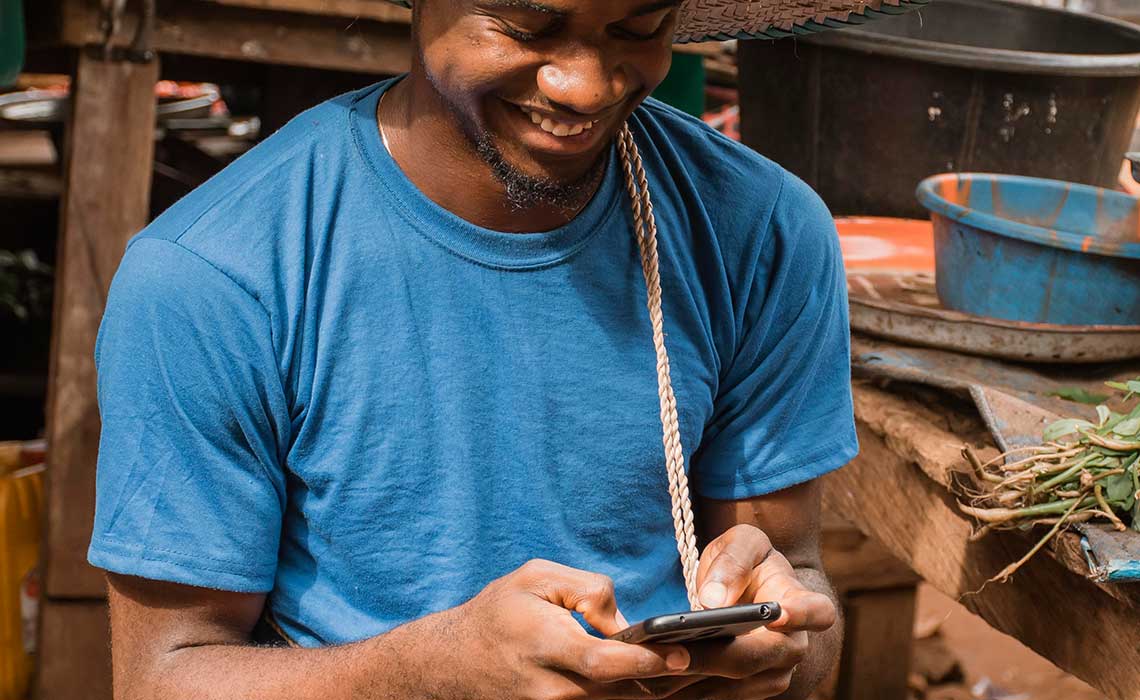

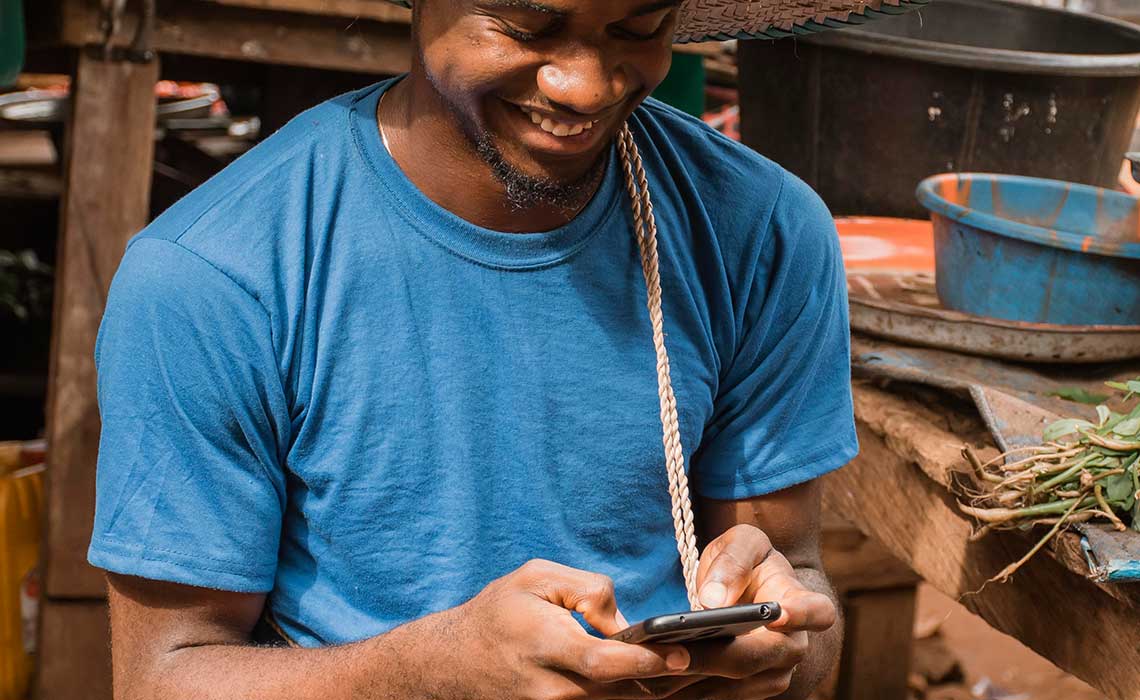

Kaspersky– A global cybersecurity and digital privacy company, asserts that over 90% of Nigerians increased their usage of digital platforms and e-wallets for payments in 2021.

In a survey conducted by the online digital platform yesterday, it found out that due to several reasons accruing from the pandemic in 2020, many individuals now preferred the use of their mobile banking apps as well as their e-wallets to carryout payments that they normally would have been done migrating to the nearest banking hall as at before the pandemic.

According to Kaspersky, people now found it more convenient to carry out these transactions and maintain the social distancing mantra altogether, which all goes to give credit to the saying, “acquired habits stay in”.

The survey revealed that 98% of the respondents now prefer and intend to use internet banking and e-wallet services after the pandemic. For convenience sake, 96% of the respondents preferred using their digital banking platform, and 51% of respondents did prefer having to manage their financial information online.

Read also: Next of kin: The dangers of undisclosed investments among young Nigerians

However, when asked about their reservations prior to using mobile banking and payment apps, about 49% of users admitted their fears of having their data stored online and 31% of them didn’t trust the security of these platforms to secure their information. Nearly 3 in 10 revealed that they are afraid of losing money online. 31% don’t have any reservations at all.

It is apparent that even while most Nigerians are gradually adapting to the new possibilities posed by the pandemic for more robust digitally aware citizens and individuals, some kind of reservation for digital platforms still exists.

Quite a number of Nigerians fall prey to cyber theft according to a report from the Federal Bureau of Investigation (FBI). The FBI listed Nigeria as the 16th country worst affected by cybercrime.

Irrespective of the concerns and reservations of Nigerians on their usage of digital platforms for payment, the statement by Bethel Opil, Enterprise Sales Manager at Kaspersky, reiterates facts on the opportunities brought about by the pandemic, to Nigerians and the world.

Digital payment services are gaining more adopters despite the concerns and reservations. The pandemic was an opportunity in disguise for people to understand, learn and use digital payments services at their disposal for their own benefit.

Bethwel Opil

We can use the data presented to argue that recognition and acceptance of digital platforms are more widespread than ever. However, the government needs to do more by investing in cybersecurity to prevent catastrophic occurrences that could crush the already establishing confidence of the citizens in a digital economy.

To help users embrace digital payment technologies securely, Kaspersky experts suggest the following:

- Do not share your PIN, password or any other financial information with anyone online or offline.

- Avoid using public Wi-Fi to make any online transactions.

- Use a separate credit or debit card to make online transactions. Set a spending limit on the card which can help keep a track of financial transactions.

- Shop from trusted and official websites

For developers, banks and companies involved in providing digital payment services, Kaspersky recommends:

- Invest in holistic cybersecurity solutions that can help detect fraud across multiple levels of online payment processes and consumer touchpoint.

- Complex attacks by APT groups on financial institutions are also on a rise. In-depth visibility and threat intelligence are a necessity to keep customers protected and to ensure business continuity. Using the Kaspersky Threat Intelligence service is helpful to support your IT teams in analysing and mitigating threats.

- Conduct cyber awareness training for employees continuously. This will help employees know the red flags to look for when an organisation is under attack and to understand their role in protecting the organisation.

Sustainability is a big question here, and while we argue that digital platforms are documenting phenomenal growth patterns, and expanding beyond their launch borders, there is more to be done. And, the private and public sectors of the economy should be doing this together.