There was a time when buying shares was a prioritised investment option, and most of our parents bought as many shares as they could. Companies like First Bank, Nestle, Cadbury, Nigerian Breweries and even some now-defunct enterprises like Allied Petroleum (AP), Savannah Bank etc., had at least a shareholder from households across Nigerian cities.

Fast forward into the future, the front-burners are different but the same motivation drives it – economic opportunities and realities. And with the advent of technology, young people find themselves latching on with the expectation that these innovations would be their ticket out of poverty and lack.

For instance, even though there wasn’t an institution for training software developers in Nigeria in the early days, many early developers nonetheless trained themselves and took a gamble on the emerging space as a means to financial sustenance. It paid off, and many early developers are running today’s Nigerian tech space.

Besides that, many Nigerians who bought early into cryptos like Bitcoin cashed out big time. This has caused many later adopters of teeming youths to rue their losses and position themselves for the next big innovation they could take advantage of, hopefully at its infancy.

This is where NFT comes in.

NFT and the youth debacle

According to data from Trading Economics, Nigeria’s youth unemployment rate hit 55% in 2020. While this figure is expected to fall to 53% by the end of 2022, it vividly paints youths’ difficult situation in the country. This means the average Nigerian youth is hungry for financial success.

While some of them are willing to go the route of patient hard work, there are others who can’t afford that luxury of time. The get-rich-quick drive of young Nigerians has been widely documented. This has led many youths to such vices as online fraud, and has pushed others to the more honourable paths like cryptos and now NFTs.

A conversation with the average Nigerian young person about NFT reveals a lot of confusion about what NFT is. But more importantly, they are confused about how best to take advantage of it for financial gains to better their financial situations and those of people around them.

Many young people see NFT the way they see cryptos – some kind of digital currency they could invest in today and reap bountifully tomorrow. But the truth is, NFT is not exactly a digital currency like Bitcoin or Ethereum. On the contrary, it is more of a token. Simply put, an NFT is a token on the blockchain that proves ownership of a digital item.

Each NFT has a unique digital number that identifies it once it is logged into the blockchain smart contract. Thus, no two NFTs are the same.

So the primary purpose of NFT is to help maintain originality and help the owner of digital works prove ownership of their works. This is contrary to what many young Nigerians think that NFT is primarily a means to financial ends. This is quite similar to the wrong notion we have about cryptocurrencies. While their original aim was to simplify and crash the prices of international transactions, many Nigerians see them as commodities to be traded for financial gains.

Images, paintings and general works of art are the most common items stored and sold as NFTs today, but they aren’t the only ones. Practically anything can be converted and even sold as NFT. They include physical assets like wristwatches and phones, services like baking and advanced tutoring, and content like films, music, books etc. Even special moments of, say a sporting event, can be preserved as NFT. However, their NFT versions have to be produced as digital artwork.

“There are a lot of copyrights violations around the world today. Musicians suffer from copyright violations a lot, people take paintings, music, they copy it and they resell. But with NFT, once you mint that picture or painting, it becomes the only one existing. If someone wants to check the authenticity, they only need to copy the address and check it on the block explorer.”

Jonathan Emmanuel Zenith Chain CEO

While not widespread yet, the later offerings can be achieved by taking advantage of the smart contract characteristics of NFTs and other blockchain-based technologies. With smart contracts, owners of these original items, say a book, could undertake to deliver an actual copy of it to anyone who buys the NFT.

In a nutshell, unless one has original items (and services) worth preserving and selling as NFTs, this technology by itself might not be the financial rescue many people think it to be.

Minting and selling NFT doesn’t come easy

As earlier noted, the primary purpose of NFT is to preserve (and sell) original works that have been converted into digital format on the blockchain. This means such works first need to be converted into digital formats, after which they have to be minted into NFTs.

Minting of NFT derives from the process of creating money. So, just like coins, NFTs are minted. The process of minting NFT is not a jolly one, however. The minter needs to have a crypto wallet linked to his NFT marketplace account. This crypto wallet will fund all expenses required in the process.

NFTs can only be minted on a blockchain platform. This includes platforms like Ethereum, the most popular, Tezos, Flow, EoSio, and several others. To mint on any platform, you need to have the cryptocurrency of that platform in your wallet. This will serve as your legal tender for payment. Ethereum’s crypto is Ether (Eth), Tezos’ crypto is Tez (XTZ), EoSio crypto is the EOS etc.

Minting NFT requires payment of gas fees. This is especially so for minting on Ethereum. The reason for gas fees is that every transaction on the blockchain (like minting an NFT) requires miners who expend some serious computational power in executing them. Gas is the unit for measuring the computational power required to perform a transaction (like minting an NFT).

The gas fee is, therefore, the payment made for executing the transactions. Payment for Ethereum gas fees is measured in Gwei which is 0.000000001 Ether. The minimum amount of gas units required for any blockchain transaction on Ethereum is 21,000 units. Depending on the amount of gas units required and the base fee charged plus tips required to carry out the transaction (minting), sometimes, the gas fee for minting a collection of NFTs could run into several hundred dollars.

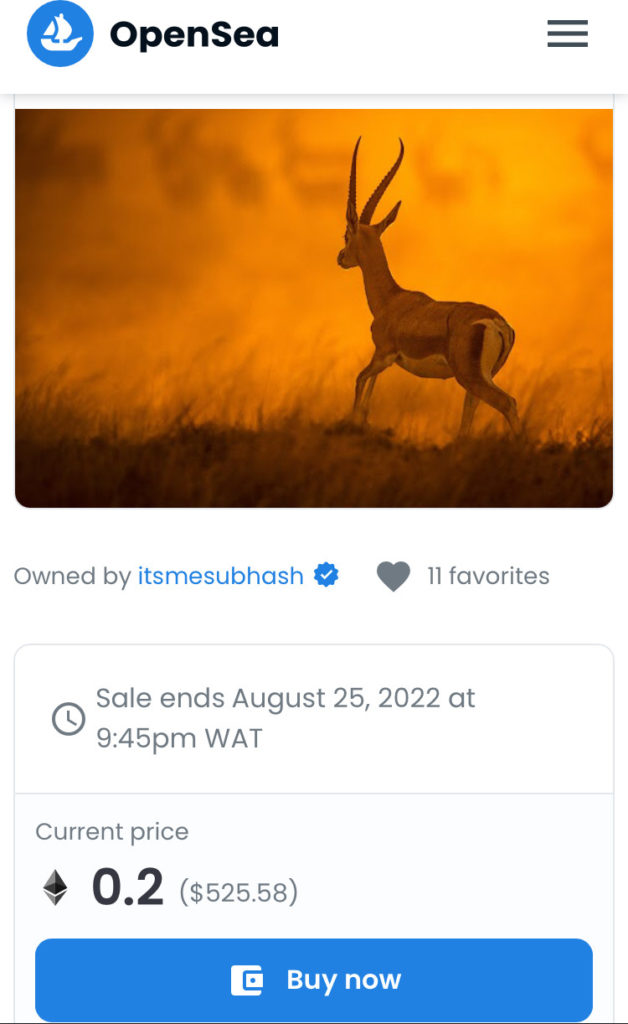

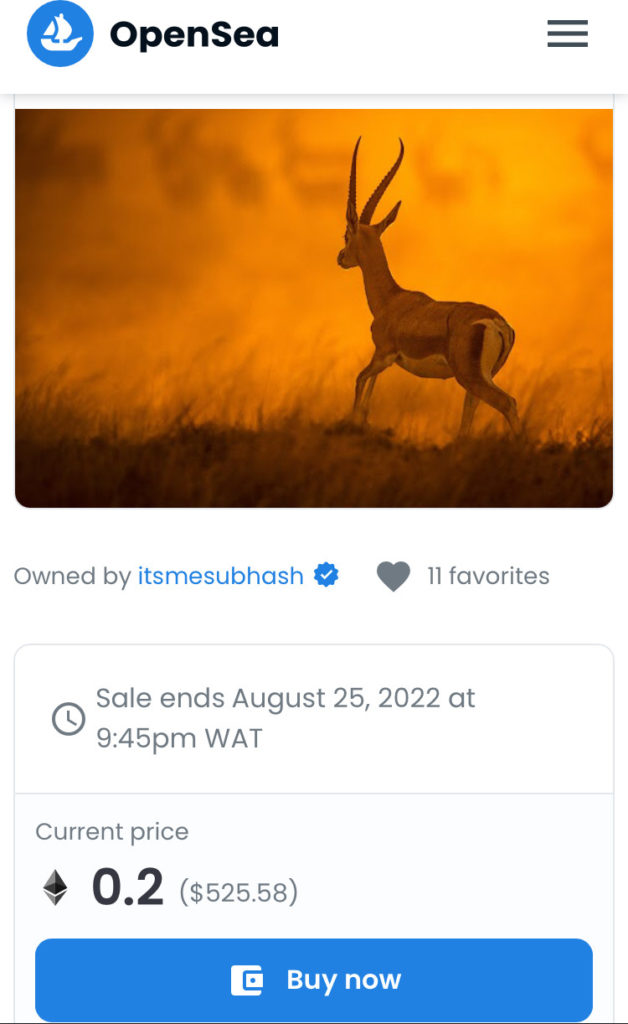

Now, there are NFT marketplaces that facilitate the minting and mostly selling of NFTs. The most popular of them is Opensea which is hosted on the Ethereum blockchain. However, there are other marketplaces like Rarible (on Ethereum blockchain) and Eos (on the Eosio blockchain). A marketplace like Opensea offers the lazy-minting option. With this option, you can place your NFT on sale without minting it. Once a buyer buys it you can then mint it out. In this case, the buyer usually pays for the gas fees.

Marketplaces usually charge up to 2.5% of the price of an NFT as fee for their services. Creators also have to pay for the gas fee for all transactions. The first of these gas fees reportedly range between $70 to $300 while the second costs between $10 to $30. There are gas fee trackers that could help you decide when the fees are low enough to save you cost.

It is important to note that minting of NFT does not guarantee that you will sell such an NFT. There’s also a possibility that if you eventually sell, your cost of production might exceed your selling price. Therefore, physical trading and NFT marketplaces might not be very different.

Should you be too worried if you aren’t doing NFT?

Indeed NFT is the new rave in town. But should young Nigerians be worried if they aren’t catching up or latching on to the trend? For producers of digital arts, collectables, music, videos, wearables and other creatives that could easily be pirated or stolen, the answer is yes, because NFT helps them preserve the originality of their works and be exposed to a wider market.

But the marketplaces are not that big enough yet. A platform like Opensea only recently crossed 1 million users. Rarible boasts about 1.6 million, according to Business Insider. These platforms will surely grow more prominent as more people adopt the technology, though.

More intriguing is the fact that the platforms haven’t been much adopted by Africans yet. A look at Opensea’s visitor map on Alexa reveals that a bulk of visitors are from the US (33.5%), India (7.7%) and South Korea (5.7%). The number out of Africa is not significant. This isn’t different from Rarible which is the second most popular, and indeed other marketplaces.

This means the digital product of a Nigerian needs to have international appeal to attract these non-Nigerian, non-African visitors. But more importantly, it may also mean your customers are probably not on that timeline. A look through Opensea shows lots of Africa-themed and African-owned NFTs without offers for them. Those with offers don’t do anywhere as well as their overseas counterparts.

Therefore before going ahead to mint and display that product or service as NFT, you need to be sure there’s a market for it on the marketplace and indeed elsewhere.

Conversely, an NFT creator might have to build their own audience and market. This explains why NFT creators are the biggest users of Twitter Spaces. Here they publicise their NFT collections to potential buyers and collectors. These Spaces are replete with many Nigerian NFT creators stuck with finding buyers for their digital products.

Also, note that buyers must have crypto wallets and enough native cryptos (Ether or EOS etc.) to buy the items. Essentially, converting traditional buyers of your physical product to NFT buyers presents the challenge of converting them to crypto experts. It is essential to see NFT marketplaces as new avenues for making sales.

Furthermore, while you might have heard of NFTs being sold for several million dollars, it is very important to note that most NFTs don’t get to sell anywhere near that high. Indeed, the average price for NFTs ranges from a few hundred to a few thousand dollars. And these depend on the value the product offers. It’s rare to see NFT sold for millions of dollars.

For folks who plan to make money reselling NFTs, it is important to note that during the minting process, the creators of the NFTs usually schedule royalties for themselves. This means they receive a commission each time their work is resold to someone else or traded on the secondary market.

In summary

You may spend money minting NFTs but end up not selling and making money. That doesn’t mean you can’t earn some income by creating and selling your own NFTs though. However, like every other business, you need to establish a reputable and popular brand around your NFT.

Furthermore, your product or service must have underlying value otherwise it won’t sell much. It is therefore important to ask yourself the following questions:

- What value do you expect your consumer to derive from buying your NFT?

- Why exactly are you offering your product or service in NFT form?

- Is there a demand for your product or service especially on the NFT marketplaces?

- Are you ready to actively build a community of customers interested in your NFT offering?

- Did you present your NFT in a unique and creative way so that it stands out from others?

- Most importantly, are you creating NFTs just for the purpose of making money?

For young Nigerians, the answer to the last question would be ‘yes’. While it will be a very valid answer given the economic situation, it is usually the first step to becoming disappointed. If your response to these questions show that your product is not ready for the NFT marketplace, then it certainly isn’t for you and there’s no need wasting your money on the venture.

If you must venture into it, it is important to note that there are many scammers and online fraudsters in that space as well. One of the ways they get you is by requesting your seed phrase which usually consists 12 to 24 words.

A seed phrase is a series of words generated by your cryptocurrency wallet that give you access to the crypto associated with that wallet. Think of a wallet as being similar to a password manager for crypto, and the seed phrase as being like the master password.

Coinbase

If scammers have your seed phrase, they will have access to all of the crypto associated with the wallet that generated the phrase. Even if you delete or lose the wallet, they will still be having a field day with it.

It is crucial to ensure that the marketplaces and other sites you use have solid reputations in the industry. You might also want to store your NFTs on a hardware wallet. A hardware wallet is a cryptocurrency wallet that stores your private keys to authorise outgoing transactions.

In the end, NFT is an exciting technology. However, not everybody is ready for it, especially in Africa. So before you venture into it, be sure to have all your strategies in place to guarantee your success.