It is tech and cryptocurrencies leading our conversations these days. You look left, or right, or back, or front, you are surrounded by digital realities that will determine the future. The now and the future is humanity-oriented and it is driven by cryptocurrency platforms like Tradefada.

Cryptocurrency exchange platforms give users the tools to trade different digital currencies. These platforms make it easy to buy and sell currencies and usually have strong security features.

In February 2021, the Central Bank of Nigeria (CBN) ruled that all financial institutions stop facilitating crypto transactions and desist from transacting with entities engaging in crypto. Despite this, crypto exchanges in Nigeria have found ways to serve their customers through peer-peer exchanges.

Tradefada, a Nigerian crypto exchange platform found a safe and compliant way of conducting business – the cash voucher payment system, in partnership with AfriTickets. Founded in 2017 by Seun Dania, Tradefada is an all-in-one crypto exchange that provides on-ramp and off-ramp services and spot exchange.

Seun’s foray into the crypto space started as a curiosity. He wanted to know how payments would work in the new age, one which held lofty expectations.

The electronics and computer engineering graduate of the Lagos State University (LASU), while working as an IT Manager at an Oil and Gas company started selling e-gold and Liberty Reserve. Both currencies were centralised and when they were shut down, all his assets were frozen by United States courts.

With the advent of bitcoin in 2009 came his decision to build an exchange after clearly understanding what decentralisation was all about, and the fact that no government could shut it down. He built 234 Exchange to give people a platform to buy, sell, and transfer digital currencies. Tradefada came later to accommodate new features.

Tradefada Services

Tradefada services extends to over 30 countries, providing easy access to buy and sell crypto for various fiat currencies, made possible through a partnership with a third party service provider, Moon Pay.

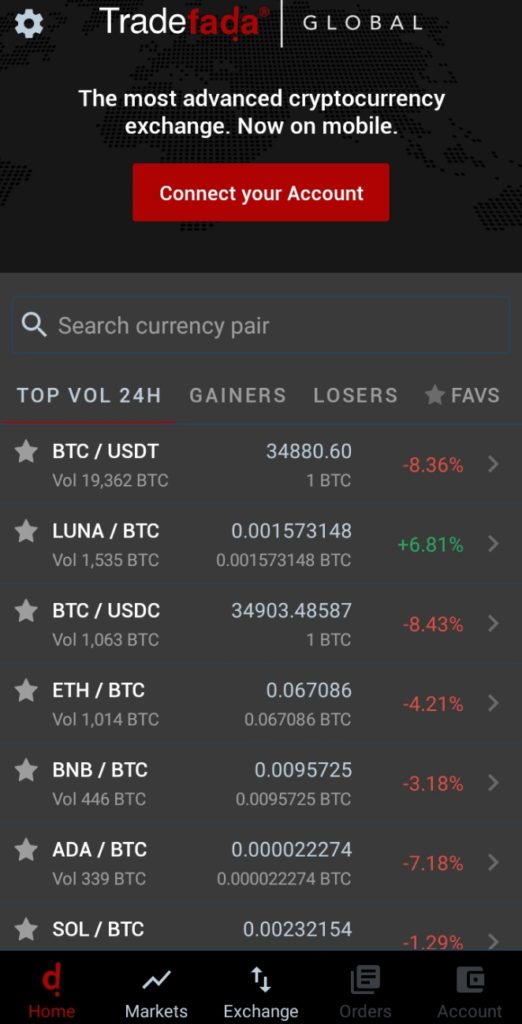

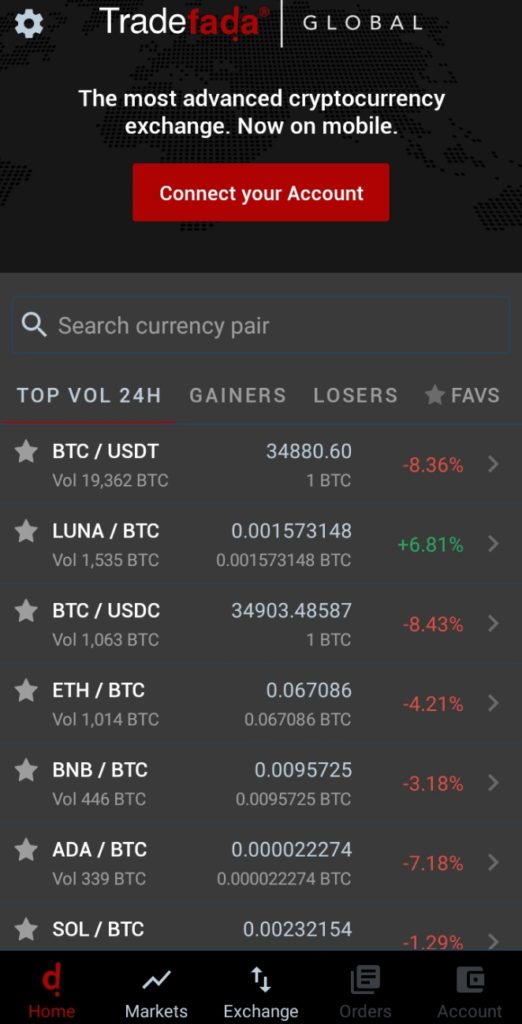

On TradeFada, users can trade crypto-crypto on the spot on over 100 trading pairs including Bitcoin, Ethereum, USDT, Dogecoin, PAX, Polkadot, Unobtanium, Ethereum Classic, Litecoin, Ripple, Cardano, AAVE, etc.

The spot exchange, available on the Tradefada mobile app on iOS and Android devices, boasts high security as users are mandated to use high complex passwords and enable Multi-Factor Authentication on their accounts.

Seun himself is a certified ethical hacker and Information Securities specialist, so he makes sure there is periodic auditing and system checks for vulnerabilities. Users can store their currencies on the exchange’s enterprise-grade wallet, which abides by the highest security standards for protection and reliability.

Tradefada is very secured and fully insured. We also have very strict AML policies whereby we are able to verify every transaction.

Seun Dania, CEO

Operating in a strict regulatory market like Nigeria of course has its challenges, the biggest of which is the CBN ban which took Tradefada out of business until the cash voucher system.

Read also: 2021 in Review: The biggest consequences of CBN’s crypto ban

Seun’s work in the corporate sector informs his need to stay informed through regular research. As part of the committee that worked on the digital assets framework for fintech for SEC, Seun goes the extra mile to make sure Tradefafa is compliant and operates as a standard organisation.

‘For each of the currencies listed on Tradefada, there are legal opinions done by lawyers who clearly define whether they are securities, tokens or cryptocurrency. We do not operate in countries that have strict regulations against crypto or sanctions. We do our proper KYC’, he says.

With three teams operating out of Nigeria, United States and Eastern Europe, Tradefada has recorded a monthly growth of about 1000 users. The CEO boasts of being the most liquid Nigerian spot exchange at the moment, processing over a billion dollars on the spot exchange daily.

While he admits that there are a lot of bigger exchanges, he says only a few ‘care about the Nigerian people’. To him, their focus is simply on the numbers they can pull from the Nigerian market.

“For us at Tradefada, we are a Nigerian exchange built in Nigeria. We are also able to cater to the Nigerian needs because we understand the situation of the average Nigerian.”

This understanding is why Tradefada takes a customer-centric approach to the business. Customers have 24/7 support across all social media platforms because Tradefada understands the angst people experience when dealing with money.

Tradefada is being bootstrapped at the moment, and there are plans to raise funding at the appropriate time. For now, the startup gains revenue from trading fees on the platform.

It is intentional that Tradefada is not in the public eye. According to the CEO, the more exposure, the more the challenges, especially in a heavily regulated market, but there are plans to increase visibility. For now, their target audience is people within the crypto community on social media and people interested in the market.

As we are seeing things unfold, we will do more in order to increase our market reach. It is getting more and more competitive.

Seun Dania

Future plans

There are plans for expansion to other African countries and an independent app for offramp services as it is currently web only.

Seun believes that cryptocurrency will soon a major part of the economy. Tradefada is making moves towards that future by adding new features.

One of them is the Staking feature that allows users stake their currencies and get an annual interest. There are also plans to build an NFT marketplace and add Futures Trading, a USD card for payments, and a feature that will allow merchants receive crypto on Tradefada. All these are in addition to plans to expand to other African countries.

“The thought has always been to stay focused on your core. There are plans to build more but for now, there’s focus on the exchange side of things.”

The CEO also mentions the Unobtanium coin. The Uno coin is one of the oldest currencies with a low inflation rate and low scarcity. It has a maximum supply of 250,000 coins and Seun believes it could be the next BTC.

There have been attempts to partner with companies and mobile money agents in this regard but there have been challenges as most do not want to play in a space that is volatile.