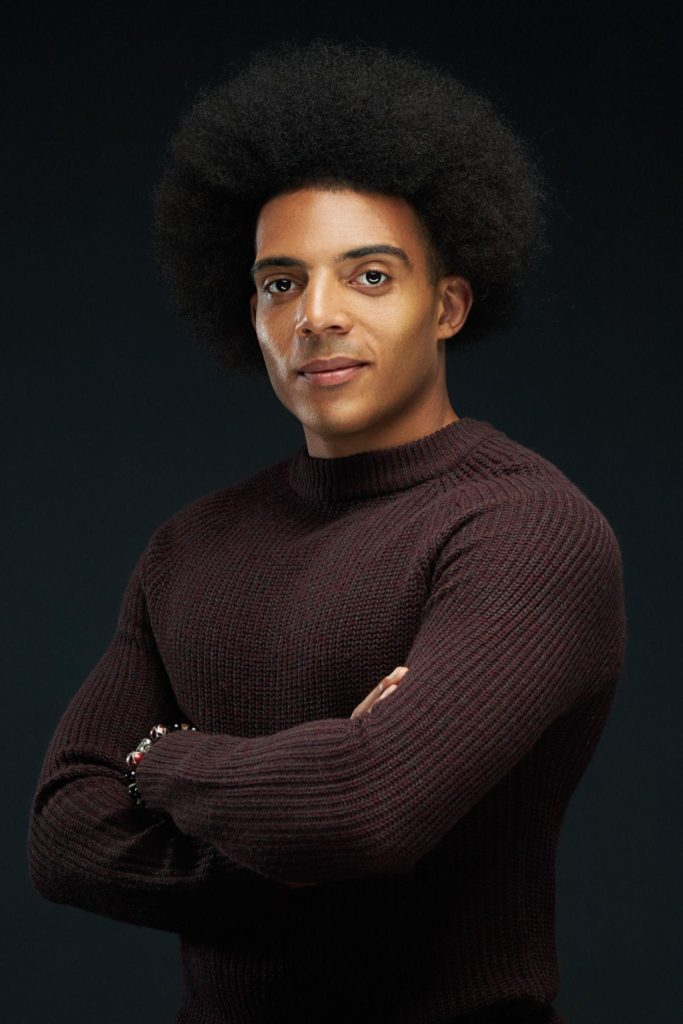

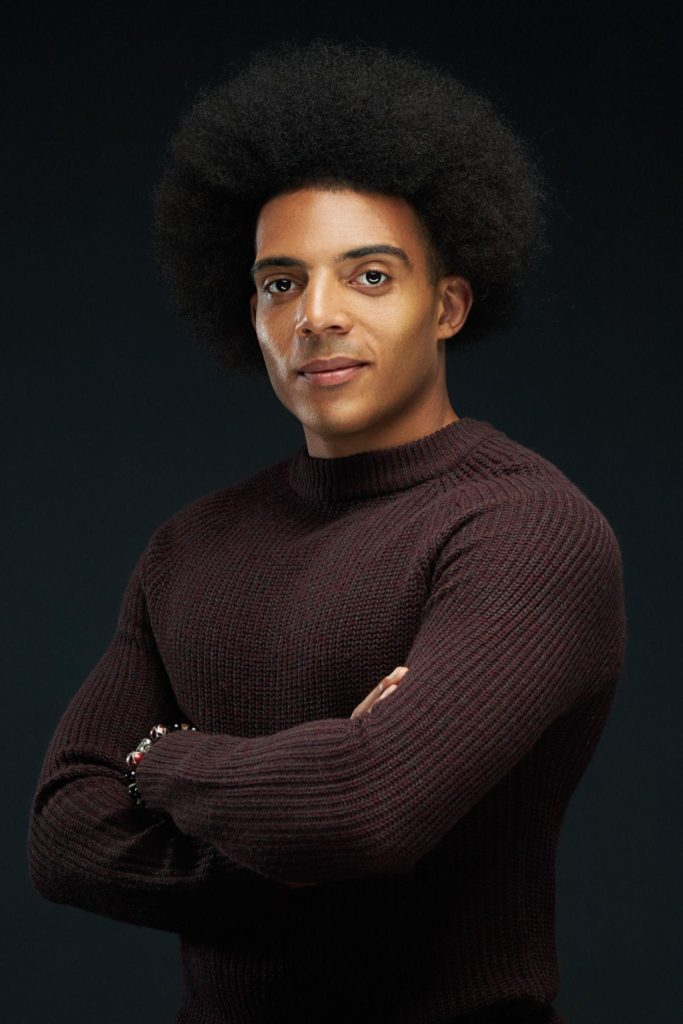

Laurin Hainy, CEO and Co founder of FairMoney MicroFinance Bank; a leading credit-led digital bank, has projected a continuous growth for the Nigerian tech enabled lending and digital banking sector. This growth he said will be driven by the untapped population and continuous mobile penetration within Nigeria.

Laurin Hainy made this known at the Fintech outlook 2022 webinar, organized by the FinTech Association of Nigeria, where he shared the stage with the likes of Odunayo Eweniyi, CEO of Piggyvest, Mitchell Elegbe, Founder and CEO of Interswitch, Nkebet Mesele, Sub Saharan Senior Director at VISA, Daniel Awe, Head, Africa Fintech Foundry, Premier Oiwoh, MD and CEO NIBBS, Ade Bajamo, President FintechNGR among other insightful individuals.

Laurin Hainy who spoke in the first session was tasked with giving a 2022 outlook for digital lending in Nigeria. He explained that with over 80% mobile and 36% internet penetration in Africa, 42% growth of young population between age 15-24 expected by 2030, only 4.5 bank branches per 100,000 people in Sub-saharan Africa and 66% unbanked Africans, there is a great opportunity for growth of the digital banking and lending in Nigeria.

He further explained that the mobile penetration and mobile data will serve as the major driver for the continuous growth of digital lending, this is because mobile gives innovative fintech companies like FairMoney more access to the larger masses and mobile data has become a major underwriting tool for Fintech firms in the lending space.

According to Hainy “We see that a significant number of the population have adopted the use of mobile devices, we will liken mobile devices in this case to a train rail, and what a train rail does is to help us drive financial services to the average Nigerian. Looking at the data we see that the traditional banks are far away from their customers, which has constituted a major part of the financial inclusion challenge, but the good thing is that while the bank might not be close to your house, the average consumer has a smartphone, and as penetration is increasing it will enable us to build further and close the financial inclusion gap”

“Our goal at FairMoney is to close the Financial inclusion gap, ensure the average Nigeria has access to the best financial services, service the retail sector as well as the MSME sector which is the backbone of the Nigerian economy” he added.

FairMoney MFB, is a credit-led digital bank offering seamless digital banking and lending services. The firm enables customers to receive loans into their FairMoney bank account in minutes and as at 2021 they have disbursed over N117 million in loans to Nigerians. The bank began operations in 2017 as a micro lending app, but transitioned to a full fledged digital bank offering customers access to banking services such as Bank Transfers, Free Debit cards, Fast & secure Bill payments, savings, and has achieved over 5 million app downloads and over 2 million bank accounts. The fintech firm is currently on a journey, building a digital bank for emerging markets and working towards being the number one financial hub.

FinTech Association of Nigeria (FintechNGR) is a self-regulatory, not-for-profit and non-political organisation incorporated in Nigeria by the Corporate Affairs Commission CAC and a member of the global body Global Fintech Hubs Federation. The Association was established to serve as a platform for the development of the financial technology (“Fintech”) industry in Nigeria and to be a forum for the exchange of ideas and dissemination of information by and between various stakeholders in the Nigerian financial technology services industry.