Aside from Spotify, Netflix, and Hulu, several new streaming services have emerged in the last decade or two. As they emerge, they have recorded varying degrees of success, competing for customers.

With each streaming service’s battle to stay at the top intensifying, Spotify continues to outperform expectations with consistent growth. The year-on-year (YoY) increase was driven by the company’s Ads business and ongoing subscriber growth.

Figures from the corporation’s latest results for Q4 2021 suggest that the company has made significant progress on several initiatives, indicating that remarkable capabilities in 2022 are possible.

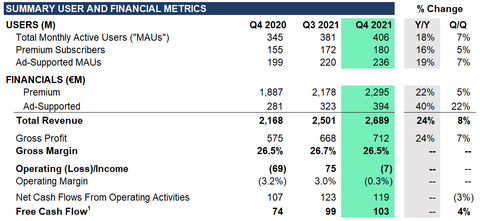

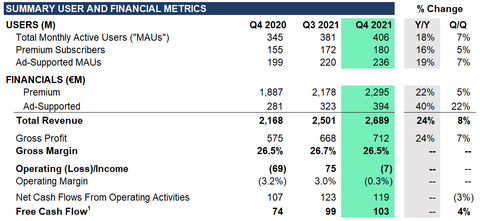

Figures from the company’s Q4 2021 report put the number of monthly active users on the streaming platform at 406 million, indicating an 18% YoY growth from the 381 million recorded in Q3 2021 and the near top end of its guidance range.

The company witnessed a double-digit growth rate, particularly from the rest of the world, powered by excellent performances in India and Indonesia. Latin America also did better than expected.

7th annual year-end Spotify Wrapped campaign

The streaming platform saw exceptional year-over-year growth of 29 percent across all geographies and demographics with the successful launch of the 7th annual year-end Spotify Wrapped campaign in December to customers in 103 areas.

During the campaign, consumers shared almost 60 million wrapped stories and cards internationally, resulting in high levels of consumption across the two personalized playlists. Within 48 hours of its introduction, this accounted for roughly 8% of total on-platform usage hours.

16% growth in premium subscribers.

More than ever, the Spotify suite of services appeals to a large number of individuals, resulting in a steady stream of free users upgrading to premium subscriptions and staying with them.

Spotify Premium subscribers increased by 16% year on year to 180 million in Q4 2021, up from 172 million in the previous quarter and nearing the upper end of the projection range. On an absolute Q/Q basis, all regions contributed to growth, with Europe and Latin America leading the way.

For its standard plan, the corporation tried a shorter holiday selling campaign, which, even though there were two fewer weeks in the campaign, outperformed expectations.

Xiaomi, Shopee, Visa, and TecToy are among the primary promotional partners the firm announced in Q4 2021. It also extended its reseller agreement with KPN, the Netherlands’ largest telecom company.

With a noticeable growth in the company’s monthly active subscribers, there was a proportionate growth in its revenue for the same period.

Due to substantial growth in advertising and favorable FX moves, the company’s revenue of €2,689 million increased 24 percent year over year in Q4 and was beyond the high end of Spotify’s projection range.

Premium revenue increased by 22% year over year to €2,295 million, while ad-supported revenue increased by 40% year over year to €394 million. Premium’s average revenue per user (“ARPU”) of €4.40 was increased by 3% year over year, which was principally from the company’s pricing hikes, excluding the impact of FX.

Spotify’s gross margin also increased in Q4, reaching 26.5 percent, which was beyond the high end of the range of its expectations and unchanged compared to the previous quarter.

The trend in gross margin represented a positive revenue mix shift towards podcasts, marketplace activity, and other costs of revenue savings, including payment fees and streaming delivery costs, which were offset by increasing non-music and other content expenses, as well as higher publication rates.

As a reminder, the company’s Q4 2020 gross margin was boosted by roughly 60 basis points as a result of revisions to expected music royalties.

In terms of spending, the company’s operational expenses totaled €719 million in Q4, up 12% year over year. Given the growth in the company’s share price throughout the quarter, Social Charges exceeded expectations.

Personnel expenditures, as well as some marketing expenses, were also lower than planned. Operating expenses were better than expected, excluding the impact of social charge changes, and led to positive operating income in the quarter.

The monthly average number of users for podcasts increased by double digits in Q4 compared to Q3. In Q4, consumption trends among MAUs who engaged with podcasts continued to be robust (up 20% Y/Y per user), and the podcast share of overall consumption hours on various platforms reached another all-time high.