Barely two months after launching its Norrsken House in Kigali, Rwanda, which will house hundreds of entrepreneurs by next year, Niklas Adalberth’s Norrsken Foundation has made headlines once again.

This time, the foundation has partnered with Flutterwave CEO, Olugbenga Agboola as well as thirty unicorn entrepreneurs and a few seasoned venture capital and private equity investors to create a $200 million fund aimed at African growth-stage startups.

According to a statement obtained from TechCrunch, the fund, branded the Norrsken22 African Tech Growth Fund, has reached its initial close of $110 million.

The Norrsken22 African Tech Growth Fund is Norrsken’s newest fund, after the closure of a €125 million impact fund for European companies in March. It’s $110 million first close includes $65 million from a worldwide group of unicorn entrepreneurs.

Olugbenga Agboola, co-founder of Flutterwave; Niklas Zennström, co-founder of Skype; Jacob de Geer, co-founder of iZettle; and Niklas Stberg, co-founder of Delivery Hero, are among the unicorn entrepreneurs who have invested.

Carl Manneh, co-creator of Mojang, Sebastian Knutsson, co-founder of King, and Willard Ahdritz, founder of Kobalt Music, are also on the list.

Aside from financing, the unicorn founders will advise entrepreneurs on how to grow their businesses from series A to billion-dollar firms, according to the founding partners.

According to the partners, the Norrsken22 African Tech Growth Fund is also backed by a local advisory council board. This board will assist portfolio businesses in navigating business obstacles across Africa.

The Norrsken22 fund will finance companies in fintech, healthtech, edtech, and market-enabling technologies, including B2B marketplaces and inventory management firms.

The company plans to achieve this by relying on its general partners’ years of expertise and investing philosophies.

Founded by an ex-partner at Northzone

Norrsken was founded by Hans Otterling, a partner at Northzone which is a U.K.-based early venture capital firm that led the investment in Adalberth’s prior startup, Klarna.

The company’s general partners include Natalie Kolbe, the ex-global head of private equity at Actis, a private equity fund focused on emerging countries; Ngetha Waithaka; and Lexi Novitske, the ex-managing partner at Acuity Ventures Platform, who make up the firm’s investment.

Novitske was a partner at Singularity Investments before joining Acuity. The companies’ portfolio companies include API fintechs like Mono and OnePipe, as well as existing startups like Flutterwave, Paystack, and mPharma.

$4 billion in Africa’s VC funding

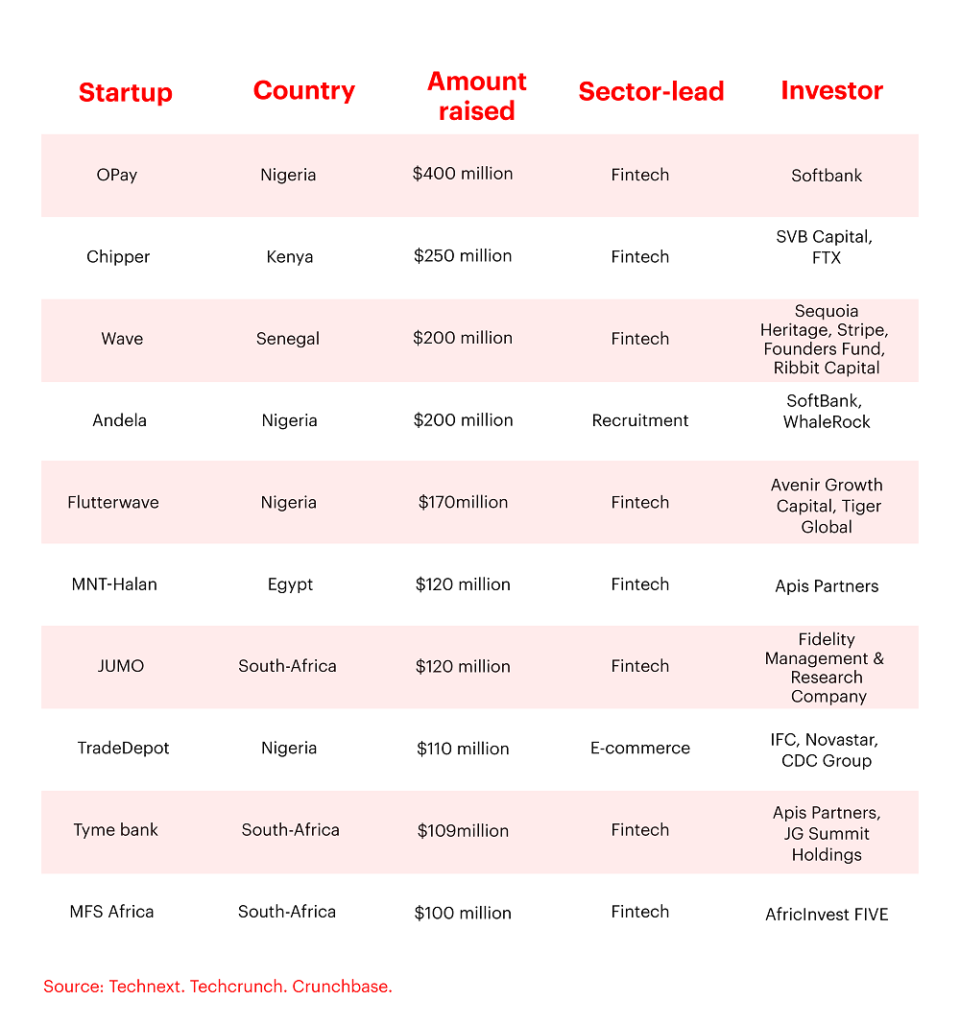

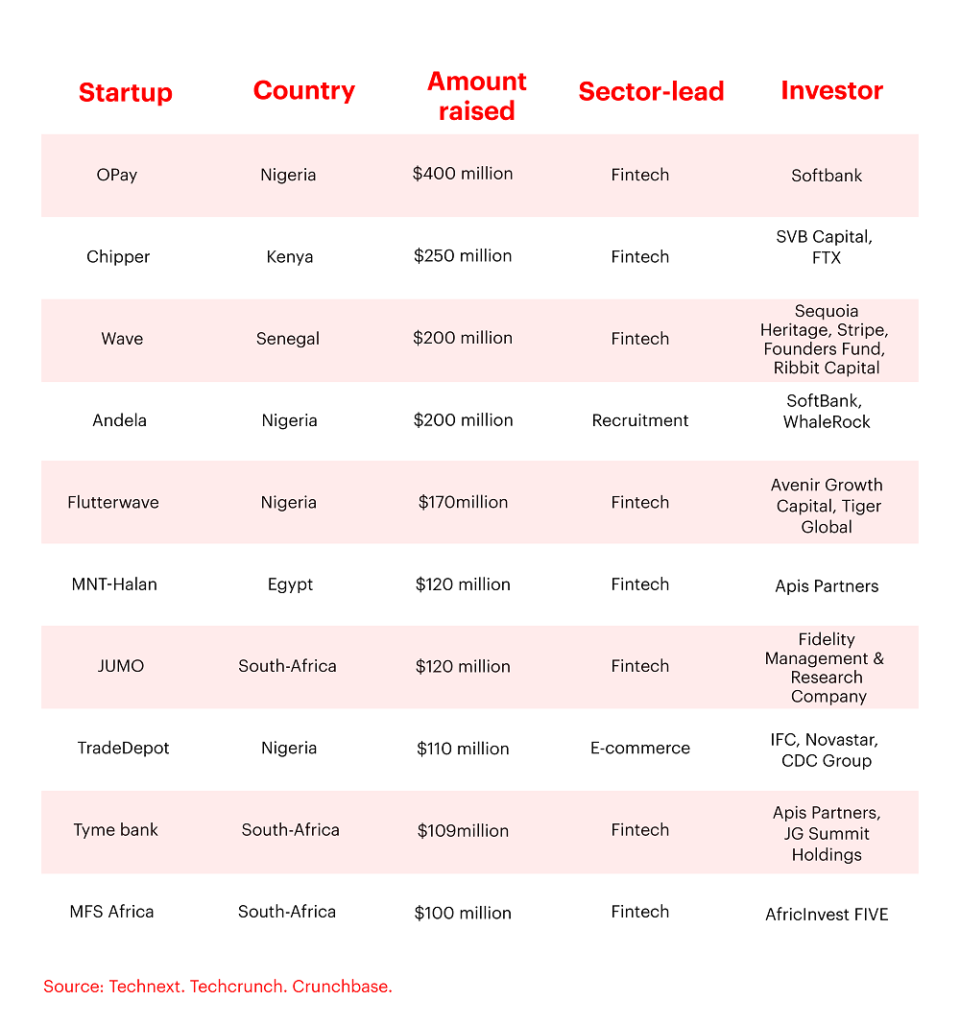

Africa’s VC financing hit an all-time high of $4 billion in 2021. This is more than startups on the continent raised in the previous two years combined.

This impressive rise in funding was mostly fueled by growth and late-stage transactions such as $100 million-plus rounds from unicorns Andela, Flutterwave, Chipper Cash, OPay, and Wave, as well as other startups.

Most of these huge deals were backed by overseas VCs, as local investors prefer to focus on pre-seed to Series A rounds with micro-to-medium-sized funds.

According to Novitske, “What’s happening is, and we’ve seen this in our Acuity portfolio, is that our founders, as they grow and want to scale, have to take time away from their business and spend it with Silicon Valley-based investors who they have to educate on the African growth story.

“These investors are coming with their capital, which is valuable, of course, but they’re not coming with the local knowledge to help those companies scale across the continent. And that’s the missing middle that we’re looking to unlock with this fund. “

According to the company, Norrsken22 is to be the growth-stage local business that enables companies to form meaningful relationships in order to increase revenue, acquire the finest people, and support development plans throughout Nigeria, Kenya, and South Africa.

Norrsken22 is ready to invest beyond the Series B rounds, which other African-focused VC funds rarely do. According to Waithaka, who also spoke about the fund’s approach, the Norrsken22 fund wants to invest 40% of its cash, or $80 million, in Series A and B firms.

He went on to say that the business will make 20 investments with an average ticket size of $10 million and may go as high as $60 million, with follow-on rounds in select portfolio firms.

“I think that a reserve capital pool is incredibly essential because we want to be able to help enterprises throughout their whole lifespan. Because innovation is unpredictable and doesn’t happen overnight, we want to make sure we can assist the company’s top winners so they can be the IT ecosystem’s advocates. ” Kolbe said.