The African tech startup ecosystem is evolving very rapidly. This evolution is fueled by a generation of tech-savvy youths that have boosted the digital population on the continent as well as the adoption of several new technologies by startups.

The evolution has also brought about rapid growth in the space, with numerous startups solving real problems sprouting across the continent. As of July 2021, 576 fintech startups were headquartered in Africa according to Statista.

One major driver as well as a consequence of the growth in the space is venture funding, an area that has also witnessed a mind-blowing explosion in 2021. Tech startups in the continent raised $4.6 billion in 2021 alone. This is more than the amount raised in 2020 ($1.7 billion), 2019 ($1.3 billion) and 2018 ($800 million) combined ($3.8 billion).

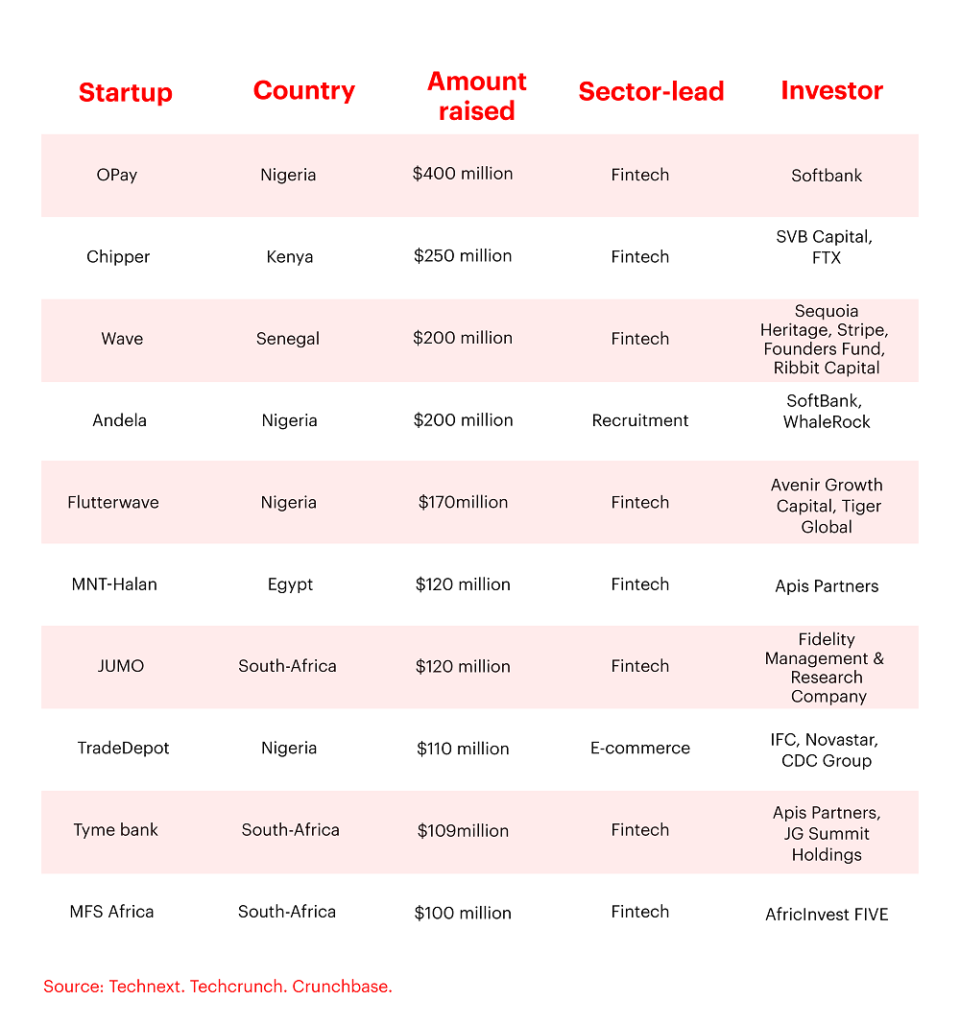

Furthermore, mega rounds became quite common in Africa in 2021 as at least 10 companies each raised $100 million and above during the year. They include Nigeria’s Opay, Flutterwave, Andela and Trade Depot; South Africa’s JUMO, TymeBank and MFS Africa; Kenya’s Chipper Cash; Senegal’s Wave; and Egypt’s MNT-Halan. See the full list below:

While this is an exciting development for the space, Venture Builder at Catalyst Fund and Founder of The Big Deal Maxime Bayen thinks an even more exciting prospect is the sheer amount of pre-seed startups produced on the continent.

In a video chat with me, the African venture expert said he’s excited by the number of early-stage startups attracting VC funds because it is one of the strongest indicators of how healthy an ecosystem is. According to him, large early-stage startups guarantee the longevity of an ecosystem.

“If you want to see how many unicorns we will have in Africa in the next 10 years, look at the number of pre-seed companies we have this year. I’m more excited to see a lot of pre-seeds. The big companies are already there. If you don’t have a lot of companies at the pre-seed and seed stage then the future is not looking great,” Maxime said.

2021: great year for VC funding, not so much for female-founded startups

2021 was the year of explosive venture capitalist funding in Africa. Not only did total venture funding into the continent nearly triple, the funding rounds also came in thick and fast. They were also well distributed among the different stages of startup growth.

Furthermore, more investors trooped into the continent last year than ever before, They consist of both institutional and angel investors. There’s also a rapid rise in the number of African investors and venture capitalists re-investing into their home continents. About 800 investors reportedly sign cheques to African startups in 2021, and this gave them a pool of diverse sources for funding.

Speaking about the impressive aspects of venture funding in Africa for 2021, Maxime Bayen pointed out that the sheer size of total funding invested into the continent was quite extraordinary.

“The overall number is quite big. We have over $4.3 billion raised by startups in Africa in 2021 and that represents more than 2.5 times the amount raised in 2020. What’s interesting is that despite the fact that there are a couple of very very large deals, we still have a lot more smaller deals as well. We basically have around 820 deals worth over $100,000 in 2021. This forms a really strong pyramid where a vast majority of fundings are pre-seed and seed deals and that’s very positive for the future,” he said.

Another impressive aspect of the funding story of 2021 is the massive growth rate recorded on the continent that year. $4.3 billion raised by African startups in 2021 represents an astonishing 150% growth rate from $1.7 billion raised in 2020.

For emphasis, tech startups across the globe raised a total of $621 billion according to CB Insights State of Venture Report 2021. This represents a 111% Year-on-Year increase from $294 billion raised in 2020. While it may seem that Africa’s $4.3 billion is a drop in the ocean of global funding, Africa’s 150% growth rate, however, trumps the global growth by some distance.

Despite these huge positives recorded in the year, there are some not so impressive facts as well. First is that a vast majority of funding still goes to the same four large markets in Africa, with Nigeria, Kenya, Egypt and South Africa all getting more than 80% of total funding ($3.5 billion).

While some startups from smaller countries like Wave from Senegal and Al Soug from Sudan made some huge statements, they were, however, not enough to bridge the uneven spread in funding on the continent.

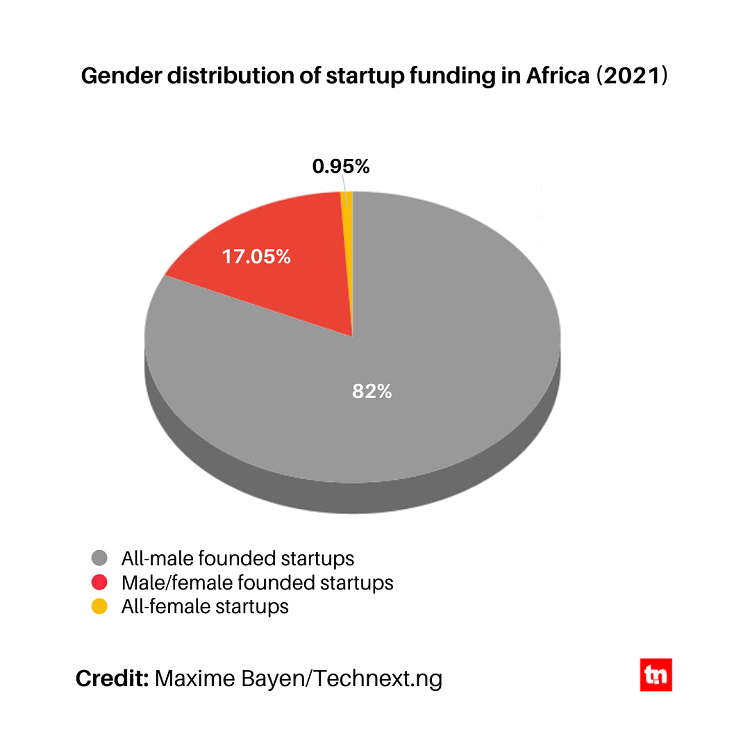

But perhaps the most important downside is the huge disparity between male-founded and female-founded startups. According to a Briter Bridges report, only three per cent of African tech startup funding since 2013 has gone to companies with all-female founding startups while 76% went to all-male founding startups.

In 2020, 84% of total investments went to startups with all-male founders. While that number fell to 82% in 2021, the story wasn’t very different for all-female founded startups and it didn’t sit well with Maxime.

“You have 82% of the total funding (in 2021) raised by startups led by men co-founders. That’s definitely not balanced at all. Not a single female-only founded startup that raised more than $6 million. There are some startups with female CEO’s that have raised significant funding but in these cases, you always have like male co-founders. It’s not specific to Africa, but it’s something that needs to change. We need to change this,” he said.

It’s interesting to note that only 2.8% of global venture capital funding goes to women-led startups according to a study by Women who tech.

Resilient ecosystem

It is no longer news that the global Covid-19 pandemic caused huge disruptions in the global tech ecosystem. This had a very huge negative impact on the state of funding in Africa, especially in 2020.

Even though startups on the continent managed to raise $1.7 billion, it wasn’t a very significant growth from $1.3 billion raised in 2019. However, the pandemic might also explain the reason behind the huge venture funding realised in 2021 as most of the funding that was planned for 2020 was carried forward into 2021 due to the pandemic.

For Maxime, however, the pandemic showed a lot of positive aspects for the African tech ecosystem. The most important of them is that the ecosystem is resilient to crisis.

“What the pandemic has shown us is that the ecosystem is quite resilient to crisis. Most of the startups that have raised funding last year are really solving important problems affecting millions of people. When your startup provides food, healthcare, education, access to finance to people, these things aren’t going away. Even if there’s a pandemic, these things are still there. This is why the ecosystem has been very resilient,” he said.

How much should startups celebrate a fundraise?

A startup raising funds should be a thing of joy. Shouldn’t it? In Africa, it is and there has been quite some debate about how much startups should celebrate or rejoice when they get funding.

Some think they should really celebrate it because it is a form of validation of years of hard work. To them, funding not only depicts recognition, more importantly, it also depicts trust because investors aren’t just investing their money, they are also investing their trust by backing a team and its dream.

But folks on the other side of the divide are quick to remind all that investors’ money is not a reward for years of hard work but rather an invitation to more work. To these ones, funding is not an indication of success and neither does it guarantee the same.

For Maxime, rejoicing after completing a funding round isn’t a bad thing. However, he thinks startups should rejoice more when they hit their first major revenue milestone because that is a more convincing indicator of a healthy business.

“Internally, within the startup, you should rejoice probably more when you reach your first $10,000 GMV (Gross Merchandise Value) than when you raise $8 million because your customers are your first investors to some extent. If you can do it without raising money and scale super fast, that’s great. There are companies that are able to scale without raising money and it’s good.”

Maxime Bayen

He explained, however, that funding is good news because it shows that the ecosystem is catching up and accelerating. Also, the only milestones that external observers of the ecosystem can see and assess startups with are the funding deals. They can’t see the GMV, EBITDA etc. Therefore, funding is some kind of success metric for startups.

“That a startup has raised a million dollars, it doesn’t mean they are a fantastic startup. But it’s the closest proxy we have to that. It does mean that investors who have that access to the financials and looked at it in detail, talked to the team and really done due diligence have said ‘okay, I’m happy to put my money in this,” he said.

He also pointed out the role model value of raising funding, explaining that while the biggest players in global tech might raise huge money and it seems to the beginner in Africa like that is impossible for him, if a founder who graduated from UniLag raised huge funding, it hits closer to home because their always someone who knows him either directly or indirectly that will be inspired.

Looking forward to 2022 and advice to early-stage startups

The African tech space has indeed come a long way. In 2021, the space enjoyed what is by far its best year in terms of funding and it is everyone’s hope that the momentum doesn’t slow down in 2022.

Indeed the new year picked up where the last year left off and so far, different startups are already announcing impressive deals in the new year. South Africa’s Poa already raised an impressive $28 million in Series C.

Other startups that have raised funding so far this year include Ghanaian fintech, Float which raised $17 million in seed funding, Kenya’s Lipa Later which raised $12 million, Nigeria’s SeamlessHR which raised $10 million series A, Nigeria’s Orda which raised $1.1 million pre-seed, and of course Pivo which got an undisclosed amount for funding from African VC platform, Microtraction.

The early signs are good and Maxime expects it to get even better.

“The early signs are good, not only because there has been a number of deals already signed in January but also because there’s been a number of funds that have been closed at the end of last year meaning that these funds will be deployed in 2022 and the coming year. On paper, there’s quite a bit of money to be deployed this year,” he said.

With this influx of funds from venture capitalists looking to improve their portfolio with more African startups, it is important that startups keep themselves ready to seize any opportunity.

Noting that securing funding can sometimes take time, Maxime however advocates that startups should always anticipate and keep improving their solutions. He also advocated that startups also carry out due diligence on venture capital companies too so they don’t find themselves hooked to undesired investors.

“Do your homework. There’s no point reaching out to Partech if what you do is pre-seed. They will not sign your cheque now. Once you know which investors could be a good fit for you, you can also check which startups they invested in, talk to them, are those good investors to onboard, are they helping you provide the value you want to provide. So check so you can be in a good position to say no to some investors and look out for the best ones,” he said.

Watch the full video below: