The founder of Cryptopreacher Academy, a fast-growing crypto academy in Nigeria, Rume Ophi has called on the Nigerian Senate to hold a hearing on cryptocurrencies to better understand why Nigerians are adopting them.

Nigeria continues to experience the most growth in crypto adoption. This is despite spirited efforts by the Nigerian financial regulator, the Central Bank, to stifle the adoption of cryptos in the country.

This increasing adoption has prompted the CryptoPreacher who is also an analyst for Channels Television on cryptocurrency matters, to call on the Nigerian senate to investigate this rising adoption and possibly enact legislation to guide the crypto space.

“Like the US Senate, our lawmakers can hold a hearing on the role of government concerning crypto where stakeholders in this space will have a dialogue with lawmakers on cryptocurrency in Nigeria and how Nigeria and Nigerians can make the best of it.”

Rume Ophi

The crypto expert referenced the United States Congress’ committee on crypto which held a hearing on November 17 titled: ‘“Demystifying Crypto: Digital Assets and the Role of Government”. The hearing was chaired by Representative Don Beyer — who has previously proposed legislation expanding the regulatory and legal framework for digital assets in the U.S.

CBN’s clampdown on crypto users

In February 2021, the Central Bank issued a directive for all banks to quit facilitating transactions by accounts suspected of dealing in cryptos. This directive effectively stifled the operations of crypto exchanges and companies in Nigeria.

The reasons for this prohibition as announced by the apex bank include:

- Crypto prevents oversight, accountability, and regulation

- Cryptocurrency is increasingly being used for criminal activities

- Crypto prices are extremely volatile

- Other countries have also banned cryptocurrency

- Cryptocurrencies do not generate returns

CBN’s restrictions forced Nigerians to adopt Peer-to-Peer (P2P) platforms in dealing and transacting cryptos. Barely a week after the CBN order, Bitcoin P2P trading volume in the country increased by about 16%. Nigeria posted $7.35 million in P2P trading volume that week, representing a $1 million increase from the $6.35 million processed prior to the ban.

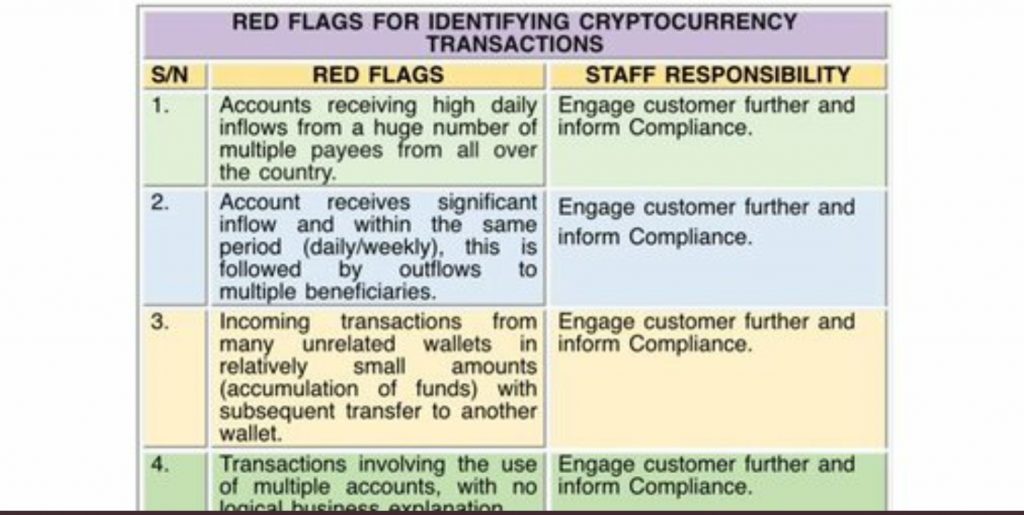

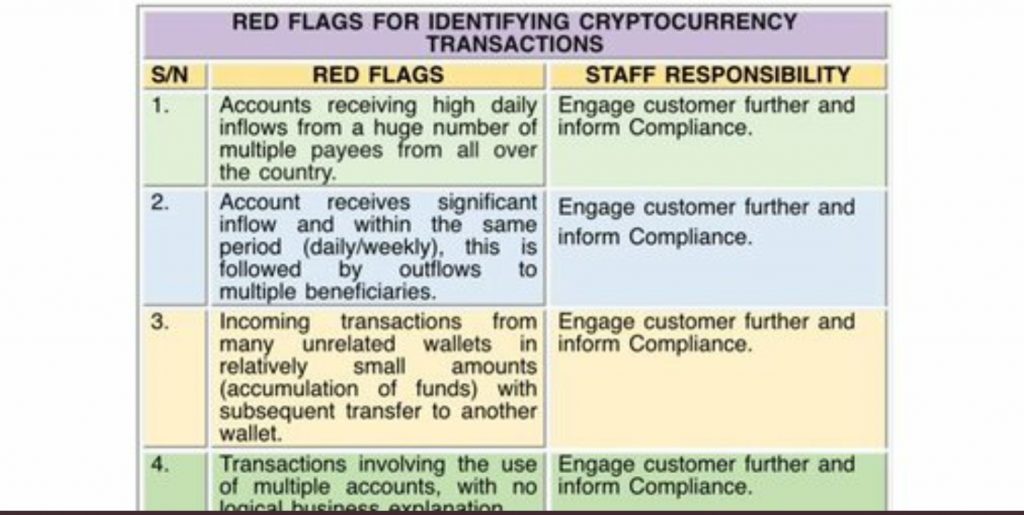

P2P trading continued to flourish until November when the CBN issued circulars to banks to commence the shutting down of bank accounts suspected of belonging to crypto dealers. According to an FCMB circular, bank accounts targeted include:

- Accounts receiving high daily inflows from a huge number of multiple payees from across the country.

- Accounts receiving huge inflow within the same period to be redistributed to multiple beneficiaries

- Banks receiving funds from many unrelated wallets in relatively small amounts with subsequent transfer to another wallet

- Transactions involving the use of multiple accounts with no logical business explanation etc.

In essence, the CBN is targeting possible escrow accounts as well as smallholder accounts.

The clampdown on accounts of crypto dealers saw a 43% drop in P2P trading in the country barely a week after the renewed onslaught.

Why Senate intervention might be necessary

Many legal experts have declared the shutting down of bank accounts based on a CBN directive as illegal. The legal experts noted that only a court order could cause a bank account to be forcibly frozen or shut down.

But more importantly, a judge at the Federal High Court in Abuja, Taiwo O. Taiwo, while ruling in the case of CBN vs Rise Vest, asserts that the CBN could not freeze a bank account without a law that allows for such.

“I have perused the counter affidavit of the respondent and I see that the reason for freezing the account of the applicant is based on the alleged infraction of the circular of the CBN. The law is trite that any conduct that must be sanctioned must be expressly stated in a written law”

Taiwo O. Taiwo

Similarly, a blockchain group, the Blockchain Industry Coordinating Committee of Nigeria (BICCoN) noted that crypto dealing in the country cannot be declared illegal by the CBN and dealers cannot be punished because there’s no law in Nigeria that criminalises it.

“There is currently no legislation by the National Assembly criminalizing or illegalizing trade in cryptocurrency in Nigeria. Therefore, it is questionable whether the CBN has the statutory power to order the permanent freezing or closure of these accounts,” the group said in a statement.

All of these point to the fact that Nigerian lawmakers have a role to play in the ongoing debacle involving crypto users and the financial regulator. A statute, either way, would put to bed all the uncertainties arising from the issue. And if the lawmakers must arrive at popular legislation, they must listen to the people to understand why they keep flocking to the digital currency despite the regulator’s prohibitions.

“Impressively but not surprisingly, Nigeria is leading in worldwide adoption of cryptocurrency. The reason is very simple: inflation is a chief cause of this. This is evident in markets like Nigeria, Zimbabwe, Tanzania. This is a way people can actually hedge themselves and get into other currencies and enable them offset that.”

Rume Ophi

Now that you’re here, don’t forget to register to be a part of the largest crypto conference in Africa put together by Technext. Kindly follow this link for registration and more info.