According to details from last week’s trading activities, peer-to-peer cryptocurrency transactions in Nigeria dropped by 43%. This decline is attributable to the effects of a recent clampdown on bank accounts suspected of trading cryptos.

Recall that the Central Bank of Nigeria (CBN) and commercial banks in the country recently began imposing limitations and shutting down bank accounts of customers suspected of being involved in cryptocurrency trading.

This recent closure of accounts followed a directive from the apex body reiterating its stance in a post-no-debit circular dated November 3, 2021, issued by J.Y. Mamman, the bank’s Director of Banking Supervision.

The renewed directive led to several bank accounts being restricted, severely impacting crypto trading activities within the country and also resulting in a sharp decline in Nigeria’s P2P trade volume.

CBN’s renewed onslaught

The recent wave of restrictions follows realizations by the financial body that crypto remains an actively traded asset in the country, despite its prohibition of these exchanges.

Earlier this year, the apex bank prohibited banks from facilitating cryptocurrency-related transactions. According to the regulator, volatility, money laundering, and terrorism financing were among the reasons for the restrictions.

However, rather than the volume of transactions taking a download plunge at the time, trading had instead witnessed tremendous growth. This is largely due to the activities of platforms that enable peer-to-peer transfers as Nigerian dealers quickly made the switch.

These transactions became more attractive to lots of Nigerians, accounting for approximately $9.4 million in weekly P2P volume out of the $18.8 million recorded in the Sub-Saharan Africa region.

This transaction volume is supported by Kenyans and South Africans, who also have $2.8 million and $1.8 million, respectively.

Impact on Nigeria’s P2P trading

Nigeria’s increasing bitcoin volume has seen sub-Saharan Africa emerging as the leading region in P2P transactions. This massive adoption remains a source of concern for financial regulators, as Nigeria ranked second only to the United States in terms of bitcoin peer-to-peer trading.

Peer-to-peer trading refer to an exchange of value between parties (such as individuals) without involving a central authority. Peer-to-peer exchange of bitcoins between individuals and groups takes a decentralized approach, but still, a growing number of Nigerians still have to use their banks to settle in cash while carrying out their P2P trading.

However, all that progress is on the verge of being halted as the CBN appears resolute to snuff out the very avenue for the completion of P2P trading in the country.

The recent decline in Nigeria’s P2P transactions due to this renewed onslaught is one such consequence as Nigeria’s and indeed Sub-saharan Africa’s numbers are about to tank.

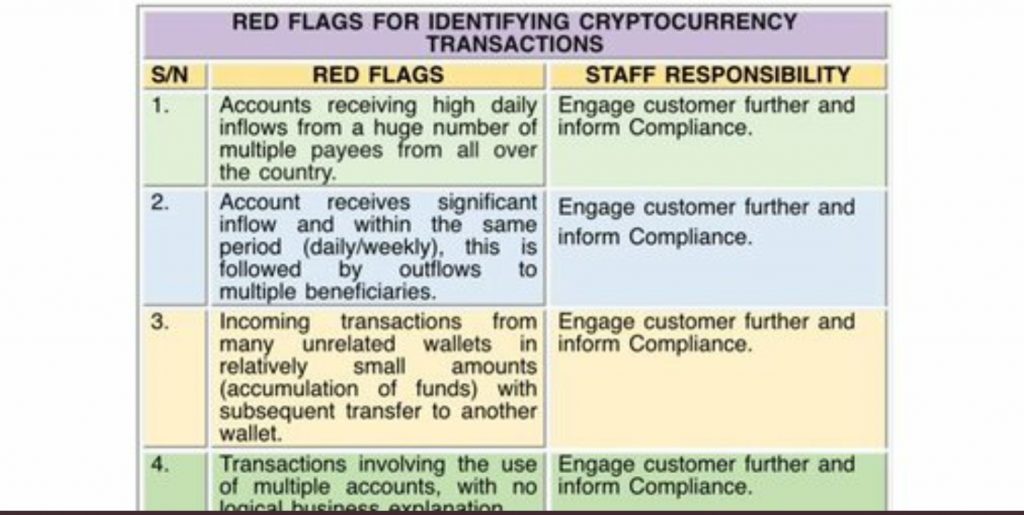

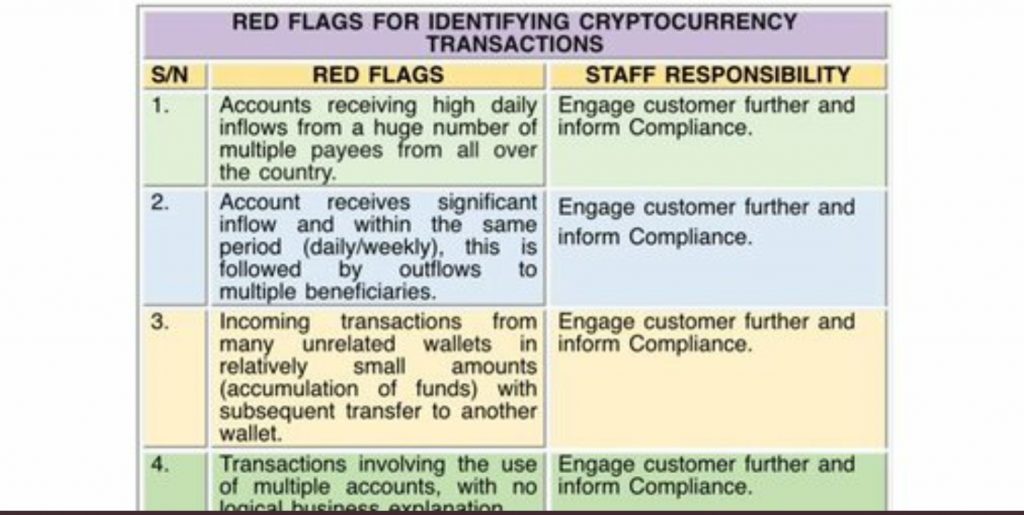

According to an FCMB circular, bank accounts targeted include accounts receiving high daily inflows from a huge number of multiple payees from across the country.

Others are accounts receiving huge inflow within the same period to be redistributed to multiple beneficiaries, banks receiving funds from many unrelated wallets in relatively small amounts with subsequent transfer to another wallet, transactions involving the use of multiple accounts with no logical business explanation etc.

In essence, the CBN are targeting possible escrow accounts as well as smallholder accounts.

The legality of the account’s restrictions

Legal experts are of the opinion that unless the CBN obtains a court order to that effect, it is unlawful for the CBN to block users’ accounts for the purpose of dealing in cryptocurrencies. It is also unlawful to the extent that cryptocurrencies have not been declared illegal by the country’s laws.

According to a Lagos-based lawyer who declined to be identified, a judicial precedent has been established in the Lagos High Court to that effect.

“The Lagos State High Court, on 13 August 2020, delivered a landmark decision in BLAID CONSTRUCTION LIMITED & ANOR. V. ACCESS BANK PLC. Basically, this is the decision that is saying that no bank, regulatory or security agency has the right to order the freezing or freezing of any account without an Order of Court,” he said.

Similarly, a judge at the Federal High Court in Abuja, Taiwo O. Taiwo, while ruling in the case of CBN vs Rise Vest, asserts that the CBN could not freeze a bank account without a court order that allows for such.

“I have perused the counter affidavit of the respondent and I see that the reason for freezing the account of the applicant is based on the alleged infraction of the circular of the CBN. The law is trite that any conduct that must be sanctioned must be expressly stated in a written law, “

Taiwo O. Taiwo

Now that you’re here, don’t forget to register to be a part of the largest crypto conference in Africa put together by Technext. Follow this link for registration and more info.