Global smartphone shipments fell by 6.7 year-on-year in the third quarter of 2021, bringing an end to the double-digit growth the market experienced in the early quarters of 2021. This is according to a report by the International Data Corporation (IDC).

According to its Worldwide Quarterly Mobile Phone Tracker, the research firm reports that global smartphone vendors shipped a total of 331.2 million units during Q3 2021. This is significantly lower than the 353.6 million shipments recorded in the same quarter of last year.

A year ago

Smartphone shipments witnessed growth globally in the latter quarters of 2020, largely due to the gradual reopening of economies around the world as COVID-19 restrictions were gradually relaxed.

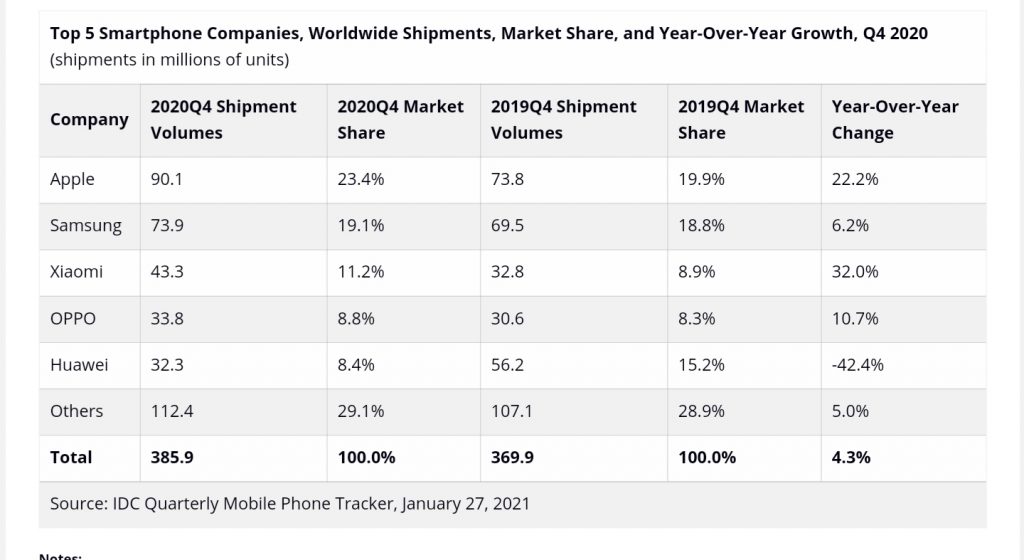

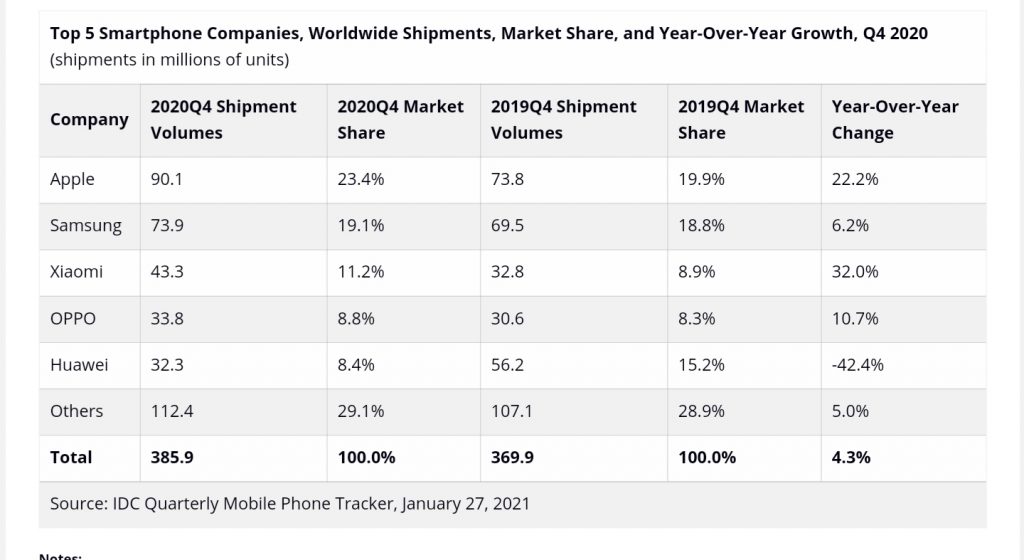

According to IDC preliminary data, these figures continued their upward projections into the last quarter of 2020, with 385.9 million smartphone units shipped.

The first two quarters of 2021 also saw a growth rate of 25.5% and 13.2% year on year, respectively.

However, these figures took a negative turn in the third quarter of the year largely due to the supply chain situation which hasn’t drastically improved from the Covid-19 pandemic hit.

Reasons for the decline

According to the research director of IDC’s Mobility and Consumer Device Trackers, Nabila Popal, the drop in shipment was caused by supply chain and component shortage issues which have finally caught up to the smartphone market.

Until now, the smartphone market seemed almost immune to the issue despite its adverse impact on many other adjacent industries. However, recent reports indicate this is no longer the case.

“In all honesty, it was never fully immune to the shortages, but until recently the shortages were not severe enough to cause a decline in shipments and were simply limiting the rate of growth. However, the issues have now compounded, and shortages are affecting all vendors alike.

Nabila Popal, research director with IDC’s Mobility and Consumer Device Trackers.

According to the director, the industry has also been hit with other manufacturing and logistical challenges. One of them is stricter testing and quarantining policies which are delaying transportation. Another reason is power supply constraints in China that are restricting the manufacturing of key components.

“Despite all efforts to mitigate the impact, all major vendors’ production targets for the fourth quarter have been adjusted downwards. With continued strong demand, we don’t anticipate the supply-side issues to ease until well into next year,” the director said.

As with the seasonally low third quarter, a slight decline was expected in global smartphone shipments, but the actual decrease was twice the -2.9% that was forecasted.

Positive results from the first two quarters of the year put the 2021 growth projections at 7.4%, with an estimated smartphone shipment of 1.37 billion units. This was expected to be followed by a 3.4% increase in 2022 and 2023.

How are the vendors faring?

Virtually every smartphone vendor experienced a supply chain constraint in Q3 2021. However, Samsung finished the quarter in the top position, shipping 69.0 million units and having a 20.8% market share. This was a year-over-year decline of 14.2%.

Apple regained second place, having about 50.4 million units of its smartphones shipped and claiming a 15.2% market share, an incredible 20.8% year-over-year growth.

Xiaomi, also struggling, registered a 4.6% decline in the third quarter after high double-digit growth over the previous four quarters. It still managed to capture the third position with a 13.4% share and shipments of 44.3 million units.

With 33.3 million and 33.2 million units shipped respectively, and market shares of 10.1 percent and 10.0 percent, Vivo and OPPO tied for fourth place.Vivo saw 5.8% year-over-year shipment growth, while OPPO saw 8.6% year-over-year growth in the third quarter.