A Nigerian Couple, Gloria Igberaese and Muyiwa Folorunsho wanted on charges of multimillion-dollar fraud have reportedly fled to the Dominica Island to avoid arrest.

The entrepreneurs allegedly used a company they cofounded, Divergent Enterprise which operated businesses such as Landlagos, PorkMoney, Hyberfactory and Porkoyum, among other companies to fleece millions of dollars from Nigerians in a slew of Ponzi schemes.

The couple was declared wanted following a petition filed by one Mr Chijioke Ukaegbu and other victims. The intelligence research firm, Sylnam Strategies coordinated the petition against the suspect.

In a petition submitted to federal authorities on January 21, 2021, the suspects were allegedly accused of defrauding investors of over N1 billion.

“These funds were however diverted to personal use, including for the purchase of luxury properties and foreign citizenship,” the victims said in the petition.

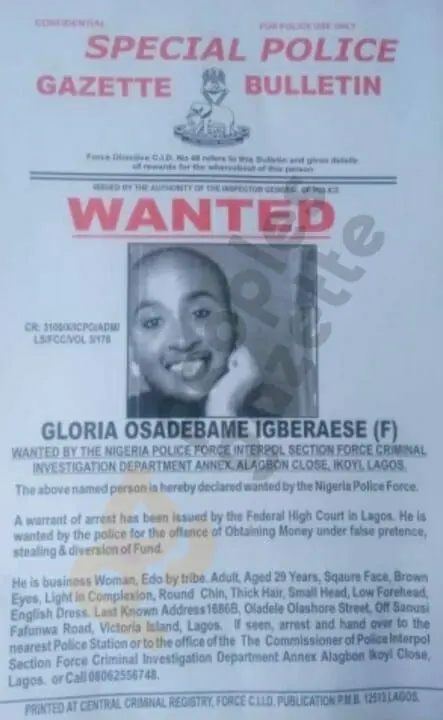

Arrest warrants have been separately issued for them by the Lagos Division of the Federal High Court on the charge of obtaining money under false pretence and stealing.

“He is wanted by the police for the offence of obtaining money under false pretence, stealing and diversion of funds,” a notice issued by the Interpol section of the Nigeria Police Force in Lagos.

“If seen, arrest and hand over to the nearest police station or to the office of the commissioner of police Interpol Section Force Criminal Investigation Department Annex Alagbon Ikoyi Close, Lagos,” the documents added

The perfect investment trap

Gloria and Muyiwa ran several investment businesses in Lagos over the years. Some of their biggest companies were Landlagos where they posed as realtors and land developers, and PorkMoney, where they crowdfunded investments for pig farming.

Landlagos was involved in land sales but later delved into investment in Land developments. One of those land developments was lands around Ibeju Lekki and Lakowe.

In a chat with Technext, a former employee revealed that Muyiwa didn’t own the lands he took money for investment in.

“We sold undocumented land, the lands were bought with mouth alone.”

He explained that the idea was to crowdsource enough money to buy and develop the land.

“The cheapest lands we sold was N3 million per plot, every sale came with the commission so workers were encouraged to sugarcoat reality and push sales.”

However, the couple had other things in mind. New discoveries show that the couple diverted funds to personal accounts while stalling investors.

Similarly, PorkMoney took investments as high as N1 million and above with a promise of 20% ROI in one year.

Our source revealed that several investors recovered their money in the first few sales but those that invested later were scammed.

This gave rise to the accusation that the founders ran the business like a Ponzi scheme by paying old investors with new investor funds until they allegedly stole enough to run.

Running from Justice

Signs that the PorkMoney co-founders were playing a fast one didn’t just surface. As far back as 2019, the CEOs came under heavy criticism on Twitter after former employees accused them of fraud, creating a toxic work environment, deducting from their salaries or firing them over trivial mistakes.

Ada, one of the alleged former employees narrated that the couple was defrauding clients and keeping their married status from public space.

At the time Gloria denied ever mistreating any staff member, claiming that she did what was necessary to survive as a business owner in Nigeria

“For those who are unhappy with my perceived treatment of them while working for me, I sincerely apologize, and I do hope that over time, as you venture into creating businesses of yours that you get to understand why some things however unpalatable are totally necessary if one is to survive as a business owner in Nigeria,”

Gloria

However, new development has unveiled a web of lies. Another former employee revealed that the company had a very toxic environment with a stern deduction of salary at any slight mistake.

She added that they generally employed unqualified staff that can be easily bossed and sacked easily. “They employed your graduates that majorly unqualified and desperate for cash,” the former employee said.

She also narrated her nasty experience of sacking when business slowed and proved unprofitable. “When they realised people were not buying the new business, they sacked everyone.”

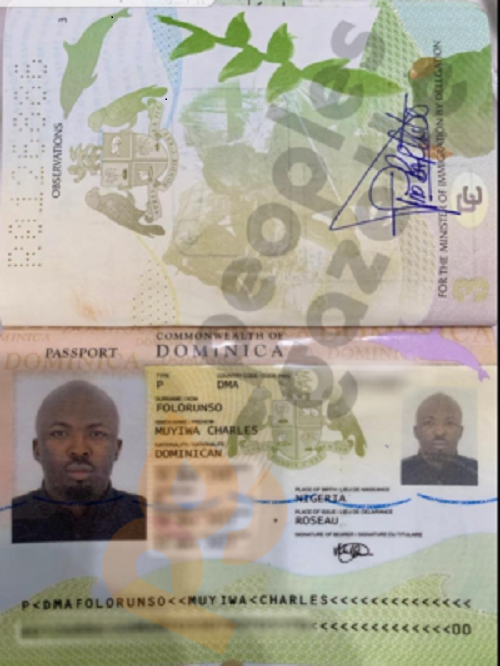

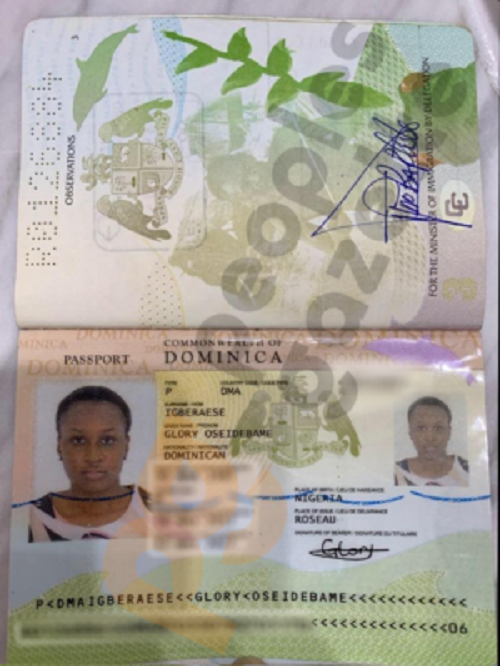

With the cat already out of the bag, the wanted couple is on the run. Reports have confirmed that they purchased foreign citizenships in Dominica, an Island nation that has become a haven for fraudsters attempting to escape the arm of the law.

Dominica, a small island in the eastern Caribbean Sea, has become a haven for fraudsters attempting to escape the arm of the law.

According to reports, the island offers the sale of its citizenship and diplomatic immunity to the highest bidder. One of its most popular sales is that of Nigeria’s former Minister of Petroleum Resources, Diezani Alison-Madueke, who was on trial for looting billions of dollars from oil revenues.

According to a 2019 documentary by Aljazeera, the fees for diplomatic immunity range between $250,000 and $2 million depending on the personality involved.

With millions of dollars stolen, acquiring a Dominican passport wouldn’t have been difficult for the couple.

The many dangers of investments

The tale of the PorkMoney founders scam is one of many occurrences that has made investment sour in the mouths of many Nigerians.

Many are yet to recover from the effects of popular schemes like MMM and most recently Racksterly that crashed, suddenly leaving their investors pants down.

Despite the woes, investment through digital platforms is quickly becoming an alternative means of income for many Nigerians.

With its increasing popularity comes an increasing expectation of these platforms to fulfil their promises of return on investments.

However, with fraudsters mixing with genuine businesses by using similar methods, there is a growing need for more means of protection for investors.

Some experts are of the opinion that many investment platforms are innovative Ponzi schemes.

The new licence requirements and regulations by the Securities and Exchange Commissions (SEC) on crowdfunding and investments is a good start but more may be needed.

Due to the dire economic straits in the country, Ponzi schemes have become very popular, creating an industry worth several billions of Naira.

The idea of making wealth in a difficult economy is enticing. Despite many Nigerians being wary of these schemes, many still fall prey because the perpetrators keep evolving.

From education to stronger enforcement, more is needed from both the private and public sectors to reduce such schemes.