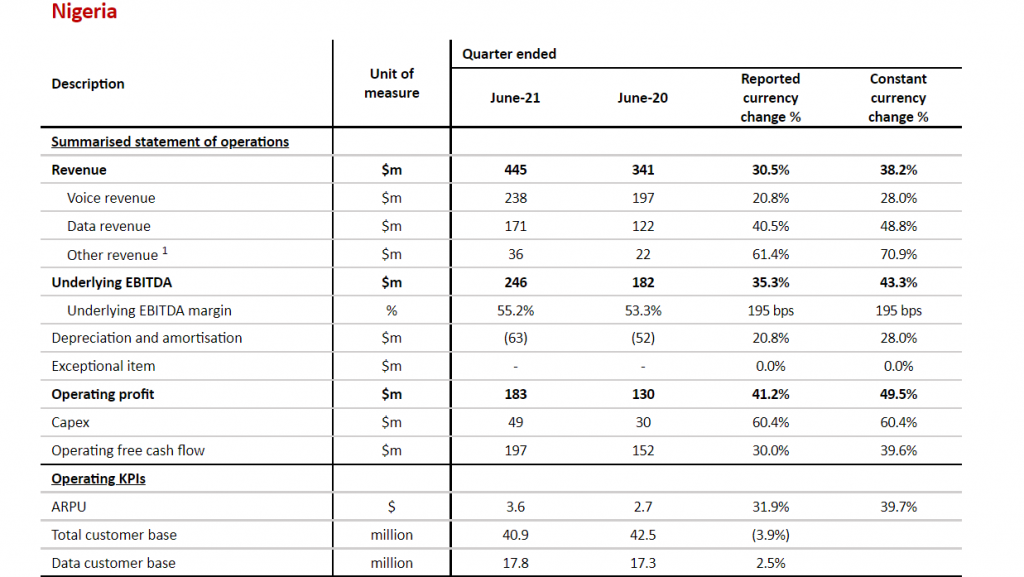

Airtel’s telecom business in Nigeria is growing despite a drop in subscriber numbers. According to Airtel Africa results for the quarter ended 30 June 2021, the revenue generated in the country rose by 30.5% to $445m.

This is more than double the 12% growth recorded in the previous quarter and significantly higher than the $341m generated during the same quarter last year.

According to the report, the telco’s revenue growth benefitted partially from the weakened performance in the first quarter of the prior year during the peak period of Covid-19 related restrictions in the country.

However, the growth would have been higher if the Nigerian naira didn’t devaluate by 6% (YoY).

Data sees the highest growth

A breakdown shows that voice is the biggest revenue generator for the telco, growing by 28.0% to hit $238m. This growth was driven by the increase in voice usage per customer which corresponded to a 29.3% increase in average revenue per user (ARPU).

Data also contributed significantly to the revenue growth recorded during the quarter, rising by 48.8% to hit $171m. This is the highest growth percentage witnessed by any segment of the telco.

Data revenue accounted for 38.5% of total revenue in the quarter, up 2.7 percentage points from 35.7% in the prior period.

The boom in data was driven by the 41.5% growth in ARPU for data and was supported by a 42.2% increase in data consumption per customer. “Airtel subscribers used an average of 3.8 GB per month, up from 2.7 GB per month.”

Other revenue grew by 70.9%, with the main contribution coming from the growth in value-added services revenue, led by airtime credit services.

4% drop in subscribers

Airtel lost about 1.6 million active mobile customers in Nigeria in the first quarter of its fiscal year. This is a follow on from 2.5 million customers lost in the first quarter due to the effects of the sim registration ban.

Despite the loss, the telco’s revenue grew as seen above largely due to the significantly lower ARPU of the churned base and increased usage by the active base.

In April, the NCC lifted the ban on sim sale and registration, allowing new customer enrolment to recommence from certified outlets. This led to the data customer base growing by 2.5% to 17.8 million.

The 4G data customer base now contributes 40.2% of the total data customer base with a total data usage contribution of 69%, up from 57.9% in the prior period.

The total customer base of Airtel in Nigeria currently stands at over 40.9 million. The report is however lower than NCC’s June numbers for Airtel which pegs its customer base at about 50.6 million, making it the second-largest telco in the country.

Airtel Africa profit doubles to $142m

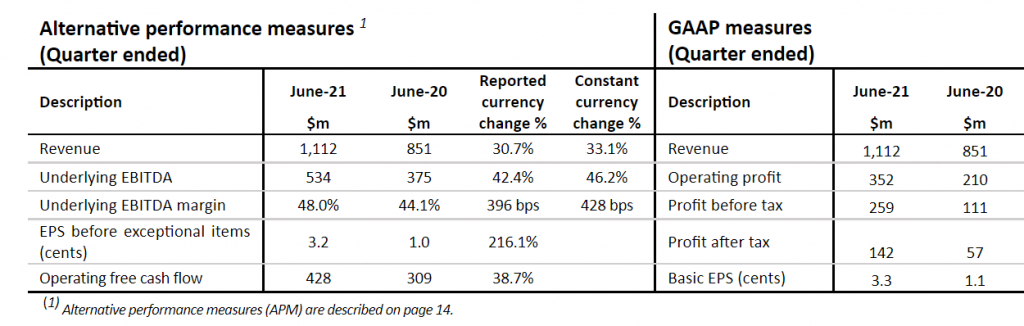

Across Africa, Airtel’s revenue increased by 30.7% to $1.1 billion in reported currency during the quarter. This represents a huge growth from the $851 million generated during the pandemic last year.

Similar to Nigeria, the revenue growth across the continent benefitted from a weakened quarter in the prior year.

Nigeria saw the highest growth up 38.2%. East Africa followed with revenue growth of 32.8% while Francophone Africa also saw double-digit growth of 24.9% during the quarter.

The Francophone Africa business region includes Chad, Democratic Republic of the Congo, Gabon, Madagascar, Niger, Republic of the Congo, and The Seychelles.

Despite the growth, the revenue was affected by currency devaluations, mainly in the Nigerian naira (6%) and Zambian kwacha (24.2%). This was in turn partially offset by appreciation in the Central African franc (6.6%) and Ugandan shilling (5.3%).

In general, the growth in revenue resulted in a net profit after tax doubling to $142m, up 148.7% from the previous year. The profit was primarily driven by higher operating profits along with stable net finance costs which more than offset the increase in tax charges due to increased profits.

Basic EPS was 3.3 cents, an increase of 200%, as a result of higher profit and stable finance costs and foreign exchange.

Mobile Services rakes in $955 million

An in-depth analysis of the segments shows double-digit revenue growth. Mobile services which including both voice and data, grew 27.6% to $918M from $719M during the same period last year.

Of the $918M generated, voice revenue contributed $562M after growing by 23.8% during the quarter. Similarly, subscribers increased 8.4% to 120.8 million.

Across the regions, Nigeria contributed the highest in terms of voice revenue $238M, East Africa $178M and Francophone Africa $146 million.

Data on its part grew 34.5% to $356 million. The growth was driven by an increase in the data customer base to 42.4 million and data usage growth.

Across the regions, Nigeria contributed $171M, East Africa $105M and Francophone Africa $80 million.

Mobile money

Mobile money continues to be one of Airtel’s fastest-growing service segments of Airtel Africa, accounting for 11.15% of total revenue.

The segment saw revenue growth of 52.8%% to $124M from $81 million for the quarter ended 30 June 2020 and $110M during the previous quarter.

The growth in revenue was driven by a 24.6% growth of the customer base and a 25.4% growth in ARPU, led by a transaction value per customer growth of 34.2%.

The customer base growth was largely driven by the expansion of its distribution network (kiosks and mobile money branches).

The East Africa business region includes Kenya, Malawi, Rwanda, Tanzania, Uganda and Zambia.

Across regions, East Africa has the largest mobile money users. The region generated about $91 million up 57.6% from $58 million. Francophone Africa comes second, after growing 41.3% to $33 million during the quarter.

Recognising the huge growth in Airtel’s mobile money, investors have been flocking in as the arm has raised over $500 million. The investments came from Mastercard ($100 million), TPG’s Rise Fund ($200 million) and most recently a $200 million from Quartar Holding LLC.

Summary

The growth of Airtel customer base has begun to recover with acceleration in East Africa and Francophone regions despite continuing negative net additions in Nigeria.

With the easing of restrictions in late April, Airtel says it has begun to add even more customers. This is visible in the NCC June numbers which shows that the telco added about 600 thousand users.

In general, the report says that the telco will continue to focus on the modernisation and rollout of its network, along with simplifying products and improving distribution.

However, with the third wave of the pandemic and added measures of lockdowns and restrictions in Sub-Saharan Africa, Airtel says it is considering the potential impact on local economies and consumers.