Nigeria is leading the growth of Africa’s booming mobile app market. In the last 1 year, the country contributed a significant amount of the total 41% uptick in overall installs on the continent.

This is according to a new report from AppsFlyer in collaboration with Google that tracked mobile app activities across three of Africa’s largest app markets (Kenya, Nigeria and South Africa) between Q1 2020 and Q1 2021.

A breakdown from the report shows that Nigeria registered a 43% increase in installs, the highest growth on the continent while South Africa follows with an increase of 37%. Kenya comes third with an increase of 29%.

The Appsflyer report analyzed over 6,000 apps and 2 billion installs in the three markets.

Pandemic inspired boom

With a young and mobile-first population, the app market across Africa has been growing steadily over the past few years. The effect of the 2020 pandemic further accelerated the growth of the market as shown in the report.

To better understand the effect of the pandemic, Appsflyer says that app installs increased during the second quarter, growing up to 20% compared to the previous quarter as more people spent time at home across the 3 countries.

The lockdown restriction which started in March 2020 with Rwanda spread to other Africa countries including Kenya, South Africa, and Nigeria.

A breakdown shows that the South African market was the quickest to feel the effects of the pandemic as installs increased by 17% from the previous quarter (Q1, 2020).

The growth in Nigeria and Kenya was slower with just 2% and 9% increase respectively during the same period.

The report attributed the gap in initial adoption to the varying levels of restrictions across countries with South Africa experiencing the strictest lockdown.

Game apps show the most impressive adoption

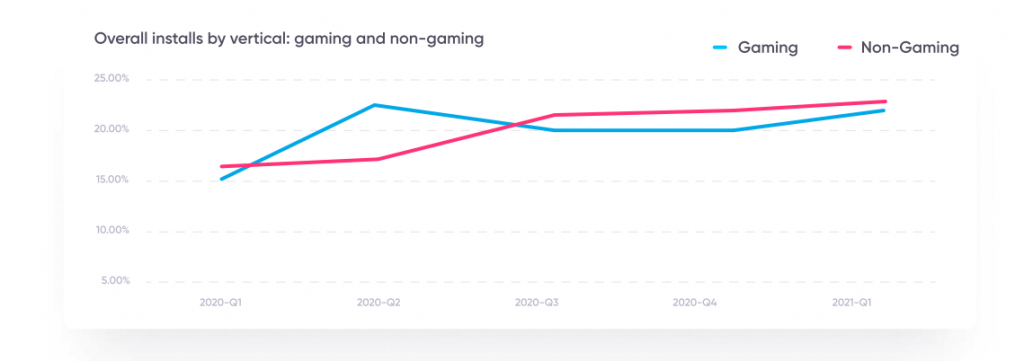

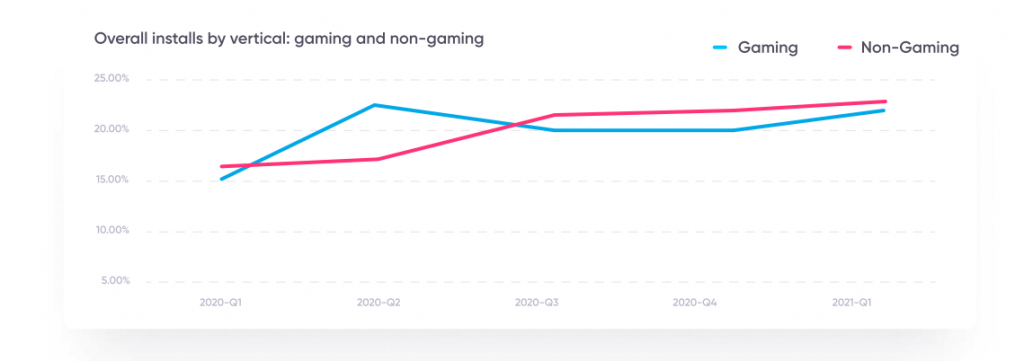

Of all categories of apps, gaming apps particularly showed strong performance during the early months of the pandemic. AppsFlyer revealed that game installs increased by 50% across all 3 markets.

In comparison, non-gaming apps only increased 8% during the same period. Among non-gaming apps, the report highlighted fintech apps and super apps among those on the rise.

According to AppsFlyer, Africas large mobile-first population who are inadequately served by traditional financial institutions are driving this growth.

This corresponds with a Disrupt Africa report that revealed that African fintech’s have grown by 89.4% between 2017 and 2021.

For super apps, the report says that its rise is partly due to device limitations on the continent. “Super apps remove some of the barriers that these users face, as well as providing a level of customer insight and experience that traditional banks cannot,” the report said.

Super apps are “all-in-one” apps that offer users a range of functions such as banking, messaging, shopping and ride-hailing.

South African’s spent more

Aside from installs, the pandemic also drove consumers to spend on apps. App revenue between July and September was up 136% compared to the previous quarter.

Most of the increase in consumer spending notably came from non-gaming apps which climbed 172%.

According to regions, the breakdown of the revenue shows that South Africans leads the way with a massive 213% increase as users spent more within mobile apps, from retail purchases to gaming upgrades.

Nigeria and Kenya also showed a significant increase of 141%and 74% respectively in IAP during the same period.

Advertisers spent more

With African’s spending more, it’s no surprise that marketers also spent more in the last year. According to the report, in-app advertising (IAA) increased 167% in revenue from Q2 2020.

Similarly, non-organic game installs (from ads) increased by 56% as game marketers were increasing spending in response to increasing consumer spending.

However, non-organic installs for other apps fell by 17% in Q2 but picked up in Q3. This suggests that marketers restricted ad spending amid the initial uncertainty of the pandemic but resumed when things opened up around July.

In Summary

Nigeria leads the way in terms of apps growth while South Africa has been a more lucrative market with the highest amount of consumer spending.

Generally, the incredible growth seen by the mobile app market on the continent further affirms Africa has one of the fastest digital adoption rates in the world.