The concept of income diversification cannot be overemphasized. In a country such as Nigeria, it is imperative that one sustains multiple streams of income, both passively and actively to ensure financial freedom.

Active income, however, is only earned by investing time and effort into a job or task given in return for money. While it can be very rewarding, it can be so demanding that it allows one very little time to engage in other activities for self-interest or self-development.

Over 60% of Nigerians dabble in passive income opportunities such as real estate, stocks, startup investments etc. This enables them to detach the time spent in making money and focus on other needs and interests. Their money works for them by securing assets that generate income monthly, quarterly or yearly.

However, keeping tabs on these assets can be a humongous task due to an active lifestyle, indoors and outdoors. Keeping up with various investment portfolios on various platforms makes tracking progress and income much more tedious.

One way to combat this problem involves having all investment portfolios listed on one platform. This enables the users to have access to all asset information, balances and track asset sizes.

Cova app is a web app that enables subscribers to link and track their digital assets such as stocks, cryptocurrency, mutual funds and other digital investments from their smartphone. It also enables its users to secure documents of traditional assets on the vault feature and add beneficiaries of their assets in cases of unforeseen circumstances.

I reviewed the app while it was still in its beta phase. It is not available on the app store but is fully functional on the web as getcova.com

How Cova app works

Users can access the platform by following the getcova.com link. There are various features operational on the app but you need to create an account on the site to fully access those features. To get started, one can easily use the Google sign in or fill in a quick form.

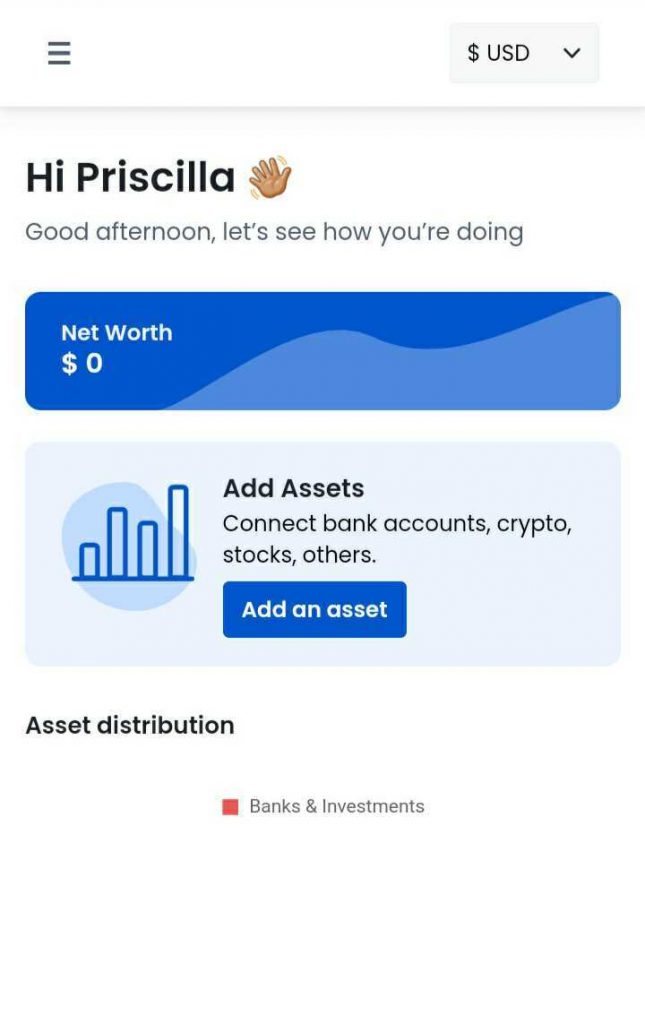

For old users, the home page shows you your net worth and asset distribution on a pie chart, displaying the amount each asset is worth at each given time. There is a collapsible list at the top right-hand corner of the dashboard that allows you to switch to your preferred currency.

There is also an option to add assets on the home page with which you can click and add assets in various categories like bank accounts, stocks and brokerages, startup investments, cryptocurrency and real estate.

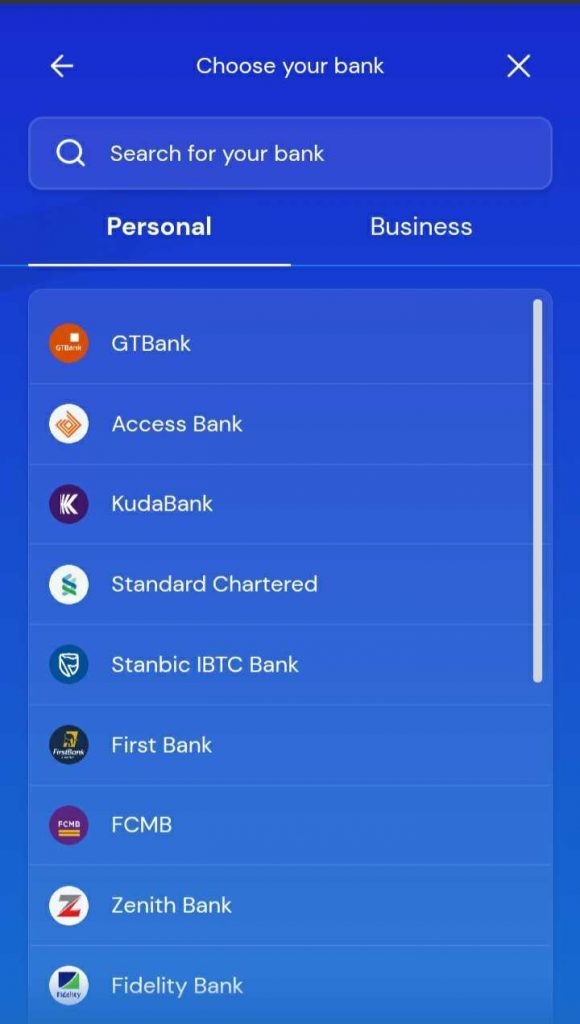

When connecting bank accounts, you will be presented with a list of banks available in your country for both personal and business use for you to select. You will need to log in either by internet banking or mobile banking. You will be required to provide your account number, password and token for internet banking or only an account number and password for mobile banking.

Users can add cash manually from their bank accounts by clicking on the manual option and providing details such as account number and name, bank name and value.

There is also an option to add custom assets should your asset type not fit the listed categories. With this option, you can describe the asset type, the cost and its value.

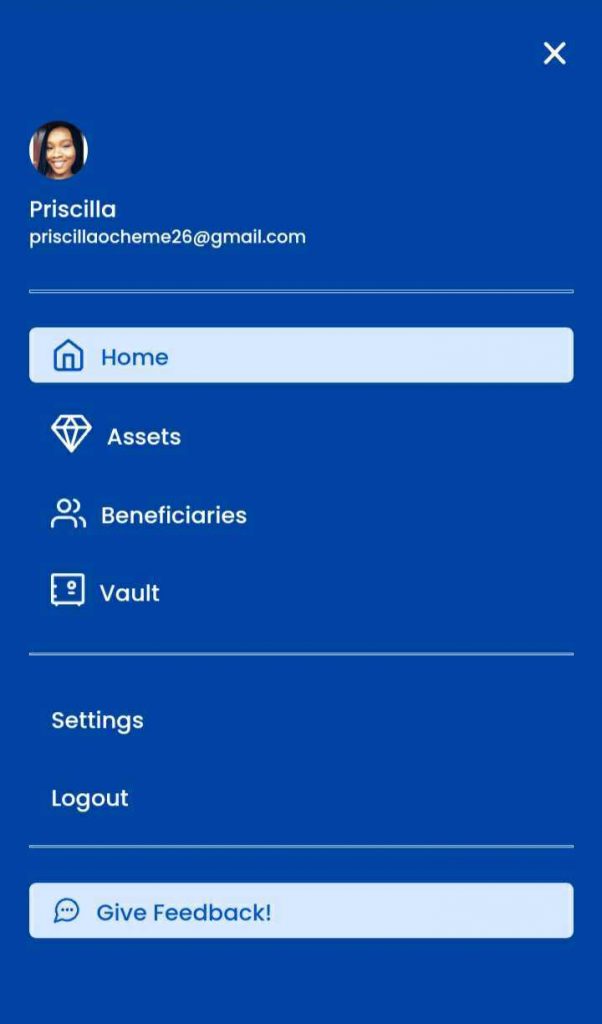

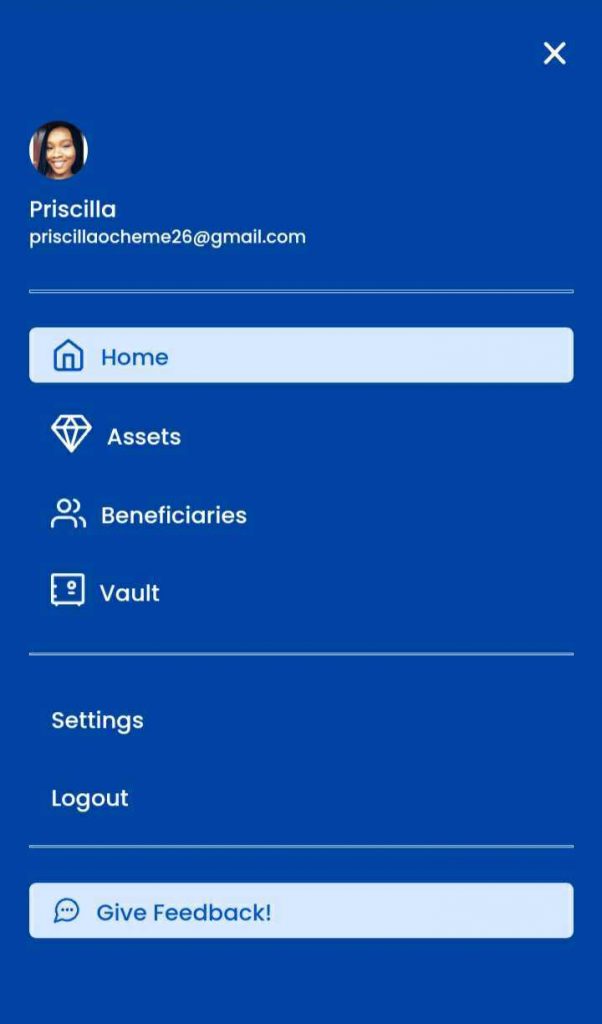

The main menu can be accessed by clicking on the three dashes on the top left corner of the dashboard. This will lead you to a list of operational features which include the home page, assets, beneficiaries, vault and other maintenance options like settings and an option to log out.

To add a beneficiary, you need only click on the beneficiary option and follow the prompts. Details such as the first name, last name, email and phone number of your beneficiary will be requested. An option to allow Cova to send an email notification to your beneficiary is displayed as well. You need only accept or reject it.

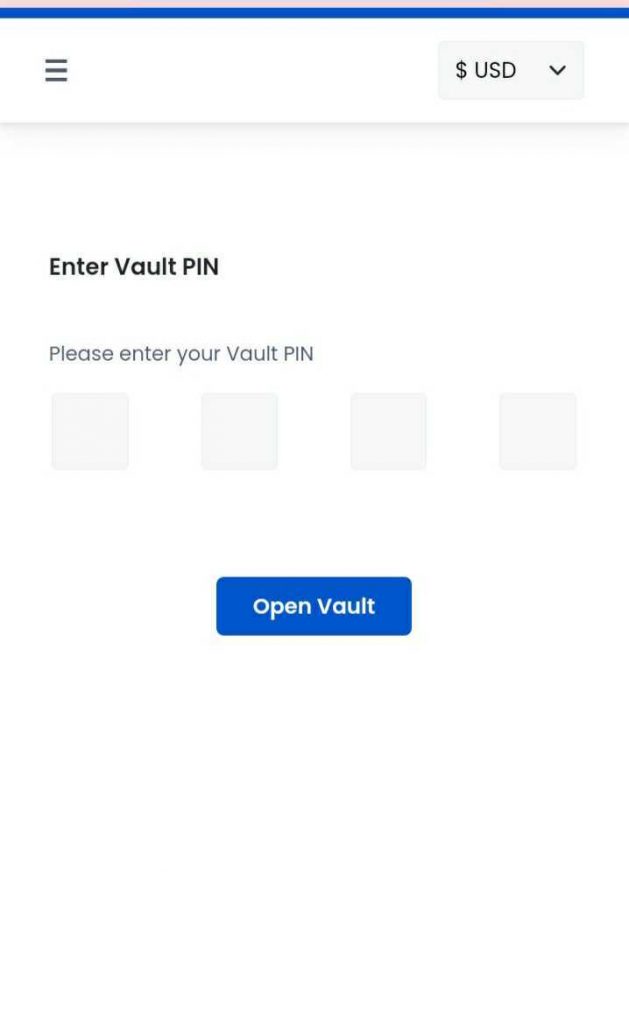

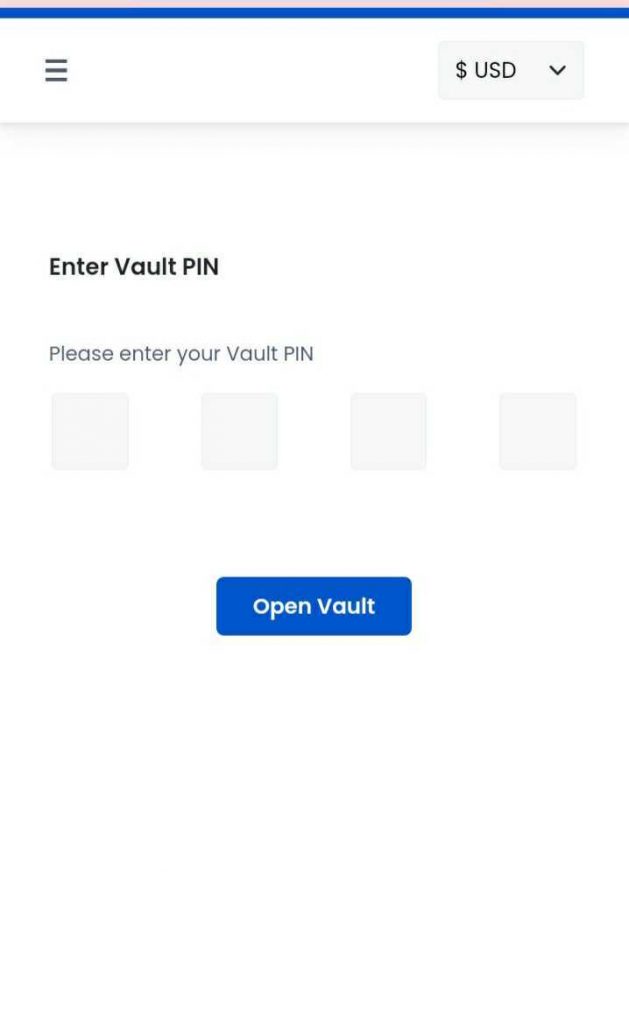

The Vault feature is a secure option that allows you to upload and secure important images and documents. To use it, you must create a four-digit pin unique to you to secure your files. After creating the pin, you can drag items you want to secure or upload from your smartphone by selecting ‘click’ on your screen.

Pricing

Depending on the value of your investments and how indispensable a service that aggregates and collates them on one platform is to you, Cova’s pricing seems pretty affordable.

Securing and tracking your investments is free for the first 14 days. After the free trial period, users would have to pay a subscription fee. Subscription fees can be paid either monthly or on annual basis. It will cost a flat fee of $7.99 (N3,600) per month. this plan is advised for users who are still trying to decide if the benefits are worth it.

The yearly plan of $79 (N35,550) grants a discount of nearly $16. It is advised for users who have decided to continue using the platform for the foreseeable future. It is yet unclear if the founders are working on other subscription plans.

‘A simple directory of your assets’- what users are saying

Even though the app is still in the beta stage, users are nonetheless impressed by the experience it offers. A user, Feranmi, says the basic fact that it offers a platform to pool all your investments means you don’t get to lose sight of anything.

“The way we forget money in our pockets is the same way many of us forget investments. And it’s not necessarily because we are that rich. It just happens. Use Cova_HQ to keep a simple directory of your assets,” Feranmi says.

Users are also lauding the app for providing a solution to the matter of digital assets. This can’t be overemphasized given how easy it is these days to lose gadgets to theft, damage etc. Thus, having all digital investments and assets on one platform reduces the risk of losing an asset due to password/PIN losses etc.

Joy Ajuluchukwu summarised this while celebrating her early access to the platform. According to her, Cova app finally presents a ‘successful solution’ to digital assets.

In summary

While it is not always advisable to put all one’s eggs into a single basket, there are always exceptions and Cova could be one of them. It is a great fix to the problems of digital investments and how easy it is to lose track of them.

The app acts as a general ledger to individuals who own multiple digital assets and can’t seem to have a good grip of their progress and asset value. It is an excellent way to keep track of your investment portfolios and making sure finances are in order.