Embattled agro investment platform, reQuid has promised that returns on all investments on its platform will be paid before February 2022.

A spokesperson from the company revealed this new development in a chat with Technext. According to the source, payment schedules have been communicated to affected investors and payments will be completed within 3 to 8 months.

“We have communicated the respective payment schedules for each of the affected investments, ranging between three to eight months from now.”

Recall in May, the agritech startup was accused by irate investors of not settling capital as well as returns on the farm ventures they partnered with on the platform.

Some investors who opened up to Technext lamented that they had not been paid even though their investments had matured for more than 9 months.

Responding to the accusation, reQuid acknowledged that some payments were delayed due to a series of adverse developments surrounding the pandemic that led to subsequent defaults by partners.

It however, assured investors that all their returns will be paid.

‘We haven’t received payment yet’- investors

A few months after the initial promise, follow up revealed that several investors are still being owed. Irene says that she has only been able to recover 30% of her capital on the rice investment she made on reQuid.

She also said reQuid sent a message to investors saying they have engaged a legal team to help recover the money from Novus Agro (the original owners of the rice project) while looking for alternative financing to refund them.

“They sent a message to say they have engaged legal team to help recover our money, and are looking for alternative financing to refund us. They’re saying if we want to be co-complainants, we should fill a form.”

Another investor simply identified as ‘Tender’ on Nairaland also said he hasn’t been paid at all on the JV rice investment on the platform.

The reQuid spokesperson, however, denied the accusation, telling this correspondent that the company has kept to the payment schedule communicated with investors despite reQuid not receiving the expected payments.

“We have kept the payment schedule for the Novus Agro Rice JV project as communicated with investors. All subscribers to the project have received the agreed payments, despite reQuid not having received the expected payments from Novus Agro.”

reQuid

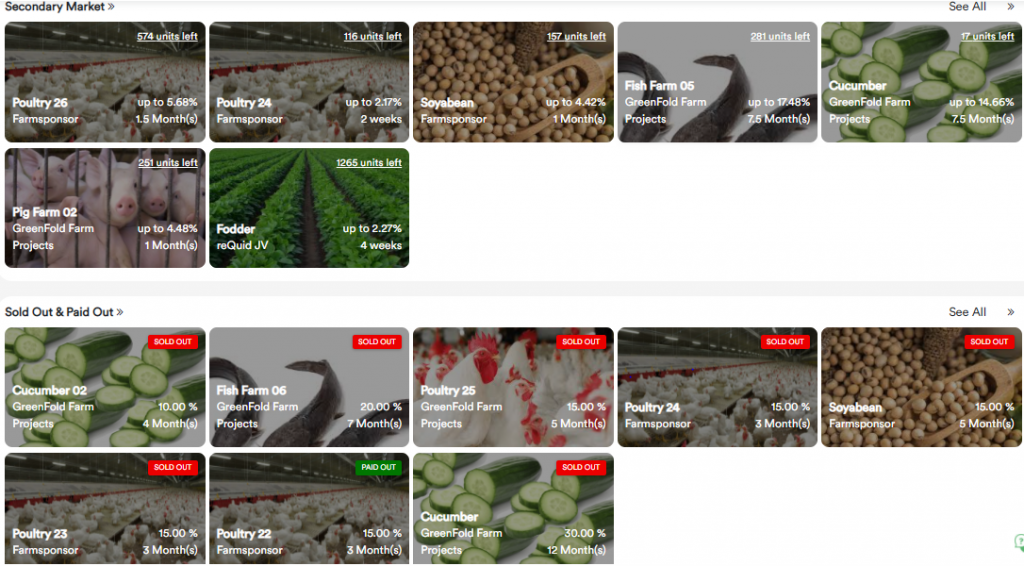

While we could not ascertain if payments on the rice investment have been made, we were able to confirm that reQuid made several payments. A reQuid investor with the handle Sanerugwei confirmed that he received payment for Farmsponsor’s investment on June 22nd.

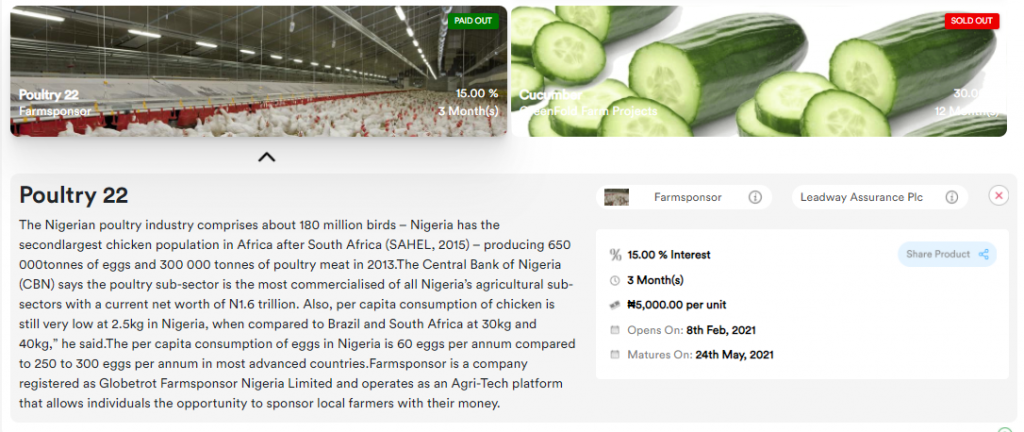

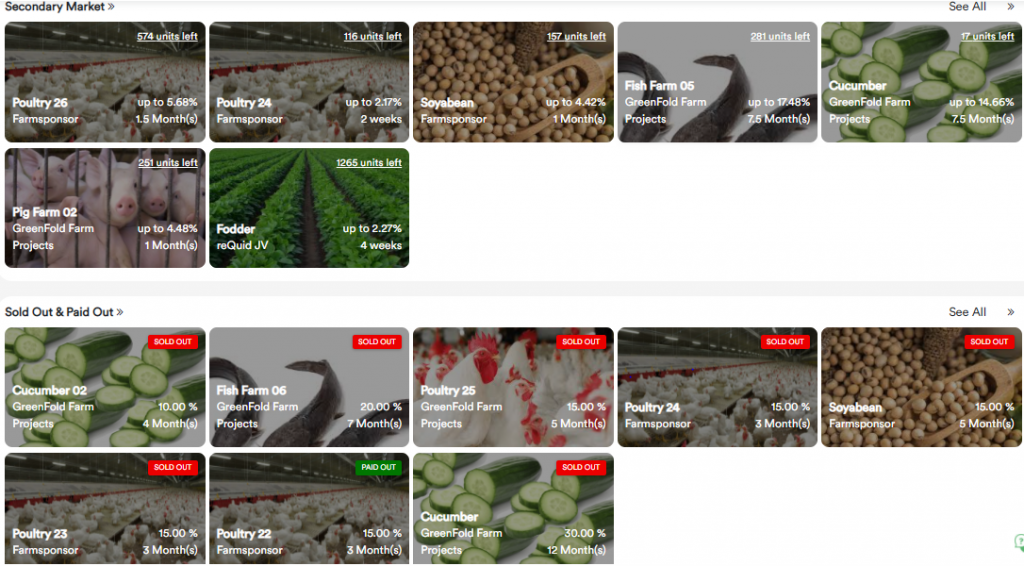

A look at reQuid portfolio shows that the Farmsponsor Poultry 22 was marked as paid out. Analysis shows that the payment was due on May 24th but was probably paid around June as reported by Sanerugwei.

More reQuid investments fail

The most troubling discovery from our investigation is that more investments are failing while current defaults have not been cleared out.

In May, reQuid revealed that five major partners including Groupfarma and Novus had defaulted due to several reasons.

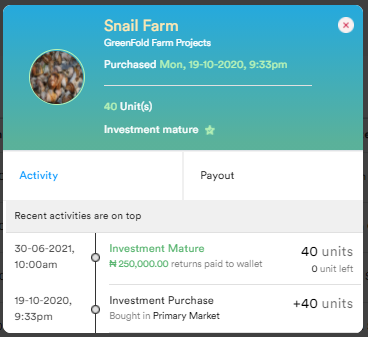

Recently, investors opened up that more investments schemes on the platform have defaulted. An investor revealed that his investment in Greenfold Snail farm matured on May 31st, 2021.

Another investor, Dennis Maria said his investment in Greenfold goat farm matured on June 30th but he’s yet to get payment. Another user, Joey also revealed that his friend made similar investment and hasn’t received payment.

Sam Christ, an Investors shared this mail from reQuid.

Dear *******

We wish to notify you of some developments on one of your investments.

We are aware that your Grasscutter Farm Investment will mature on Monday, May 31st, 2021. Unfortunately, there might be a delay with the payment. Greenfold reportedly suffered massive mortality of colonies of Grasscutter. Although insurance was taken on the farm, the amount paid by their insurance company was insufficient.

We have visited Greenfold to ascertain the extent of their current challenges, to determine the feasibility of the payment plan and to ensure commitment to this payment.

In the light of this, Greenfold has requested that payment to you will be staggered in two phases:

Payment of your ROI on invested capital on June 30th, 2021

Payment of your initial capital on July 30th, 2021

We plead that you remain patient with us while we work with Greenfold to ensure that all payment obligations are met, and provide timely updates when necessary.

As an extra step to ensure that we don’t have another default and to protect your investment, we have engaged our legal team to ensure compliance and timely recovery.

We apologise for any inconveniences this might cause, and sincerely hope that you bear with us as this gets resolved.

Kind Regards,

Upon enquiries by this correspondent, reQuid confirmed that several other agribusinesses have failed to meet payment obligations thereby resulting in defaults on investors payments.

The spokesperson explained that one of the defaulters, Groupfarma have applied for and received some funding from the Central Bank of Nigeria (CBN) for a new planting season. They are, therefore, already having discussions on a payment plan for investors.

Another partner, Abadini have reportedly communicated a new payment timeline after failing to meet payment obligations for the Rice Paddy aggregation project. According to the company, the delay was due to the sudden surge in the price of acquiring rice paddy (seed) and the unstable FX policies that affected their importation.

Farmsponsor, which is the latest defaulter according to the company appears to have made a failed gamble with investor returns. reQuid says the agribusiness blamed the 3-month delay in its poultry investments to a restriction on crowdfunding by the Securities and Exchange Commission (SEC). reQuid, however, says it doesn’t agree with Farmsponsor’s excuse.

Nigeria’s investment regulator, SEC now has new regulation that requires crowdfunding platforms to register and comply with its updated terms before the already expired deadline of June 30 or stop operating

According to its findings, reQuid believes that Farmsponsor spent investors funds in a bid to expand their operations.

“More recently, Farmsponsor has communicated a three-month delay for their poultry investments. While their claim is that their liquidity is affected by the restriction in crowdfunding by the SEC, from our findings and engagement, we believe that in a bid to expand their operations, they invested their funds in more infrastructure than they should with the hope that they could still raise funds from the crowd for operational costs.”

Despite the increased defaults, reQuid spokesperson exuded strong confidence that the platform will pay investor for all the projects. “For each of these projects, we have communicated the adjusted payment schedules with the respective subscribers.”

The source also added that they are working on new procedures to reduce the risk of failure of future agric investments.

“While reQuid as a crowdfunding intermediary cannot guarantee returns promised by issuers (fundraisers) on our portal, we are having conversations with relevant institutions to further derisk investments in agriculture.”

Dropping Investors confidence

Although reQuid has promised to repay defaulted investments using payment schedules, several investors do not believe them.

Erinbola, a reQuid investor claimed that her GroupFarma – Poultry 16 that was due on April 2nd was said to be delayed till June 7th (over 2 months), only for a mail to be sent June 8th saying they are still unable to recover the fund from GroupFarma without a new date for payment.

Another, investor Joey claims that the platform doesn’t even bother to tell people their investments have matured anymore. “They just hope you forget,” he added.

He also predicts that more farms on the platform will default as some of the embattled partners still have several other farms on the platform that are yet to mature.

“How on earth did they keep opening farm upon farm from Greenfold without due diligence? There’s like another 5 farms on Greenfold yet to mature and they are almost certainly defaulting on those too.”

Asked what the company’s plans to do restore investor confidence, the spokesperson revealed that the company has signed several key partnership that it will revealed soon.

The source also added that the company is excited about some of the provisions in the Crowdfunding Rule by the SEC which makes it a requirement for issuers to be more transparent and provide access to relevant information for investors to make more informed decisions.

In summary

Despite reQuid’s promise of repayment, the most important to investors is recouping investments and not promises- as seen in the similar Thrive Agric debacle.

Also, the revelations from the ongoing scandal in the Agri industry highlights a huge problem that, if not solved quickly, could set the budding industry back years.

The new SEC licence and incubator for investment platforms seems like a good start for the industry but beyond the incubator more is needed to be done to protect subscribers investment.

reQuid on its part says it’s going for an SEC Crowdfunding license and will also be tweaking its business model to better protect its users.