Nigerian fintech startup, FairMoney has raised $42 million Series B to expand and diversify offerings for its users in Nigeria and India.

The round was led by Tiger Global Management, one of the investors in Flutterwave’s $170 million round in March. Existing investors from the company’s previous rounds, DST Partners, Flourish Ventures, Newfund, and Speedinvest, also participated.

The company raised €10 million Series A in 2019. Before then, it received a €1.2 million seed round in 2018. With the latest investment, the company’s total fundraising comes to about $55.26 million.

Scott Shleifer, a partner at Tiger Global, expressed excitement about the investment. According to him, Fairmoney has shown strong growth and they are happy to partner in helping the fintech build a better financial hub for customers.

“We are excited to partner with FairMoney as they build a better financial hub for customers in Nigeria and India. We were impressed by the team and the strong growth to date and look forward to supporting FairMoney as they continue to scale.”

Scott Shleifer, partner at Tiger Global

Providing quick access to loans

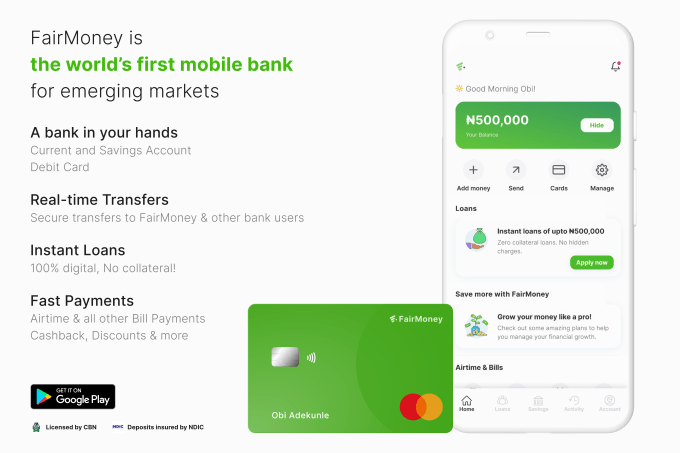

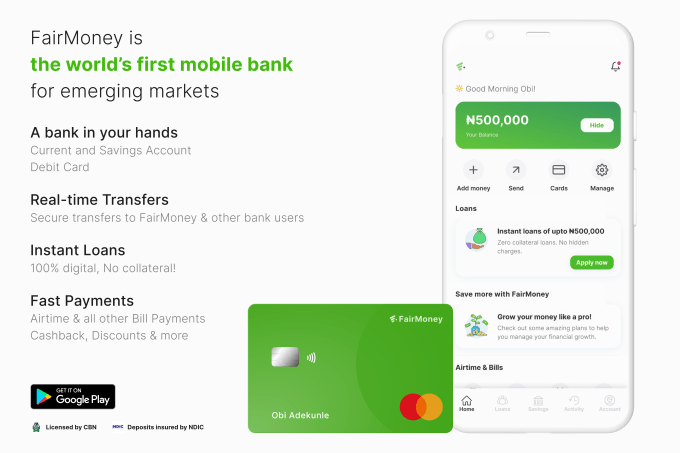

Founded in 2017 by Laurin Hainy, Matthieu Gendreau, and Nicolas Berthozat, FairMoney started as an online lender that provides instant loans and bill payments to customers in Nigeria.

Since its launch, the company has grown its user base to about 3.5 million registered users which includes 1.3 million unique bank account holders.

Last year, Fairmoney reported that it disbursed a total loan volume of $93 million to over 1.3 million users who made more than 6.5 million loan applications.

This year the company is looking to disburse $300 million worth of loans.

Outside Nigeria, the company has started expansion into India. According to its CEO Laurin Hainy, it has processed more than 500,000 loan applications from over 100,000 unique users in its 6 months of operation in the country.

Financial hub for users

FairMoney is one of the few fintech’s which had acquired a microfinance bank license. The license allows the company to operate as a financial service provider in Nigeria.

After achieving this goal, the company says it wants to become a financial hub for its users.

Before now, the company offers loans to individuals from ₦1,500 to ₦500,000 ranging with repayment periods ranging from a few days to six months. Now, the company has revealed that it will start servicing loans to registered SMEs in Nigeria.

Other services it plans to introduce include the issuance of debit cards, savings products, stock trading, and crypto-trading products depending on regulations.

In Summary

Fairmoney’s CEO has revealed that the company has no plans to expand outside Nigeria and India for now. However, he revealed that the company plans to aggressively expand its user offerings in its markets.

He added that to achieve their goals, the company plans to boost the team by hiring worldwide.

“We are hiring worldwide, and there are 150 open positions out there right now that we’re trying to fill with strong talent to help us build the financial app for Nigerians,” Hainy told TechCrunch.