Nigeria has fallen 5 spots to rank 57th in the 2021 Global Fintech Ranking despite Flutterwave and Chipper hitting unicorn status.

This is according to the new Fintech report released by Findexable, which identifies emerging hubs, fintech companies and fintech trends across the globe. The index was first published in 2019.

The Index algorithm ranks the fintech ecosystems of more than 250 cities across 83 countries incorporating data from Findexable’s records which is collated and verified by its Global Partnership Network, including Crunchbase, StartupBlink, SEMrush and 60+ fintech associations globally.

The fintech ecosystem is expanding

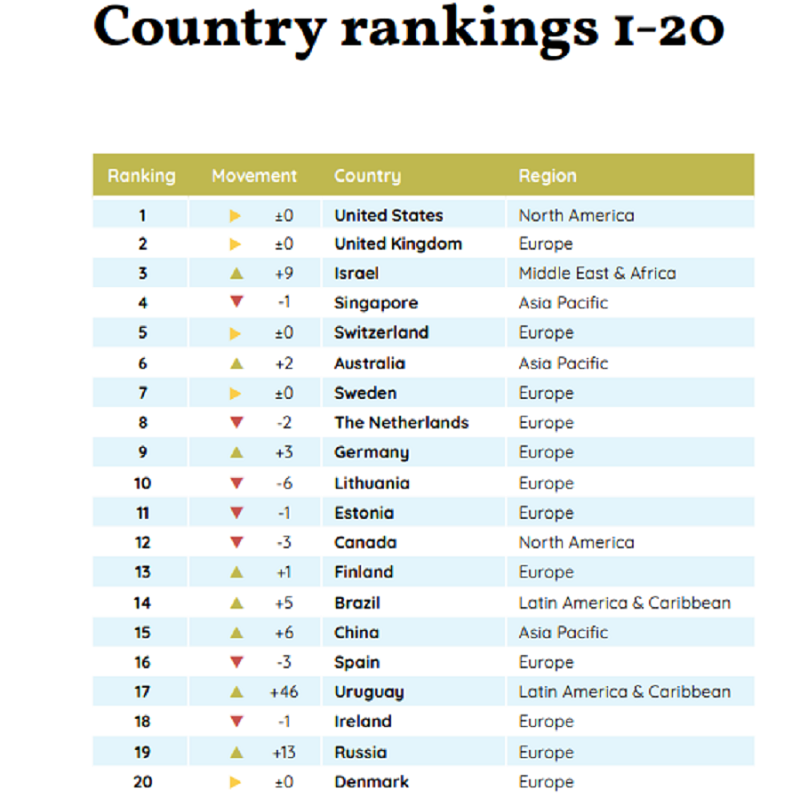

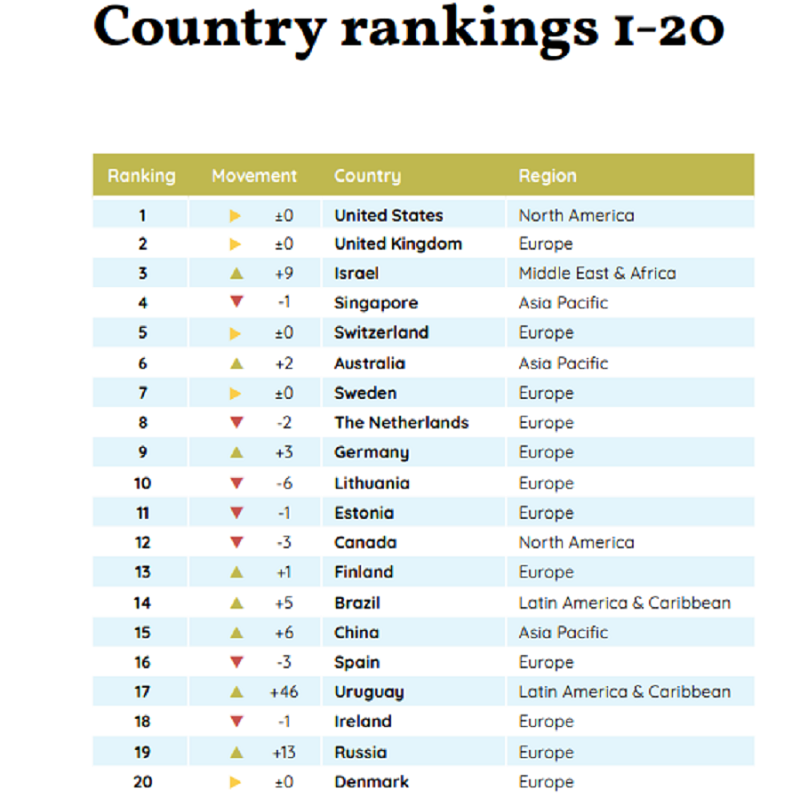

Unsurprisingly the United States and the United Kingdom still top the rankings list globally. However, some countries like Israel in the Middle East and others in the African region have broken into the top 5.

The report shows that although London, New York and San Francisco are still global centres of development, the fintech industry is becoming more geographically diverse.

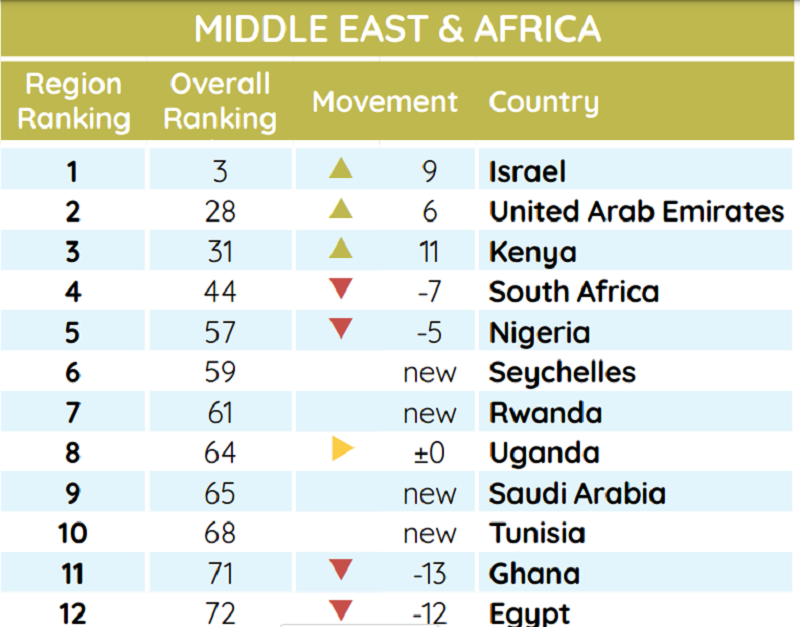

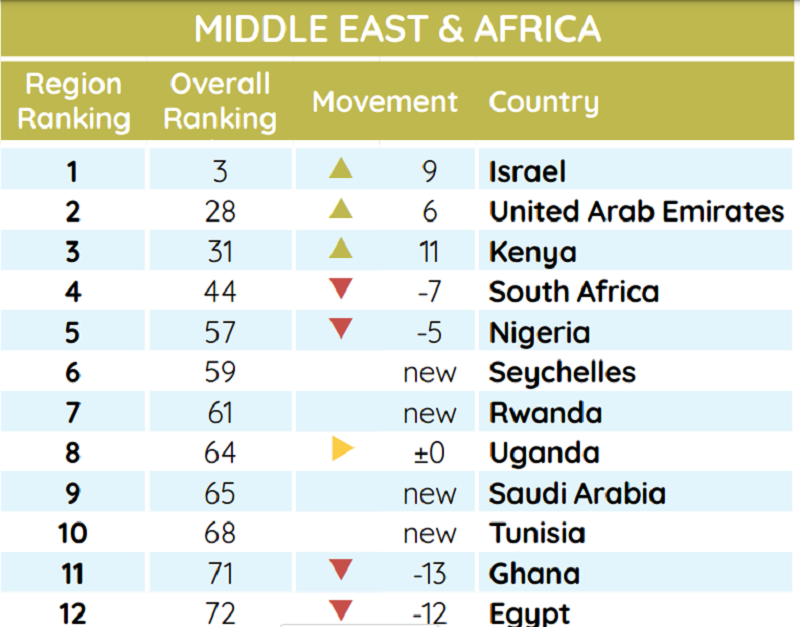

Kenya, home of Safaricom’s M-Pesa, solidified its lead in Africa, rising 11 spots to 31st globally, 26 spots above Nigeria.

South Africa also ranked higher than Africa’s largest economy even though it fell 2 spots globally to rank 44th on the Index.

Nigeria, on its part, remained third in Africa but failed to make the global top 50 fintech ecosystem. Other countries in the top 5 for Africa include Seychelles (59) and Rwanda (61).

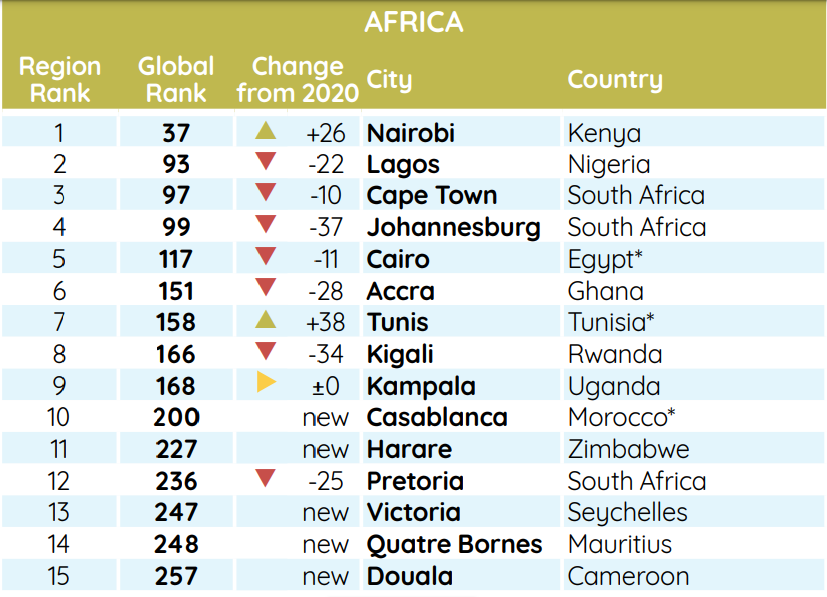

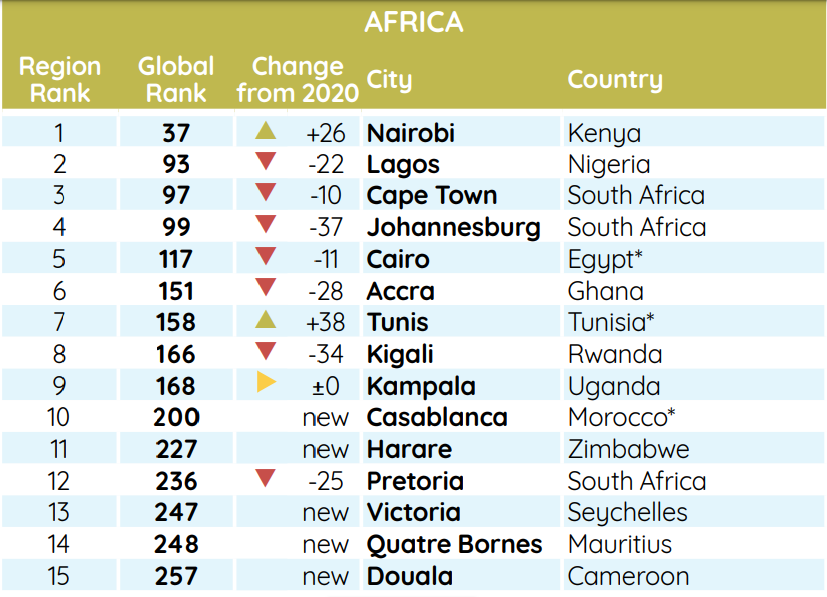

Nairobi tops African cities

In terms of tech cities, Nigeria’s commercial centre, Lagos also dropped in the ranking. The city dropped 22 places to rank 93rd in the fintech rankings.

While Lagos slumped, Nairobi, jumped 26 places to rank 37th on the global standings. This makes the Kenyan capital the only African city to make the list of top 50 fintech cities around the globe.

South Africa’s Cape Town and Johannesburg comes in at numbers 97 and 99th after dropping 10 and 37 spots respectively. Cairo completes the top 5 African cities after ranking 117 globally.

Accra, Ghana’s capital city, dropped 28 places to rank 151 on the global ranking of cities.

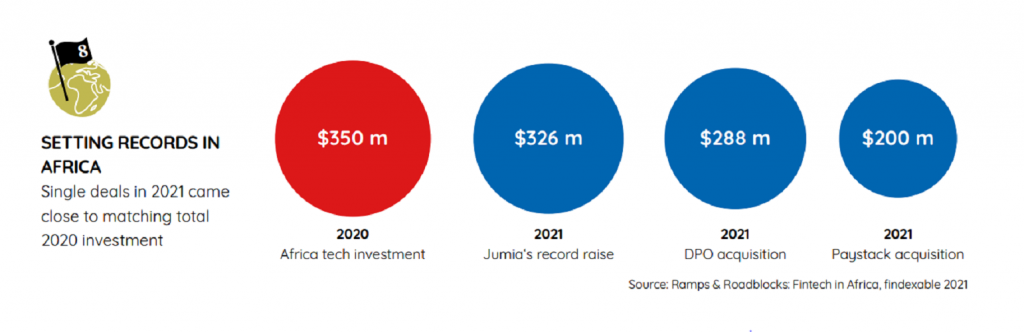

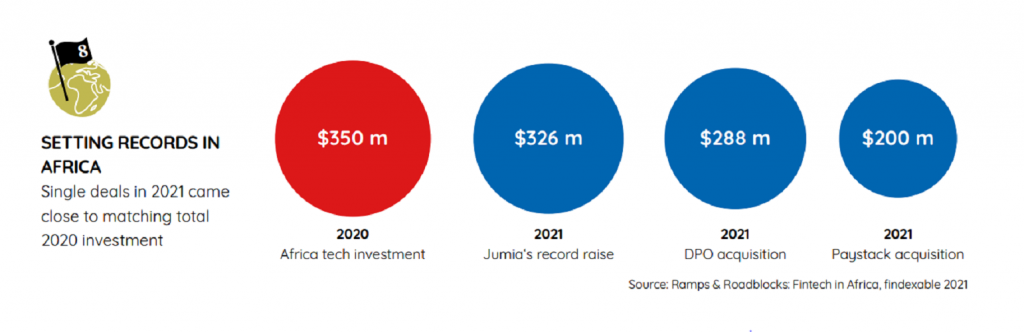

Funding bounces back in 2021

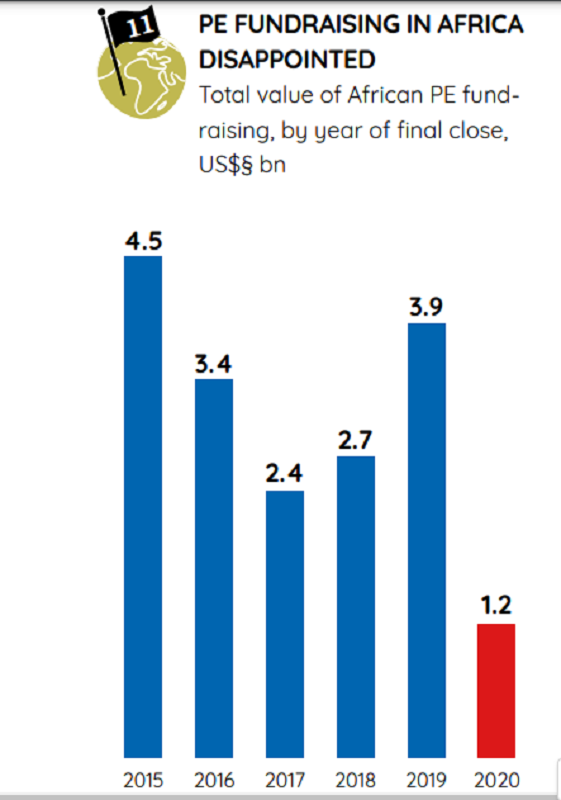

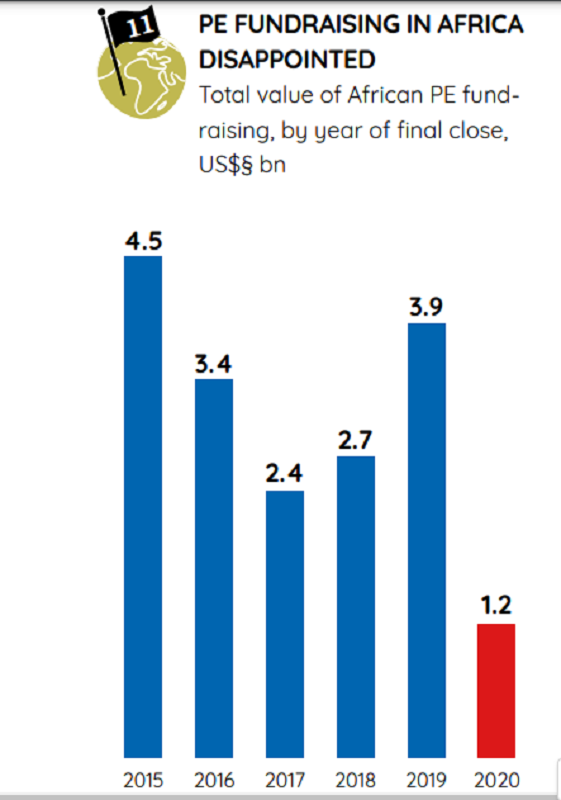

According to the report, the drop in most ecosystems was due to the effect of the pandemic on VC investments last year when compared to the record-breaking 2019.

Although some headline deals were made during the year, the report revealed that 2020 was the worst year for capital raising by VC and private equity funds based in the continent since at least 2015. The $350 million total raised in 2020 was less than a third of the 2019 figures.

Fintech is giving financial services the push it needs to become more diverse

However, at the beginning of 2021, things changed. The financial technology sector expanded globally, building upon a surge in demand for technology that increased access to digital finance.

The pandemic showed digital financial services to be fundamental to the smooth functioning of an economy and investors noticed.

According to CB Insight, the number of fintech unicorns surged from 61 in April 2020 to 108 this year. The combined valuation of fintech unicorns has also more than doubled to $440bn.

Flutterwave is one of such unicorns. The fintech raised more than $170m in a funding round in March, as its services have become vital to businesses across Africa trying to weather the current situation.

Fintechs now represent more than 20% of total tech unicorn value, compared to 15% just a year ago

Africa is the new home for fintechs

The number of African countries on the global fintech rankings has risen to 13 with the debut of 7 newcomers. The newcomers include the Seychelles, Rwanda, Tunisia, Zimbabwe and Somalia.

This means that in the last year, fintech startups in these 7 African countries have grown, with each having more than 10 fintech startups.

In addition to that, the fact that Africa contributed 7 out of the total 20 new countries to join the index shows it’s one of the fastest-growing fintech regions in the world.

According to the report, emerging markets are natural sources of fintech innovation given the hunger for financial services among young, digitally savvy but underbanked populations.

It added that the giant populations in the region helped, providing domestic companies with the opportunity to scale before needing to consider entering foreign markets.

The pandemic was also a significant accelerator of both the speed and scale of fintech growth in many of these less developed countries.

In Nigeria for example, as queues to enter physical banks lengthened due to capacity restrictions during the pandemic, customers turned to digital banks, some of which saw customer enrolments triple.

In summary

Going forward, the high influx of fintech startups and funding this year could mean more growth and expansion for the sector in Africa.

According to an advisor at African tech, Jake Bright, the over $270 million already raised by Flutterwave and Chipper Cash may cause Venture Capital funding for Nigeria and Africa in general to hit record levels this year.