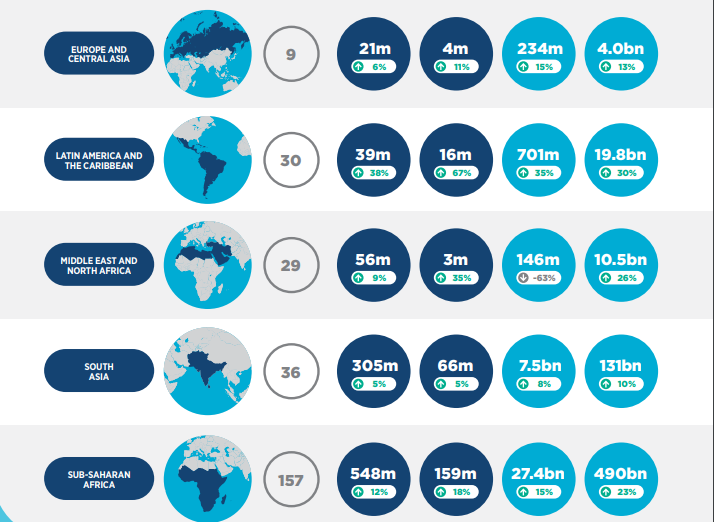

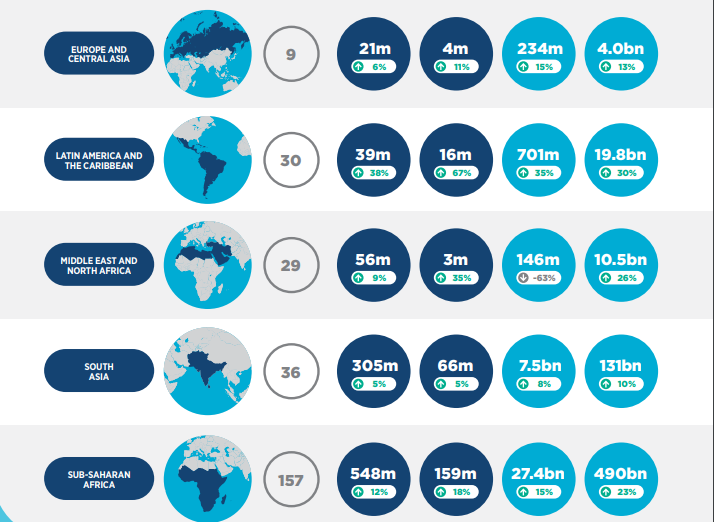

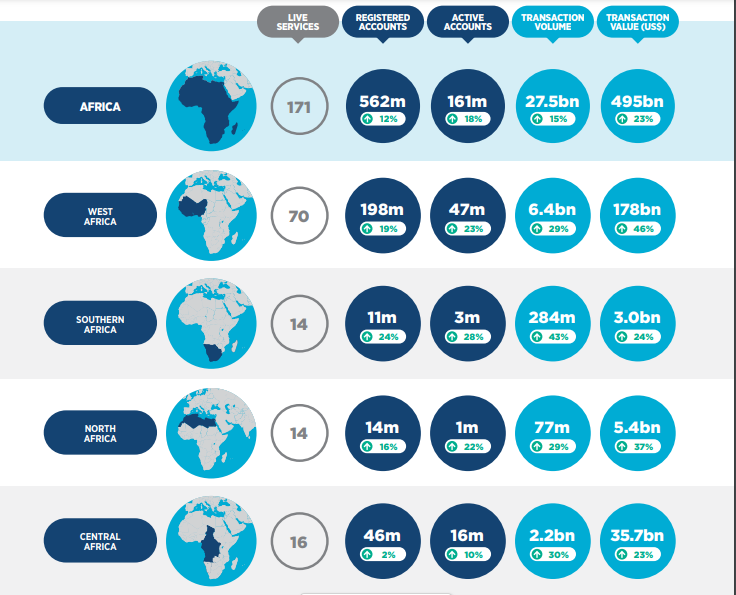

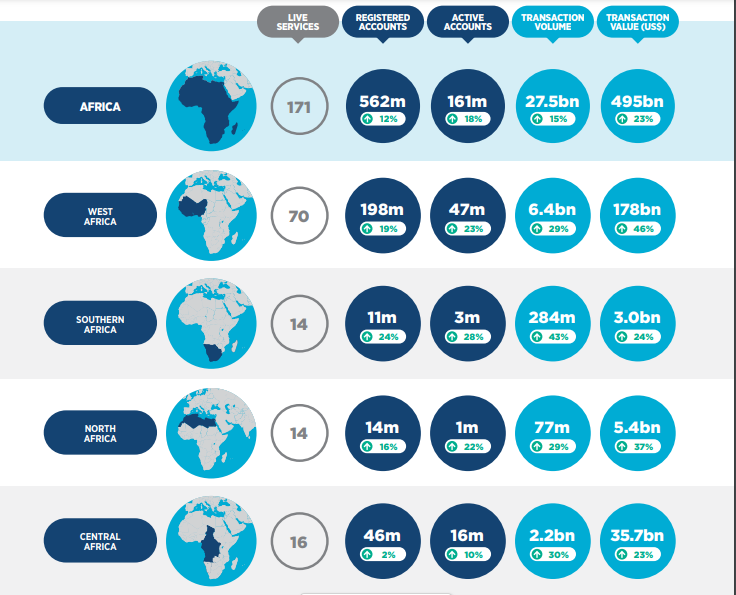

Sub-Saharan Africa has been at the forefront of the global mobile money industry for over a decade. In 2020, the region continued its dominance after seeing a significant 43% growth on new accounts according to a new GSMA report.

As predicted in last year’s State of the Industry report, registered accounts in Africa comfortably surpassed the half billion mark. Sub-Saharan Africa gained 79 million new accounts, raising the total number of registered mobile money accounts in the region to 548 million by the end of the year.

Globally, the total number of registered mobile money accounts reached 1.21 billion after crossing the 1 billion mark during the previous year. Also, the number of monthly active users hit 300 million after seeing a 17% growth.

While it took nearly a decade for the mobile industry to reach its first 100 million monthly active accounts, it has taken just over five years to reach another 200 million

This growth was achieved despite the effect of the year long COVID-19 pandemic. The report revealed that the outsized role mobile technology, and mobile money, in particular played in keeping people connected, delivering vital financial support and providing safe, no-contact ways to pay for food, electricity and other life essentials contributed to its growth.

The sheer amount of funds transferred via mobile money during the period pushed the global value of transactions to exceeded $2 billion a day for the first time. At the current growth trajectory, GSMA expects it to surpass $3 billion a day by the end of 2022.

A breakdown shows that the Total transaction values grew by 22% to reach $767 billion while the transaction volume rose 15% to 41.4bn in 2020.

With more than $2 billion being transacted every day, mobile money

became a part of a new daily routine for millions around the world.

West Africa nears 200 million milestone

West Africa has a total of 198 million mobile money accounts, up from 163 million in 2019. The number of active accounts in the region also rose 23% to 47 million.

The sub-region now has about 70 mobile money services up from 59 in 2019. This is the highest in the Sub-Saharan Africa region.

The recorded transaction volume was about 6.4 billion. This added up to an impressive $178 billion in value, up 46% from the $130 billion transacted last year. However, East Africa still remains number 1 in the region with 293 million registered accounts and $273 billion in value.

Although absolute growth was highest in West and East Africa, Southern Africa grew the fastest at 24 per cent year on year.

The effect of COVID-19 on the mobile money economics

The pandemic may have driven the adoption of digital transactions on mobile platforms, but the report shows that mobile money providers have not reaped the commercial benefits.

It pointed out that consumer spending, the major driver of mobile money revenues, has slowed dramatically. The revenue of Africa’s top mobile money provider, M-Pesa Kenya declined by 14.5% year on year between April and September 2020.

“Results of the Global Adoption Survey show that despite healthy growth in mobile money revenues in the last quarter of 2019, revenues dropped sharply at the beginning of 2020 due to the global economic downturn and the regulatory measures that were implemented.”

However, this did not last till the end of the year as total revenues rebounded when economies began reopening in mid-2020. This ultimately led to the great year the industry had.

International Remittances

In contrast to earlier predictions, international remittances kept flowing. The number of international remittances processed by mobile money reached a record high in 2020.

International remittances sent and received through mobile money increased by 65% to reach $12.7 billion during the year. This is a significant jump from $5 billion in 2020.

This means that, on average, the industry for the first time processed more than $1 billion in international remittances per month

A breakdown shows that the volume of remittances received increased by 73%, while the volume sent via mobile money increased by 69%.

This gap is to be expected since the incomes of people sending from mobile money markets are likely to have been more severely affected by the pandemic.

Friendly regulations

The pandemic was also a catalyst for regulatory institutions to make decisions and implement measures that may have been pending.

Kenya and Ghana, for instance, implemented measures like increasing daily transaction limit. That had the distinct effect of supporting the small and medium-sized enterprise (SME) sector which turned to mobile money to accept payments instead of cash.

That’s not all, in several other markets, regulatory changes such as simplifying and streamlining processes to make it easier to sign up for a mobile money account were adopted.

Agents still the backbone of adoption

2020 saw the highest increase in the number of registered agents in the last three years. The number of agents grew 14% year on year to reach 9.1 million. On average, markets with over 100,000 registered agents saw networks grow by 15 per cent in 2020.

However, for clarity, the report estimates that there are about 5.2 million unique agent outlets globally.

The GSMA believes that the growth was driven by both supply and demand. “As restrictions on travel were introduced, and governments advised against the handling of cash, demand for non-cash payments (primarily P2P and merchant payments) increased,” it says

In a country like Nigeria where cash is still a major form of transaction, agents are the main leverage driving mobile money adoption.

The ease with which agents provide convenient and trusted ways of converting cash to a digital value and vice versa is a major aphrodisiac that drew adoption during the thick of the pandemic.

Conclusion

2020 saw higher levels of mobile money activity and increased use of more advanced ecosystem services, suggesting that more and more people are reaping the benefits of digital financial inclusion.

Following the trend that began this year, GSMA believes Governments and regulators should continue to consult with the industry to create more enabling environments that not only benefit consumers but also ensure the long-term sustainability of the industry.

However, whether the COVID-19 pandemic will have a lasting impact on the use of cash, digitization or consumer behaviour remains to be seen. As the global economy continues to recover, the mobile money industry will continue to navigate the new economic trends created.