Differing responses to the Covid-19 pandemic have resulted in varying financial impacts on a club-by-club basis for premier league (EPL) clubs.

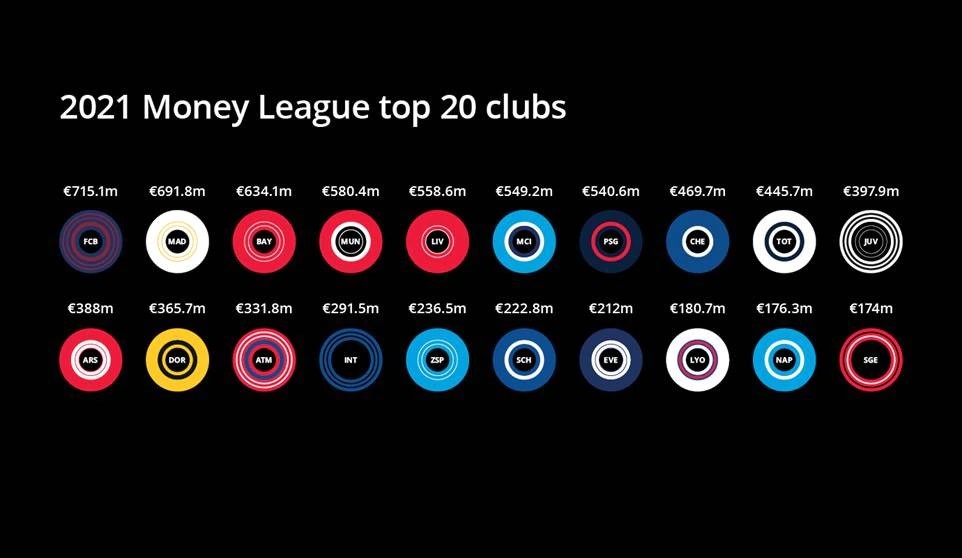

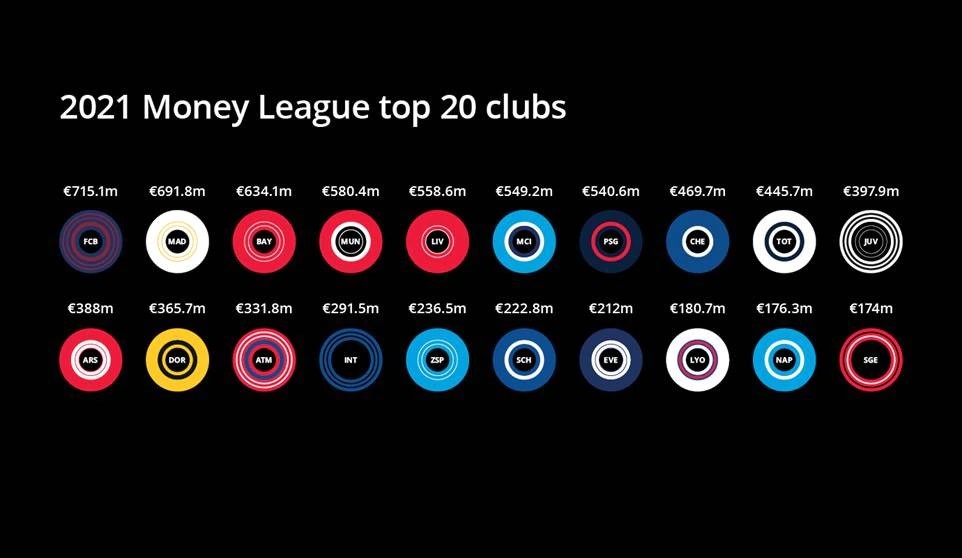

According to the Football Money League report by Deloitte, the 20 Premier League clubs that competed for the 2020/21 season saw a combined revenue of €8.2 billion. This was down 12% from the €9.3 billion generated in the prior season.

This led to a cumulative pre-tax loss of almost €1.1bn, the highest in Premier League history.

The absence of fans, postponement and cancellation of matches, rebates to broadcasters and the need to satisfy commercial partners have caused astronomical effects on the recently completed 2019-20 Premier League season.

According to Dan Jones of Deloitte’s sports business group, the decrease in revenue is unsurprising. He pointed out that the global economic and social disruption caused by the Covid-19 pandemic was significant.

The report further pointed out that the lack of matchday spectators coupled with delays in the collection of some broadcast income was primarily responsible for the drop.

Examining the drop closely shows that the total broadcast revenue dropped €937m (23%), mainly due to the deferral of broadcast revenues to the financial year ending in 2020 and rebates related to the disrupted season.

Matchday revenue also fell about 17% (about €257m) due to matches that were first postponed and then either cancelled or resumed behind closed doors.

Streaming and broadcasting revenues just weren’t enough

Despite the drop in revenue, the 20 top-flight clubs still brought in a combined €5.23billion.

The accumulated revenue was helped by an €82m (2%) increase in commercial revenue, reflecting the commencement of several major commercial arrangements across the league.

Another was the renewal of some of the league’s broadcasting and streaming deals. With most stadiums empty, people turned to streaming and broadcast stations to enjoy the thrill of EPL matches.

For example, in Sub-Saharan Africa, most people turned to Multichoice’s DSTv which offered Premier League football as part of its offering on its sports channel, Supersport.

How clubs adjusted to the drop in revenue

As revenue dropped, Premier League clubs took several measures to cut cost during the season. For example, Arsenal Football Club asked its players to take a wage cut during the thick of the pandemic. The wage cut still didn’t stop the club from furloughing at least 50 non-football staff.

Like Arsenal, several clubs also asked their payer to take various levels of cuts. Another means of coping with revenue loss was the deferment of end-of-season bonuses to the next financial year.

For some other clubs, it was the cutting down of already planned costs like suspending stadium repairs and renovations, furloughing or sacking of staffs among others.

Manchester United, Chelsea FC and 4 other EPL big clubs took an even more surprising turn by attempting to break away with other top clubs in Europe to form a new organisation called the European Super League. The major aim of this move is to boost the clubs’ profits.

Although the Super League plans fell apart, it was one of the fallouts of the bad financial year that affected even the clubs with heavy wallets.

Possible effects of the drop in revenue on clubs

Matchday revenue is a significant part of EPL clubs’ revenue. After feeling the brunt of the pandemic, it is possible that clubs are looking for new and multiple ways of generating funds to prevent a recurrence.

One major way could be asking for an increase in broadcasting and streaming revenue. Video streaming, including streaming of sporting events like football, boomed during the pandemic as most stadiums were shut.

According to Conviva, the time spent streaming video on mobile rose 30% globally, with video on demand seeing 34% growth and live content up by 16%.

Similarly, Grand View Research calculates that the global video streaming market will reach $223.98 billion by 2028.

This exposed some issues in the current business model of the Premier League as the broadcasters mostly enjoyed the benefit of the boom.

Digital engagement led by live streaming offers a way out, but at the cost of a seismic jolt to business models.

However, with no set time as to when stadiums will be back to full capacity, streaming numbers are expected to continue rising.

Over The Top (OTT) providers like Amazon Prime and Netflix that have not driven up the TV rights bidding process over the last bidding cycles are now being anticipated. This could mean clubs asking for a bigger share in new deals.

According to the Rethink TV Forecast, the football bidding industry for TV rights is expected to increase from $12.8 billion to $31.9 billion before 2024.

Another effect is the possible drop in spending during the transfer window. Last year, clubs like Chelsea FC made several big-money signing like Kai Haverts who set the club back at least by 70 million pounds. The club spent over $200 million in total in last summer’s transfer window.

However, this year’s transfer window has opened for about a week now and not much traffic has been felt. Although several factors might be responsible including low cash reserves.

Going forward

The unexpected consequence of the fall in income was the 3% increase in wages in raw terms. The player wages jumped to occupy 72 per cent of club spending in 2019-20.

According to Deloitte’s Tim Bridge, this change doesn’t necessarily mark a shift in clubs’ approach to wage spending.

“With wages always representing the largest cost for football clubs we will watch with interest in years to come to understand whether this financial shock will come to be seen as having caused a change in approach and greater control over wage expenditure.”

Dan on his part believes that the disruption caused by the Covid-19 pandemic and will have a heavy impact on next seasons financial results. He, however, added that it is dependent on the return of fans to stadiums

“Matchday operations are a cornerstone of a club’s business model and fans’ absence will be more fully reflected in the financial results of the 2020-21 financial year. Once fans are able to return in full Premier League clubs have the potential to again return to record revenue levels.”

In Summary, the report points out that the longer-term outlook of club revenue remains uncertain. It added that if the condition remains, Premier League clubs will have missed out on over €2 billion in revenue by the end of the 2020/21 season as a result of the pandemic.