Startups need funding to grow and scale. From setting up the business to hiring staff or expanding into new locations, funding pervades the totality of a startup’s operations.

Hence, Venture Capitalists (VCs) have largely become the preferred entity many startups approach when trying to raise external financing. But pitching to a VC does not always mean a startup will get funded.

In fact, only a fraction of startup founders who pitch to VCs ends up closing investment deals.

There are over 250 startups in Nigeria, according to Startuplist Africa. In 2020, up to 82 Nigerian startups raked in $170 million, a drop-off from the 147 startups which raised $377 million in 2019.

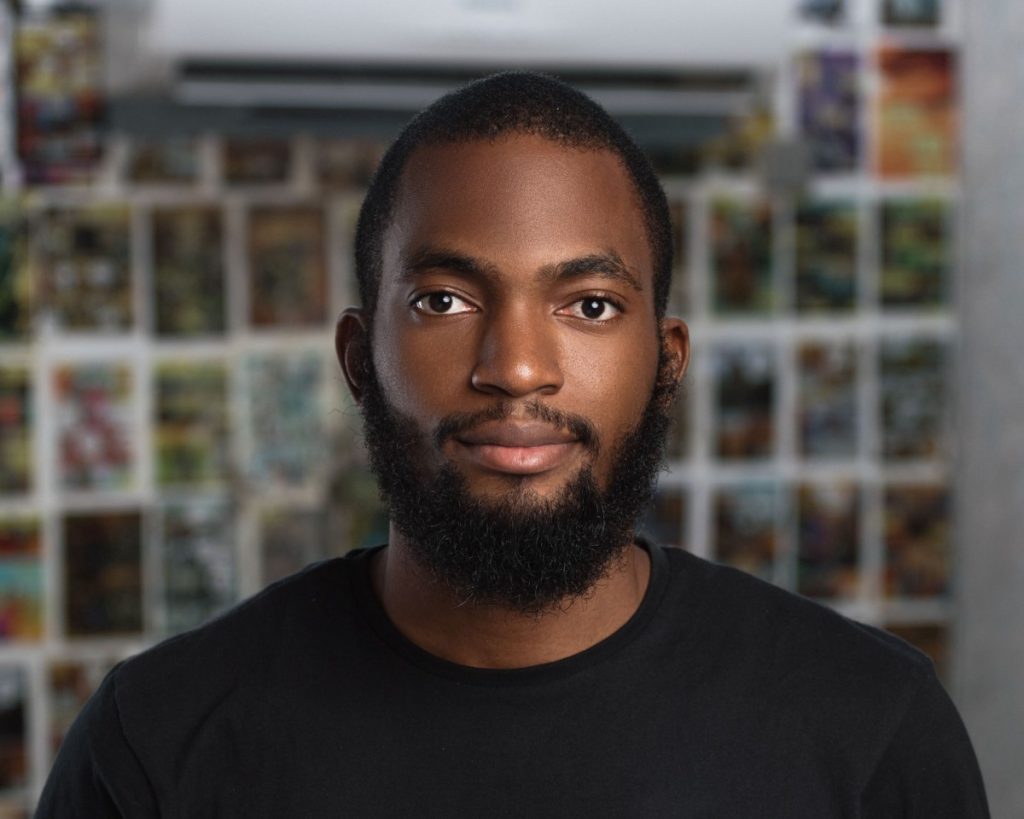

On a chat with Technext, Dayo Koleowo, Partner at Microtraction talks about the key criteria VCs look out for in startups before going ahead to invest. “Investors play at different stages, however, some core criteria are the same,” he said.

Build the right team

Speaking from a Microtraction point of view, Dayo starts off by saying that the quality of the team running a startup matters a lot to investors.

Because we play at the pre-seed stage, the team is super important for us. It may sound quite cliché but we believe in investing in the right set of people. We’ve done about 23 startups now and I can categorically say that we will invest in every single founder we have invested in again if the opportunity arises in the future.

Dayo Koleowo

He goes on to explain that the team must have cross-functional abilities and a deep understanding of the problem it is trying to solve.

“Your understanding of the problem is more important than the solution so you need to be able to clearly communicate the challenges that people go through before proffering a solution,” he said.

Dayo explained that VCs like Microtraction want to fund founders with in-house technical teams as the startup saves time and money that would otherwise be spent on outsourcing senior developers.

Beyond domain expertise and technical competence, he maintains that VCs want to be able to have a cordial relationship with portfolio startups for a long period of time.

We want to invest in people that we can call our friends.

“Investing is a relationship game and so beyond the business and investment, we look at your mannerisms, your personality, if you are coachable and able to take feedback,” he added.

How much money can you make?

A pertinent question startups should answer before pitching to investors is how much money can the company make? This comes down to the size of the startup’s target market, according to Dayo.

“You want to be solving a problem for a large number of people, that really is the market. The market is literally how many people would feel happy that you have solved this problem and how many of them will pay because at the end of the day we are in the business of making money from the startups we invest in,” he said.

You may like: VC Funding in Africa Drops 40% in 2020 as Early-stage and Pre-seed Funding Suffer Due to Covid-19

Dayo then gives an interesting analogy:

We’ve seen some good companies and they’re making some revenue but we know the market is not beyond Lagos or Abuja, it’s going to be difficult for them to actually scale.

Dayo Koleowo

“We term those companies non-venture backable businesses, so the market is really important. It might be small when you’re starting out, but how likely are you to realise $50 million annual revenue in say 5 years? How quickly can you scale to other locations?” he said.

Gain traction

The world today is very fast-paced, and this extends to the startup ecosystem as well. For startup founders, therefore, Dayo says they must show how fast they can move with their solutions.

“We want to see your execution prowess. That’s why we call ourselves Microtraction – we actually want to see some traction, that your efforts so far have yielded clear results.”

If you come to us and pitch an idea, one of the questions we’d ask you is when did you start this company and what have you been able to achieve within that timeframe?

Dayo further stresses that VCs as Microtraction do not want to put money into a startup that would take three to four years to make significant progress.

We don’t want to work with part-time founders, but want to see that you are committed to making the business work. One of the things we like to say at Microtraction is, if a startup founder comes to us, we want to be sure that the founder will be successful without us. So coming in with funding and other value adds just gives them an extra advantage.

Define your business model

Investors are also very interested in a startup’s business model. VCs want to know how founders plan to acquire customers and make money.

Is it B2B, B2C or B2B2C? Are you seeking partnerships? This is important to us because we have a network of professionals and organisations that founder(s) can leverage.

Dayo Koleowo

One of the biggest challenges African founders face is customer acquisition, which ultimately makes it imperative for a startup to devise a working strategy to acquire/retain customers, earn revenue and be capital-efficient.

In summary..

Besides all this, Dayo says Microtraction particularly pays attention to the risks associated with running the business.

There is always a form of risk, either regulatory, operational, execution or competitive risks. It is important that founders try to work around how to bypass those risks.

“Then there’s the legal side of things where we do due diligence, equity split and want to know if you have a legal entity, founders’ agreement, vesting schedule, among others,” he added.

On the whole, Dayo expects that startups that fulfil the above criteria stand a better chance of convincing VCs to fund their solutions.