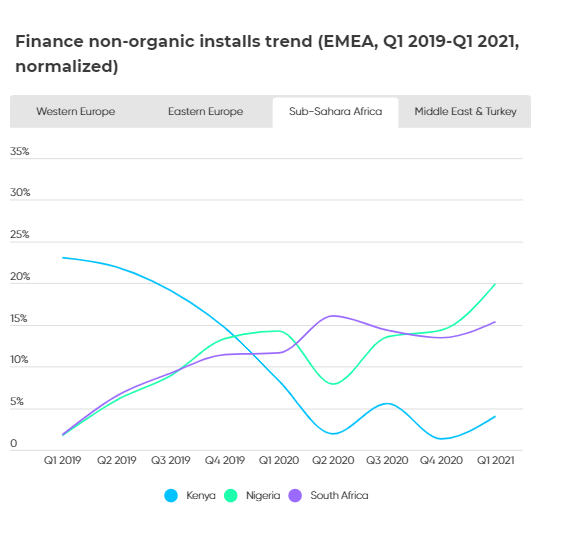

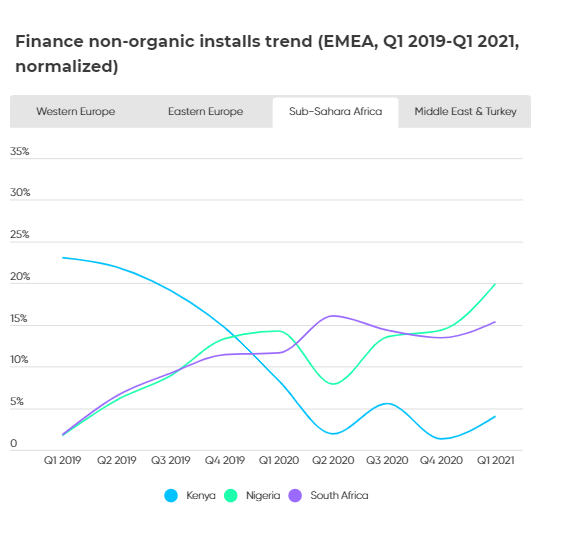

The astounding growth recorded in the fintech space of Nigeria goes beyond just the influx of funds. The country reportedly had the highest number of fintech app installation in Africa in the last year.

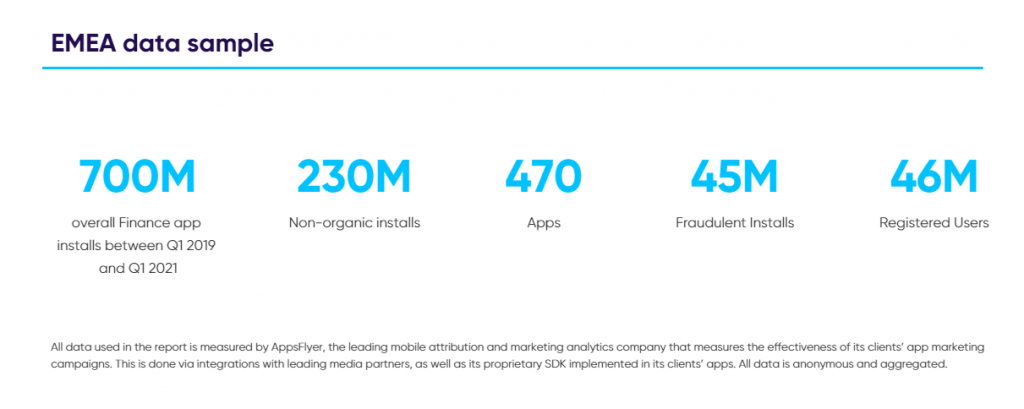

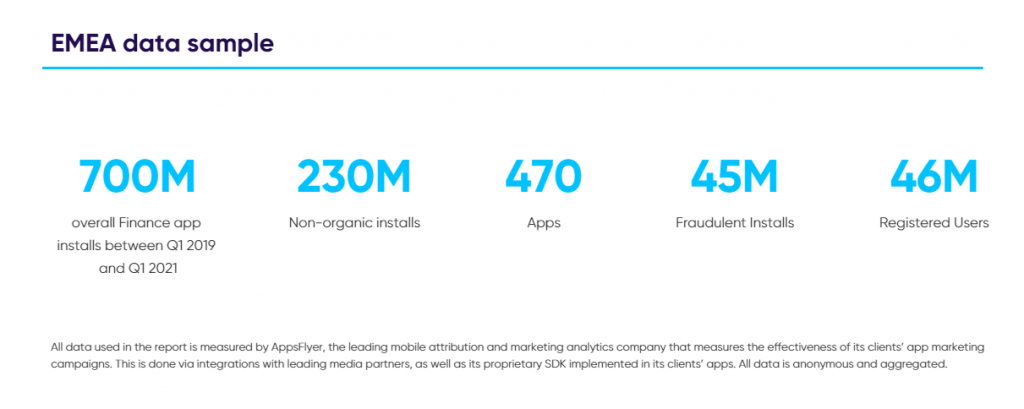

This is according to the new State of Finance App Marketing Report by AppsFlyer, the global marketing measurement leader.

According to the report, fintech app installation saw impressive growth of 160% from the numbers in the second quarter in 2020.

A breakdown shows that loans apps were the highest at 43.3%. Financial services followed at 35.6% while investment apps saw just 20.3% growth.

The growth was, however, not peculiar to Nigeria as other countries in the sub-Saharan African region also witnessed impressive growths. Kenya recorded a growth of about 100% while fintech app installations in South Africa saw a 52% rise during the same period.

App downloads in Sub-Saharan Africa grew by 55% in 2020

Digital boom fueled growth

The immense growth of fintech app downloads was majorly attributed to the digital acceleration driven by the COVID-19 pandemic.

The global pandemic has significantly impacted the world of fintech, radically transforming how consumers interact with financial institutions, and how the institutions themselves operate.

Financial activity which initially fell at the beginning of the pandemic later transformed into a boom as finance app installs pointed up in H2 2020 and continues to bear fruit well into the first quarter of 2021.

Particularly, in Nigeria, the large population of unbanked (56%) and the tough regulatory conditions pushed a large number of people to turn to apps to take out loans as well as explore other financial services.

Marketing rise

Another major factor for the boom is the marketing rise in the fintech industry. Since Q2 2020, when COVID lockdowns began, the number of finance apps investing in marketing increased in all regions.

In sub-Saharan Africa, market spending in Nigeria rose the highest, climbing a whopping 150% since the second quarter of 2020. The country’s Cost Per Install (CPI) was up 70% since Q2 2020, leading to a spike in spending, especially in Q1 2021 when budgets almost tripled.

South Africa also saw a significant increase of about 33% since the first quarter of 2020. Kenya was, however, abandoned by investors as spending dropped more than 80% in the last two years.

According to the report, the high spending in Sub-Sahara Africa was driven by fierce competition as apps employed aggressive marketing tactics.

50% of installs in the region was driven by marketing despite the high cost of media

More incoming investments

Over the last two years, the fintech sector has led in terms of the amount of VC investments raked into the region. The huge numbers often reported show that these fintech solutions are reaching a large amount of the region’s population.

These attractive numbers serve as an aphrodisiac to draw in more investors into the region. The success of Paystack and Flutterwave are perfect examples that already shine a beam on the market.

The dawn of loan and investments Apps

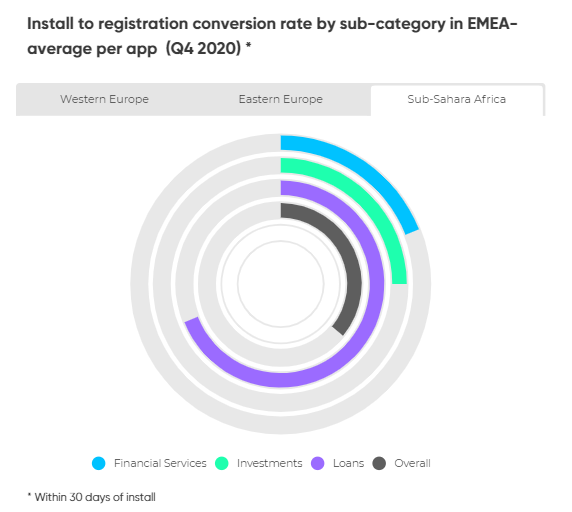

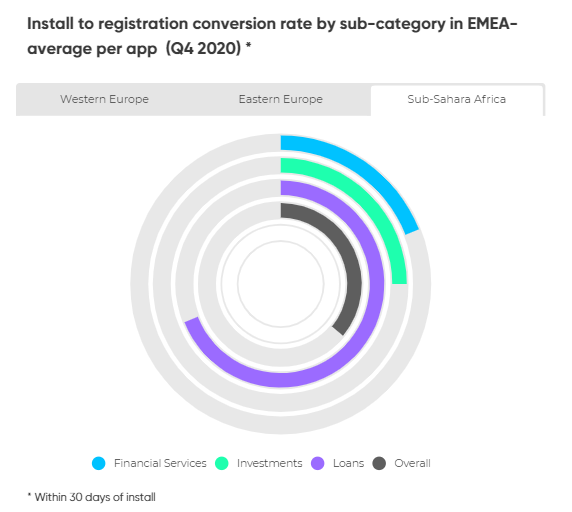

In sub-Saharan Africa, the installation to registration conversion rate is impressive across categories but loan apps have the highest.

The report shows that Loan apps have a 69% conversation rate compared to 25% for investment apps and 19% for financial services.

This shows that Nigerians are more interested in loan and investment apps than any other type of fintech service. This is evident in the popularity of loan apps such as Branch, Carbon, OPay; and investment apps like PiggyVest, Thrive Agric and Cowrywise as well as Crypto investment apps like Yellow Card, Bundle and BuyCoins.

In general, the report validates analyst predictions that fintech adoption is growing in the region. 25%-35% of users who install finance apps across the region showed strong intent to perform a financial activity completing the registration despite a relatively lengthy process.

Demand for Finance apps is at an all time high

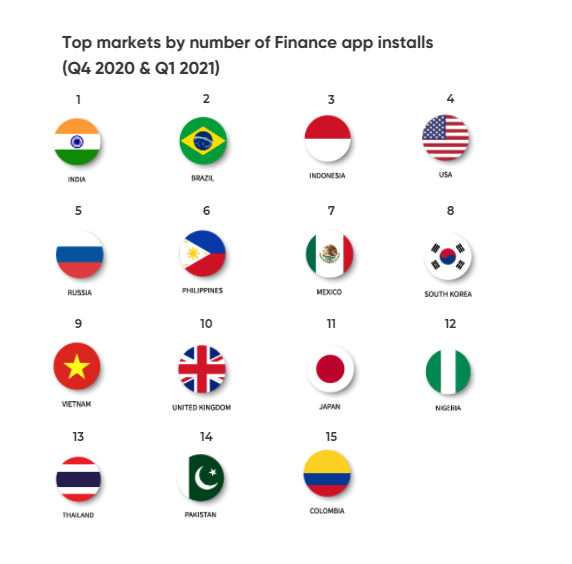

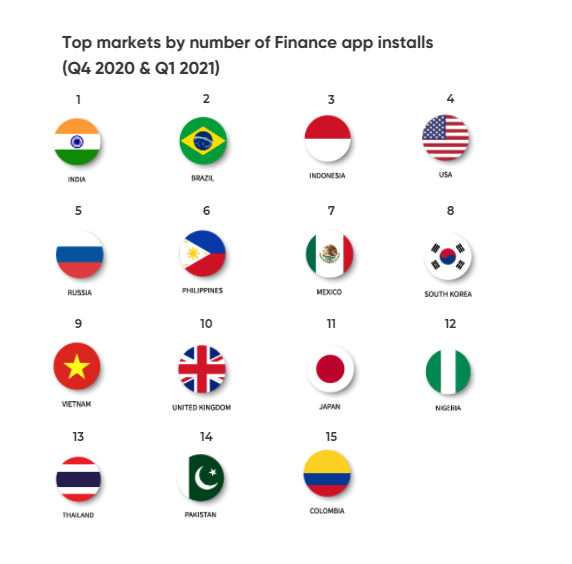

The demand for finance apps is spiralling out of control, not just in Africa but across the globe. 29 of the top 40 finance markets (by app installs) enjoyed growth of at least 20% YoY. However, it was the developing markets that dominated the number of installs.

Fintech apps are in high demand, experiencing a 132% leap in global downloads in the last two years.

The average number of downloads in developing markets was 70% higher than the average in developed markets, with India, Brazil and Indonesia making up almost half of the global number of downloads.

Like Africa, most of this market growth was instigated by Covid and the increase in market spending. The report shows that the number of remarketing conversions has tripled globally between Q1 2020 and Q1 2021 as total spend reached no less than $1.2 billion in Q1 alone.

Overall, the growth trajectory of non-organic installs continued upward, hitting 172% between 2019 and now.

In Summary

The COVID-19 pandemic rapidly accelerated the adoption of financial technology globally, especially in emerging markets.

The emergence of several finance apps helped millions of consumers and businesses remain connected.

The high growth in Q1 2021 alone shows that the trend is likely to continue and understanding how to best market their apps will be key to African fintechs growing their customer base.

However, for countries like Nigeria where regulations often change, it’s important for FinTechs to be flexible and innovative to stay at the head of the curve.