Starting a fintech business in Nigeria is about to get even more difficult. The is because of the new capital requirements for payment firms released by the Central Bank of Nigeria (CBN).

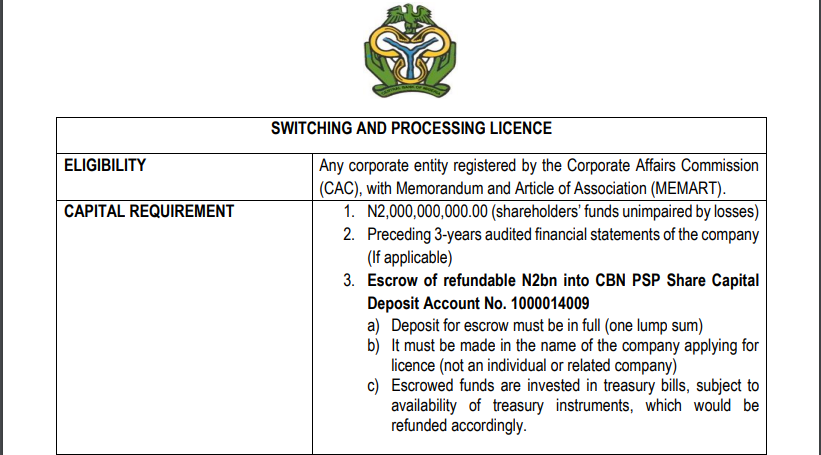

The new requirement states that payment firms must have an escrow of refundable N2bn paid into the CBN’s PSP share capital deposit account.

It added that the deposit for escrow must be paid in full (one lump sum) and must be made in the name of the company applying for license (not an individual or related company).

This is in addition to the non-refundable application fee of N100,000 and the licensing fee of N1 million to be paid before the issuance

of the final licence.

That’s not all, there are other capital intensive requirements based on the categories of the fintech licence.

For Mobile Money Operator and Switching & Processing license, the regulator adds that a firm must have another N2 billion shareholders’ funds unimpaired by losses.

The total for Payment Solution Services was pegged at N250 million. A breakdown shows that the Super Agent licence retained its N50 million shareholder fund requirement while Payment Solution Services Provider & Payment Terminal Service Provider was N100 millon.

Also, the deposit for escrow dropped to N50 million and N100 million respectively for the three licence categories.

The CBN has also stated that escrowed funds be invested in treasury bills, subject to the availability of treasury instruments, which would be refunded accordingly.

growing difficulty of doing business in Nigeria

Working and doing business in Nigeria is already hard enough. According to the World Bank Group’s ease of doing business report, the country is ranked 131 compared to Ghana and South Africa which is ranked 118 and 84 respectively.

That’s not all, several regulations by the CBN hasn’t been helping. This year alone the country’s apex bank has banned the transaction of cryptocurrency which almost crippled crypto startups in the country.

It has also banned the use of Bank Verification Number for KYC for FinTechs. This removes one of the cheapest means of KYC for fintech firms.

The addition of more capital requirement means the cost of starting a fintech business becomes higher.

Looking at the current requirement for a mobile money operator, a new entrant will need to have nothing less than N4.02 billion to start.

In summary

The boom of the Nigerian fintech space has been phenomenal. The ecosystem has grown so big over the last year that it has created unicorns and attracted global payment giants.

However, a significant amount of the population is still financially excluded. The move to increase the capital requirements may have a reasonable explanation, but the fact remains that the increase may make starting a fintech business in Nigeria only for the rich.