The price of Bitcoin, the world’s most valuable cryptocurrency, has suffered a decline for the second consecutive day. This follows reports that the world’s largest crypto exchange, Binance, is under probe in the US for aiding money launders and tax evaders.

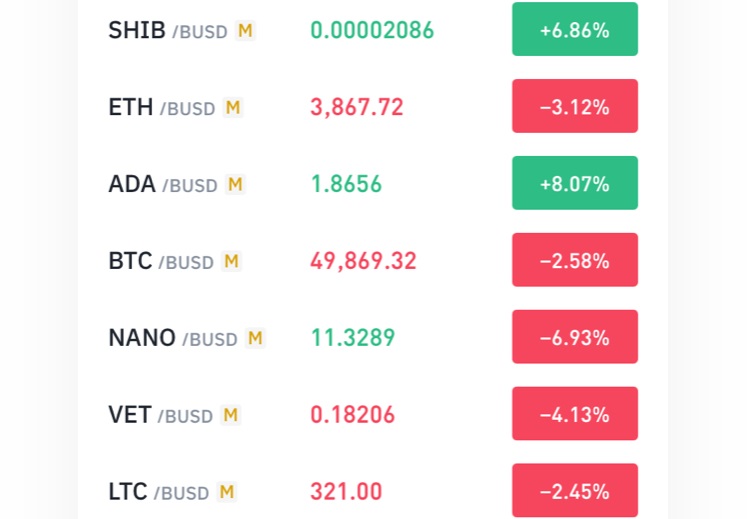

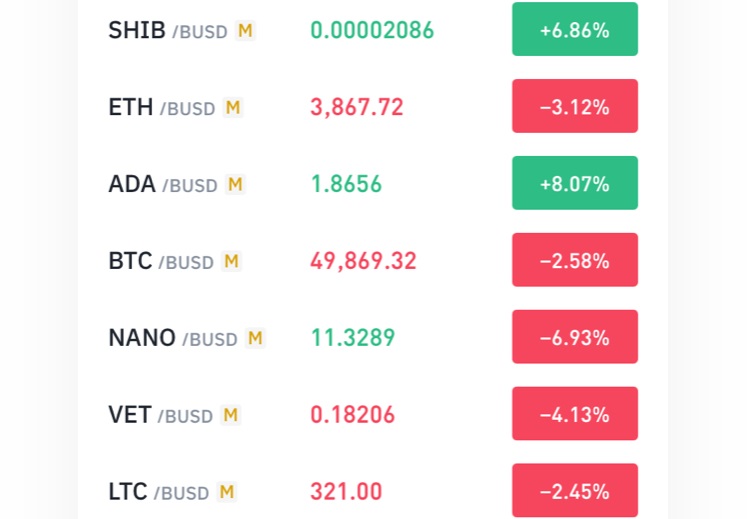

Recall that Bitcoin price fell a whopping 16% to trade just under $51,000 yesterday after Elon Musk’s Tesla discontinued the use of the crypto for the purchase of its electric cars. The crypto has depreciated a further 3% since report of the Binance probe and is currently trading at $49,880.

This is probably a good time to buy. Or selling depending on which side you lean more to.

The Binance probe

Binance is currently involved in a federal investigation with the US authorities regarding money laundering. The officials, specializing in tax and money laundering, are probing the company for trails that it is used for evading taxes and launder money in the States.

The crypto exchange was founded in 2017 by Changpeng Zhao and He Yi and is the largest in the world.

The exchange is used globally except in the United States. In November 2020, it started to block the accounts of users from the US because of regulatory uncertainties from the authorities.

Why then is Binance being probed?

Last year, Chainalysis Inc., a blockchain forensics firm, concluded from its examination of criminal activities that more funds from these activities flowed through Binance than any other exchange. Chainalysis is used by many agencies including US federal agencies in investigations involving crypto.

Several officials in the States have been vocal about their concerns that crypto is being used largely for illegal transactions because there is no digital footprint that can be traced back to the users. The probe seeks to ascertain whether the illegal activities originate from the US or are carried out by American citizens despite their exclusion from Binance.

On Friday, cyber attackers forced Colonial Pipeline Co, the largest pipeline system for refined oil products in the U.S, to pay the hefty sum of $5 million in ransom. The ransom was paid by the company in untraceable crypto after the cyber terrorists had infiltrated Colonial Pipeline’s records with ransomware that prevented them from carrying out operation as usual.

Also Read: Binance and Oasis Labs Launch Cryptosafe; a Global Alliance to Fight Crypto Fraud

In addition to the probe for illegal money inflow through the exchange, Binance is also being probed to see if it allows Americans to buy derivatives that are linked to digital tokens. Residents in the US are barred from buying these derivatives from any company that is not listed with the US Commodity Futures Trading Commission (CFTC). Binance is not registered with the CFTC.

Binance is not accused of misconduct, yet

Although it is being probed, the crypto exchange itself has not been accused of any wrongdoing and this may not lead to any legal sanctions against it.

According to its founder, Changpeng Zhao, it has followed US rules and banned Americans from using its platform. In actuality, the ban kicked into place in November 2020. In a response to the news about the US probe, Zhao tweeted that the company has done nothing wrong and has only “collaborated with law enforcement agencies to fight bad players.”

This is not the first time that the US is probing a crypto exchange for activities of tax and evasion and money laundering. Kraken, a crypto exchange, is also involved in an ongoing probe by the Internal Revenue Service (IRS) in the US.

The IRS filed a suit to examine the records of US crypto holders from 2016 to 2020 but it was denied in court on the basis of the timeline being too broad. However, in the first week of May, it secured a court order that now allows it to access Kraken’s records that contains the information required.

The information that is sought will identify US taxpayers who have conducted at least $20,000 or its equivalent in cryptocurrency trades on the platform between 2016 and 2020. Since 2020, the IRS has sent letters to taxpayers asking them to file tax from profits that are made from crypto trading.

According to IRS Commissioner Chuck Rettig, “There is no excuse for taxpayers continuing to fail to report the income earned and taxes due from virtual currency transactions.”

The Kraken case is similar to Binance’s probe because the goal is to identify cryptocurrency trading which has not been reported for tax and income purposes.

If US traders are found on the Binance exchange and if money laundering and tax evasion are detected, federal authorities may tow a similar line to that of Kraken by requesting the identities of the bad players and following up with appropriate consequences.