Jack Ma’s Alibaba Group Holding Ltd. generated a record $28.6 billion revenue in the quarter ended March 31st. This is a 64% growth from the $17.7 billion reported during the same quarter last year.

However, the revenue growth was overshadowed by the Chinese regulatory crackdown that triggered its first loss in over 7 years.

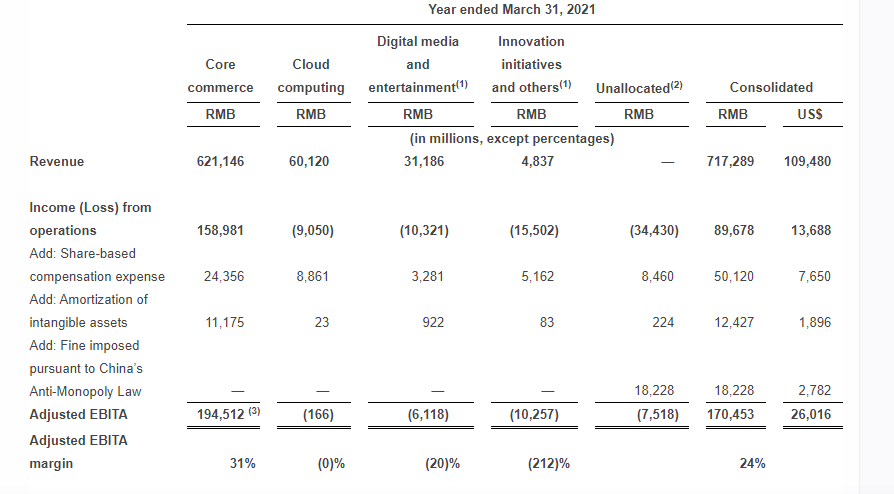

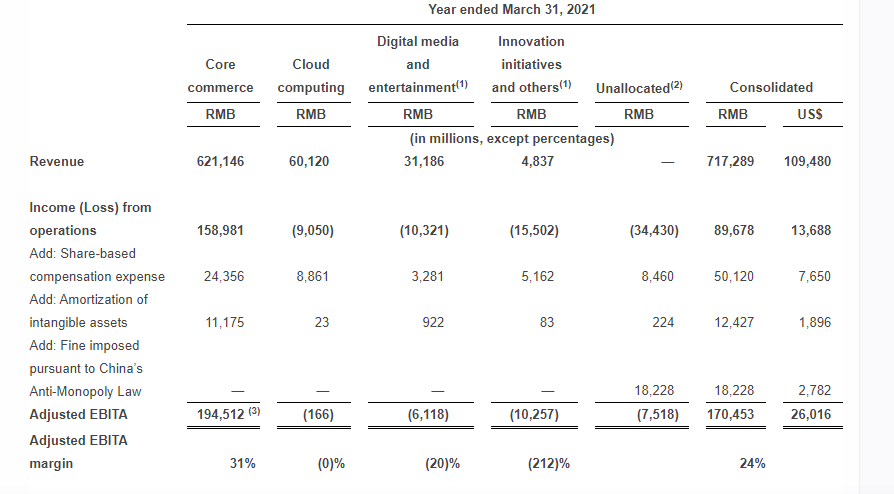

Alibaba’s profit took a major hit after the company was fined $2.8 billion for monopolistic behaviour imposed by the regulator.

The company posted a loss of $1.17 billion, its first since going public in 2014. This is a whopping drop from the $54.12 million profit recorded in Q4 last year.

Following the announcement, Alibaba’s shares fell nearly 3% in the United States in choppy trading. Similarly, its shares fell more than 6% in Hong Kong.

Alibaba is looking ahead despite regulatory uncertainty

Alibaba’s regulatory problems started last year just after Jack Ma’s speech against outmoded regulations. The speech started a chain reaction that has reduced the companies shares by 35% from their October peak last year.

Since the crackdown started, the Chinese internet behemoth has lost about $260 billion from its market value.

The recent fine imposed marks the conclusion of a four-month probe, but uncertainty persists as Chinese regulators are still sniffing around the company.

Alibaba CEO, Daniel Zhang, however, says that they are taking the fine positively. He added that the penalty has motivated the company to reflect on the relationship between the platform, economy and society, as well as its social responsibilities and commitments.

“We accept the penalty with sincerity and will ensure our compliance with determination. During the past fiscal year, we have gone through all kinds of challenges, including the Covid-19 pandemic, fierce competition as well as an anti-monopoly investigation and penalty decision by Chinese regulators. We believe the best way to overcome these challenges is to look forward and invest for the long term.”

Chief Executive Daniel Zhang

Asides from the fine, here’s how the company performed during the quarter.

e-commerce – Online Shopping continues to boom

Alibaba achieved a historic milestone of one billion annual active consumers and generated $1,239 billion in Gross Merchandise Volume (GMV) globally in the fiscal year ended March 2021.

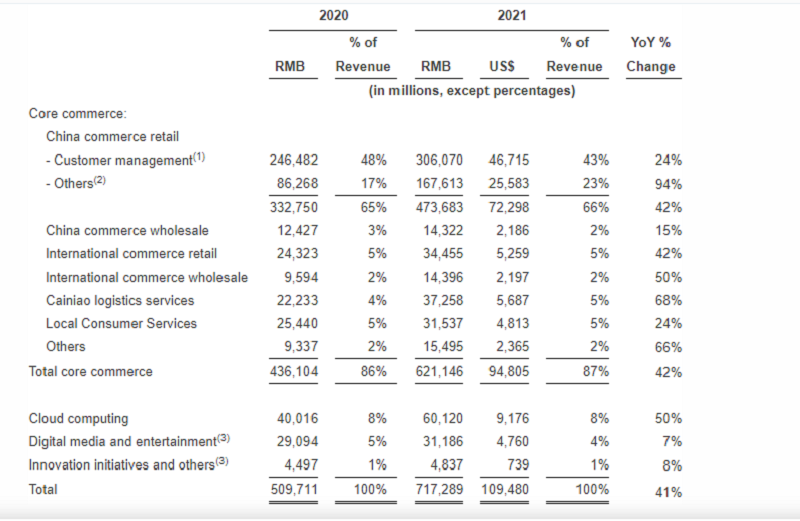

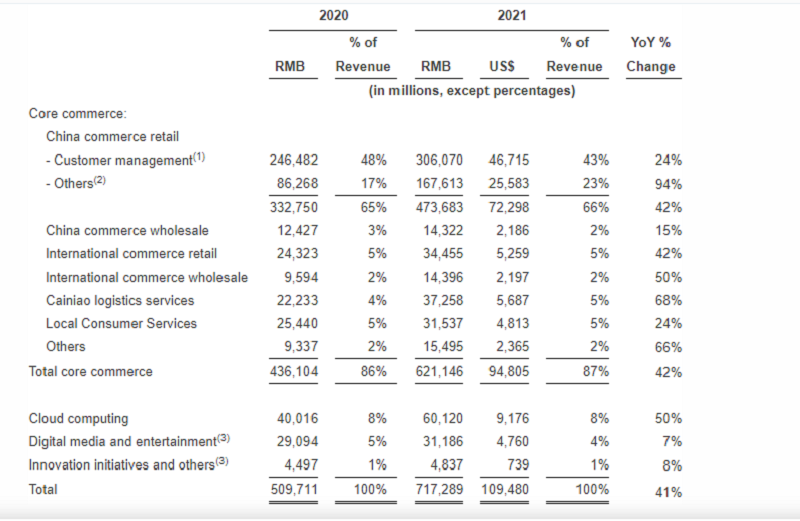

This growth in revenue and customer base was driven by the 72% growth of its core commerce businesses as well as the continued growth of Alibaba Cloud.

e-Commerce remained the highest contributor to the company’s revenue for the quarter with $24.62 billion, representing 86% of the total revenue.

Overall, online physical goods GMV, excluding unpaid orders, grew 33% year-over-year, driven primarily by the apparel and home furnishing categories.

Cloud computing contributed 9% after generating $2.55 billion during the quarter. This is up 37% from the $1.9 billion in the same quarter last year.

This was primarily driven by growth in revenue from customers in the Internet, public sector and finance industries. However, the growth could have been higher but it lost top cloud customers in the Internet industry.

Other segments like digital media, entertainment and innovation initiatives generated just $1.4 billion. The slight increase was primarily due to the increase in revenues from Alibaba Pictures and the online games business, partly offset by the decrease in revenue from customer management.

Over 800 million Active customers

During the quarter, active customers on the company’s China retail marketplaces reached 811 million, an increase of 85 million from the twelve months ended March 31, 2020.

Internationally, its retail marketplaces, which include mainly the AliExpress cross-border retail platform and Lazada in Southeast Asia, served approximately 240 million annual active consumers during the same period.

In Summary

Despite the loss, Alibaba forecasts 2022 revenue to be above market targets. It is looking at a rise of at least 30% to more than 930 billion yuan, beating the 923.5 billion average projection.

To achieve this, it is probably betting that the pandemic-driven shift to online shopping will remain resilient.

The company’s CEO has also revealed the intention to refocus on its business. He explained that the company’s incremental profits and additional capital will be used to support its merchants and invest in new businesses and key strategic areas.