Jumia’s quest to achieve profitability has continued to benefit from its shift in focus to sales everyday product.

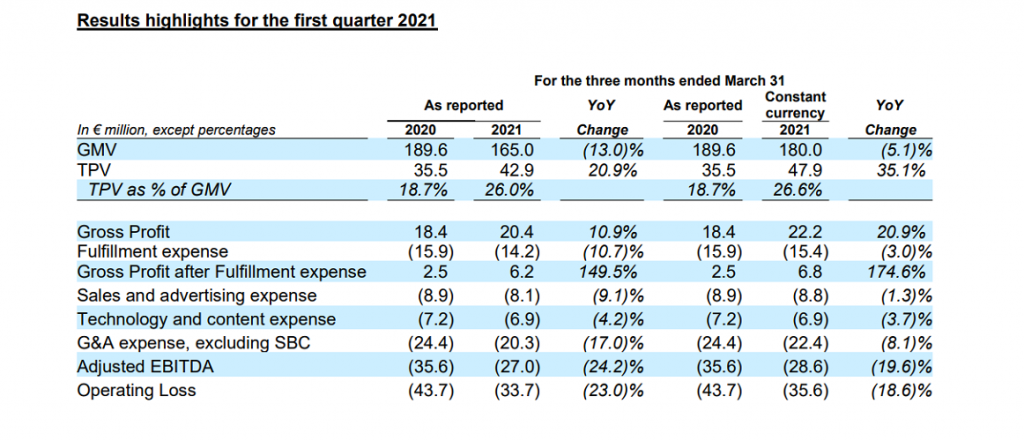

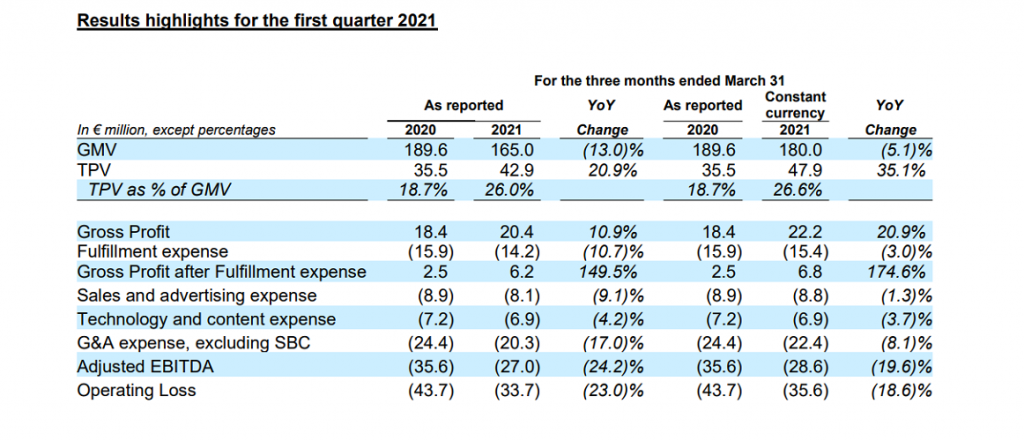

According to its recently released Q1 Report, the company’s gross profit after fulfilment expense reached €6.2 million, a whopping 149% increase from the €2.5 million recorded last year.

The gross profit after fulfilment shows that the company is making money each time it makes a delivery.

GMV & Revenue Falls

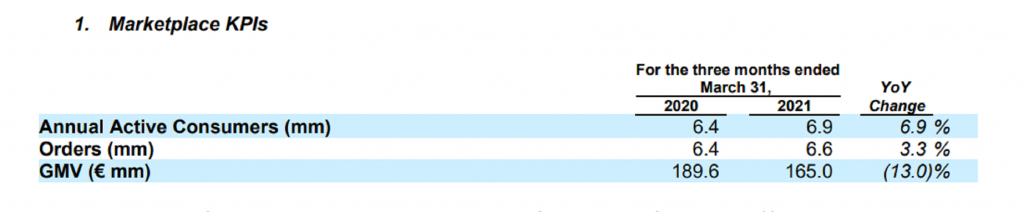

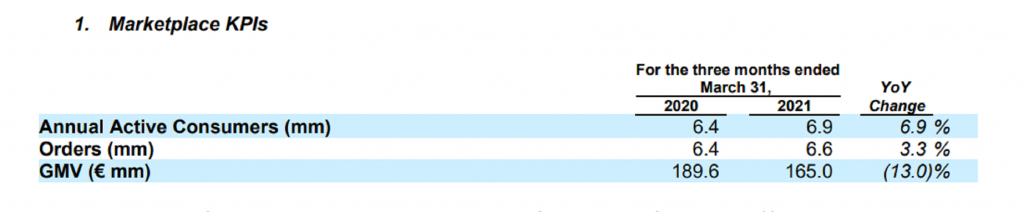

However, the shift has negatively impacted the Gross Merchandise Volume (GMV), which measures all the goods sold on the platform. For Q1, GMV fell by 13% year-on-year to €165 million despite the volume of orders increasing to 6.6 million.

The drop in value could be traced to the fact that household items are cheaper than laptops and phones which were the focus in previous years.

A breakdown of the GMV mix shows that phones and electronics accounted for 37%(€24.9) of GMV compared to 45% (€29.5) in the first quarter of 2020.

Another major cause of the drop in GMV is the depreciation of the local currency against the Euro. The Nigerian Naira, Egyptian Pound and Kenyan Shilling has declined by 15%, 9% and 19% respectively against the euro over the past year.

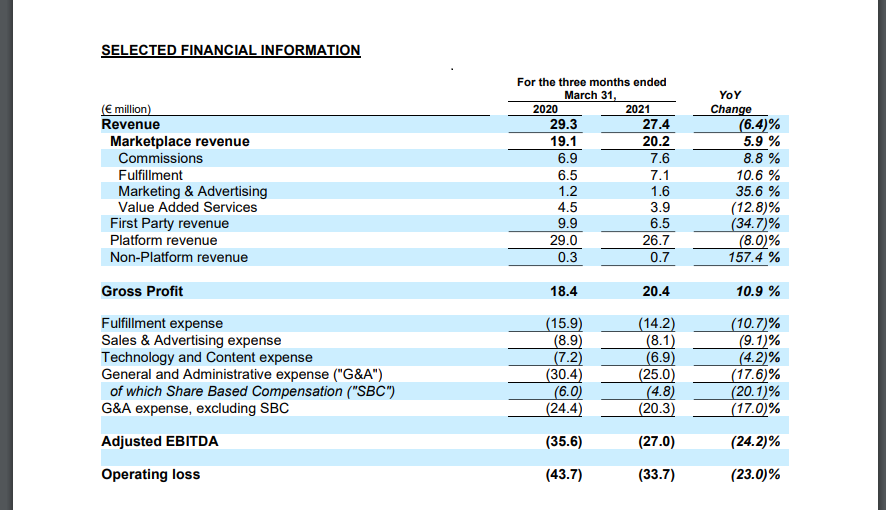

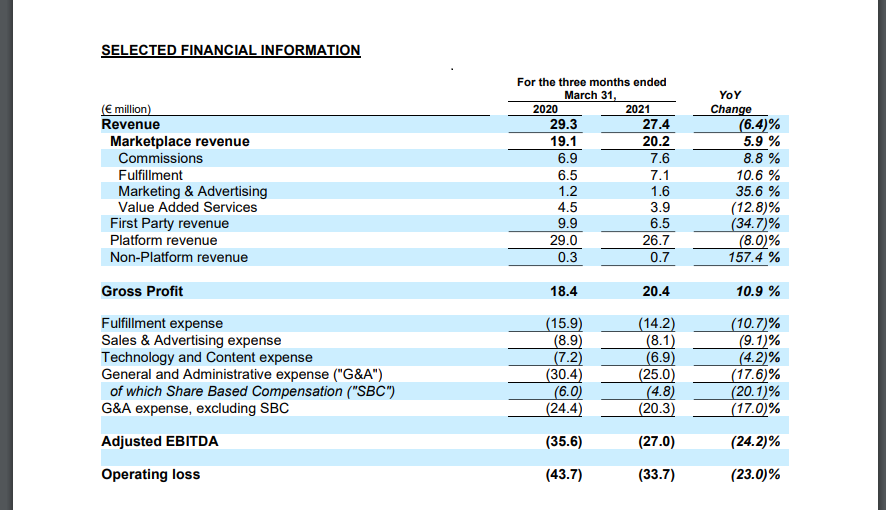

These changes ultimately led to a drop in Jumia’s revenue. The Q1 report shows that the company recorded a revenue of €27.4M, down 6.4% from €29.3 million in Q1 2020.

Market reacts negatively to Jumia’s drop in revenue

Following this announcement, Jumia’s share fell as low as $18.03, the company’s lowest share price this year. However, the price has started to slowly recover with trading at $21.77 at the time of writing.

Why Jumia is making Profit

For years, Jumia made a loss on each delivery because of inefficiencies but that is changing now. A breakdown of the revenue shows that Jumia made a higher profit despite the drop because of a number of factors.

Jumia shifted its focus to a third-party marketplace model from the first-party marketplace where it bought and sold goods directly to customers. This reduced First Party revenue from €9.9 million in Q1 2020 to €6.5 million during the quarter.

However, it reduced operating cost. For Q1, losses stood at €33.7 million, down 23% from €43.7 million for the same period last year.

Jumia has repositioned its business to primarily sell household products that cost (operating cost) a lot less money than high-ticket items like phones

Similarly, the Fulfilment expense decreased by 11% to €14.2 million in the first quarter of 2021 on a year-over-year basis. Another reason for the drop in expense is the change in the delivery pricing model from cost per package to cost per stop.

As a positive, the shift to the third-party marketplace model which allows vendors to list their products, sell them, for a commission has increased Jumia’s commissions by 8.8% to €7.6 million.

The number of annual active customers on the company’s platform has increased to 6.9 million, growing 6.9% from 6.4 million customers in Q1 2020.

JumiaPay continues to Boom, Introduces SME Loans

Leveraging on its marketplace, JumiaPay has continued to see incredible growth. During the last quarter, the Total Payments Volume (TPV) on the platform increased by 21% from €35.5 million in the first quarter of 2020 to €42.9 million in Q1 2021.

According to the report, 36.7% of the total orders placed on the Jumia platform during the quarter were completed using JumiaPay. This is up from 35.5% in the first quarter of 2020.

The increase contributed to the 7% increase in the total transaction from 2.3 million in the first quarter of 2020 to 2.4 million in the first quarter of 2021.

The constant growth of the sector shows that JumiaPay helps in solving the inefficiencies of payment on the platform. Leveraging on its success Jumia has started using the business and transactional data to help SMEs receive short term loans.

In Q1 2021 alone, over 380 loans were disbursed to 291 unique sellers. That is 90% more than in the first quarter of 2020.

In Summary

Jumia’s Co-Chief Executive Officers, Jeremy Hodara and Sacha Poignonnec, believes that its strategy to increase our exposure to everyday product categories will continue to yield positive results because it enhancing the relevance of its marketplace for consumers.

However, it will have to increase volumes to match revenue if it wants to boost investor confidence. The negative market reaction to the drop in its latest earning shows that while profitability is the goal, revenue growth is also important.