For year’s, Uber’s flagship ride-hailing business dominated its revenue source. The segment contributed 75% of the company’s revenue in 2019 and Similarly, contributed 55% in 2020 despite the decline in rides.

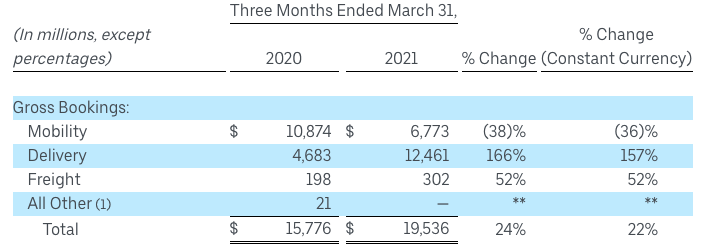

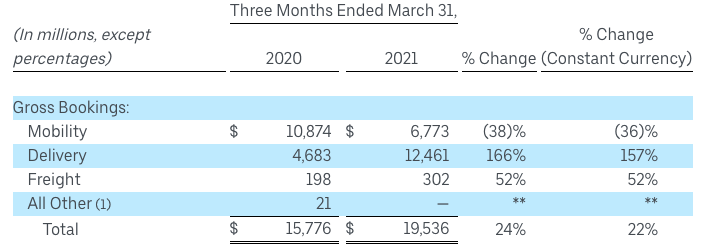

However, that is changing as the company is shifting focus and resources towards Delivery. Uber’s recently-released first-quarter report shows that its delivery business recorded about $12.4Bn in gross bookings. This is almost double the $6.77Bn gross booking recorded by its ride-hailing arm.

Delivery is now Uber’s Biggest business

This is not completely surprising as Uber has been relying on its delivery service to make up for lost earnings during the pandemic. Uber added the delivery of essential goods and medicines to its grocery, convenience store and core food delivery already being done on the Uber Eats platform.

In total, Uber generated a revenue of about $2.9 billion for the three-month period. But it was still less than the $3.2 billion recorded during the same period last year.

A breakdown shows that delivery contributed 58% ($1.7 billion) while ride-hailing contributed just 30% ($853 million) of the total revenue.

The net loss was about $108 million, a tremendous improvement from the $968 million loss in its fourth quarter of 2020. But that was largely due to a $1.6 billion gain from the sale of its self-driving unit, ATG.

In total the company’s operating loss for the quarter was still high at more than $1.5 billion.

The report also shows that trips recorded during the quarter reached 1.45 billion, representing a 13% decline from the 1.6bn in Q1 despite the continued growth in delivery trips.

It, however, added that monthly Active Platform Consumers (“MAPC”) reached 98 million, and they visited its platform at least five times per month.

Ride hailing trends are improving but Uber still face challenges

Despite the drop in the ride-hailing revenue, Uber says its rides are recovering in some markets as coronavirus vaccines roll out and restrictions are eased.

However, the e-hailing company still face several challenges. First is an immediate and growing need for more drivers.

During the quarter, active drivers and couriers on the platform reached 3.5 million. This is an increase of 4% from last quarter but its 22% lower than the number of drivers in Q1 2020.

The company said last month it would spend $250 million on a one-time stimulus aimed at getting drivers back. It is also exploring ways of providing drivers with additional revenue opportunities related to its platform for other services, such as delivery.

However, if it can’t bring in enough drivers to meet demand, the company could face annoyed customers who have several alternatives to choose from.

Another problem it has to solve is its classification of drivers. For years, its classification of driver-partners as gig workers have been embattled on several fronts.

Despite the victory of Prop 22 in California, the reclassification of drivers as workers in the UK after the Supreme Court ruling has put pressure on the company.

Classifying drivers as contractors allows the companies to avoid the costly benefits associated with employment, such as unemployment insurance, vacation etc.

The company already took a $600 million hit to ride-hailing revenue due to the accrual made for the resolution of historical claims in the UK. Now drivers in countries like Nigeria and South Africa are asking for workers classification.

If a similar measure ends up passing across more markets, it could make it harder for the company to reach profitability.

Uber could embark on global scaling of its delivery business

Uber initially had plans to expand its delivery business but Covid-19 has suddenly accelerated it. In the last year, the company has also been pushing heavily into the delivery sector by expanding its verticals beyond food.

It has acquired alcohol delivery service Drizly, rival food delivery company, Postmates and has also secured partnerships with several companies including convenience store delivery service GoPuff.

Uber Eats now has over over 700,000 merchants, with the additions of big wigs like Mr. Beast Burger, Rite Aid and Smoothie King.

Since the pandemic, Uber Eats has expanded into Brazil, Germany and has exited 8 markets including Egypt, Saudi Arabia and Uruguay. According to the company, the exits was aimed at focusing on its major markets.

However, with the companies delivery business booming, it may be considering an expansion into more markets, especially Nigeria which has the largest population in Africa.

The idea of Uber Eats launching in Nigeria is not new. As far back as 2016, Ebi Atawodi, General Manager, Uber West Africa had mentioned it as a possibility. The pandemic may just be the catalyst for it to be finally launched.

In countries like Brazil with a large population and low purchasing power, similar to Nigeria, Uber deliveries adopt a model of low price to attract a lot of the market.

The company also adopts a similar model in all three countries it has launched in Africa; South Africa, Kenya and Egypt.

Uber onboards local restaurants and employs driver-partners on its standalone Uber Eats app. Uber Eats uses the same driver-partner model as its ride-hailing model. Depending on your city, Uber Eats makes deliveries using a car, scooter or bike.

However, in some countries, Uber’s delivery arm is handled by its subsidiaries. This means that Uber buys one of the predominant players in the market and have them handle the eats business. Some of these include Careem in the United Arab Emirates and Postmates in North America.

Another model is integrating its Uber ride-hailing platform with Uber eats which has started testing in America and Canada.

If the delivery service is to launch in Nigeria, the company will probably use the models employed in Brazil or South Africa depending on which location it focuses on.

It could also mean more partnerships for stores and e-commerce platforms in the country as Uber Eats have added verticals like groceries and medicine delivery and not just restaurants.

In summary

The pandemic continues to negatively impact Uber’s ride business and positively impact its delivery business. And the company expects it to continue in the second quarter with mobility rate expected to decline about 20%.

Uber CFO, Nelson Chai has also pointed out that the growth of delivery may become tougher due to forecasts predicting uncertainty in post-reopening consumer behaviour.

Despite the forecast, Uber CEO, Dara Khosrowshahi believes the company is starting to fire on all cylinders. He explained that more consumers are riding with the company again and the company will continuing to use its expanding delivery offerings.