Remittance flow across the world has started to recover after the devastating effects of the COVID-19 pandemic and the following economic crisis.

According to Western Union (WU), one of the world’s largest international money transfer operators, its digital money transfer arm responsible for remittances grew by 45% to a record $242 million during the first quarter of 2020.

This is a huge improvement from the 20% decline projected by the World Bank in 2020. The company also revealed that the revenues from its digital money transfer arm are on track to exceed $1 billion in 2021

The World Bank projects a decline of remittance flows in 2020 across all regions: Europe and Central Asia (-16%); Sub-Saharan Africa (-8.8%), South Asia (-4%), the Middle East and North Africa (-8%), Latin America and the Caribbean (-0.2%), and East Asia and the Pacific (-10.5%)

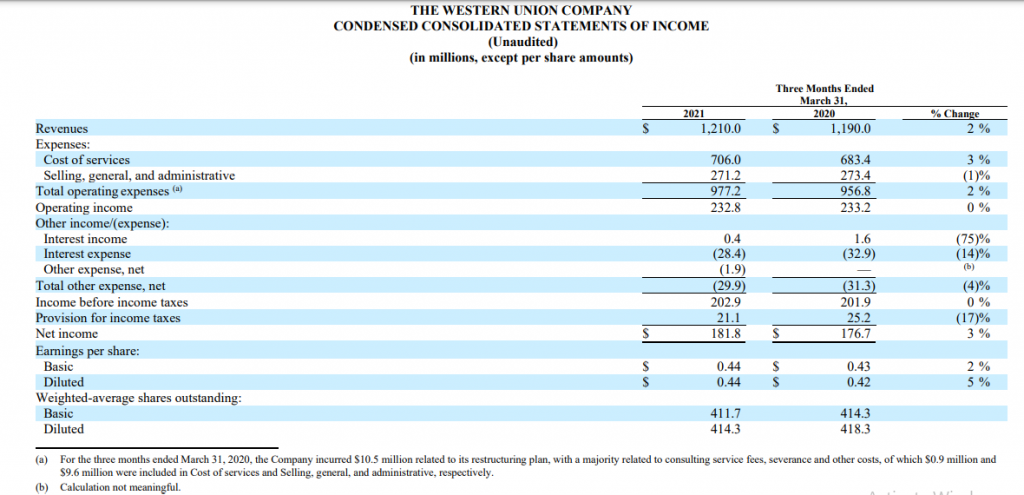

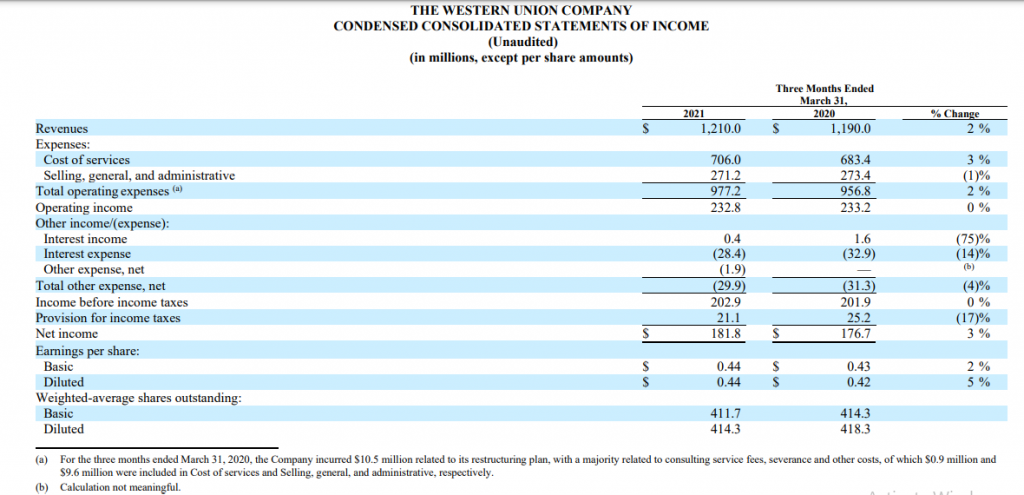

In general, WU recorded a total revenue of $1.2 billion in the first quarter, a 2% improvement from the $1.19 billion generated last year. According to the report, the increase in revenue was led by strength in digital money transfer.

Similarly, the company’s total operating expenses also rose during the quarter. The amount sent rose from $956.8 million in Q1 2020 to $977.2 million in Q1 2021.

Despite the increase in spending, the revenue generated was large enough to generate a 3% increase in profit. The net income reported by the company increased from $ 176.7 million to $181.8 during the quarter.

The Earning per Share (EPS) during the quarter also benefitted from revenue growth. EPS was pegged at $0.44, this is up from $0.42 from the same period last year.

In total, the company returned $172 million to shareholders in the first quarter, consisting of $97 million in dividends and $75 million of share repurchases.

Cross-border money transfer grows 6%

A breakdown of Western Union revenue shows that Consumer-to-Consumer (C2C) remains the company’s major source of revenue. The segment recorded a revenue of $ 1.05Bn in Q1, up 4% from the $1bn recorded during the same period last year. Similarly, the number of transactions increased 9% in the quarter.

Within the C2C segment, cross-border money transfer revenues grew 6% partially offset by declines in domestic money transfers.

In total, digital money transfer represented 23% and 34% of total C2C revenues and transactions respectively. The increase in revenue was up from a 16 per cent contribution a year ago in the first quarter.

Transaction growth was led by Europe and CIS, U.S. outbound, and the Middle East while the revenue was led by Latin American countries which were up 8%, followed by Europe at 4%.

The company revealed that of the roughly 150 million customers WU counts among its installed base, roughly half are senders, while the others are receivers.

WU Monthly Users surge by 46%

Westernunion.com average monthly active users for the first quarter increased 46% year-over-year.

It was also the most downloaded mobile app among peer money transfer companies during the first quarter, according to data provided by Sensor Tower.

Westernunion.com revenue grew 38% on a reported basis, or 37% constant currency, including cross-border revenue growth of 49%.

Business Solutions Continues to decline

Western Union’s other major segment, Business Solutions, is still feeling the effect of the pandemic. The report shows that its revenues declined by 2%, from $98.4 million to $96.5 million.

Other revenues, which consists primarily of retail bill payments in the U.S. and Argentina and money orders, declined 18% due to the ongoing impact of COVID-19 and the depreciation of the Argentine peso.

Business Solutions and Others represented 8% and 5% of total Company revenue, respectively.

In summary

Western Union’s first-quarter earnings result shows a rebound in cross-border activity, particularly in remittances globally.

The $1.2 billion total revenue is roughly in line with expectations but the incredible growth in digital money transfer is the major highlight of the report.