Ugandan fintech startup, Ensibuuko has announced a funding of 1 million dollars from an impact investor, FCA Investments.

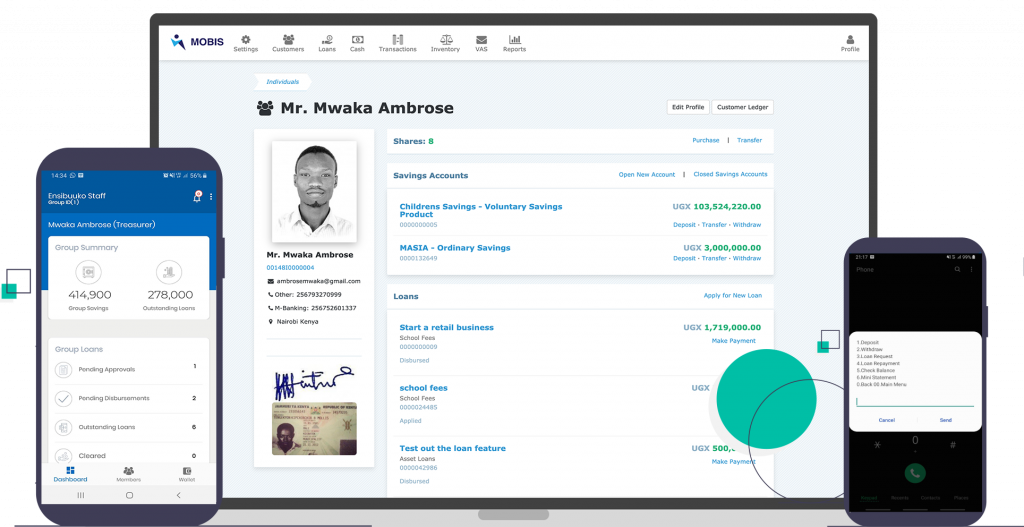

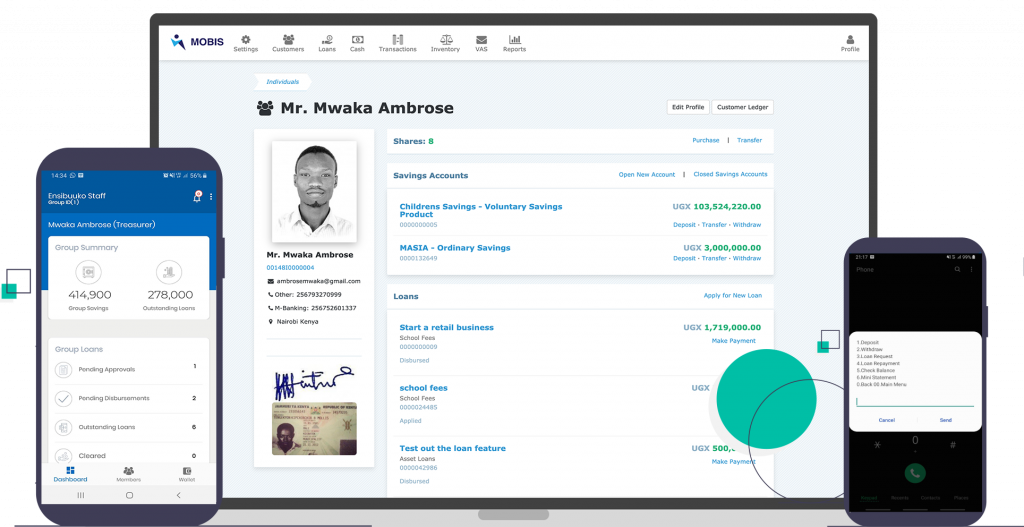

Ensibuuko was founded by Gerald Otim and Opio David in 2012 to offer a better way of delivering financial services to microfinance entities. These entities and savings communities make use of the startup’s software called Mobis to automate their data, processes and payments.

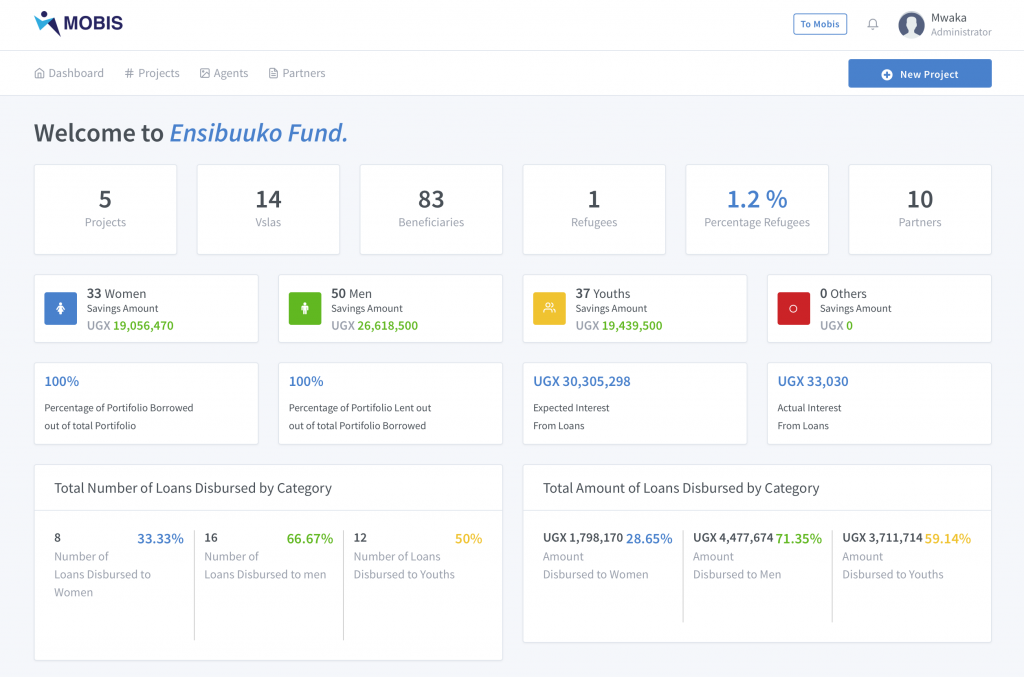

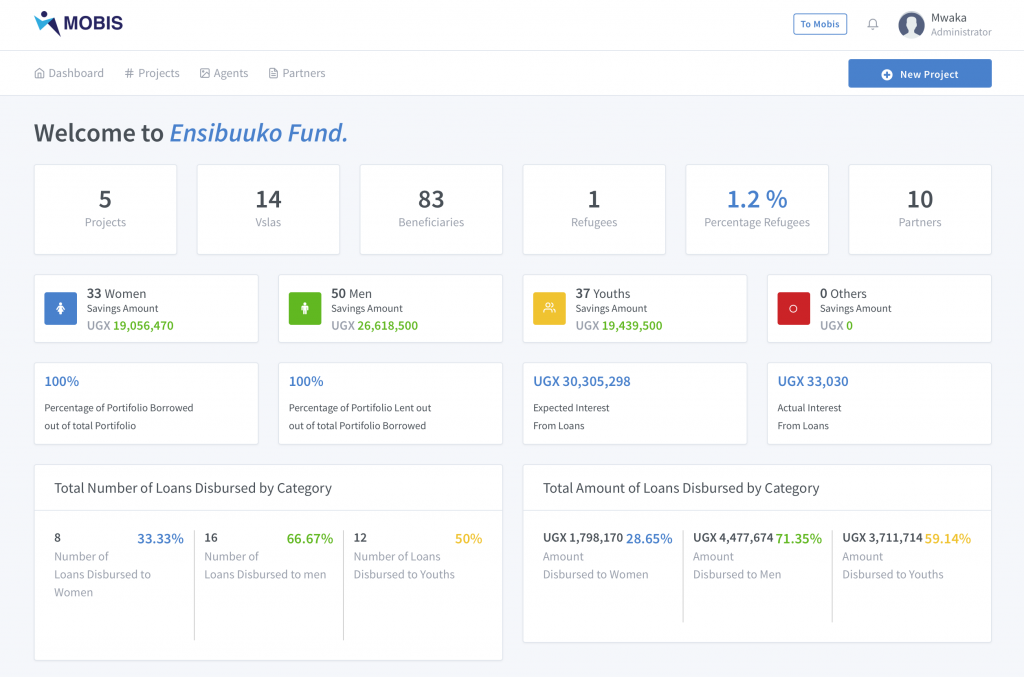

The platform is used by about 200,000 rural customers in Uganda, according to the company. It is also available in Zambia, Tanzania and Nigeria through the microfinance institutions and other partners that use it.

Like Mali’s insuretech Oko, which recently raised $1.2 million, Ensibuuko also offers crop insurance plans to farmers. The insurance is activated if the crops are lost to hazards like fire, floods and drought, thereby making it easy for the farmers to get back on their feet.

Also Read: Ugandan Fintech Startup, Numida Closes $2.3M Seed Round to Scale across Africa

Beyond savings communities and microfinance entities, Mobis is also used by investment clubs and companies that lend money to their users. Its dashboard allows the designated admin to create meetings for club members to discuss funds.

Source: Medium

To make money disbursement easier for savings groups, Ensibuuko creates a process within the app where three admins of the savings group all have to approve loan applications. The money can be sent to the right bank account without leaving the app itself.

The newly raised $1 million is billed to help the startup capture more of the Ugandan market as well as expand into other international markets. Touching on the fundraise, founder and CEO, Gerald Otim said, “With this latest investment, Ensibuuko ups its competitive stance in Africa’s fintech space.”

Prior to this funding, Ensibuuko had raised a total of $870,000 from 5 different rounds, according to Crunchbase data. The latest round was a sum of between $137,000 and $344,000 from the GSMA innovation fund for mobile internet adoption and digital inclusion. Back in 2018, it also raised $350,000 from GSMA in a seed round.