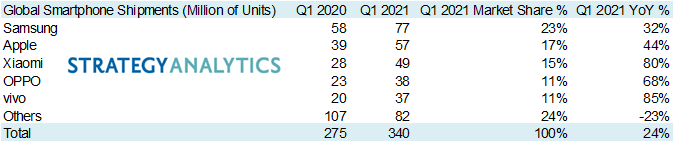

Global smartphone shipments grew impressively in the first quarter of 2021, according to a report by Strategy Analytics. A total of 340 million smartphones were shipped globally, according to researchers at Strategy Analyst. This represents a growth of 24% from the 274 million smartphones that were shipped in Q1 2020.

The list of companies in the top 5 manufacturers this year has seen a big shift from that of the same quarter in the previous year. The most marked change is that Huawei is no longer on the list

The smartphone maker has experienced a dip in its shipment volume largely due to the ban placed on it by the US. Recall that on May 15, 2019, the US government forbade companies in the states from trading with Huawei or exporting any equipment to the company.

Towards the end of 2020, some companies like Qualcomm, Sony and Samsung got approval for partial deals with Huawei in the US. However, the prolonged cut off from its major chip and equipment suppliers has affected the Chinese company and its smartphone business to the point that it is no longer in the top 5.

In Q1 2020, Samsung was the king with 58.3 million smartphones shipped while Huawei came in close with 49 million. Samsung had the highest market share with 21.1% while Huawei had 17.8%.

2021’s Q1 report still has Samsung as the leader of the pack as it exported 77 million phones. Apple snatched the second position with a total of 57 million shipments. In the third, fourth and fifth positions are Xiaomi, Oppo and Vivo with 49 million, 38 million and 37 million smartphone exports respectively.

Samsung retains the highest market share with 23% while Apple dropped from its 20.8% market share in Q4 2020 to 17% in Q1 2021. Oppo and Vivo tied at 11% while Xiaomi had an impressive annual growth of 80% and increased its market share from 11.3% in Q4 2020 to 15% in Q1 2021.

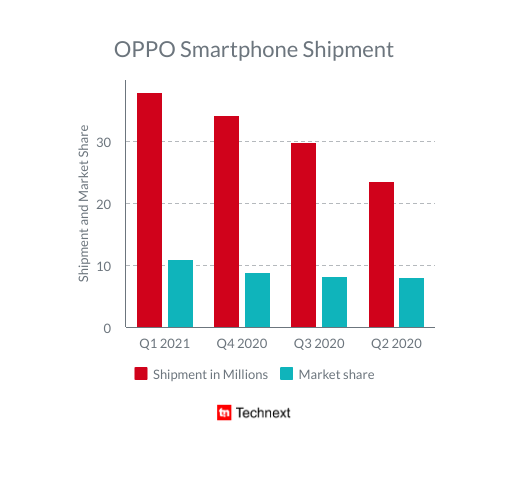

Oppo maintains steady growth in market share

Within the first quarter of this year, Oppo smartphones have attracted wider recognition in the market. With phones like OPPO Find X2 lite, Reno 5G and others with prices below the $300 range boosting its performance, it came in at the 4th position.

The smartphone brand has been steadily climbing its way up since the second quarter of 2020. In Q1 2020, it was not among the top 5, however, its shipment volume increased to 23.6 million in Q2 and it moved up to 5th place with an 8% market share.

As demand for affordable smartphones rose because of more online learning, remote working and demand for 5G-enabled phones, its shipment also increased. It finished Q2 2020 with a 29.89 million phone count and increased its market share to 8.2%.

Oppo crossed to 4th place at the end of the 4th quarter after 34.3 million smartphones globally. Its market share increased to 8.9%.

The brand performed better in Q1 2021 than it did in previous quarters. With a total shipment of 38 million, it held on to its 4th position and increased its market dominance to 11%.

Huawei’s fall from glory has presented competitors with a chance to increase their market shares respectively.

From being the second-largest phone maker in Q1 2020 and holding on to that position through Q2 and Q3, it slipped to the 5th position in Q4 and totally left the list in Q1 2021.

With some companies having received permission to partially trade with Huawei, the phone maker may be able to find its way back into the top 5 before 2021 is over.