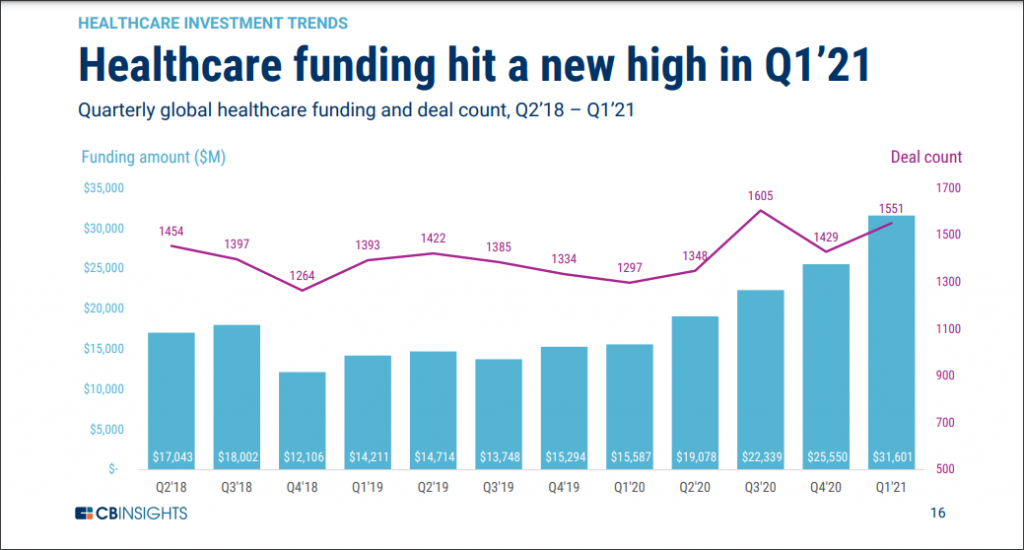

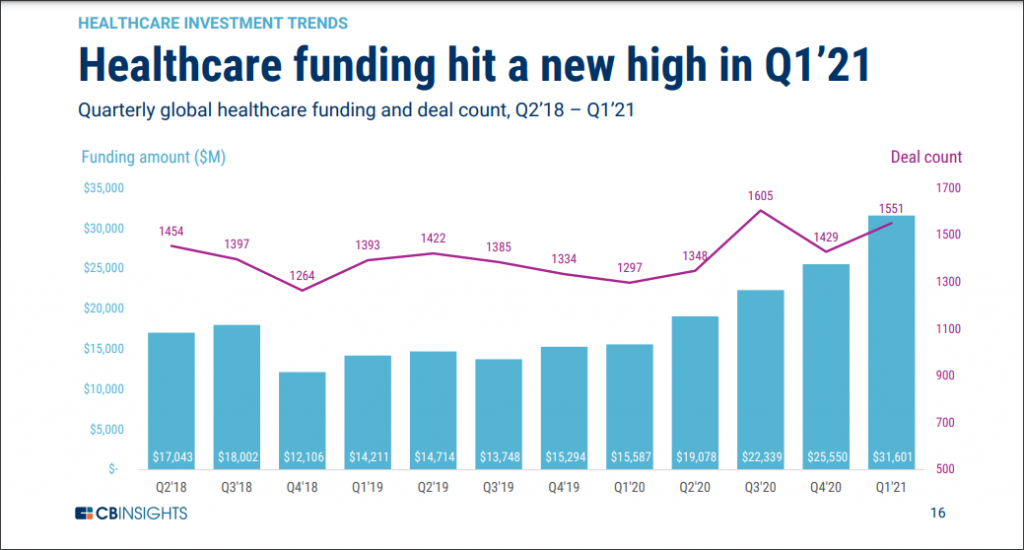

Investor interest in the healthcare sector continues to grow across the world. Recent data by CB Insights show that global healthcare funding reached a total of $31.6 billion in the first quarter of 2021.

This represents a new quarterly record funding and numbers (96) of mega-rounds ($100M+). The total deal count grew by 9% to 1.5K+ deals, the second-highest in the four years.

Equity financings include: convertible notes, seed, Series A, Series B, Series C, Series D, Series E+, private equity, growth equity, other venture capital, and other investment rounds

Digital Health Funding Hits $9B+

A breakdown of the spread of the funding shows that global digital health similarly saw record growth during the quarter.

The report shows that funding jumped by 9% to reach an all-time high of $9B+ in Q1 2021. The deal count in the sector also saw an increase, as the numbers rose nearly 13% from the previous year.

Digital health is defined as companies in the healthcare space

that use technology/software as a key differentiator vs. their competition.

This increase in investment can be tied to the shifting focus toward the pandemic’s long-term effects, especially around telehealth and its role in care delivery from here on out.

It also continues the trend of investors being more willing to bet a lot more on healthtech companies than they have been pre-pandemic.

Other driving factors include the increasing influence of Big techs like Google in healthcare initiatives and the growth of healthcare solutions that prioritize the consumer or patient experience through accessibility, transparency and personalization.

The largest investment during the quarter was the $535 million in Denmark-based LEO Pharma health startup that develops medical dermatology products.

Others in the top 5 include the $525 million in ElevateBio, EQRx ($500 million), Ro ($500 million) and China-based Miaoshou Doctor ($466M)

5 new Unicorns

Another major milestone during the quarter was the fact that the number of Healthcare care unicorns have risen to 58.

The most valued new unicorn in healthcare is PointClickCare an electronic health record (EHR) platform that helps automate complex administrative processes for providers. It raised an undisclosed fund in January and is now valued at about $4 billion.

Globally there are 58 Healthcare Unicorns valued in aggregate at

$147 billion

Other new unicorns include Cedar ($3.2Bn), Hinge health ($3Bn), Atai Life Sciences ($2Bn) and Aledade ($1.9Bn)

North America is still the most attractive Healthcare Investment location

In terms of region, North America remains the most attractive location for healthcare investors. A total of $19.86 billion dollars was raised in 69 deals during the quarter.

This is an increase from the $11.3 billion recorded in Q1 2020 and the $14.26 billion in the last quarter of 2020.

Asia comes in second with a total of $7.6 billion from 17 deals during the quarter. Europe follows with $3.72 billion raised from 9 deals during the same period.

Other regions which include Africa, South America, and Australia raised just $401 million from an unspecified number of deals. However, the report shows that there was growth in funding in the regions compared to Q1 2020 when only $61 million was raised.

This follows the trend that was reported in last years African funding report. Disrupt Africa reported that capital for health tech startups rose by 257.5% from $28.8 million 2019 to $103 million 2020.

Similarly, Nigerian health tech startups witnessed increased funding activity, raising $32.5 million across seven deals, 404% higher than the entire disclosed record ($6.3 million) for 2019.

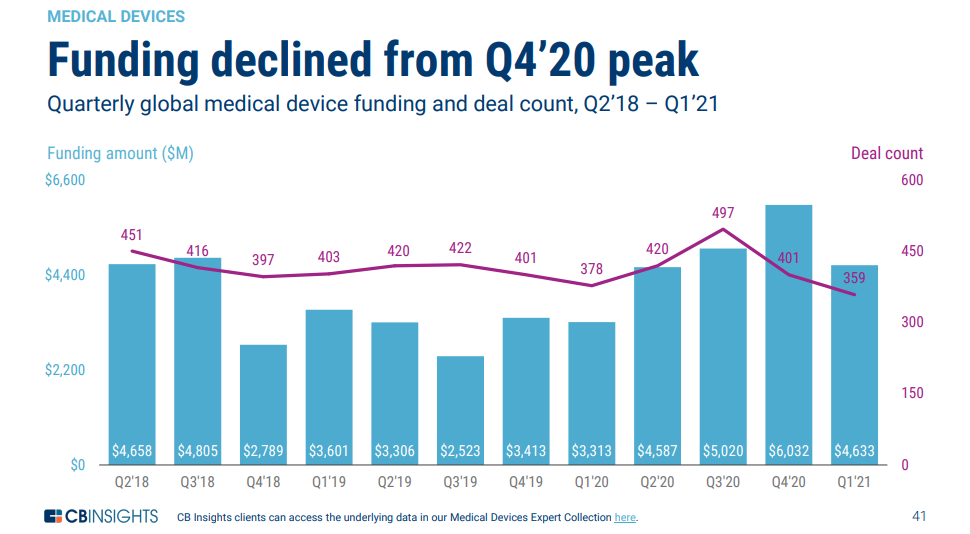

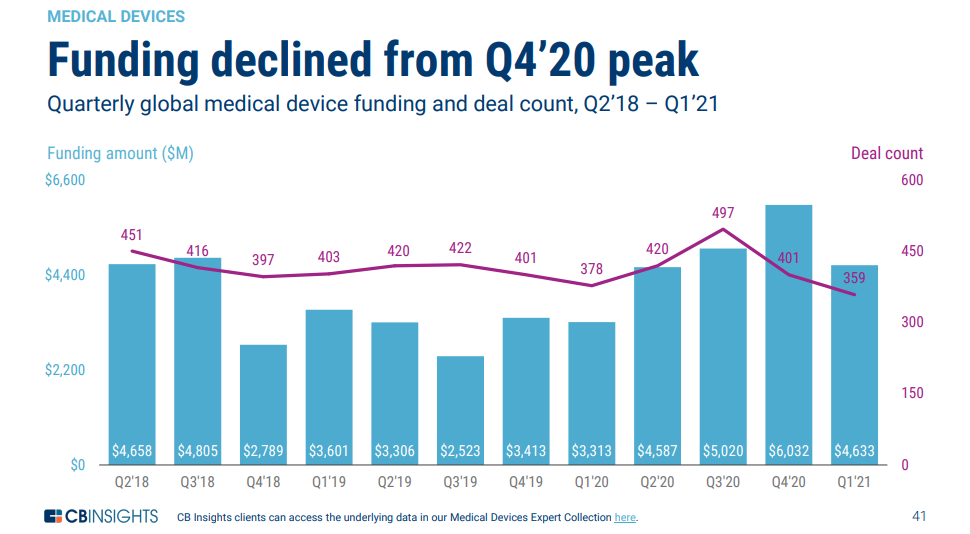

Medical devices

A break down of funding in terms of sectors show that Medical device companies raised the highest funds during the quarter. However, the $4.6 billion raised is a 23% decline from the $6.03 billion in the previous quarter.

Similarly, the number of deals count fell nearly 11% from 401 in Q4 2020 to 359 during the first quarter of the year.

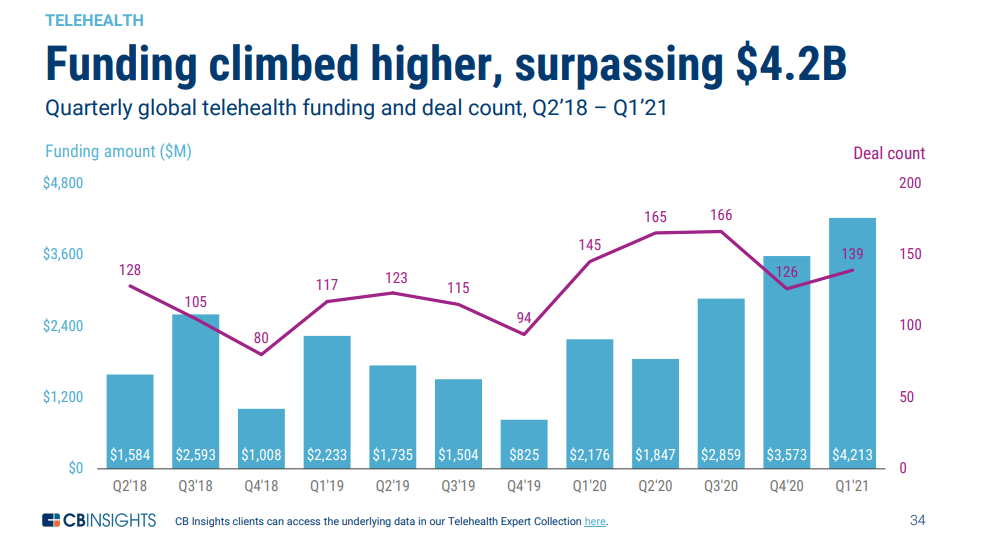

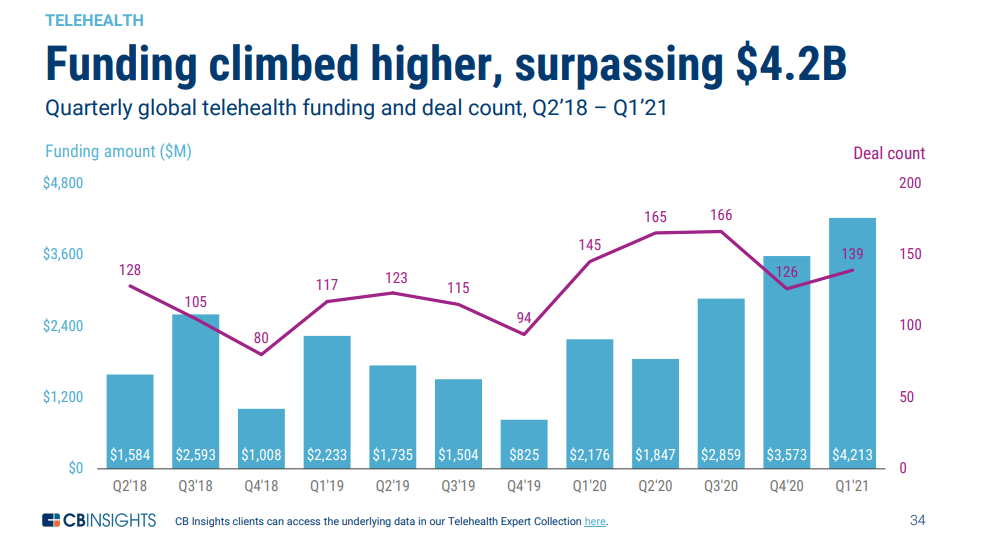

Telehealth

After medical devices, telehealth companies raised the next significant amount during the quarter. A record $4.2B in equity funding in over 130 deals from 32 countries – the most on record.

Six telehealth companies became unicorns ($1B+ valuations)

The United States had the highest number of rounds (72) while Nigeria had just 3 deals. However, the biggest economy in Africa had the highest number of deals in the telehealth category.

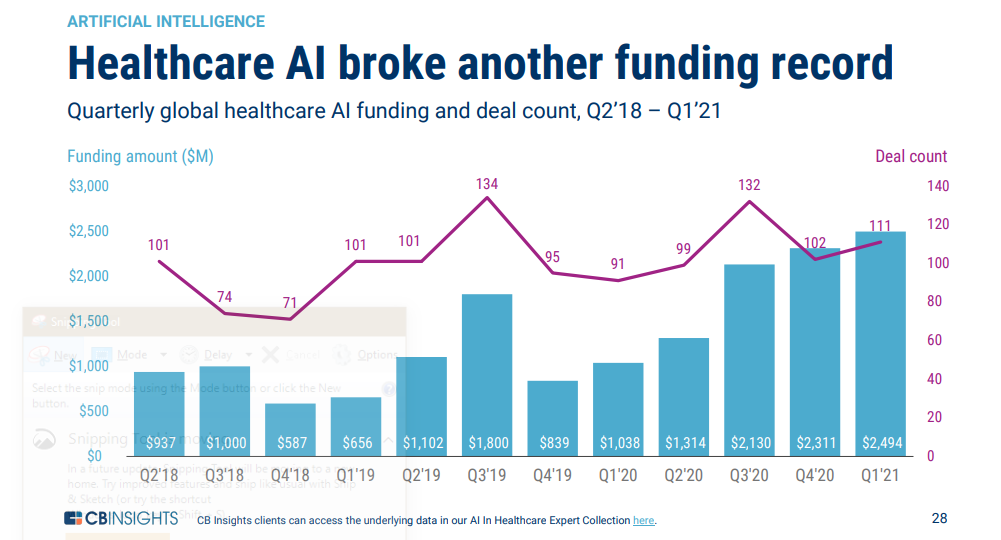

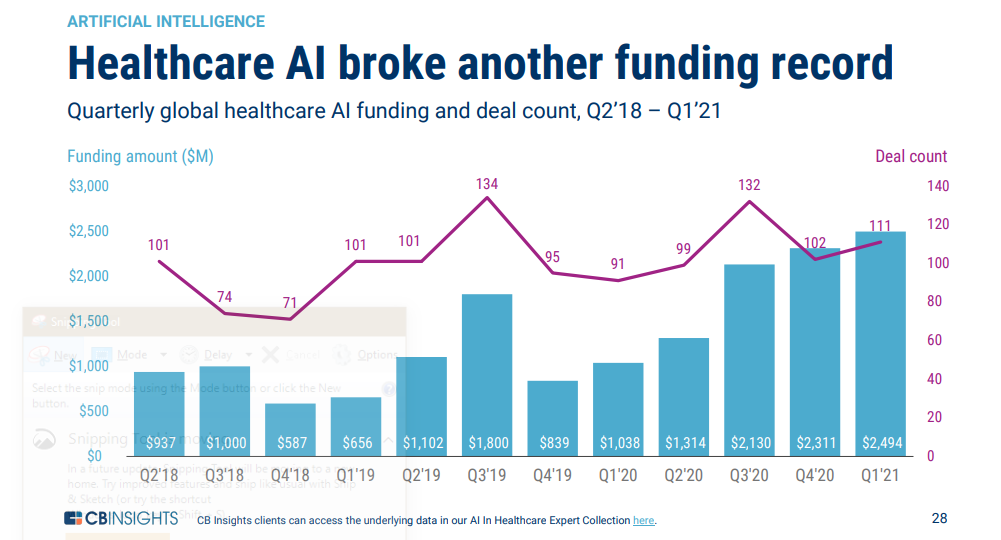

AI in healthcare

Healthcare AI broke another funding record in Q1. The sector raised $2.5B largely propelled by mega-rounds totaling about $1.5B. These rounds spanned applications from drug discovery to patient payments.

Similarly, deal count increased 9% from 91 in Q4 2020 to 111 in Q1 2021.

In Africa, Curacel, an AI-powered platform for processing and fraud management in Africa, raised $450,000 pre-seed funding to work with more than 800 hospitals in Nigeria, Ghana, and Uganda.

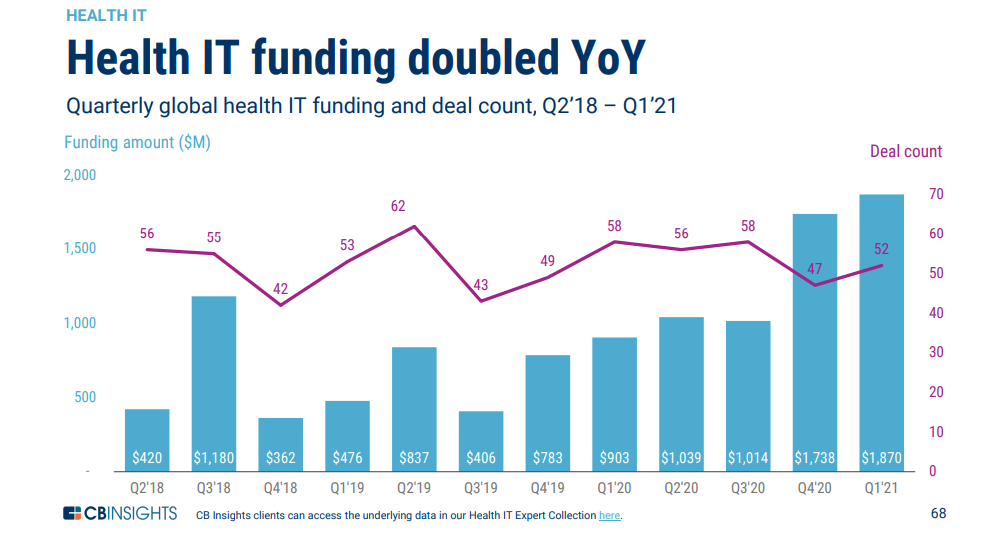

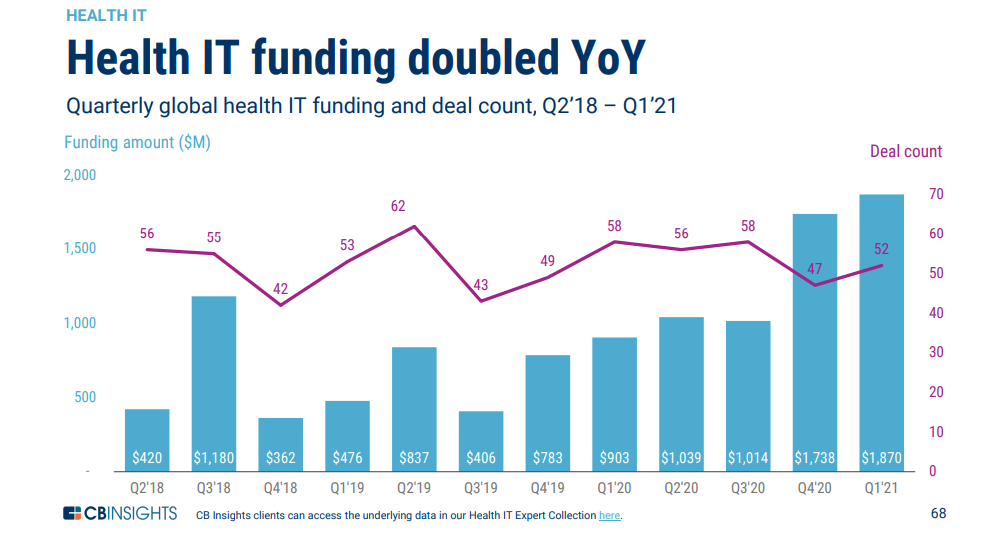

Health IT

Like AI, Health IT also saw remarkable growth doubling in just one year. The total funding in the sector rose from $903 million in Q1 2020 to $1.8 billion in Q1 2021.

Similarly, The deal count also inched forward rising from 47 to 52 between the last two quarters.

In Africa, Ghanaian e-health startup Redbird has closed a US$1.5 million seed round during the quarter. Ghanaian startup, mPharma which manages prescription drug inventory for pharmacies and their suppliers, also raised $17 million in its latest funding round this year.

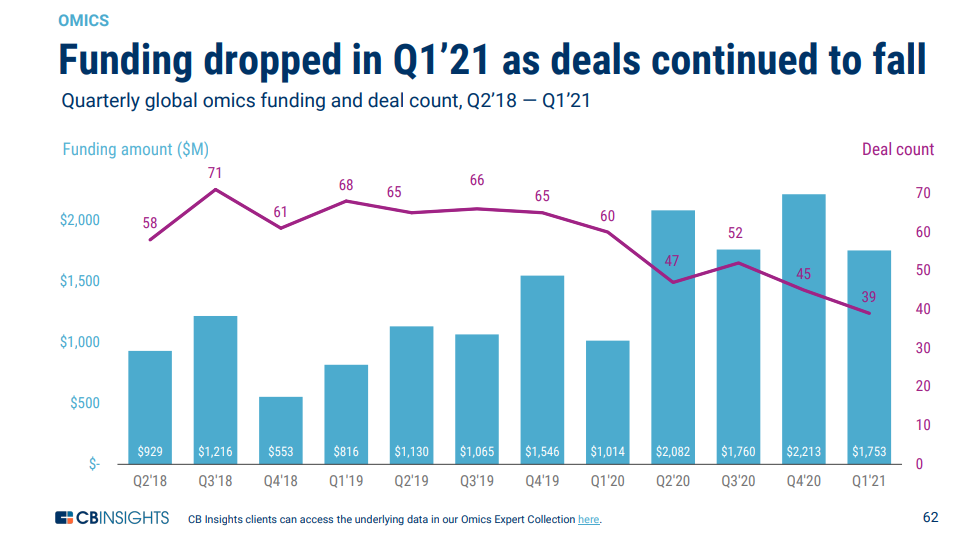

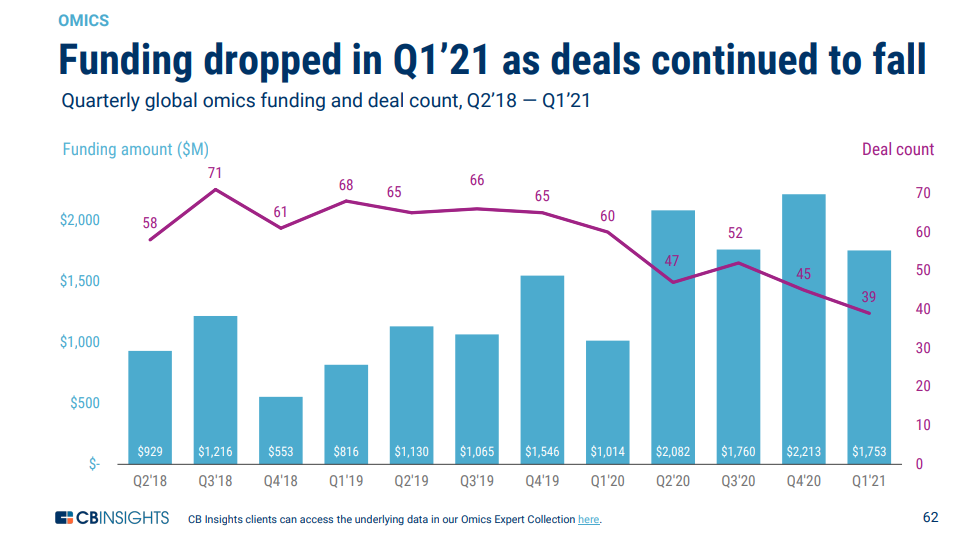

Omics

Number 5 on the list, Omnics focuses on companies involved in genome and DNA sequencing. The report shows that a total of about $1.8 billion was raised across 39 deals.

Omnics – Companies involved in the capture, sequencing, and/or analysis of genomic, transcriptomic, proteomic, and/or metabolomic data

However, data points out that the category continues to receive significant mid and late-stage funding. This is backed up as the US witnessed over 60% of omics deals, a significant uptick after a 3-year downward trend.

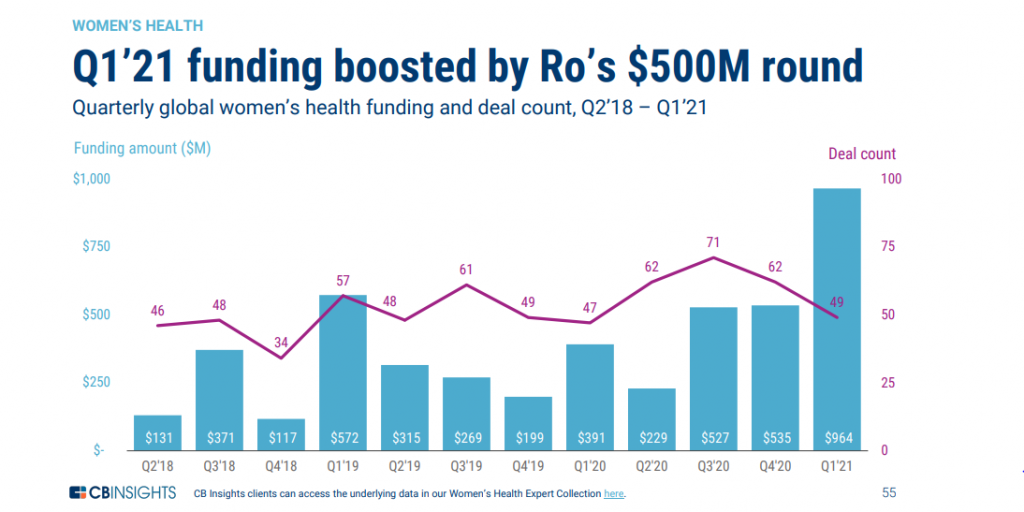

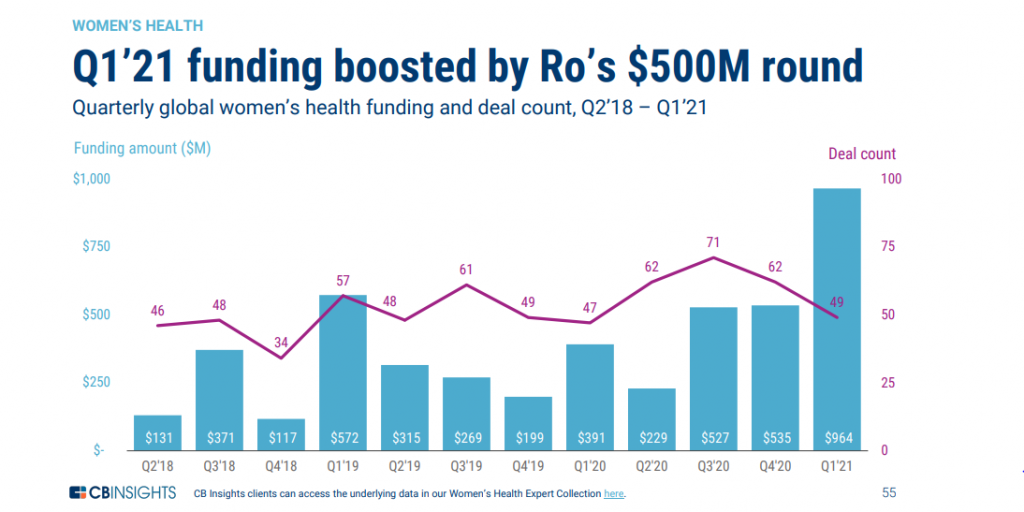

Women’s health

Another aspect of the report highlight was that of companies focused

specifically on providing healthcare products and services to women.

The numbers show that total funding of $964M was raised in the quarter. This is a significant increase from $535 in the previous quarter. According to the report, the increase was spurred by Ro’s $500M round.

Similar to the amount, the number of deals also increased. The total rose from 61 to 100 during the quarter. However, nearly 70% of the deals were early stage.

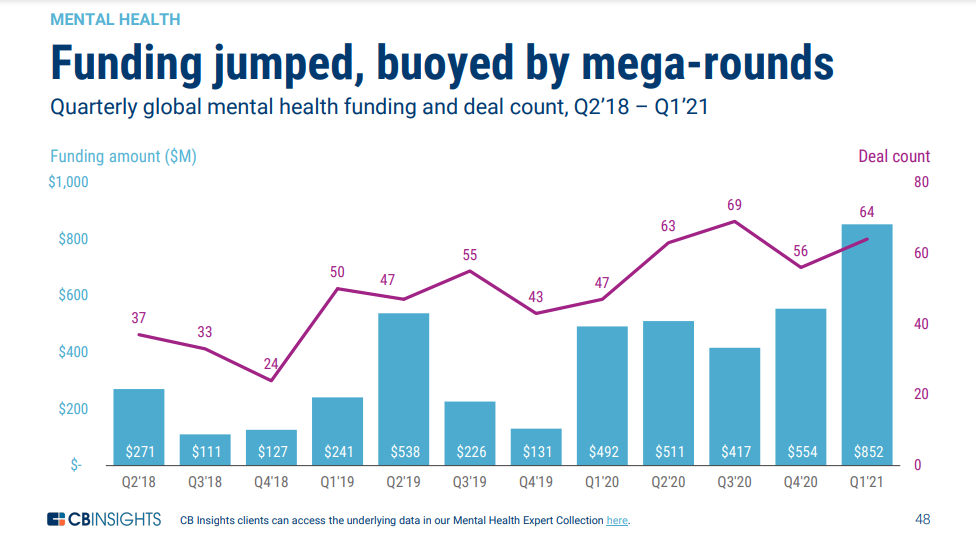

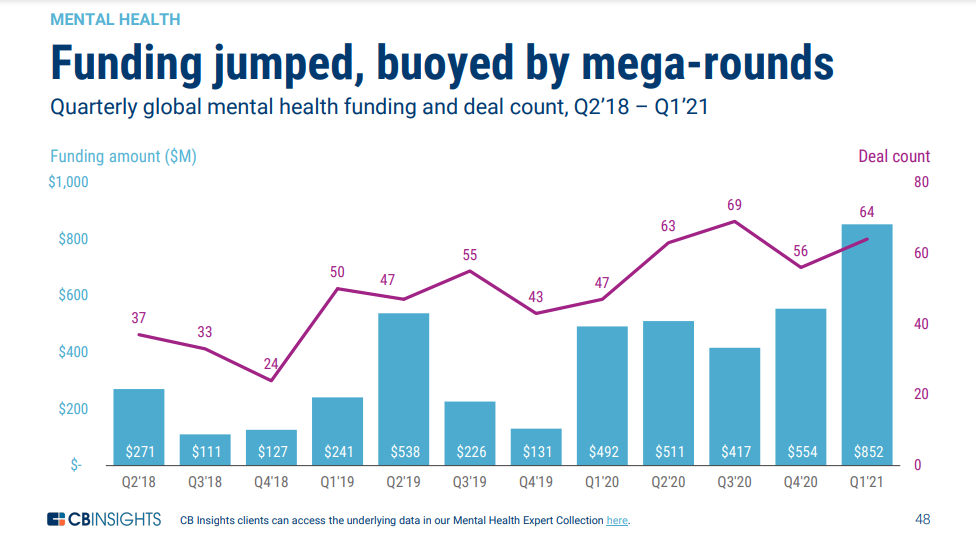

Mental health

Finally, we have funding raised by Mental health startups. Although funding in the category is small compared to others, data show that volume raised increased exponentially during the quarter.

Mental health – Companies applying technology to problems of emotional, psychological, and social well-being

A total of $852M was raised, representing a 54% growth from the $554 million raised in Q4 2020. The increase was spurred by mega-rounds raised by late-stage mental health and wellness benefits platforms geared toward the employers market.

Similarly, the deal count grew by about 14% from 54 in Q4 2020 to 64 during the quarter.

In Summary

The global healthcare industry is growing significantly and the report forecast that the growth will continue into the second quarter.

Formerly ignored sector like mental health and Telehealth are now getting more traction as the aftermath of COVID and the introduction of tech innovation is creating new trends.