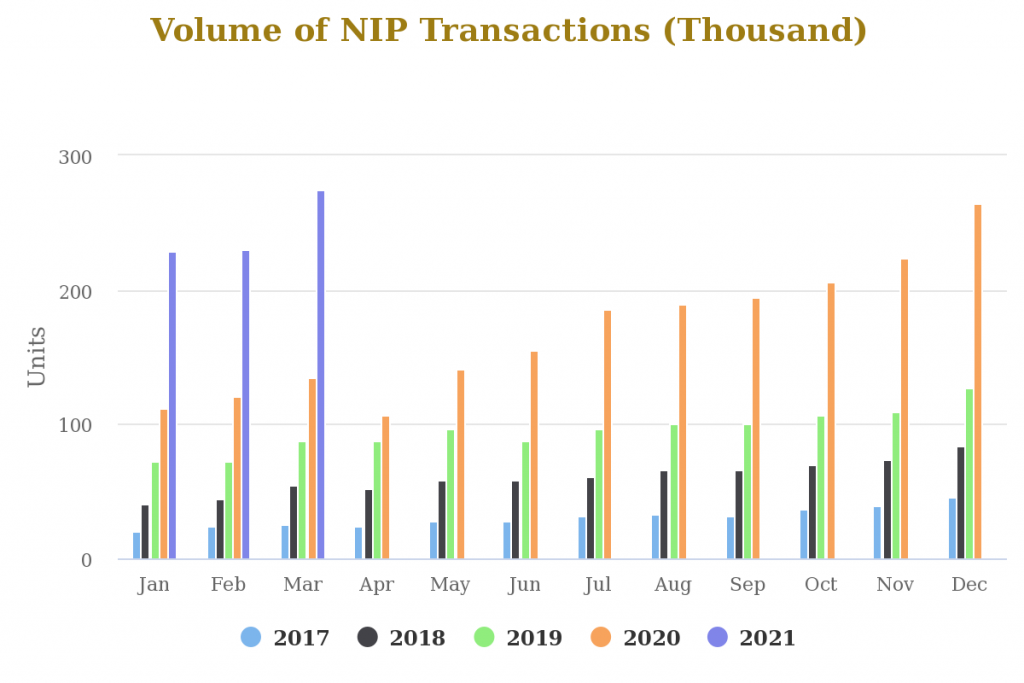

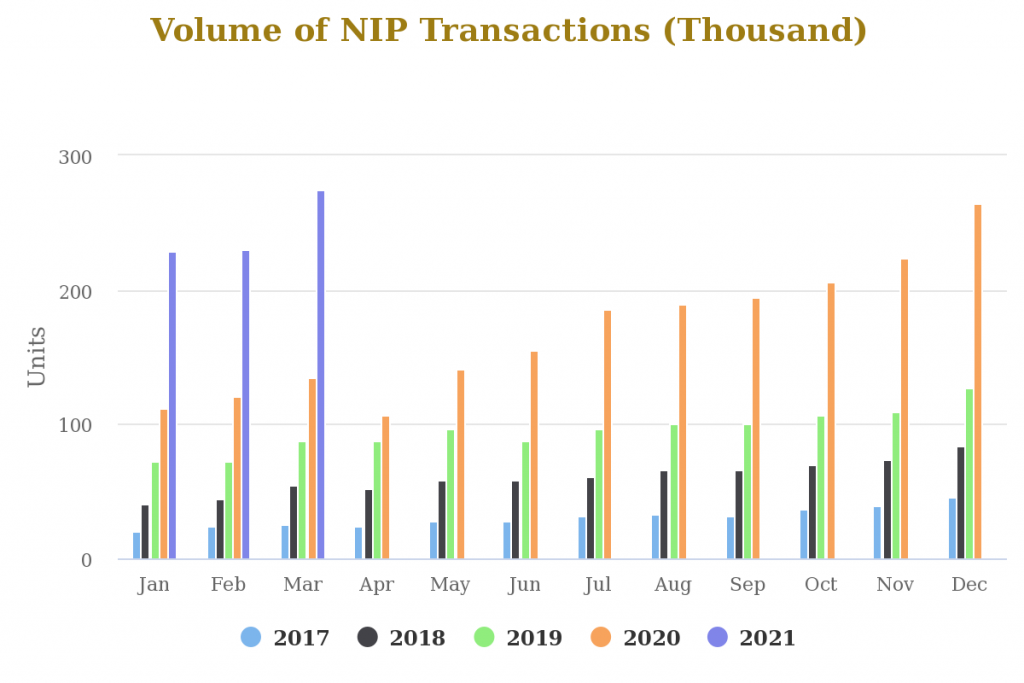

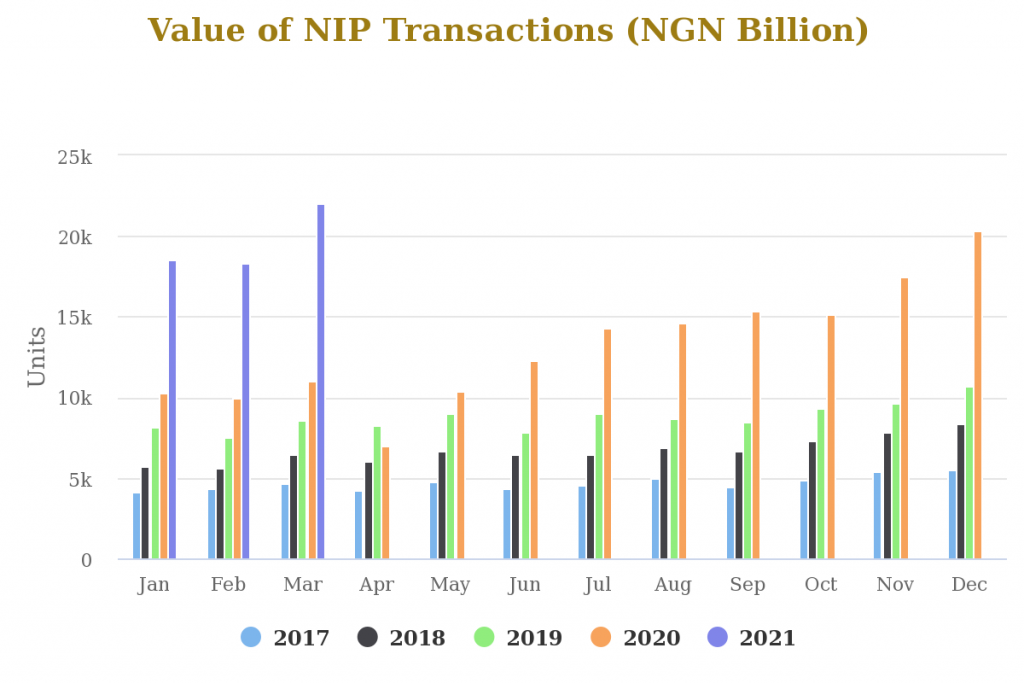

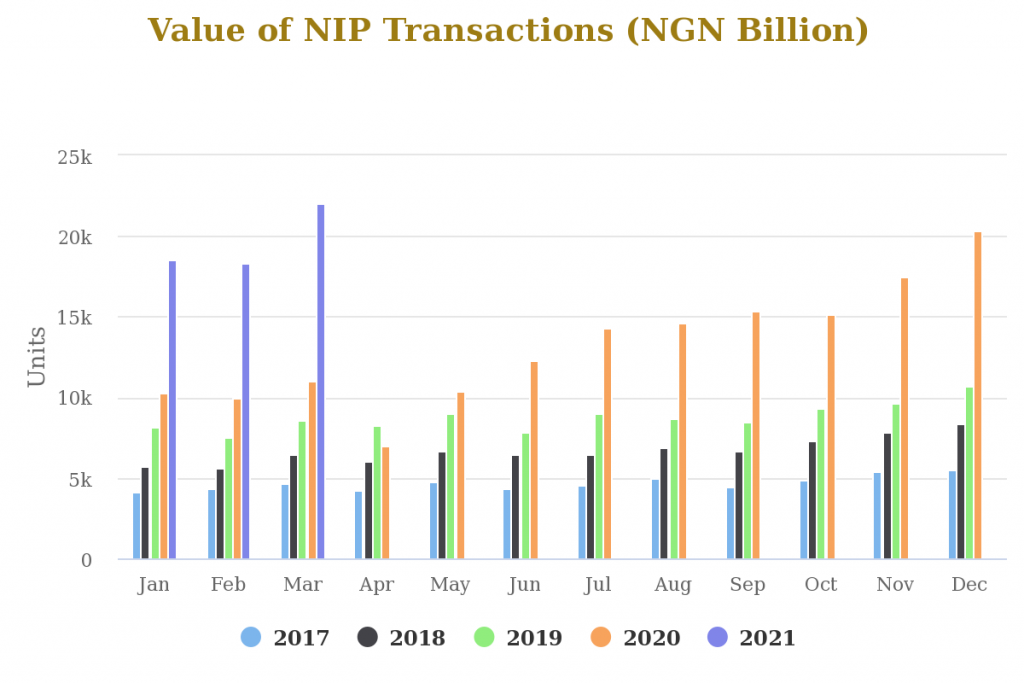

Although Nigeria is still a dominant cash-based economy, digital payment has been growing exponentially. According to Nigeria Interbank Settlement System (NIBSS), the value of transactions through instant payment rose to a record N58.8 trillion in the first quarter of 2021.

NIBSS Instant Payments (NIP) is an account-based, online real-time Electronic Funds Transfer (EFT) through all available electronic channels including Mobile, USSD & Internet Banking, POS, ATM, Web and internet platforms.

This is a whopping 88.4% growth from the total value recorded during the same period last year and an 11.2% increase compared to the last quarter of 2020.

Similar to its value, the volume of transactions skyrocketed during the quarter. A total volume of 734,056 was recorded more than double the 366,904 recorded during the first quarter of 2020.

However, compared to the fourth quarter of 2020 the volume only increased by 5.7%. Notwithstanding, the general number show a booming trend of digital payment adoption.

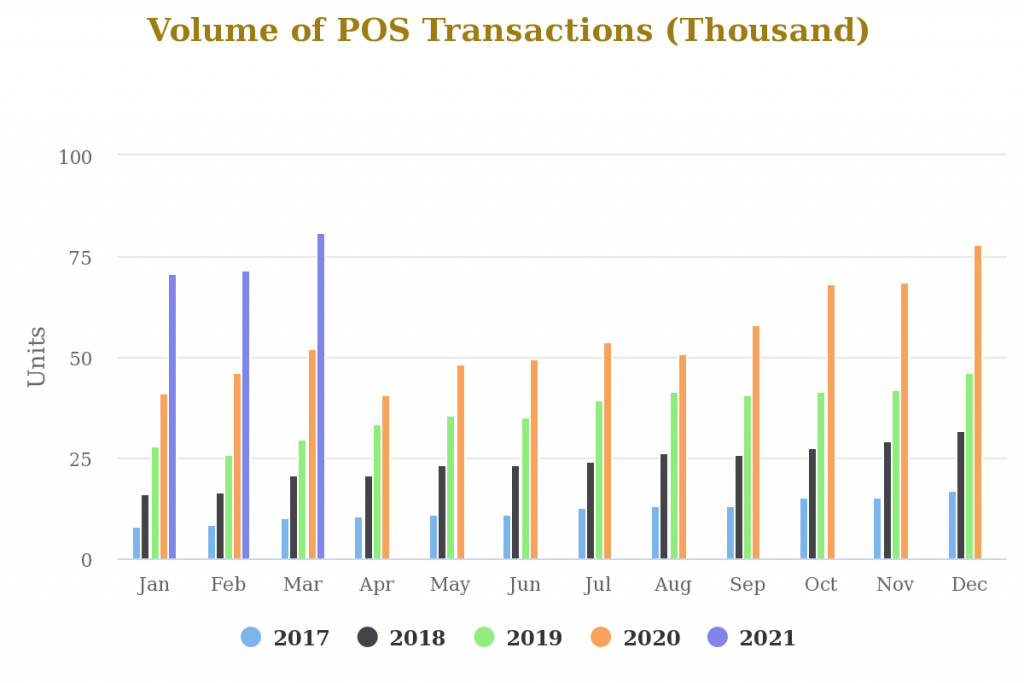

POS Volume reaches an all-time High

A breakdown of data obtained from the report showed that PoS and mobile channel fueled the growth of electronic payments during the quarter.

In terms of POS volume, the numbers of transactions hit an all-time high of 80,947 in March. This added to a total of 223, 453 during the quarter, a 60% increase from Q1 2020 and a 4% increase from the last quarter.

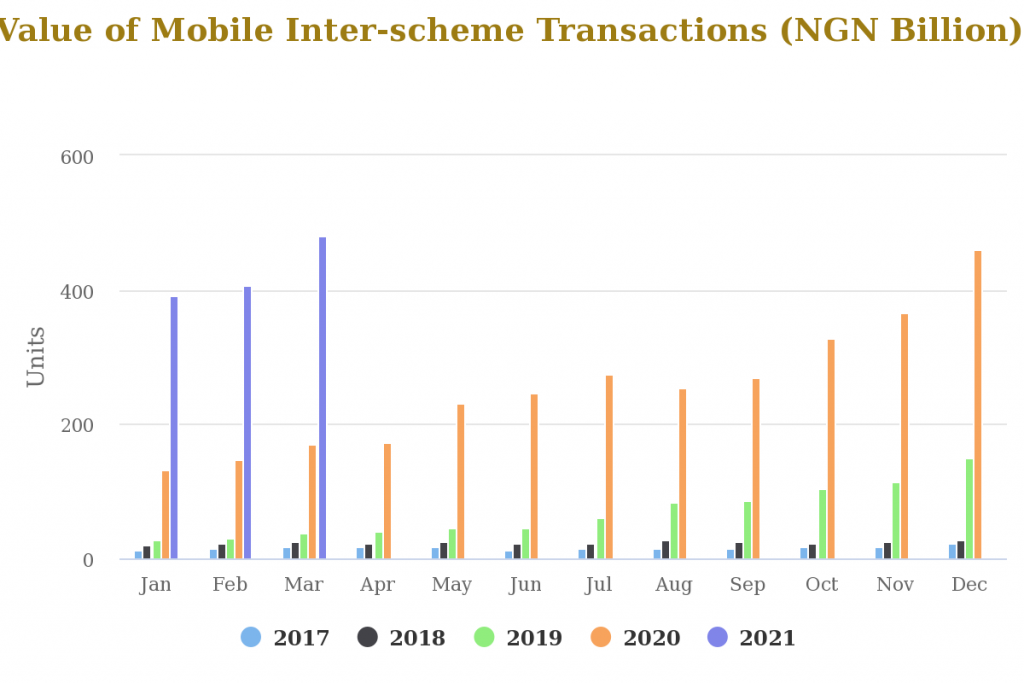

Similarly, the volume of Mobile transactions saw a huge growth of about 100% year on year. The total volume recorded was about 48.54 million, an 8.6% growth from the last quarter.

The incredible growth of both channels can be traced to the growing trend of digital adoption since the COVID-19 Lockdown. Another reason will be the growing internet population in the country.

Despite the 4-month ban on SIM registration, Nigeria’s internet population during the first quarter still stands at around 150 million. This is 12 million more than the 136 million internet subscribers during the same period in 2020.

In terms of value, POS transactions fell short of the N1.5 trillion recorded in the previous quarter. However, the N1.48 trillion reported is still 48% higher than the total value recorded in Q1 2020.

Mobile on its part was on a riot. The channel had a whopping 181% growth year on year after recording N1.27 trillion during the first quarter. Compared to the previous quarter the growth was 10.4%.

March had the highest growth of PoS and instant payments value and volume in the first quarter of 2021.

Looking at the numbers, the trend shows that the month of March was responsible for the high growth. Asides from the factor of COVID, it appeared that both value and volume often recover fully in March after falling for the high festive spending in December.

For instance, the volume and value of Mobile rose to 18.3 million and N480.98 billion respectively in March 2021 after recording 16.93 million and 459.7 in December 2020.

This is similar to the volume and value of Mobile in March of 2020 which rose to 8.85 million and N169.8 billion respectively after recording 8.23 million and 148.96 in December 2019.

This can also be seen in the general trend of NIP transactions between December 2020 & March 2021 and December 2019 and March 2020.

In Summary

Mobile still remains one of the largest contributors to electronic payments in Nigeria. According to the NIBSS, Mobile phones and tablets were responsible for 78 per cent of total transfer transactions in 2020.

This isn’t surprising as smartphone penetration keeps increasing exponentially. The success of fintech’s like Paystack, Kuda and Flutterwave have also contributed to the adoption of digital payments.

However, the recent numbers by NIBSS show that POS is picking up the pace despite challenges like internet connection, charges and high error rate.

As things stand, Only 167,000 of the 307,000 PoS machines deployed in Nigeria are active. If the growth of POS is to be maintained, more POS machines need to be available for cardholders that want to adopt it.