The Central Bank of Nigeria has reportedly suspended the provision of the BVN validation service to all fintech and third-party partners in the country.

According to an email notification sent by Paystack, the new directive affects every non-bank that offers BVN validation services in the country. This means that startups operating in the payment, crypto, saving, trading and loan spaces will be affected.

“We’ve recently been made aware of a regulatory directive from the primary custodian of Nigeria’s BVN service to all their partners to suspend the provision of the BVN validation service to their third-party partners. In light of this news, we’re hereby informing you that the BVN Resolve service will be temporarily unavailable starting at midnight, today, April 8”

Paystack also added that BVN Resolve Service will be going offline from April 8.

BVN validation services

Before now, the CBN AML/CFT Regulation 2018, allowed Banks and other companies to use Bank Verification Number (BVN) as forms of identification for users who wanted to open an account.

The verification of identity or Know Your Customer (KYC) according to regulations is a compulsory requirement before any financial institution can signup or start any business relationship with a customer.

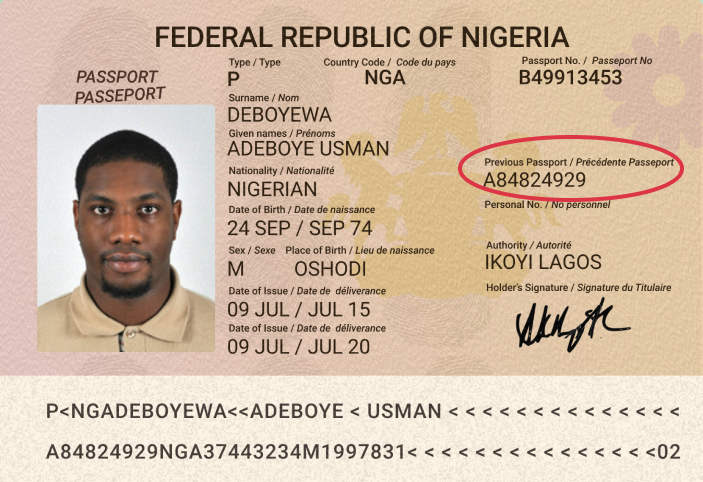

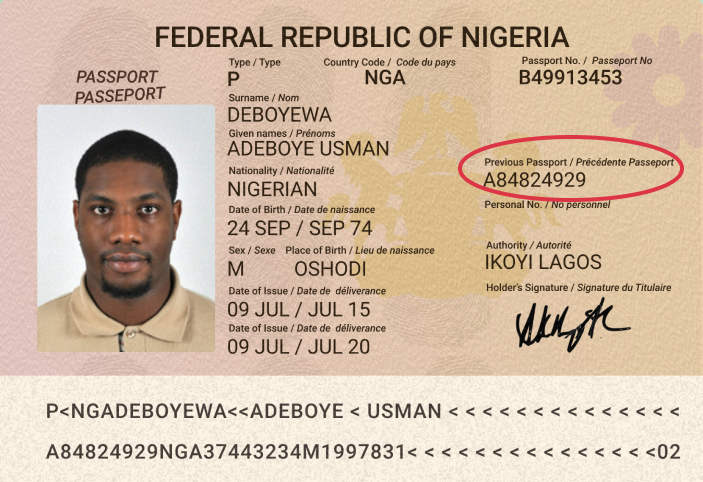

All institutions wishing to establish account or business relationship with the Bank shall provide proof of address, while operators of the account shall be required to provide other forms of identification, such as international passport/driver’s license/national identity card and Bank Verification Number (BVN)

Extract CBN AML/CFT Regulation 2018

The verification, according to the apex bank, helps check risk and determine whether or not there is an element of money laundering, fraud and other corruption-related activities.

However, with the suspension of BVN, non-banks have lost one of the most comprehensive means of identity verification in the country.

This comes as a major blow to many fintech startups that have built their verification systems around BVN. However, Yele Bademosi, the Founder and CEO of Bundle Africa says that there are non-BVN KYC companies in the market that startups can use.

Although the CBN has not disclosed the reason for this move, a possible reason could be to drive NIN registration and make it the central verification service in the country.

Over the last few months, the Federal govt has been changing the unique means of identification of all agencies, parastatal and industries to NIN. Examples include, UTME/ JAMB registration, voter registration, Banks and SIM cards

However, some industry experts especially software developers don’t think NIN verification APIs are ready. Osamudiamen Imasuen, a Nigerian app developer doesn’t believe API is ready.

He’s not alone, Abdulhafeez, a product designer says that with the constantly shifting NIN deadline. He doesn’t think it’s ready.

However, Taiwo Orilogbon, a tech guy at Bundle Africa says NIN Verification API has always been available. A Twitter user, Dark Ice agrees but added that NIMC won’t give it to companies specifically. He added that they will have to go through 3rd party like VerifyMe or smile identity.

NIN, ID and other Alternatives to BVN

Although KYC collects information ranging from name and phone number to email address and home address of the customer, only Personally Identifiable Information (PII) like BVN can be used to verify identity.

In Nigeria, there are several other PII’s that can be used like biometric information, phone number, Authorised national ID Cards, credit- bureau authentification and NIN.

Authorized IDs include international passports, driver’s license, and national identity card

However, the preferred verification method is often determined by the type of business. For betting companies for instance, both Government-issued ID card and Bank account name & number would suffice.

For Savings, Lending and Investment startups, phone numbers, credit- bureau authentification and Bank account name and number are required. For e-Commerce companies, just phone numbers may suffice.

The information provided by customers can be verified against information contained in several databases in the country.

For example, Nigerian businesses can verify customer information and NIN by consulting the National Identity Management Commission (NIMC). Before this new development, BVN can be verified with Nigeria Inter-Bank Settlement System (NIBSS) databases.

Phone numbers can be verified through collaboration with caller-ID companies like Truecaller and account numbers using a Resolve Account Number like the one Paystack offers.

There are also third-party verification companies like YouVerify that help complete the verification process by checking the information provided against government-issued IDs.

In Summary

The removal of BVN verification could increase the cost of onboarding customers. According to Bundle CEO, BVN verification Level 1 cost N11 and Level 2 cost around N50.

However, an ID verification according to Bayo, a Software engineer at Zedcrest Capital Limited, can be very expensive. Goodness, a young graduate agrees, he told this reporter he paid around N500 for an ID verification when he applied for a government scholarship.

Like Goodness, the outcome of the shift in KYC could lead to the cost of onboarding being shifted to users. This means that while the suspension of BVN validation service may favour the Federal Government’s plans, it creates new trouble for both startups and users.