2020 was a difficult year. COVID-19 and the various government-enforced lockdowns impacted every business sector. This led to mixed bag effects on Africa’s tech innovation and investment landscape.

In Sub-Saharan Africa, GDP output contracted by an estimated 3.7% and per

capita income declined by 6.1%. Foreign Direct Investment into Africa recorded a decline of about 18% to around $38bn from $46bn in 2019.

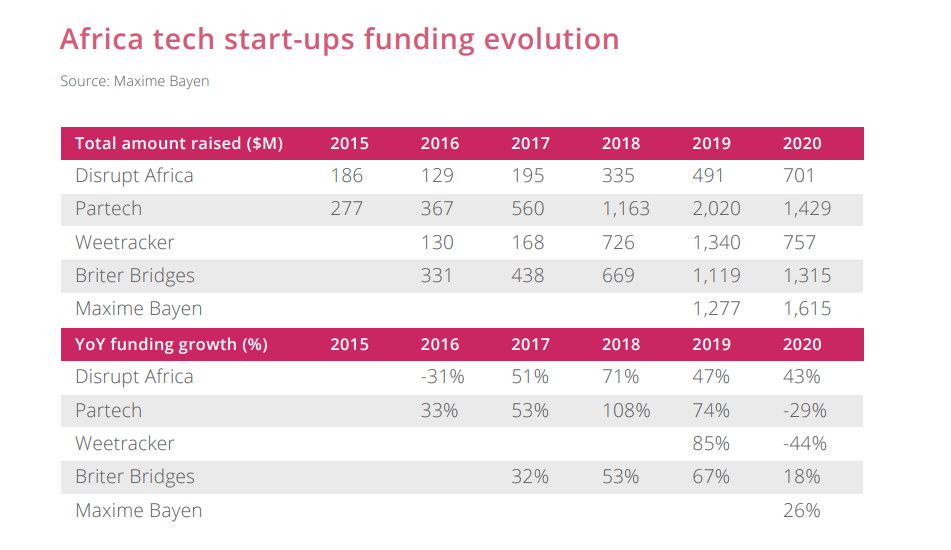

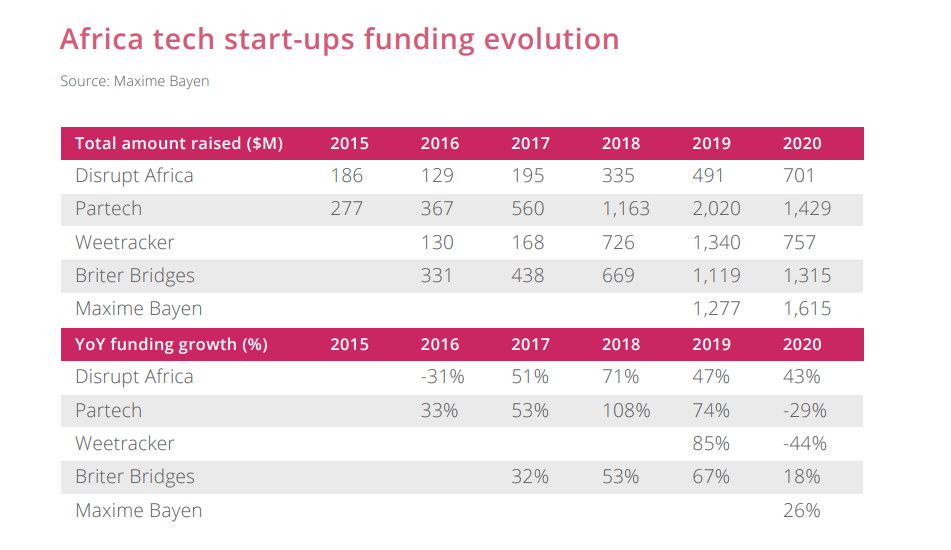

Similarly, VC investment into the continent declined by 29% to $1.43bn in 2020, according to a report by Partech.

However, on the plus side, the number of total deals on the continent increased significantly, by 44%. The deals were also spread better across sectors and market on the continent

2020 breaks the record of most deals ever recorded in Africa

Seed stage startups secured 22% of Africa’s total Funding

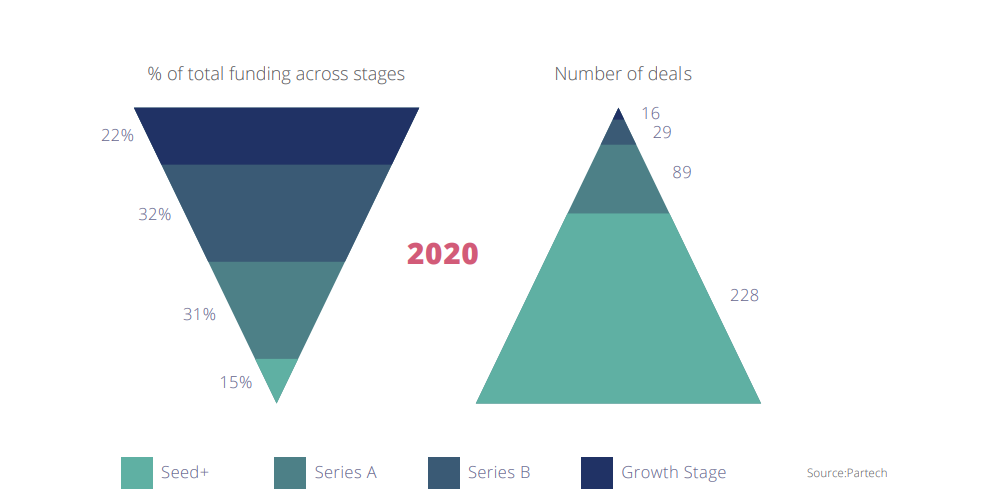

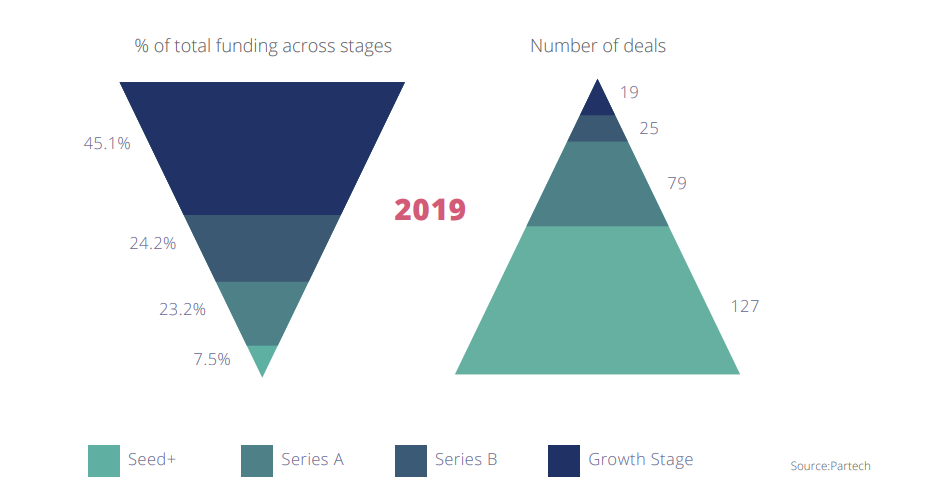

Of all the investment stages, early-stage saw the highest spike in terms of deals. The number of seed round deals almost doubled; from 127 to 228 deals.

The 228 deals in the Seed stage represent 22% of the total equity funding in 2020, a remarkable increase compared to the 7.5% in 2019.

Between 2015 and 2020, investment into seed-stage startups increased almost 10 times in deal volume and over 12 times in deal value.

However, large deals were fewer and the average ticket sizes of these deals were smaller in amounts across all deal.

There were about 86 Series A deals which contributed about $447 million. But Series B contributed the largest funding with the 29 deals recorded raising $449 million.

However, the number of deals in the growth stage dropped during the year from 19 to 16. This led to a huge drop in investment from $912 million to just $313 million.

Despite the decrease in total funding towards startups in 2020, compared to

2019, it is still remarkable to observe that investor appetite has not diminished amidst a pandemic.

Reports show that the continent’s startup ecosystem also saw more investors come to the table – 443 unique equity investors.

Tech in Africa is booming

From a global point of view, Africa’s tech ecosystem is still very small. VCs invested $3.9 Million per day into African startups in 2020 while in the US, startups received VC investment of $428 Million per day.

However, the tech space on the continent is still booming and the high investment appetite in African tech innovation confirms this.

Despite the boom, the decline in investment value and the large investment gap compared with other regions show that Africa is being overlooked.

Africa is receiving less than 1% of global VC flows

A possible reason for the low ticket is the huge variations in Africa VC funding reports. This is because investors may not want to take a great risk on a project without adequate data on the ecosystem even if its solution is great.

The number of undisclosed deals values ranges from $115m (Disrupt Africa), $240m (Briter) to $400m (Partech). The variations are mainly due to undisclosed deals and methodology some of which considers the Headquarters of Startups.

In comparison, other regions of the world have more transparent VC activity. For example in the US, the SEC requires most startups to file a “Form D” to confirm basic details of new equity financing within 15 days of closing their round of financing.

The pandemic too didn’t help matters as lockdown didn’t allow Early-stage investors who prefer doing due diligence in-person to travel because of travel restrictions.

However, the boom of investors into Africa shows that investors are becoming more accustomed to investing in the seed stage in a similar time frame as the global norm.

Nigeria Tops Africa’s VC Chart

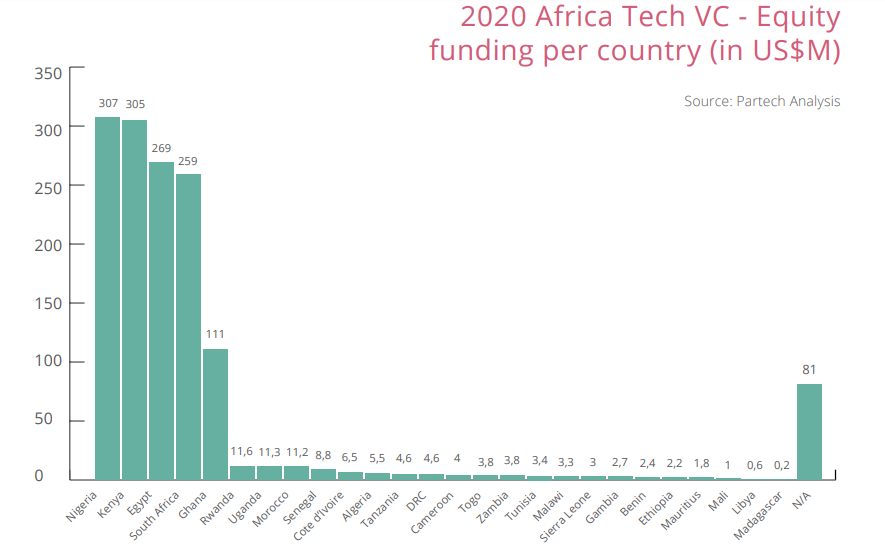

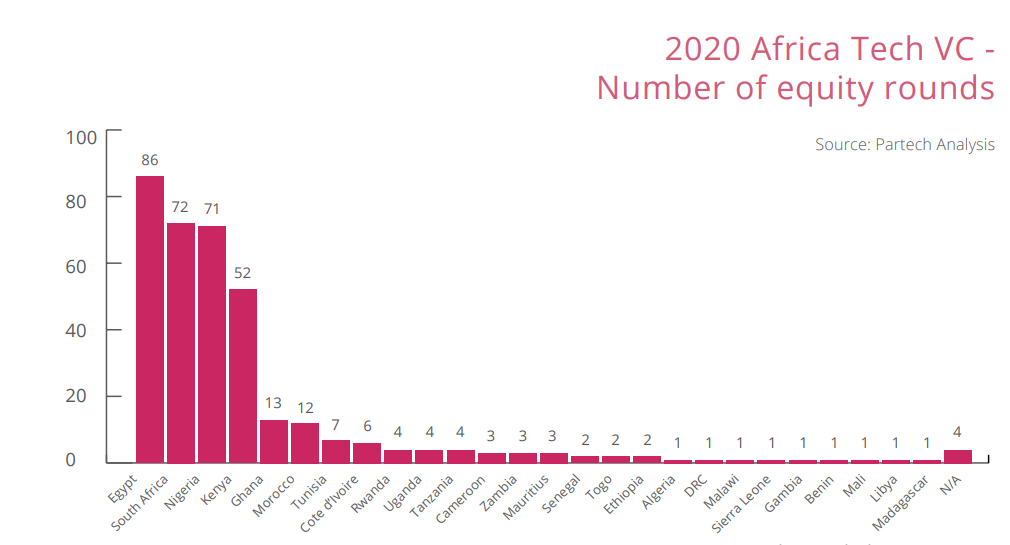

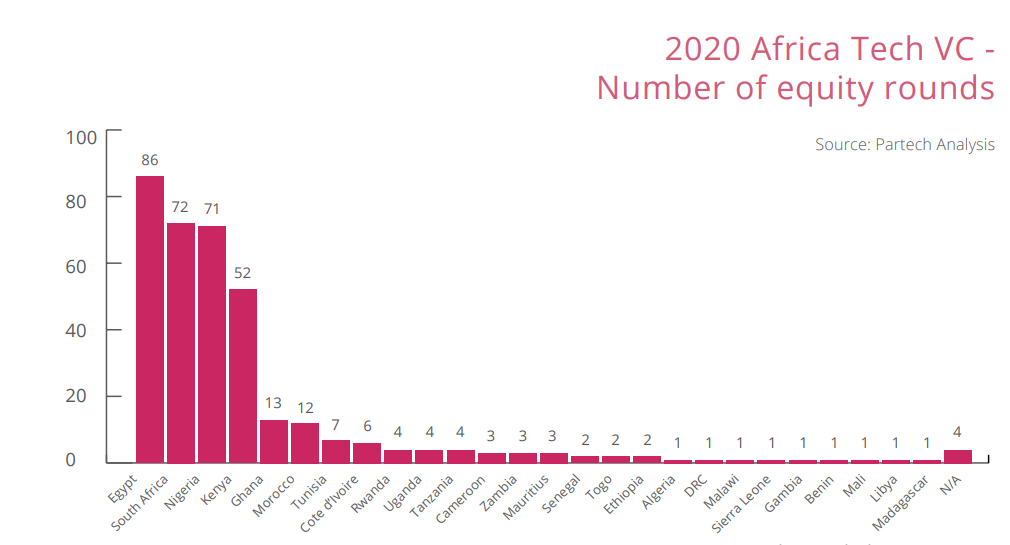

In Africa, the countries at the top of the chart in terms of value invested remained the same in rank.

Nigerian startups received the most investment in 2020 at a total value of $307m in 71 deals and an average deal size of $4.3m. This is 59% lower than the $747m invested in 38 deals at an average of $19.7m in 2019.

In 2019 Nigeria received the most investment in terms of value.

Kenya followed with $305m in 52 deals in 2020 averaging $5.9m per deal (second behind Ghana for the highest average deal value). The value of deals in the Kenyan market declined by 46% while the number of deals stayed constant at 52 (with the average also dropping 46%).

Egypt and South Africa come in at number 3 and 4.

In terms of investment destination, The report shows that investors find Nigeria attractive due to promising demographics. However, the difficult investor climate is forcing startups to domicile elsewhere.

That is why it appears that most startups operating in Nigeria that raise capital are not incorporated in the country, it concluded. This is confirmed by their low “Ease of Doing Business” rankings of 131 out of 190 countries globally.

Kenya on the other hand appears to be easier to operate in compared to the other investment destinations on the continent. It is ranked 56th in the ease of doing business score, the third-highest African country behind Rwanda (38th) and Morocco (53rd).

The Venture capital investment into the country as a proportion of GDP is also the highest in Africa. At 0.32% of GDP, Kenya’s ratio is higher than the same ratio for Asia (0.27%) and Europe (0.16%).

For South Africa’s ecosystem, its major struggle is that it is not foreign investor-friendly and foreign domiciled startups can’t raise local seed-stage capital easily.

This is because of laws that mandate South African investors to not invest in companies with foreign headquarters.

In Summary

Despite not meeting forecast, the investment landscape in Africa last year was fair because of the far reaching effects of the pandemic. Africa Arena predicts that 2021 will see a substantial surge in deals accelerating throughout the year.

It also estimates that investment into tech startups will be between $2.25 and $2.8 billion, making it the best year in the history of tech investment on the continent.