Y Combinator (YC) is a seed funding startup accelerator based in Silicon Valley, California. The firm invests a sum of $125,000 in early stage startups that it selects from a pool of applications. YC accepts startups into two different batches each year, the first batch runs from January through March while the second runs from June through August.

Since it was founded in March 2005, Y Combinator has worked with and invested in more than 3,000 companies and has built a reputation as the startup accelerator of choice for entrepreneurs seeking seed funding. Some of the startups that are part of the YC family are Stripe, PayStack, Flutterwave, Eventbrite, DoorDash, Airbnb, Coinbase, Zapier and Reddit.

Its January – March batch is called the Winter batch while the June to August batch is the Summer batch. Startups in either of YC’s batches are connected with the over 6,000-member alumni body and can get support and connections that are needed for any part of the business building. Besides funding, YC works with startups on their ideas to build products that people want and deal with investors at a later stage.

After startups apply and are selected, YC takes them through the three-month startup program which ends in a demo day. The program includes weekly talks with startup founders, venture capitalists, and executives from big tech companies as speakers. At the demo day event, the startups pitch to other investors and can raise more funding.

There are now 10 African and Africa-focused startups in the W21 (Winter 2021) batch. They are Mono, Djamo, Kidato, VendEase, Dayra, Blueloop, NowPay, Sendbox, Flextock and Ziina.

Here is a bit about each:

Mono

Mono is a Nigerian fintech startup that helps companies access data from their customer’s bank accounts and make authorized withdrawals from those same accounts.

Source: TechCabal

You must have used services that debit you automatically at specific times of the month or maybe even for a one-off service. Mono’s fintech solution enables companies to carry out those sort of transactions on the account owner’s behalf.

The company was founded by Abdulhamid Hassan, formerly a Product Manager at PayStack, and Prakhar Singh. Some of the data that Mono allows businesses to collect include income insights, transaction history, account data and real-time balances.

VendEase

VendEase is a platform that helps small and mid-sized restaurants to get the food items that they need in order to keep operating seamlessly. The startup connects restaurant owners or managers to farmers that can sell to them directly from the farm.

On the Vendease platform, food businesses can order anything that they want from verified vendors at good prices.

Image Credits: VendEase.

The startup also provides the ‘Buy Now Pay Later’ service to its restaurants by letting them get goods and then paying back when they have made a profit. VendEase offers next day delivery and provides spending analytics to partner businesses in order to monitor finances.

BlueLoop

This is another Nigerian fintech startup that was co-founded by two former Obafemi Awolowo University students; Ben Eluan and Osezele Orukpe, in 2020.

With its mobile app, Flux, Blueloop helps two different types of people carry out financial transactions; crypto traders and those who want to use other platforms besides banking apps for their transactions.

Users make payments, receive money and buy from merchants on Flux from within the app. The crypto services have been paused in order to comply with the CBN directive, however, so crypto trading is no longer an active feature for now.

According to Eluan, Flux records over $700,000 in transactions every month.

Sendbox

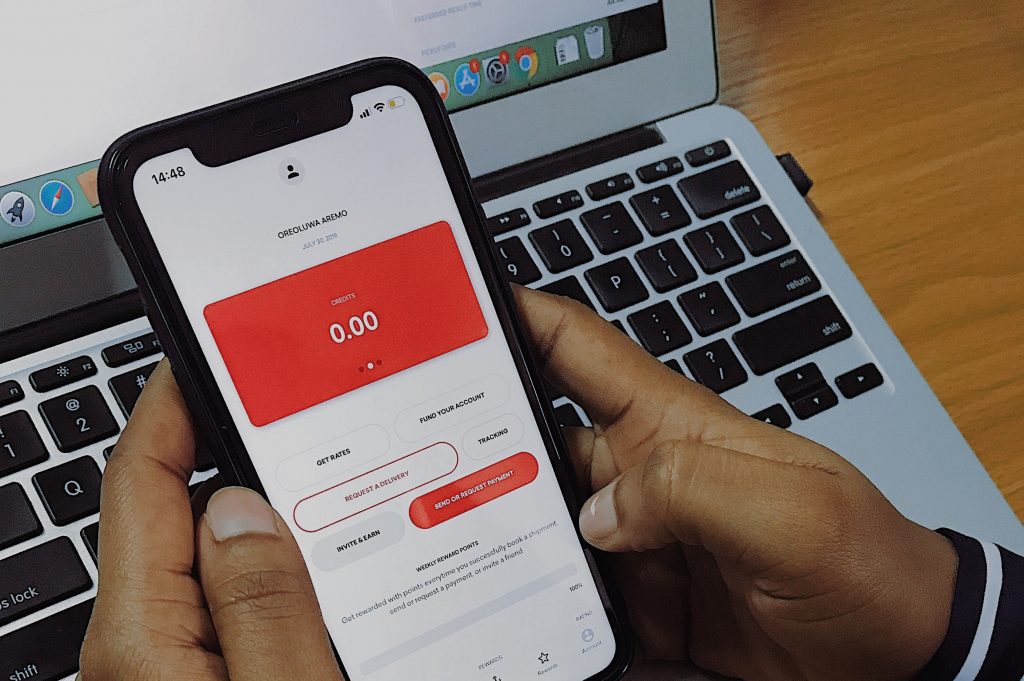

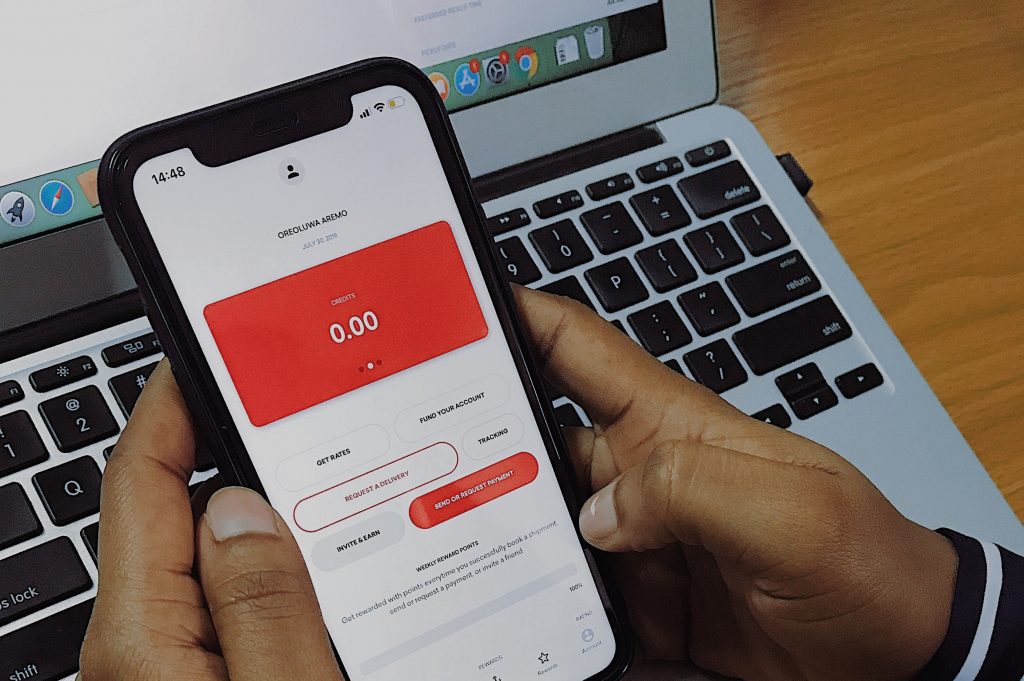

Sendbox was Microtraction’s first venture capital investment in 2019. The startup operates in the logistics space and helps individuals and businesses to deliver goods within Nigeria and to international locations.

It was founded in 2016 by Emotu Balogun and Olusegun Afolahan.

Source: Medium/Sendbox

Pickup and delivery requests can be placed by either the seller or the customer, while for businesses, bill payments and escrow services are also provided by Sendbox. Through its agents and franchise sellers, the startup also helps businesses make more sales through more channels.

Djamo

Djamo is an Ivory Coast-based startup and is the first startup from that country to be selected by Y Combinator. The fintech startup aims at bringing Ivory Coast’s huge unbanked citizens access to financial services.

Djamo was founded by Hassan Bougi and Regis Bamba.

Source: TechCrunch

Through its debit cards, which are delivered through its own logistics services a day after the user registers, Djamo enables users to pay for a wide range of bills which include Netflix subscription and Amazon fees.

Suggested Read: How to Avoid Getting Scammed When Trading Crypto On P2P Platforms

According to Hassan Bougi, CEO of Djamo, before the startup launched, Ivorians had to go to their bank branches and stay in long queues to get their ATM cards or load them with credit in order to make purchases.

Kidato

Kidato is an ed-tech platform that takes a different approach to education for the African child. Instead of going to the public schools where there are not enough teachers for each student, or paying the exorbitant fees charged by private schools, parents can enrol their children in Kidato.

According to the startup, Kidato classes have a student to teacher ratio of 5 to 1 and the students are taught using the same rigorous international curriculum as other private schools but at a lower price.

More than 528 students learn with Kidato’s learn-from-home model.

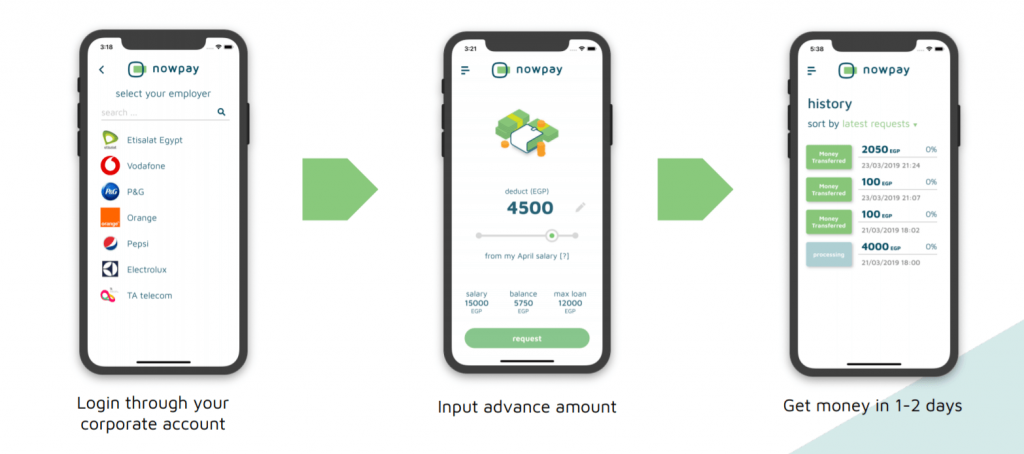

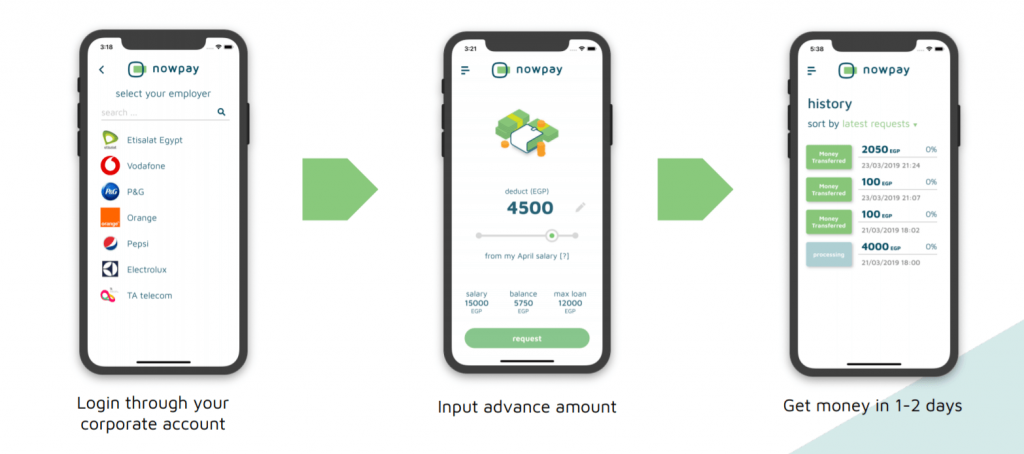

NowPay

NowPay is an Egyptian fintech startup that makes it possible for employees to have access to their monthly salary ahead of time. At any point during the month, a worker can withdraw and spend from his or her salary before the company pays it.

It recently raised an undisclosed pre-Series A round that was led by Global Ventures, Y Combinator, Beco Capital, Endure Capital, Foundation Ventures, and Abderahman ElSewedy participated in.

Dayra

Dayra, is also an Egyptian fintech startup. Through its proprietary software, an API and mobile app, enables companies of different sizes to provide financial services to their workforce.

Source: MENAbytes

Companies use Dayra to create virtual bank accounts for their unbanked workers as well as to provide ATM cards for them. With their accounts, the previously unbanked workers can now also access loans on Dayra. The startup secured US$125,000 secured from Y Combinator.

This is part of a wider US$3 million pre-seed funding round that Dayra raised through a mix of equity and debt financing from investors including Tanmiya Capital Ventures, EFG EV, EFG Hermes, and angel investors.

Flextock

Flextock is an Egyptian startup that provides warehousing services to other businesses. Using its tech, the business owners can pick anything in their warehouse, have it packed and delivered to the desired location by Flextock.

Source: Flextock

With its first and last mile delivery systems, the startup helps businesses take delivery of their goods and store it in appropriate warehouses until the goods are requested for and then delivered to the customer at the last mile.

Ziina is the last startup and it is also a fintech startup. Based in Dubai, the startup’s services are focused on the United Arab Emirates and North Africa. It provides users with a virtual wallet that enables them to carry out P2P transfers without needing bank details.