Retail banking has evolved from the days of physically visiting banks to carry out transactions. Now, there are a lot of banking apps allowing users to bank from the comfort of a device wherever they may be. With everything available on-demand, it is only expected that more financial services will be accessible outside a banking hall.

As Marvel comic writer, Stan Lee, wrote, “with great power comes great responsibility”. The financial responsibility that banks place on customers for using mobile apps is a great one and it seems to only ever increase. Social media is rife with complaints of Nigerians about several charges which include stamp duty, transfer charges, SMS charges and other fees that are deducted, sometimes without the customer’s consent.

On each electronic transfer, banks deduct a percentage fee that varies from one bank to the other. The more money being transferred, the higher the bank charges that it attracts. A report by Agusto & Co.’s 2020 Consumer digital banking satisfaction index for Nigerian banks shows that about 67% of Nigerians are more comfortable with physical than digital banking. The 33% who now prefer digital banking reflect a growth in the adoption of digital banking services.

Suggested Read: 67% of Nigerian Bank Customers Prefer Physical to Digital Banking Options- Survey Report

As more people embrace digital banking as a way of life, personal finance solutions that provide necessary services at low and moderate charges are necessary.

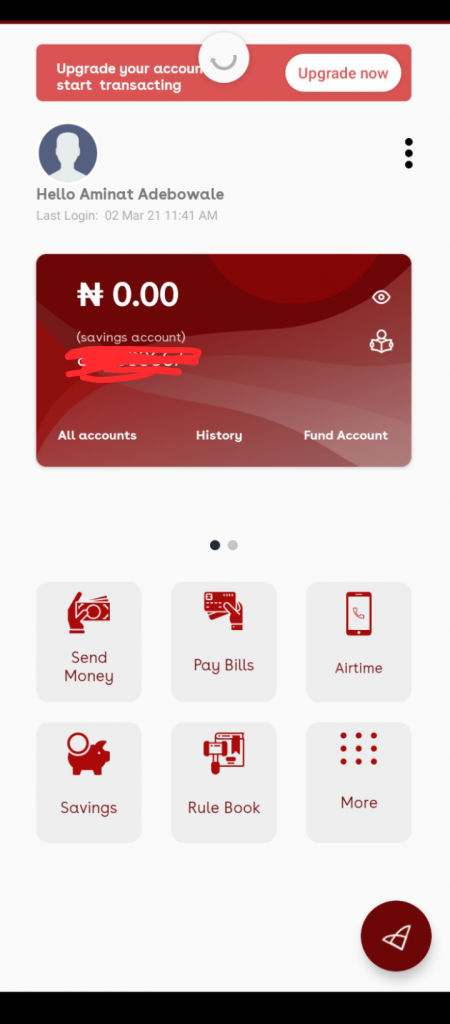

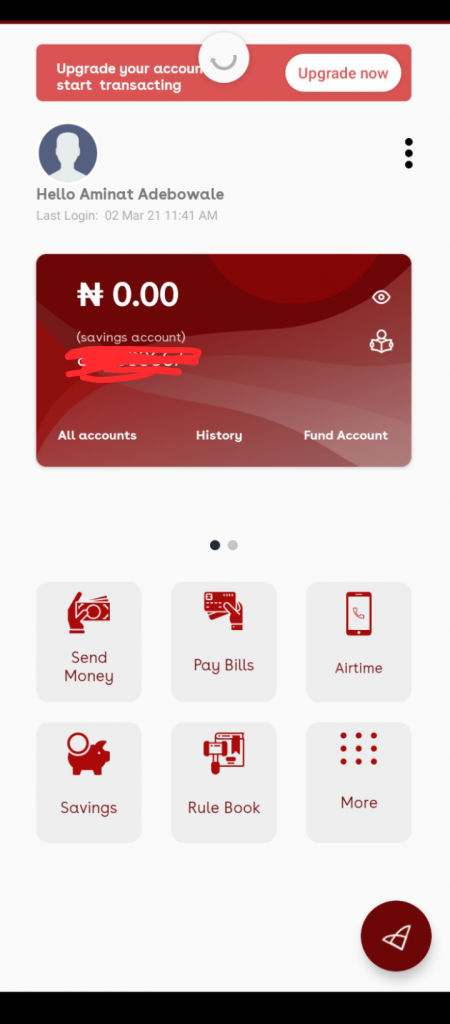

Rubies is a personal finance app that lets users manage expenses and carry out transactions without hidden charges and at a flat fee of N10. As of the time of this review, Rubies has already been downloaded more than 10,000 times.

Save, bank and pay with Rubies

After registering with Rubies, a new bank account that is connected to the user’s BVN is opened. The most interesting feature is transferring money to other Ruby account owners or other banks in Nigeria. Rubies charges a flat fee of N10 no matter the amount transferred.

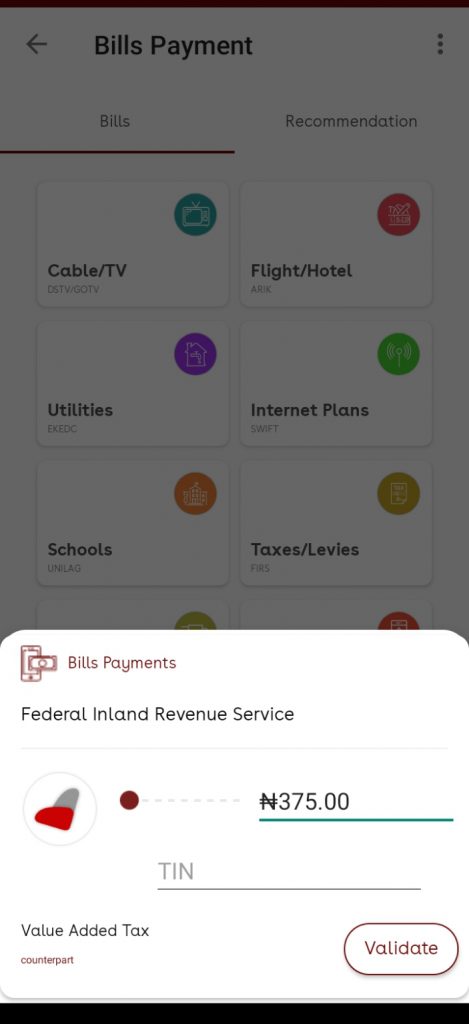

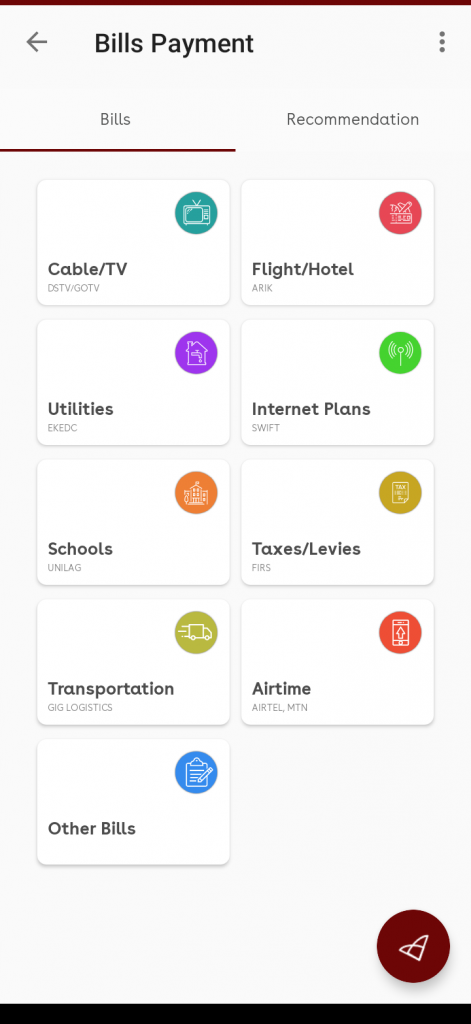

The app also has features that allow users to buy airtime and mobile data for themselves as well as for friends and family. Other utilities such as cable, electricity bill, flight, hotel and internet plans etc can be paid for from the digital banking app.

Businesses can use Rubies to pay taxes such as the Value Added Tax, Company Income Tax, Education Tax, Penalties and other levies issued by the Federal Inland Revenue Service (FIRS).

The app encourages a savings culture by allowing people to set monetary goals and save towards them. As many savings goals as possible can be created on the app. Once a goal is created, the user can either save automatically or manually, lock up the savings or leave it accessible for emergencies.

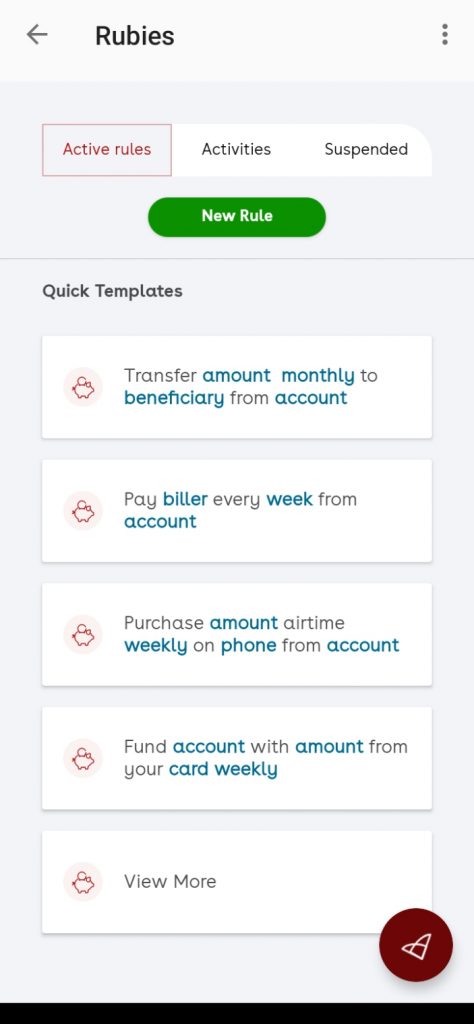

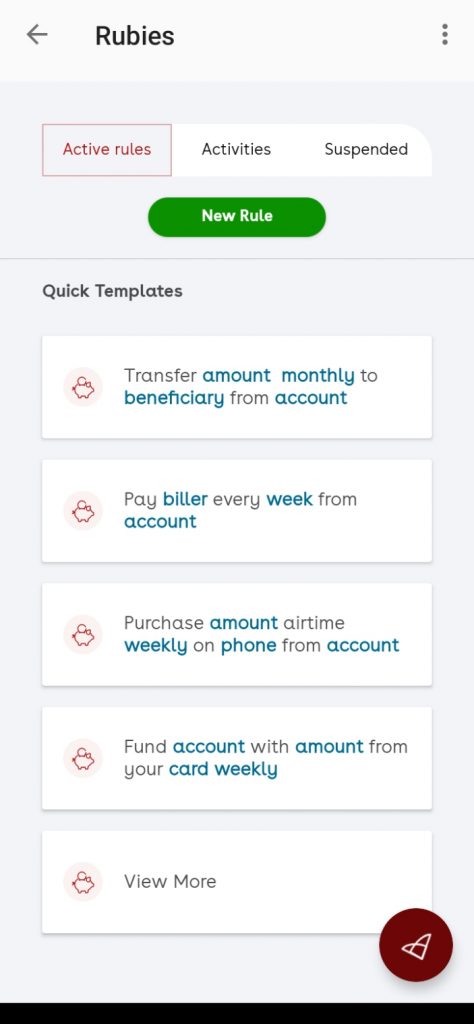

Transfers can also be automated such that specified amounts are transferred to a selected benefactor on an exact date every month, week or day. This is useful for thrift savings, tithe payments, or other regular expenses that the user does not want to bother about each month.

For all of these expenses, the Rubies account needs to be funded regularly either by bank transfer or ATM card. The funding can also be automated so that a certain amount is transferred from the user’s bank account into the user’s Rubies account monthly or at any other frequency.

Downtime is too long – User reviews

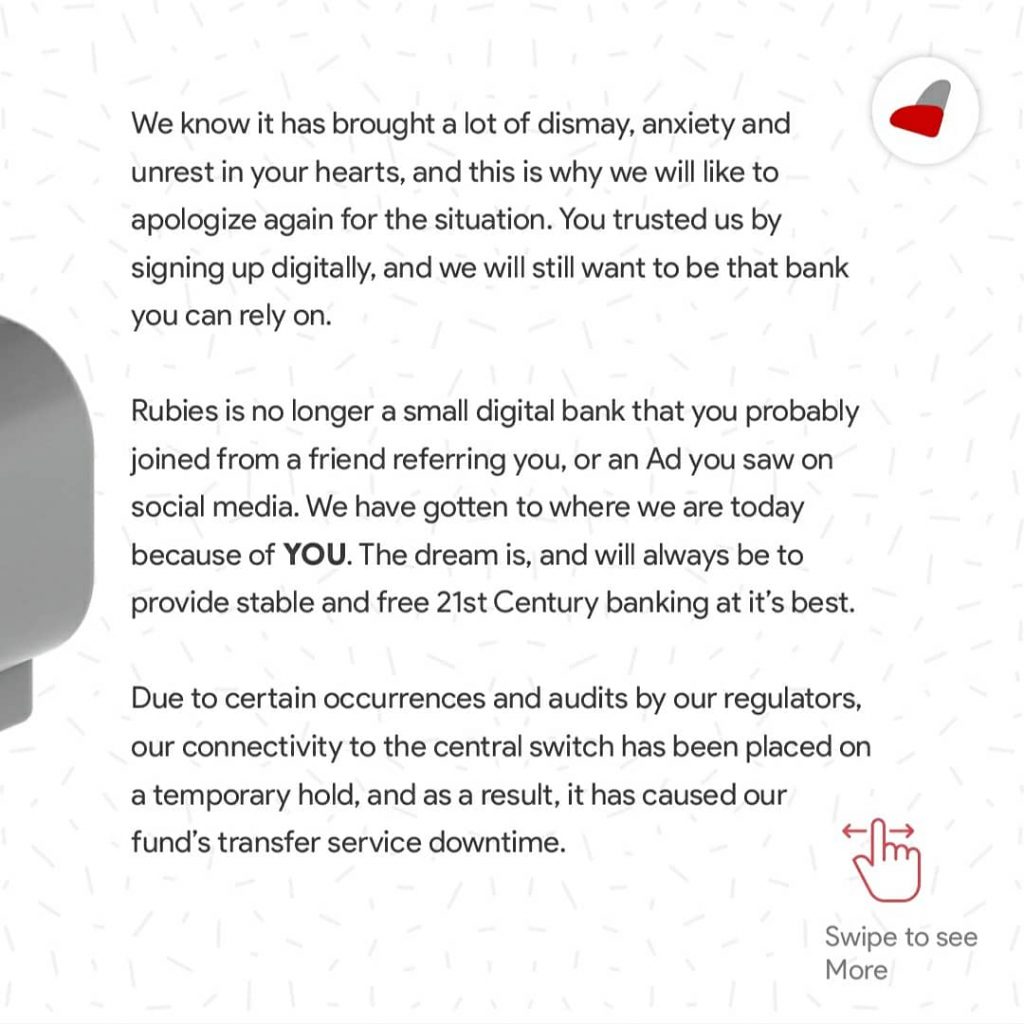

Rubies appears to have been delivering seamless service until February 2 when transfers started having glitches. Traditional banking apps also have downtimes every once in a while but they rarely are out of service for as long as 24 hours.

You may like: WorldRemit to Acquire Sendwave in Over $500m Deal, Bets On Permanent Rise in Digital Banking

Rubies has had issues of protracted downtime and this is the only con that comes with using the app. Despite the lower fees and its previous track record of seamless service, the last glitch it experienced inconvenienced users a lot.

On its Twitter handle, the digital bank explained that its transfer service has been placed on hold due to some issues with regulators and audit personnel. This went on until February 24 when users tweeted that they have been able to use the transfer feature again.

But users are nonetheless expressing their concerns. @Dynamiik is a Rubies user who claimed to be locked out of his funds by the digital bank. He tweeted in February, “Please, when are we getting access to our money, I really need my money urgently, had I know that things will look like this, I could have stick to the normal bank am using. I can’t trust Rubies again.”

Another account holder, @J-Inspiration, tweeted, “I had a rule of no more than a certain amount as I have minimum trust in Nigerian new-fangled ideas…. but I then forgot, recommended @rubies_ng to others and moved higher than normal funds there. Then this happened. Hoping for positive news.”

KennyBee also said, “Rubies, banking with you has always been with ease but then all this started. It was unexpected and the time taken has caused some damages.. Come on @rubies_ng you can do better.”

On February 27, Rubies told Damilola, one of its users that its transfer feature is back up again. Reports on March 1 also confirm that the feature is working properly.

In summary, Rubies offers convenient banking at convenient costs to the user. Its services are comprehensive and cover most of the very important transactions of individuals and businesses. The automated rules also create a framework that eases transactions and removes the need for users to repeat actions that take place each month.

However, the downtime and irregular communication between Rubies and its users is a disadvantage. Therefore it is only very effective if money is not stored in it for a long time.

If an expected sum of money is to be disbursed quickly, then Rubies is a good choice because the transfer charges are lower. Quick disbursing of money reduces the chances of being locked out of funds when they are needed. If the shortcomings are properly eliminated, Rubies can make digital banking a permanent and highly-enjoyed part of Nigerians’ daily activities.