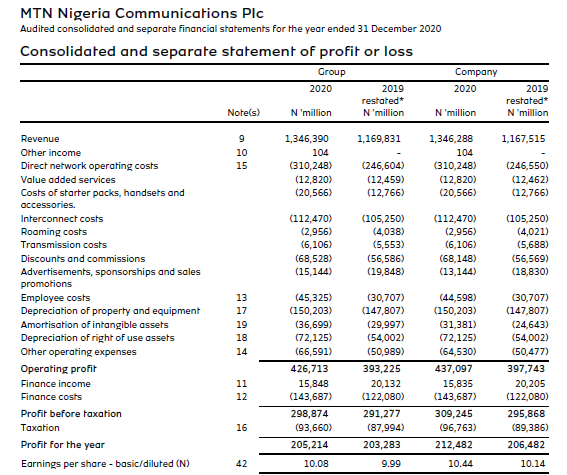

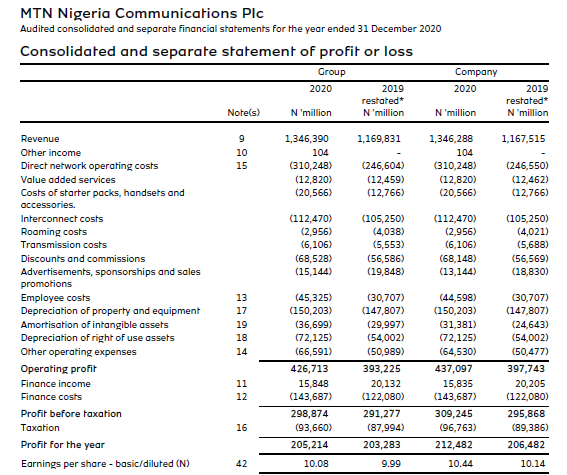

Nigeria’s biggest telecom operator, MTN, generated N1.35 trillion in total service revenue for fiscal year FY 2020. This is according to the group’s audited consolidated and separate financial statements for the year ended 31 December 2020.

Revenue grew 15.1% from N1.17 trillion in 2019 to reach N1.35 trillion in 2020. Despite the global economic disruption caused by the COVID-19 outbreak, the telco recorded an increase in profits after tax of N2 billion year-on-year to N205.2 billion in FY 2020.

Outgoing MTN Nigeria CEO, Ferdi Moolman acknowledged the effect of the pandemic in his assessment of the group’s financials.

2020 was a challenging year for all. The unprecedented disruption that the COVID-19 pandemic caused the businesses and people we serve, challenged us in new and demanding ways. The impact continues to evolve.

Ferdi Moolman, Outgoing MTN Nigeria CEO

“Adoption of our data and digital services accelerated as lockdowns and gathering restrictions were imposed, and work-from-home became the norm for many,” he added.

MTN added 12.2 million subscribers during the year, taking its total mobile subscribers to 76.5 million.

Spike in Data Usage Boosts Revenue

MTN’s revenue growth in FY 2020 was largely driven by the surge in mobile data usage amid the COVID-19 pandemic.

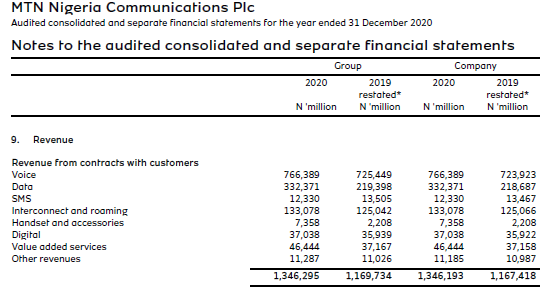

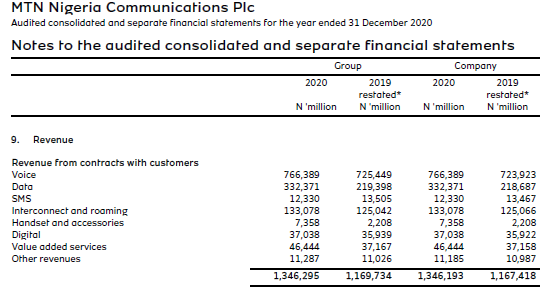

Data revenue rose by 51.6% year-on-year from N219.4 billion to N332.2 billion in 2020, contributing 24.7% of MTN’s N1.3 trillion revenue for the year.

COVID-19 restrictions including lockdowns and mobility constraints brought about an increased adoption of digital technologies. Several people had to switch to remote work, undertake e-learning, use e-retail apps more frequently, among others.

MTN also expanded its 4G network to cover 60.1% of the population, up from 43.8% in 2019. All these led to a 29% growth in active data subscribers to (32.6 million) and subsequently increased revenue. The telco added 7.4 million active data users, prompting a N112.8 billion rise in mobile data revenue during the year.

Suggested read: ‘Work From Home Won’t End in 12 Months, Covid-19 Vaccines Notwithstanding’ – Morgan Mierke, Head of W/Africa Logitech

Voice Remains the Cash Cow

While data significantly spurred revenue growth, voice services remain king when it comes to overall revenue contribution. Voice calls generated N766.4 billion in revenue, accounting for 57% of MTN’s total revenue in FY 2020.

In fact, voice revenue for the year was over 100% more than revenue realised from mobile data. At N766.4 billion, voice dwarfed data revenues by up to N434 billion.

Over half of MTN’s 76.5 million subscribers are not using data services, therefore, the bulk of subscribers in the country are predominantly using voice calls compared to data.

Mobile Money Fails to Impress

For FY 2020, MTN mobile money service, MoMo, contributed a lowly 3.4% of the group’s earnings. Although active subscribers increased by 750% to 4.7 million in 2020, as part of value added services, mobile money revenue only grew by 24% to N46.4 billion.

While the rapid increase in mobile money customers showed increased adoption, the meagre revenue growth means that the majority of subscribers did not actively process transactions using the platform.

The fintech space was one of the sectors which profited from the pandemic due to the shift towards online payments. But this apparently did not extend to MTN’s mobile money service.

Going forward

In 2021, MTN may not be able to sustain this massive growth levels in data subscriptions post-COVID-19, as more people return to working physically, schools resume and the economy fully reopens.

Its 5G network deployment plans in Nigeria could also shoot up operating costs associated with the purchase of additional spectrum and rollout of 5G tower sites. This is capital-intensive and might cut down revenues.

Suggested read: MTN Sues S/African Telco Regulator Over Exclusion from 5G Spectrum Allocation

However, the company’s imminent closure of the $65 million divestment of its 75% stake in its Syrian business unit will massively raise its assets valuation and budget capacity.

On the whole, 2020 represented a good year for MTN, but 2021 will present its own unique challenges beyond COVID-19.