The UK-Nigeria Tech Summit held on Thursday with more than 10 Nigerian startup founders sharing insights on the challenges that early-stage startups face in the country. The summit included four panel sessions with different speakers from CCHub’s Damilola Teidi and Future Africa’s Adenike Sheriff to First Cheque Africa’s Odunayo Eweniyi, Bookings Africa’s Fade Ogunro and Kobo 360’S Ife Oyedele.

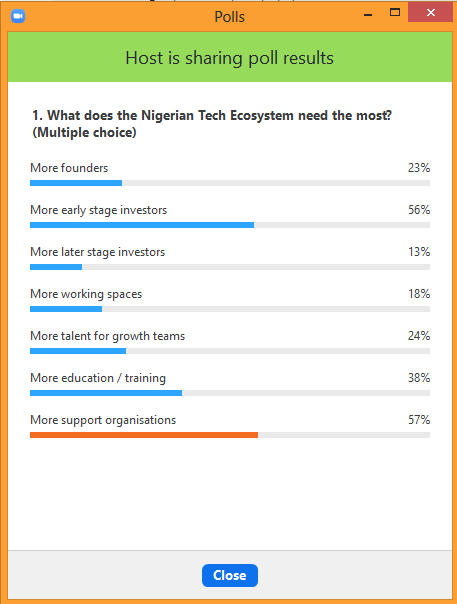

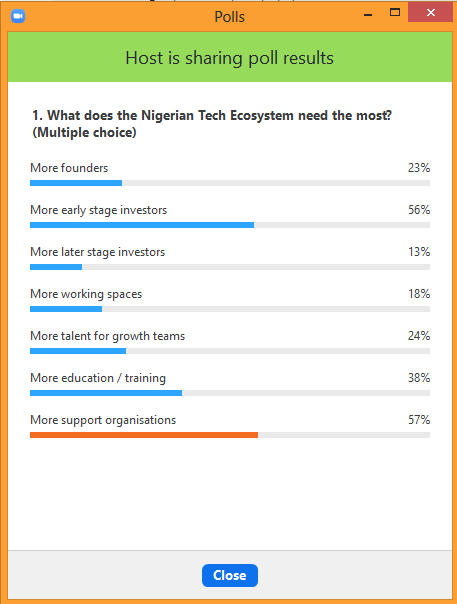

Raising funds at an early stage is one of the most pressing challenges for startups in the African ecosystem. Although it is more prevalent among women-led startups, entrepreneurs from both genders encounter a significant level of challenge when raising funds. A poll carried out with the over 200 attendees at the summit also pointed to early-stage investment as the biggest need of the tech ecosystem in Nigeria after the need for support system.

Securing investments require a personal investment on the part of the startup founder. Documents that show the business potential to the investors have to be prepared.

“When approaching investors on behalf of a startup, these three documents should be adequately prepared and ready. They are the Business Plan, Pitch Deck and the Financial model.”

Funmi Adewara, Founder of MobiHealth

Data is essential in helping investors see the viability and potential of the startup. In the ecosystem, entrepreneurs usually want to get the funding and then build the product afterwards. However, investors want to see the minimum viable product (mvp) and have proof that it is scalable before putting money into it.

Also Read: All You Need to Know About Honey Ogundeyi, New Country Director of UK-Nigeria Tech Hub

Getting investors interested in Bookings Africa for a pre-seed round was an uphill task for Fade Ogunro at first. This was because investors asked for an MVP which she did not have at the time. After putting a web app together that somehow presented the idea of Bookings Africa, she said, “things changed dramatically, I went from getting 10 Nos in a week to getting more Yes from potential investors.”

Sometimes, entrepreneurs wait until a funding round is closed completely before swinging into action. Early-stage startups ought to experiment more and gather more data from the customers, especially at the pre-seed round. Entrepreneurs can test to see if a product is going to actually work by going to the market with no answers and only questions. If the answers are positive, then a seed funding round can be sourced to take the product to the market.

“We should do more of collecting funds and moving instead of waiting to close a funding round before getting the startup on the next growth phase,” Tomi Adejana, the founder of Bankly said.

Governance is a major area that founders need to cover before receiving a huge investment into the business. As 54 Gene’s founder, Abasi Ene-Obong puts it, “founders need to wear 3 hats and balance them well before receiving investments into the business.”

The first hat is that of the investor. The founder has to think like the investor and ensure that a structure for proper use of the investment is put in place before the fund is received at all. While there are risks associated with investing, investors still very much want to make a profit from their funding ventures.

The startup founder has to have the governance structure in place to ensure that the money is effectively put to work. Funding rounds also bring in more people into the decision-making process of the company.

Besides thinking like the investor, founders need to also think like founders and then as employees. This is critical in making balanced decisions, running the company smoothly and raising funds at the early-stage.

Investors should bring more than money to a startup

Sometimes, investors are the ones who approach a startup to it and at other times it is the other way round. In either case, getting the right investor on board with a company is very crucial. As a founder, the due diligence process on investors should cover the sector they operate in, the exits they have made and other companies that they have invested in.

Tomi Adejana added that the relationship between investors and the companies they have invested in previously is of utmost importance. This will show if the investor is a good person to have onboard, has good morals and unquestionable work ethics. This will help to avoid dirty clashes like that between HealthPlus and Alta Semper where the investors and founder are at loggerheads over who owns the company.

Image credit: TechNext

At the early-stage, startups need more than just funds. A support system is almost as important as the funding to help scale legal, staffing and other types of hurdles faced by startups. The best types of investors are those who support the founders and not just invest in the business for a profit.

At the early-stage, entrepreneurs have a higher chance of raising investments when they build relationships with the investors and carry them along in the journey of the business. Keeping investors up to date as the company hits milestones, reaching out to other mentors in the ecosystem to check pitch decks and share a pipeline of other investors will increase the chances of startups getting the right investments.

At the end of each session, the founders shared resources that have personally helped them in their entrepreneurial journey. Some of them are: Startup Secrets by Harvard iLabs (A Youtube Channel); Prosperity Paradox by Clayton Christensen, Efosa Ojomo, and Karen Dillon; and Startup Nation by Dan Senor and Saul Singer.