Online sports betting was formally introduced into Nigeria in 2009 and since then has grown into an industry worth over $2 billion. And, Virtual soccer, an aspect of online sports betting is a major driver of that growth.

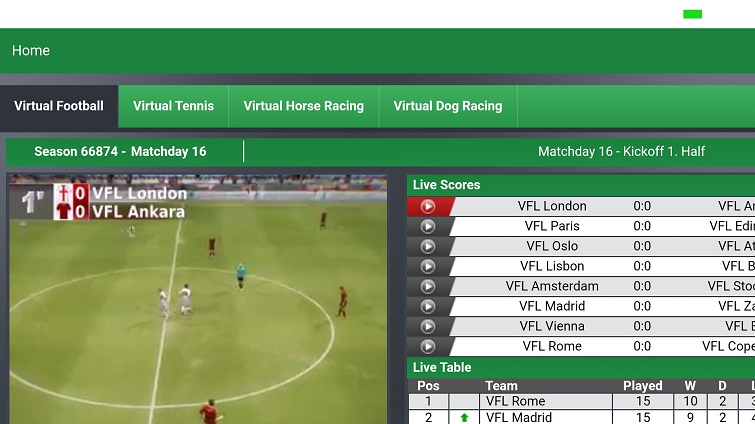

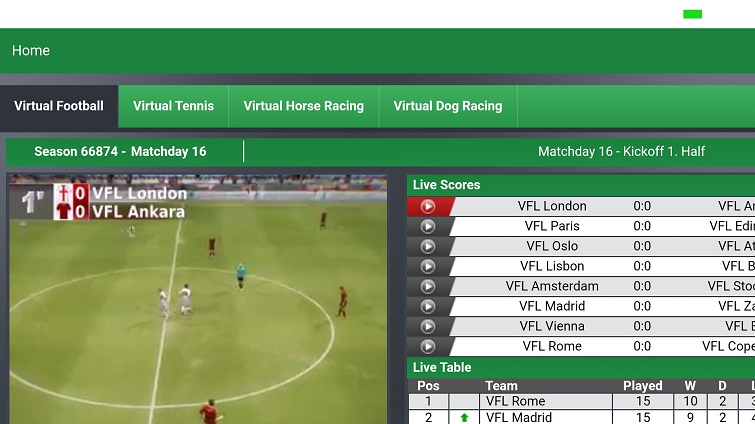

If you don’t know what virtual soccer or ‘Baby’ (as it is popularly called on the streets) is, it is a more or less simulated football games played by animation figures and which actual people bet actual money on.

It is different from regular football betting which is basically staking on live matches. People who play virtual soccer don’t need any football knowledge to win bets because the games are entirely random and aren’t based on real football games, facts, or players.

The games run 24/7 and a full season of football could be played in just a day. Even when football seasons are on break (even during the pandemic), Baby will still be live. This gives people more than enough opportunity to make or, as is more likely the case, to lose money.

Thus, behind that growth in sports betting is a long list of people whose finances, businesses, relationships and even lives have been ruined by their indulgence in Baby.

Not that any of it is the fault of the betting companies nor should it bother them anyhow. An adult is entirely responsible for his choices and it is no different in this. But their stories, though very harrowing, are nonetheless very interesting. From businessmen to corporate workers, people who have been thrown into ruinous debt because of their addiction to virtual sports betting come from every walk of life.

“It was so bad. I didn’t even have goods to sell in my shop anymore,” Eloka* a businessman in Lagos said. “I wasn’t doing badly after my Oga settled me. But I wanted more and my friend whom we served together in the market introduced me to Baby. He said it was a quick way to make big money. I didn’t know it was the opposite. It was a quick way to lose all my savings.”

The story wasn’t different for Olanrewaju* who used to run a PoS shop in Lagos. Lanre progressed from regular football betting to virtual betting after it seemed the money from regular betting wasn’t coming as quickly and as thickly as it should.

“I have a wife and 3 children,” he said. “I started betting after I heard people were winning millions with very little money. But I never won any millions. Then I heard of Aja Nsare (virtual dog race) so I decided to try my luck there. It was the worst decision of my entire life.”

Losses and Lessons

It is one thing to lose a significant sum of money on a bad business decision or even to scammers. But when one loses their entire savings by consistently tossing bit by bit of it into a venture entirely dependent on luck with terrible odds of winning, in the African context, you can’t blame people who think it’s a spiritual problem.

“My family members took me to different churches for deliverance and prayers,” Eloka revealed. “They thought it was a spiritual problem. My mother was sick in the village and I was throwing money away on the Baby game. She thought her enemies had gotten me. And I believed her because I wasn’t doing those things with my clear eyes.”

While it may not be entirely wise to overlook the influence of the ‘village people’ just because we are Africans, it is also important that we note the influence of the get-rich-quick syndrome prevalent among the youthful generation. And, how this oftentimes leads to greed and worse still, crime.

Research at San Diego State University showed that only 44.7% of Baby Boomers considered being well-off financially an essential goal by the time they were in college (university). But by the time Millenials and Generation Z were getting into college, 74% of them think being financially well off is a very important milestone. So important that being rich has consistently ranked first in life goals listed in recent surveys. In the 1980s, this goal ranked 8th.

Image: Vocal Media

Olanrewaju puts the blame of his profligacy squarely where it should be.

“I just wanted to get rich,” he said. “I used to be a banker with a new generation bank. But after I was retrenched a few years ago, I started my PoS business. There’s money in it. Not that the money was poor, it just didn’t seem enough. I have a family of four extra mouths to feed so it just always seemed I needed more. I guess I was just being greedy because I should have been content with what I had.”

Asked to quantify how much they have lost, both Eloka and Olanrewaju said they had lost a fortune.

“If I haven’t lost money, I must have lost N8 million because of Baby,” Eloka said. “Because my shop alone was worth at least 5 million. Sometimes I even sell my goods at buying cost just so I can get money to play Baby. At other times, I borrow money from people and use my goods as collateral. I’m still owing a lot of people till now.”

As for Olanrewaju, his monetary losses were nothing compared to losing the love of his wife.

“If I could sacrifice all the money I lost all over just to make her happy again, I will happily do that,” he said. “At a point, my wife had to take the children to her elder brother’s place partly because I couldn’t take care of them and partly because my addiction was causing fights between us. I’m just happy she’s back now. And I’m happy she understands that I have a problem and is helping me fight it with financial responsibility.”

Image: Complete Sports

Addiction of this kind is a real thing and if not properly checked, could lead to very damaging financial and psychological eventualities. According to 2019 research, about 60 million Nigerians between the ages 18 and 40 years spend up to N1.8 billion Naira on sports betting daily with an average investment of N3,000 Naira per day.

This, more than anything else, indicates a very widespread case of addiction passively considered as merely a youthful culture.

Sports betting is here to stay. The national economic woes would ensure that youths, in their quest for quick money, would keep flocking to these platforms. It is important that they understand the dangers of addiction and strive to bet responsibly.

*Real names have been changed to protect the identity of the respondents