Twitter finished 2020 strongly by adding a revenue of $1.29 billion during the fourth quarter. However, its strong gains were overshadowed by its increasing expenses.

The social media giant generated a total of $3.72 billion during the year but spent a whopping $3.69 billion on running cost and expenditure. Its expenditure was a significant 19% more than that of last year.

The increase in spending was driven by initial disruption and adjustments necessitated by the pandemic.

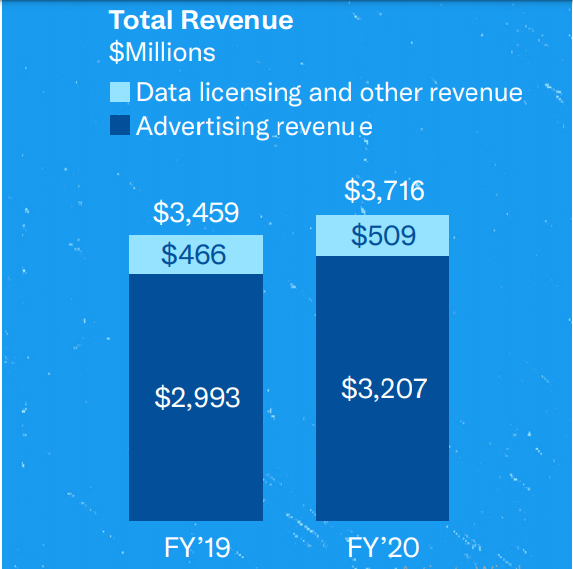

Ads drives strong Revenue growth

Revenue generated from advertisement dominated Twitter’s income for the year. The company got a total of $3.2 billion from advertisements, a 7% increase from the previous year.

According to Twitter, the growth was driven by strong advertiser demand, especially in the second and fourth quarter. It added that new ad formats, stronger attribution and improved targeting resulted in a 31% Y-o-Y increase in total ad revenue and more than 50% Y-o-Y growth in MAP revenue in Q4.

Suggested Read: Twitter Might be Rolling out Audio DMs after Testing the Feature in Brazil

A breakdown of the Ads revenue shows that the US is still Twitter’s biggest market. The bulk of the advertisement revenue for the whole year came from the States.

In Q3, $422 million was generated from the US while the remaining $380 was generated internationally. Similarly in Q4, $733 million was generated from the US while the remaining $556 million was generated internationally.

Besides the advertising revenue, data licensing and other sources increased by 9%, generating about $509 million during the year.

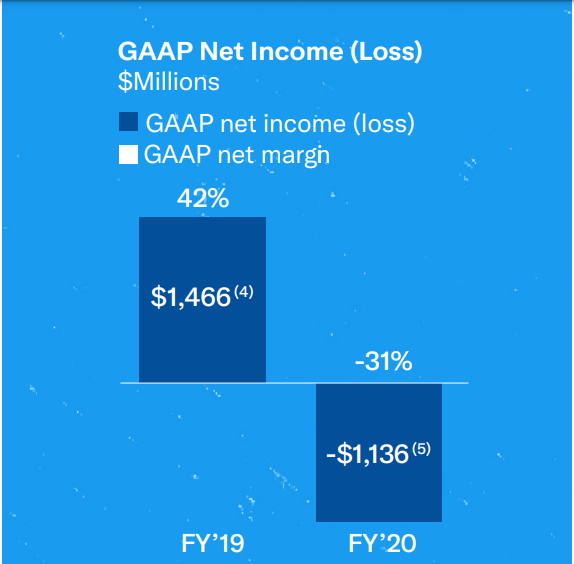

Net income drops into the negative

Although revenue for the year increased by 7%, the costs and expenses incurred by Twitter spiked exponentially. Total costs and expenses for 2020 totalled $3.69 billion.

This puts the total operating income for the year at $27 million, a huge drop from $366 million operating income raised in 2019. This led to a net loss of $1.14 billion, a net margin of -31%, and diluted EPS of -$1.44.

Last year, the company reported net income of $1.47 billion, a net margin of 42%, and diluted EPS of $1.87.

According to Twitter, the huge loss was driven by deferred tax asset

valuation allowance of $1.10 billion and corresponding non-cash

income tax expense based primarily on cumulative taxable losses

driven primarily by COVID-19.

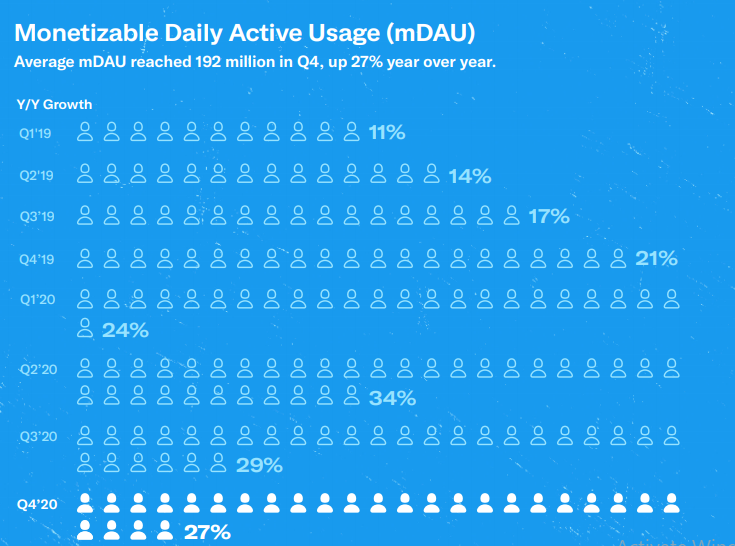

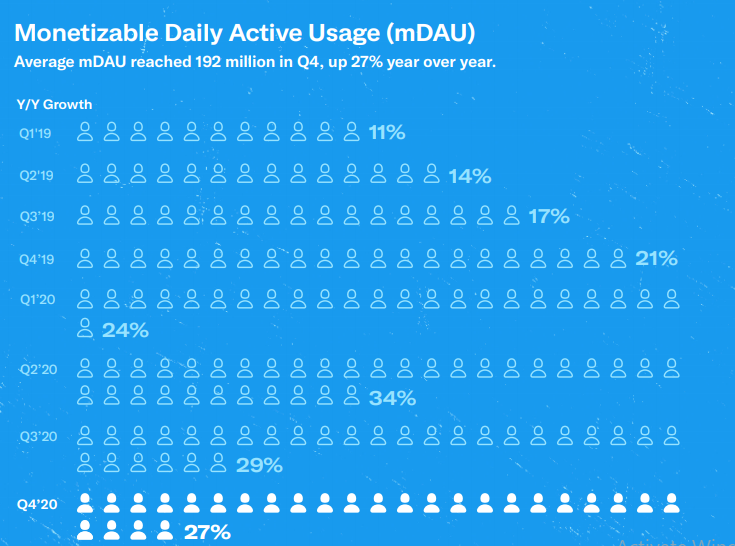

Monetizable users hit 192 million

2020 saw the number of Twitter’s Monetizable users grow significantly. The number of average monetizable DAU (mDAU) reached 192 million during the final quarter of 2020.

This represents up to 27% growth year over year and up to 5 million from the previous quarter. According to Twitter, the growth was driven by global conversations around current events and ongoing product improvements.

It added that product improvements reached an all-time high during the year. This resulted in enhanced customer experience and improved retention, reduced churn, and greater mDAU growth.

2021 forecast

Looking forward, Twitter expects its tremendous growth of mDAU in 2020 to impact on quarterly growth rates in 2021. It pointed out an mDAU growth of approximately 20% year over year in Q1’21, despite a 24% year-over-year mDAU growth in Q1’20.

It also projected growth in Q2, Q3, and Q4, fueled by the significant pandemic-related surge like that of 2020. It, however, expects it to be in the low double digits on a year-over-year basis.

In terms of revenue, the company is expecting between $940 million and $1.04 billion for the first quarter. And an operating income of between a loss of $50 million and break-even.

For the total year, it’s expecting a total capital expenditure of between $900 million and $950 million.

In summary

2020 was great for Twitter despite the net loss recorded. The company’s advertisement revenue keeps growing year on year with global users increasing exponentially.

While the company expects to break even in the first quarter of 2021, its expecting lower growth compared to the pandemic inspired boom of 2020.