9PSB is a fintech app launched by telecom operator, 9mobile as a Payment Service Bank (PSB) gateway to provide electronic banking services to people as an alternative to traditional banking.

Overview

Cash transactions, fund transfers and utility payments are always processed by Nigerians everyday. With Nigeria’s financial inclusion rate still at only 50%, improving the ease of access to financial services in the country remains paramount.

Many Nigerians would rather send/receive money and pay bills from the comfort of their smartphones than go queue for hours in front of an Automated Teller Machine (ATM) to carry out the same transaction.

Working to eliminate the stress associated with visiting a physical bank, 9mobile developed its 9PSB app to provide an online gateway for users to quickly open an account using their mobile number and complete financial transactions including money transfers, utility payments, savings and cash deposits through connected field agents.

Released on November 21, the 9PSB app is available for free download on the App Store as well as on the Google Play Store where it has over 1,000 downloads. In this article, I reviewed the version 0.91 of the app based on the functionality of available features, ease of navigating services via its user interface and its feedback mechanism.

Functionality

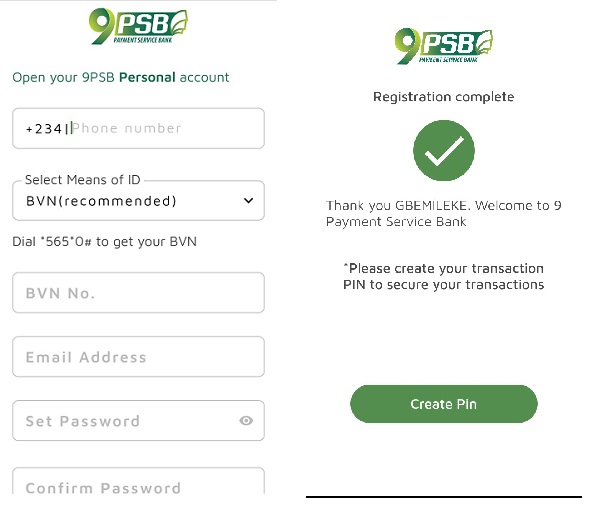

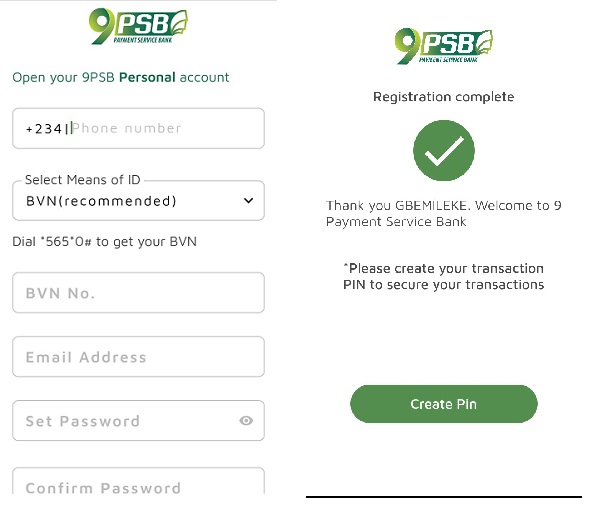

I installed the 9PSB app and set up my account in about three minutes. You will be required to enter your mobile number, email address and select a means of identification.

Only the BVN ID verification was available despite the app details stating that users can sign up using an international passport, national ID, driver’s license or voter’s card.

After your details are verified, the app takes a picture of you which becomes immediately mirrored after capture.

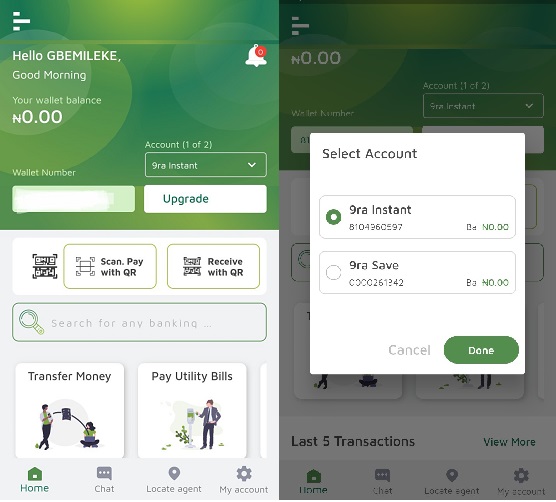

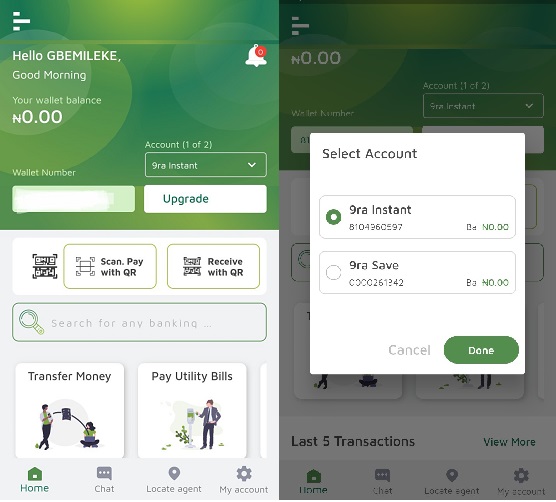

When your account set-up is done, you will have access to the app dashboard which provides you with a mobile bank account and a savings wallet.

While only your “9ra Instant” mobile bank account can be used to make payments (including QR), withdrawals and transfers, the “9ra Save” wallet enables you to add savings which can be locked for up to 3 months.

Ease of Navigating the App

Navigating the payment features proved quite easy due to a simplified user interface and quick response time. Apart from money transfers and payments for cable Tv/electricity bills, users can also purchase airtime/data and make withdrawals via ATMs and agents.

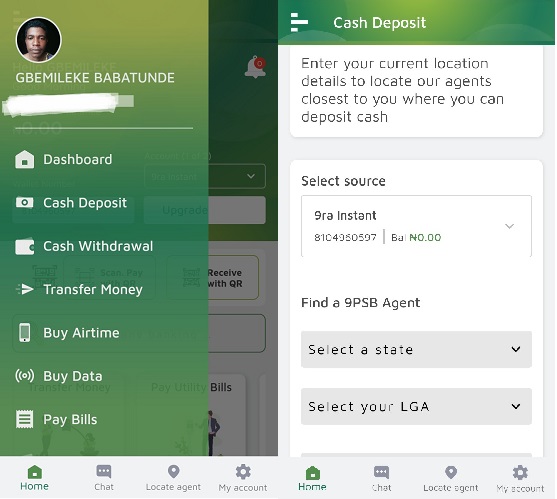

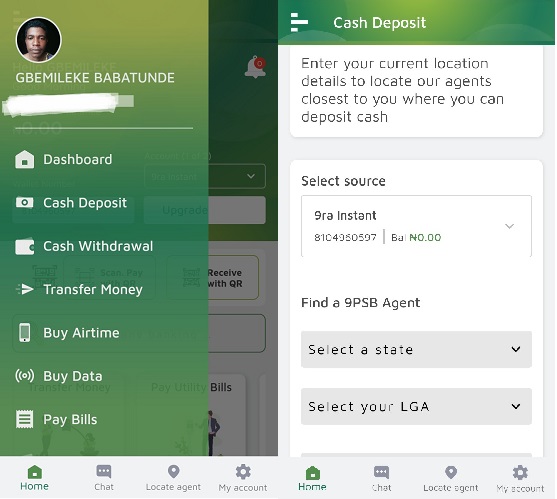

But a major letdown is that 9PSB users are restricted to making deposits through PSB field agents. This means that users have to go out physically to meet with agents before they can credit their mobile 9PSB account.

Agents are not always close to the location of the user and may be unreachable in certain areas. In this case, a user may be forced to travel far distances just to add money to their account.

This was buttressed by a user, Steve Lanks, who complained on the Play Store: “I live in Abeokuta, Ogun state and I wanted to deposit… there are no agents in Abeokuta and can’t the deposit be electronic like directly from our bank account to our wallet without meeting any agent.”

This goes to show that it is a concerning issue that many users would like to see resolved.

Feedback Mechanism for User Complaints

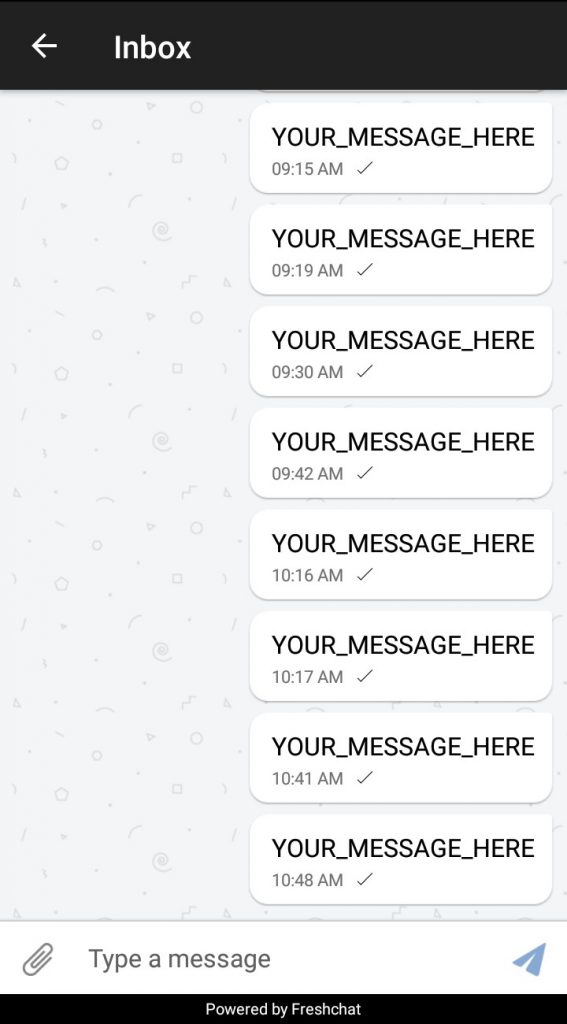

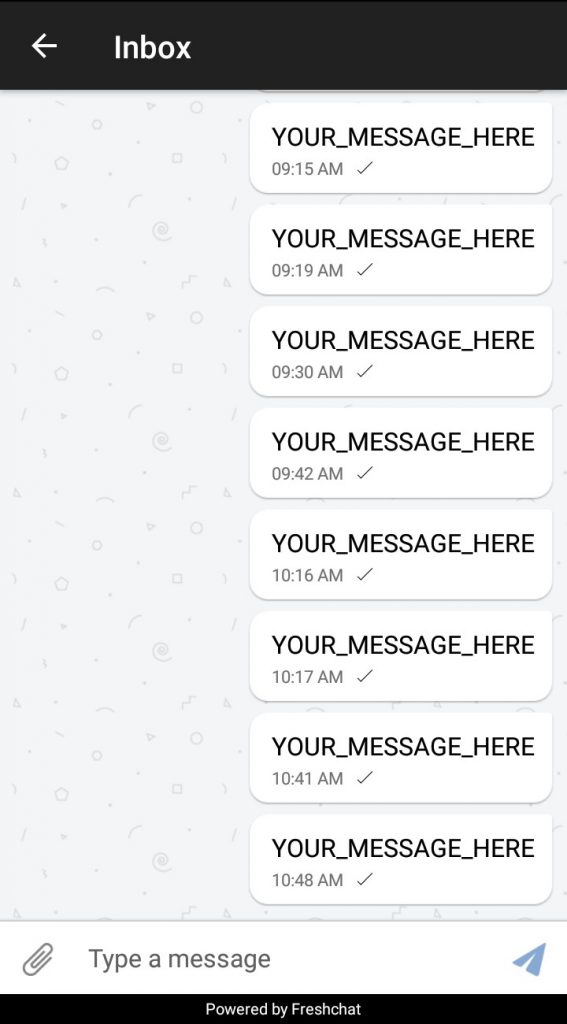

The app provides a chat option where users who are dissatisfied can lodge their complaints. I sent out a message through the chat service asking to know why deposits cannot be made through other means such as credit/debit cards and bank transfers.

As at the time of writing this report, I am yet to receive a reply. The chat service is flawed as it has duplicated automated responses more than ten (10) times on my chat interface.

In summary, although the 9PSB app provides users with simple and quick access to mobile banking transactions, limiting its deposit options to only agents undermines its goal of easing access to financial services.