Mobile gaming is a big deal globally. In 2019, it directly accounted for 45% ($68.4 million) of global gaming revenues estimated to be worth $152 billion – 9.6% up from 2018, according to Newszoo.

Interestingly, the age group 18 -35 constituted about 29% (783 million) of the 2.7 billion gamers worldwide.

With over 34 million youths in Nigeria and the increased adoption of digital technologies especially post-COVID-19, it is perhaps not surprising to see how mobile gaming in the country has evolved into a lucrative million-dollar industry.

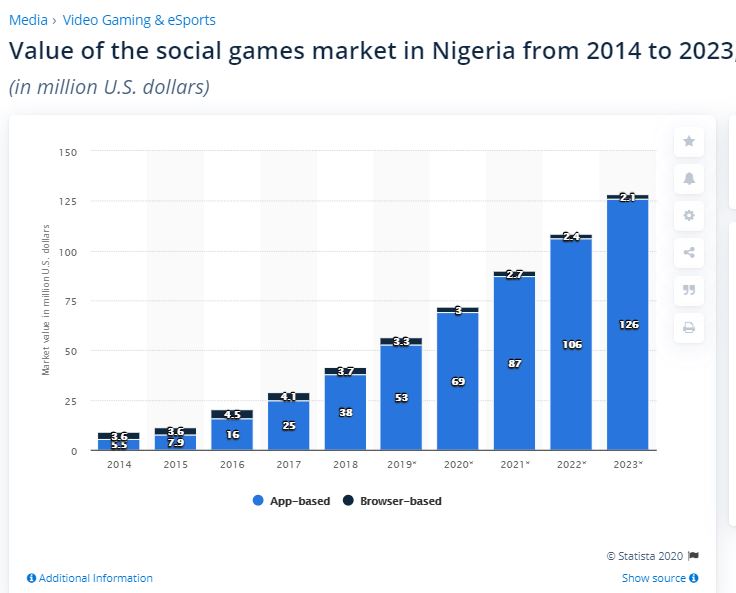

A PwC report predicts that Africa’s video game industry, worth $310 million in 2018, will be valued at $642 million by 2021. In Nigeria alone, Statista projects that the app-based mobile gaming market could be worth about $126 million by 2023, 404% higher than its $25 million valuation in 2017.

Mobile gaming’s exciting potential has gotten the attention of telecom companies in Nigeria including MTN and Airtel.

Suggested read: Report: 28% of Global Gamers are From Africa, Europe and the Middle East, Majority Use Mobile

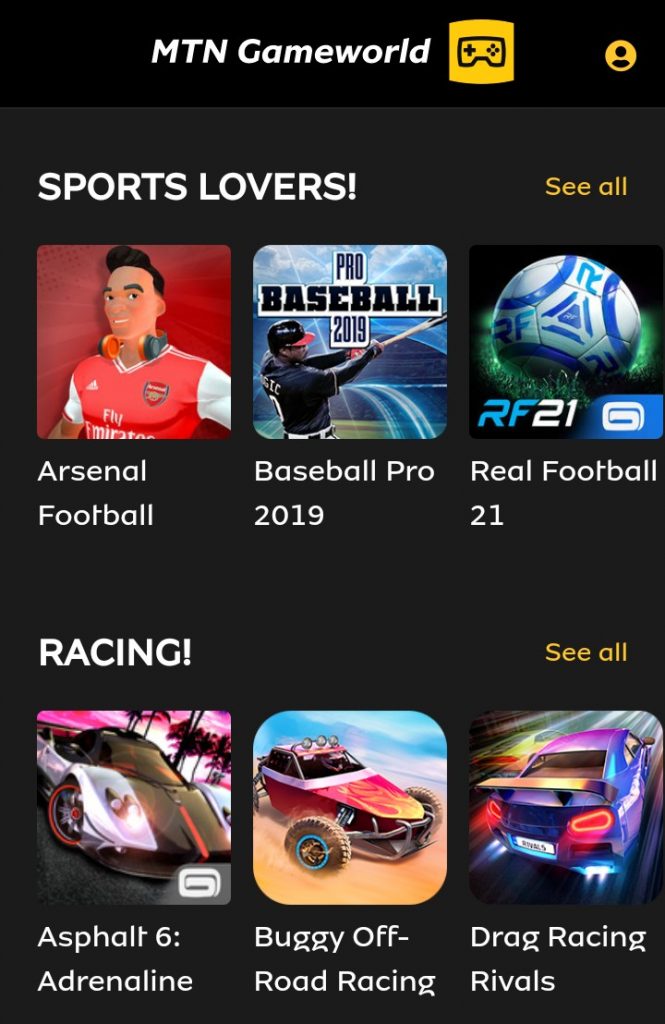

While Airtel already operates its games club, MTN recently partnered with leading global video game developer, Gameloft, to introduce its new mobile gaming service, MTN Gameworld. It offers a variety of subscription-based games which can be streamed or downloaded.

The MTN deal with Gameloft is perhaps worth millions of dollars and Africa’s biggest telco would not have struck such a massive deal without a guarantee of commensurate returns on investment.

Even though other mobile games played online generate revenues for telcos through data consumed, why are network operators also launching app-based mobile games exclusive to their service?

Considering the rise of mobile gaming in Nigeria, the answers are not far-fetched.

Rapid Rise in Smartphone Penetration

A key driver of mobile gaming is the availability of smartphones and Nigeria has seen a surge in smartphone population.

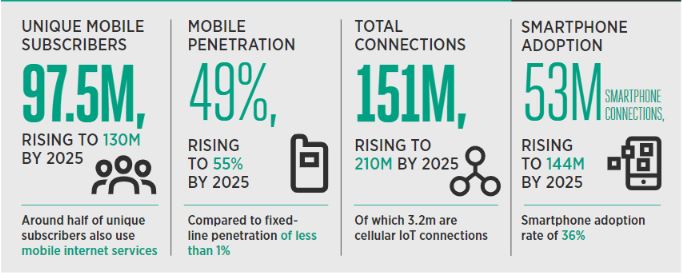

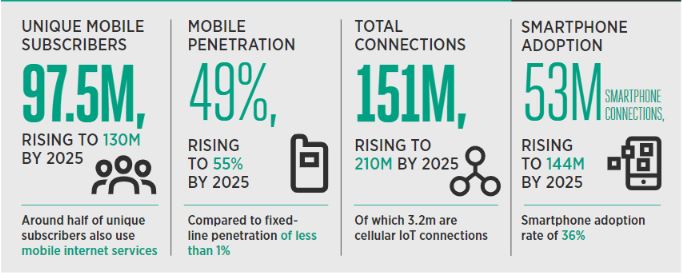

In 2019, smartphone penetration in Nigeria was almost double the rate achieved in 2018. For context, Nigeria had 53 million smartphone connections in 2019 – a 47% increase compared to 36 million connections in 2018, according to GSMA.

What this means is that 17 million smartphone connections were added in the space of a year. More Nigerians have access to mobile gaming than ever before.

Telcos recognise that increased smartphone penetration would lead to a greater number of mobile gamers and consequently higher revenues. With over 200 million mobile subscriptions in Nigeria, smartphone adoption in the country can only continue on an upward trajectory.

Absence of any Regulation on Mobile Gaming

Another big incentive for telcos investing in the Nigerian mobile gaming industry is the absence of any regulatory policy.

In Nigeria, there are no policies governing mobile gaming. While there are regulations for betting and gambling operators to obtain required licences, mobile gaming remains unregulated.

This gives more leeway for developers to innovate and create new gaming concepts without having to worry about stringent regulations such as a ban on in-app purchases or advertising.

Many mobile gaming platforms generate revenue via in-app purchases and ads. They would be stripped of these revenue streams if a regulation proscribed these monetization methods.

Without any binding regulations, telcos are not mandated to obtain a mobile gaming licence and foreign video game publishers can easier collaborate, as they would not be concerned about taxes.

Increased Mobile App Usage and Gaming Traffic

A significant increase in the use of mobile apps and internet traffic generated by mobile games bodes well for investments by telcos.

According to Statista, Nigeria had 91.5 million active mobile app users in 2019, representing almost half (46%) of Nigeria’s entire population of over 200 million people.

Of the 91.5 million active mobile app users, at least 42.6% of them made one in-app payment. This reveals that many users are willing to pay for app services that are entertaining, such as games. For context, Nigerians spent $120 billion on mobile apps in 2019.

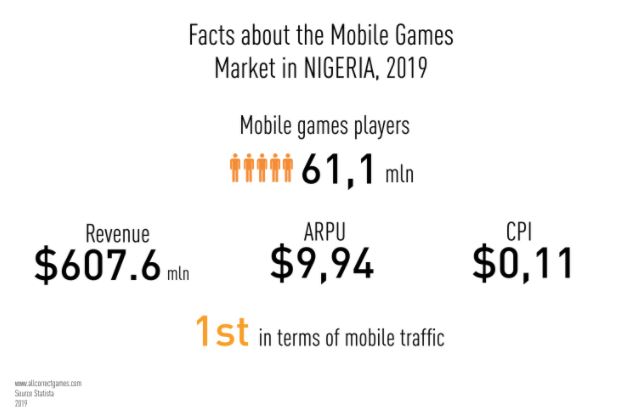

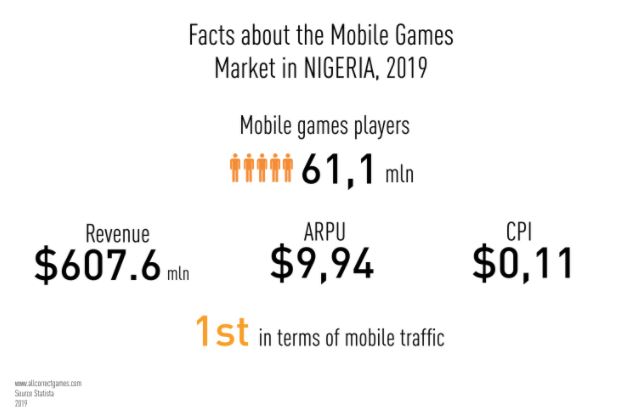

Also, Statista reported that there were 61.1 million mobile game players – 67% of active mobile app users. This figure shows how mobile gaming adoption is fast being driven by greater use of mobile apps.

In terms of internet traffic, mobile games ranked number 1 in 2019. What this means is that several people are spending more time and data playing app-based mobile games on their smartphones.

Telcos like MTN would be looking to leverage all these through their mobile gaming platforms. With app-based mobile gaming market projected to be worth about $126 million by 2023, telcos could be well-poised to realise unprecedented mobile gaming revenues.