Following the surge in cryptocurrency adoption and usage, South Africa’s Financial Sector Conduct Authority (FSCA) has released a draft publication to govern all crypto exchanges, issuers and advisors within the country.

Divisional Executive for Investigations and Enforcement, Brandon Topham opined that crypto investments are risky and suspicious due to their decentralised nature.

I am very sceptical of an asset class which has nothing behind it, nobody behind it, and not even an address anywhere in the world.

Brandon Topham, Divisional Executive for Investigations and Enforcement

“People must not see in any way that we are giving a rubber stamp of approval to crypto assets,” he added.

Under the regulatory guidelines, crypto assets are declared as financial products subject to the Financial Advisory and Intermediary Services Act (FAIS). Therefore, all crypto platforms and issuers/sponsors will be required to register with the FSCA as financial services providers (FSPs).

Currently, crypto offerings and providers are not regulated in South Africa. According to the FSCA, regulatory interventions are necessary to check crypto scams in the country.

In October, South Africa traded up to $9.3 million in volume of peer to peer (P2P) Bitcoin transactions. Only Nigeria traded more in Africa ($32.3million).

Suggested read: Here is How Nigeria’s SEC Plans to Regulate Cryptocurrencies, BlockChain Companies

The draft by the FSCA seeks to enforce certain aspects of the position paper earlier published by the Crypto Assets Regulatory Working Group (CAR WG).

Although the FSCA says it is working to secure crypto investments by South Africans, will the regulations enable or stifle crypto usage in the country?

Crypto Exchanges Cannot Operate Without a Licence

Part of the FSCA’s policy stance is the classification of crypto assets including Bitcoin and Ethereum as financial products.

If implemented, all crypto asset providers must be authorised as financial service providers as services related to the buying and selling of crypto assets will be included in the licensing activities under the Conduct of Financial Institutions (COFI) Bill.

Suggested read: Here are the Top 5 Exchanges to Buy and Sell Bitcoin and Other Cryptos in Africa

All crypto issuers must then comply with the relevant FAIS requirements, meaning that they will not be able to operate legally unless they have obtained an FSP licence according to the FAIS Act.

Even after the arduous process of applying for an FSP licence and the payment of application fees, there is no guarantee that it will be granted.

The independent operation of cryptos is one of the biggest factors responsible for the exponential increase in its provision and use in South Africa. That said, these stringent terms could lead to the closure, or proscription of many existing crypto platforms in South Africa and inhibit the emergence of new crypto innovations.

Tax Burden On Crypto Services

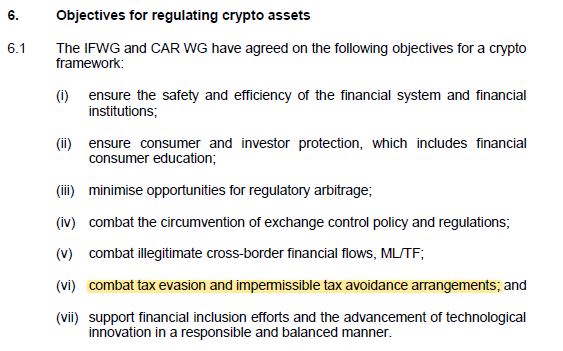

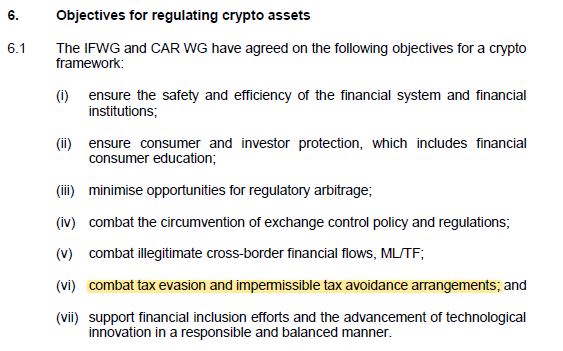

Crypto exchanges and operators who are duly licensed by the FSCA will be mandated to remit all taxes payable by financial service providers (FSPs).

The autonomous nature of crypto exchanges means that they are not required to pay any type of tax on their revenues or profits. But the FSCA regulations will effectively see crypto companies charged with taxes including corporate income tax, capital gains tax and Value Added Tax (VAT).

While the government is looking to augment its dwindling tax revenues post-COVID-19, these taxes would constrain a number of crypto entities in the country if they are not able to fulfil tax obligations.

Added to this is the fact that it could disincentivise prospective crypto companies from operating in South Africa because one of the major strengths of cryptocurrencies is the incredibly cheap rate of transfers. Having tax obligations might force exchanges to hike charges and that won’t be good for the sector.

Reaping where it didn’t sow?

Going by the regulatory policy guidelines released by the FSCA, there are really no measures proposed to create a more enabling environment for crypto issuers and investors.

There seems to be no policy to protect them, no laws to insure them, no plans to legitimise cryptocurrencies which would in turn spur adoption and cause a massive boom in the revenue of these crypto exchanges etc.

In essence, the South African regulator appears to be reaping where it doesn’t have any plans to sow. Regulation ought to be a two-way street where both the government and operators take and give. This doesn’t seem to be the case here.

In what almost seems like a clampdown on all crypto services, existing crypto businesses in South Africa will be allowed to continue operations only after an application for an FSP licence has been granted.

Chainalysis ranks South Africa as having the 7th highest crypto adoption in the world, but its position could go down drastically if the country’s financial regulator proceeds to implement proposed crypto regulations.