Nigerian fintech startup, Wallets Africa has collaborated with global payments giant, Visa to offer customers physical Visa cards for local and international payments.

The partnership has been forged through Wallets Africa’s participation in Visa’s Fintech Fast Track program.

Wallets Africa CEO, John Oke stated that the company was delighted to welcome Visa as its latest partner to drive the expansion of its fintech solutions across Africa.

We’ve been working with technology suppliers across the world since inception to help offer world-class financial services to Africans, we are very excited to have VISA onboard as we continue on our journey.

John Oke, CEO Wallets Africa

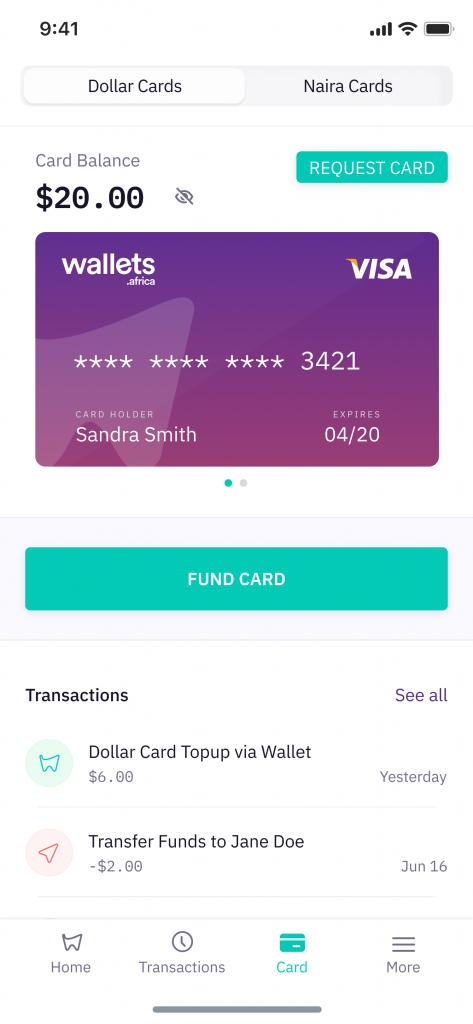

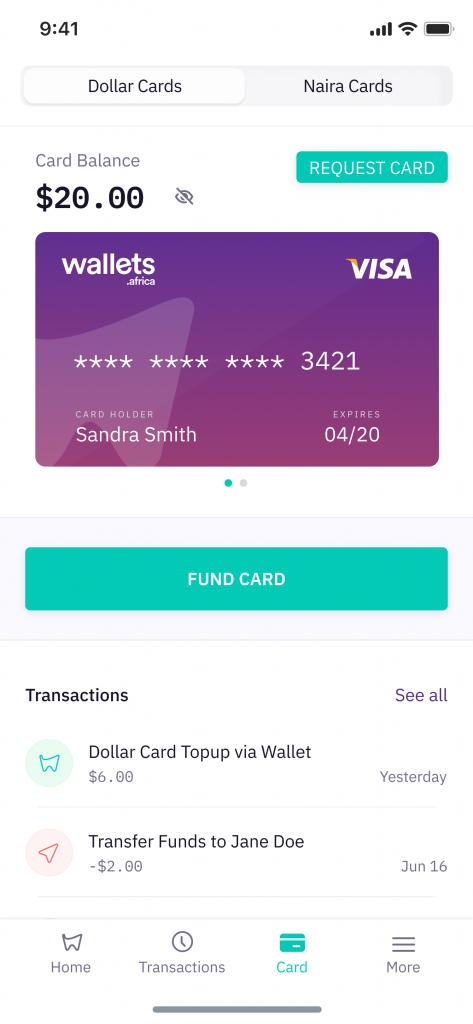

Founded in 2018, Wallets Africa has enabled customers across Africa to transact via its app locally using personalised virtual debit cards and internationally using virtual dollar cards.

Suggested read: Visa Partners Ghana’s Zeepay to Ease Diaspora Payments Through Direct Money Transfer

Operational in Nigeria, the Lagos-based fintech provides users with a platform for money transfers as well as airtime and data top-up. Users can make online payments for subscription on streaming services such as Netflix and check out with cards during e-shopping on Amazon, Jumia, among others.

Also, customers in Nigeria are able to send money to mobile money accounts in Ghana and Kenya.

Formerly known as Wallet.ng, the fintech startup has so far raised $150,000 seed capital from Y-Combinator and undisclosed funding from Microtraction and angel investors.

Physical VISA Cards for Wallets Africa Customers

Wallets Africa’s partnership with Visa will facilitate the issuing of physical Visa-powered personalised (NGN) debit cards and dollar cards to cater to a greater number of users across Africa. According to Wallets Africa, over 4,000 businesses are using the fintech’s payments solution for businesses.

Wallets Business which allows small businesses to quickly open current accounts and easily undertake payroll management and bulk payouts has played a part in the startup amassing over 4,000 users across Africa. The fintech believes that the Visa deal will facilitate a wider reach to customers who want to make offline payments using physical debit cards.

Although the company had been providing users with virtual Visa debit cards before now, Wallets Africa Digital Marketing Manager, Franklin Ugobude stated that physical cards are a more direct payments solution for customers.

Before now, we were already issuing virtual cards with our card technology and physical Visa cards needed to come into play because of our customers. This new partnership is more direct so we’re very psyched about it.

Franklin Ugobude, Wallets Africa Digital Marketing Manager

While Wallets Africa users can still transact online using virtual cards, the physical cards present customers with a reliable alternative for offline transactions.

Visa’s collaboration with the Nigerian fintech company is another addition to its rapidly growing list of Africa fintech partnerships. The American multinational financial services company recently partnered Ghana’s Zeepay to ease diaspora payments through direct money transfer.

Between 2018 and 2020, Visa has led investments of over $400 million in African fintech startups including Interswitch, MFS Africa, Flutterwave and Paystack.

Speaking on partnering with Wallets Africa, Visa’s Vice President of Innovation and Strategic Partnerships, Otto Williams said:

“The Wallets Africa team has made tremendous progress in a short period of time. I am impressed with the fact that they’ve successfully enabled Visa prepaid cards that work everywhere to thousands of digital natives and entrepreneurs in Nigeria. I look forward to seeing what they’ll do in other African countries soon.”

Wallets Africa will be looking to leverage its latest partnership to widen its scope and scale beyond Nigeria, Kenya and Ghana into other African countries.