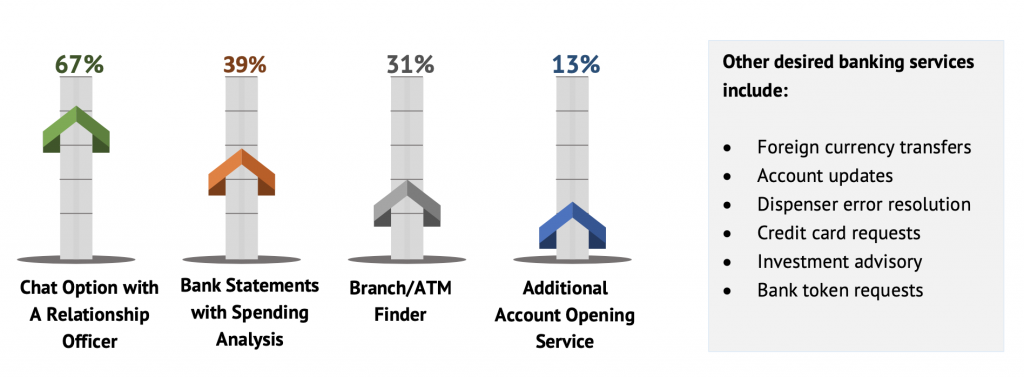

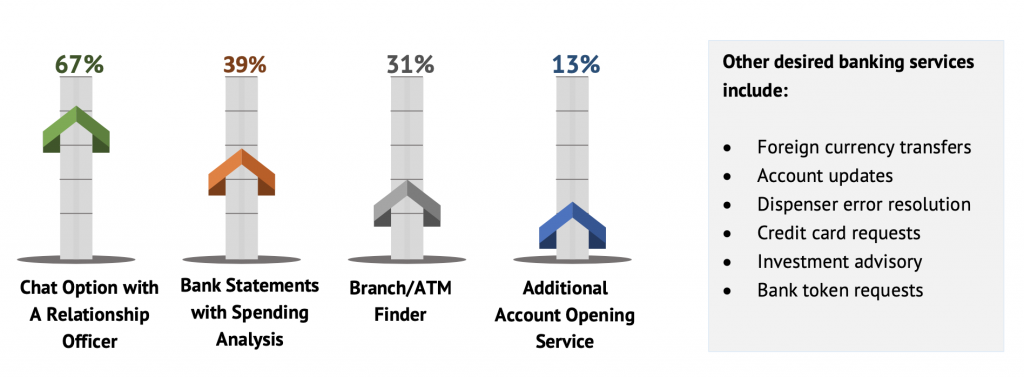

67% of bank customers in Nigeria desire physical chat options with relationship officers to fulfil basic banking needs such as Foreign currency transfers, credit card requests, investment advisory and bank token requests.

This was one of the key revelations in the Agusto & Co.’s 2020 Consumer digital banking satisfaction index for Nigerian banks released recently.

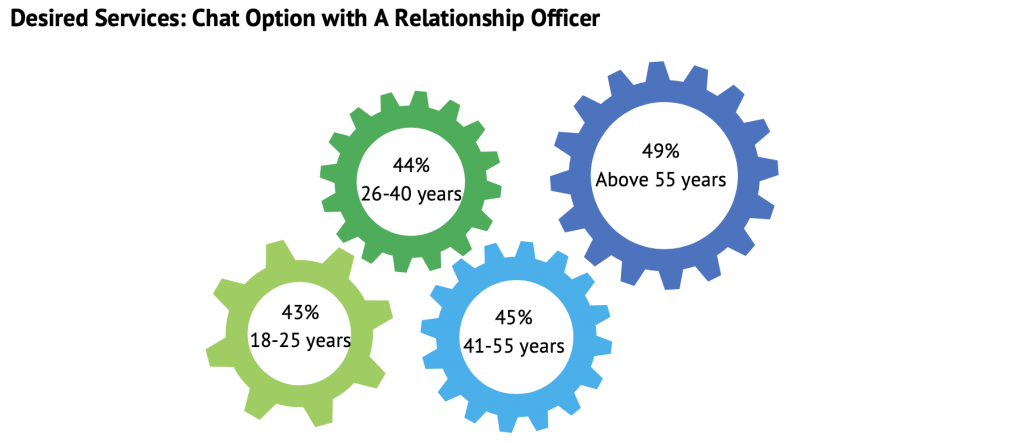

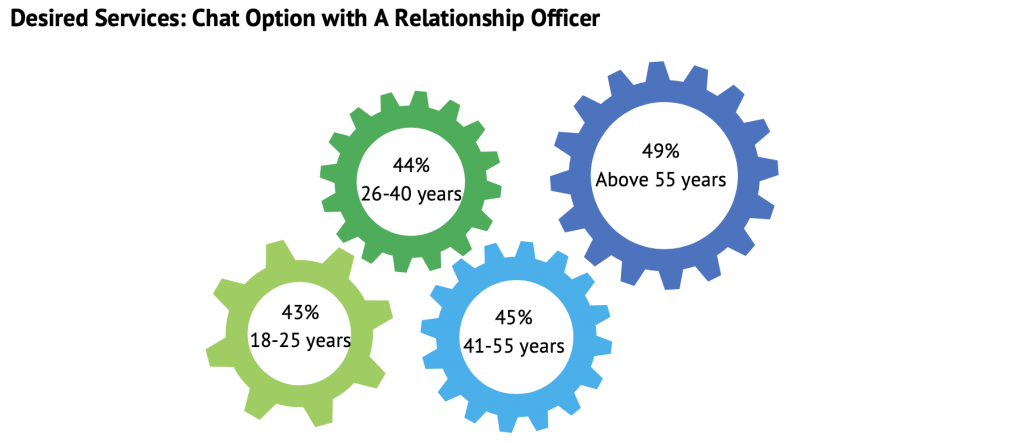

A further breakdown shows that majority of the respondents are in the baby boomers generation (above 55 years). On the contrary, 26% of millennials prefer to bank on their digital platforms instead. This is not surprising as they are typically more technology savvy and less keen on human interactions.

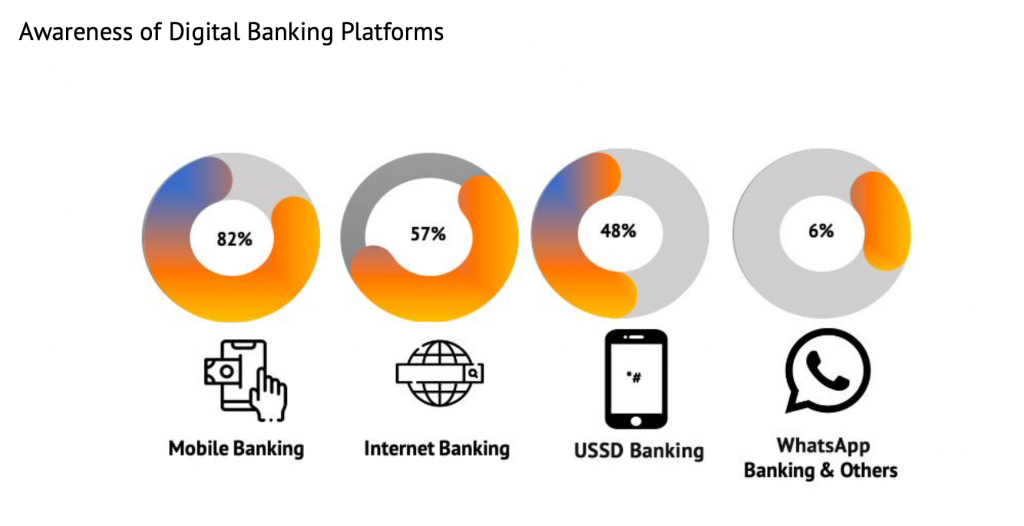

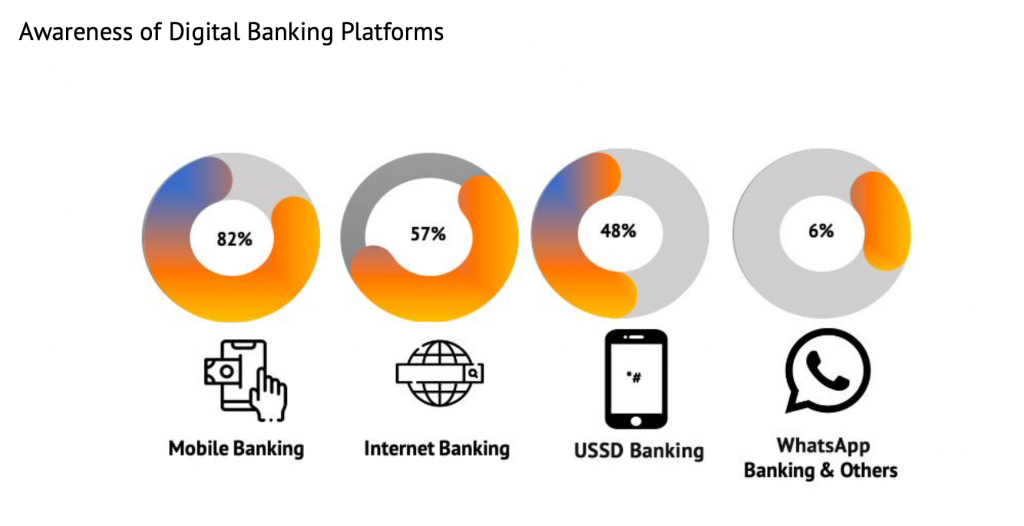

Interestingly, the report shows that a lot of bank users are familiar with digital banking platforms. The use of mobile banking applications has grown significantly owing to a five-year compound annual growth rate of mobile phone users by 6% to 184.4 million as the end of 2019.

82% of the survey respondents are aware of their respective bank’s mobile

banking service. 48% say they are very conversant with their banks USSD platforms, indicating an increase from 45% awareness in the 2019 survey.

The respondents are least aware of WhatsApp and other virtual banking platforms i.e. the chatbot service and telephone banking.

Digital banks are not as popular

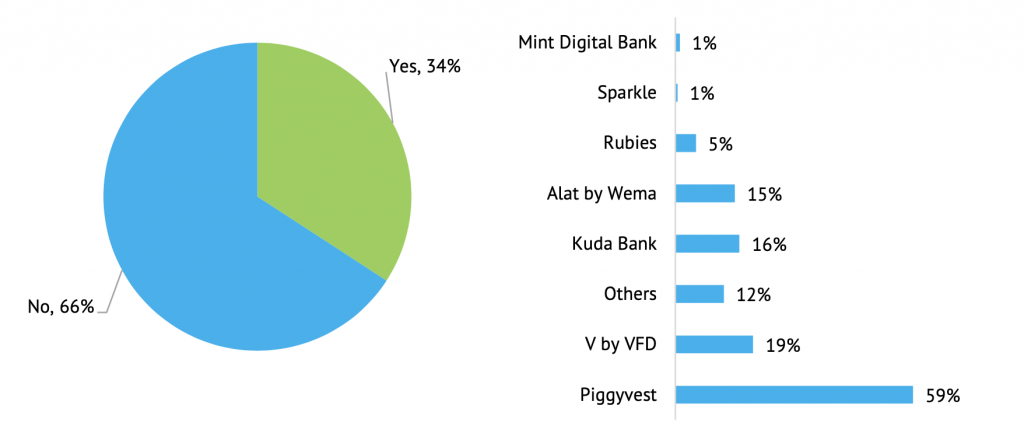

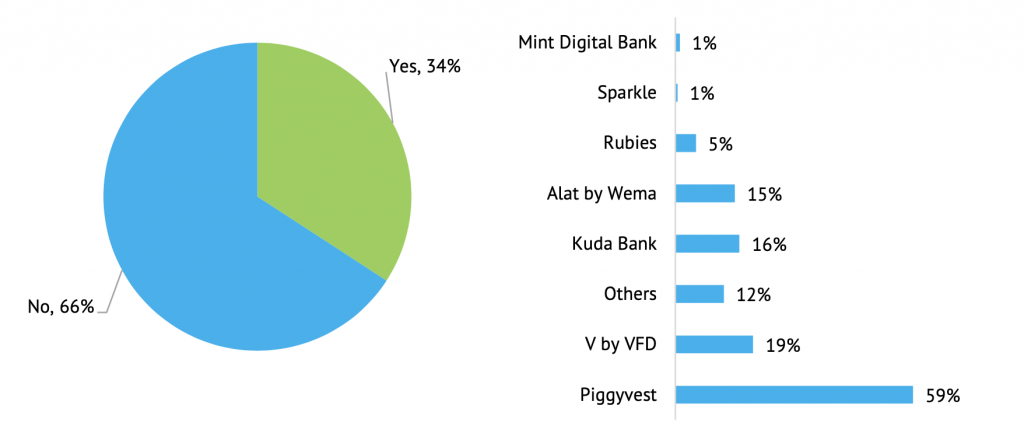

Despite the recorded awareness of digital banks in the past 3 years, only 34% of the respondents of the survey say that they have experienced the service of digital banks or have an operational bank account with any.

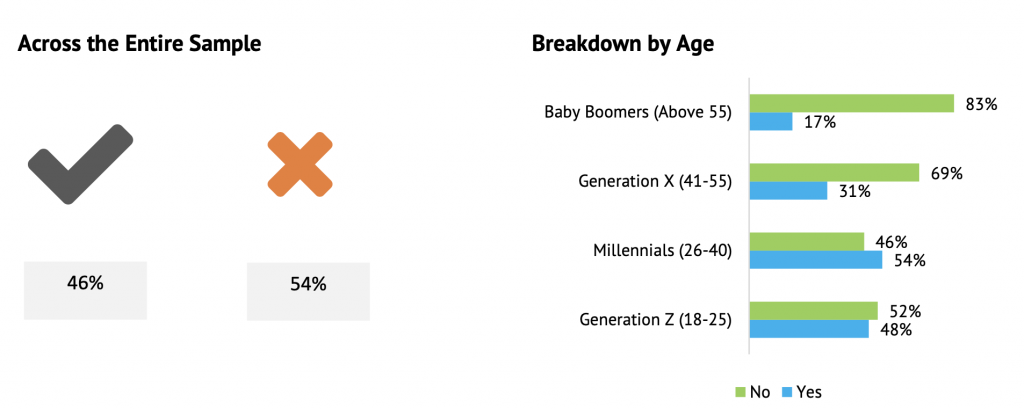

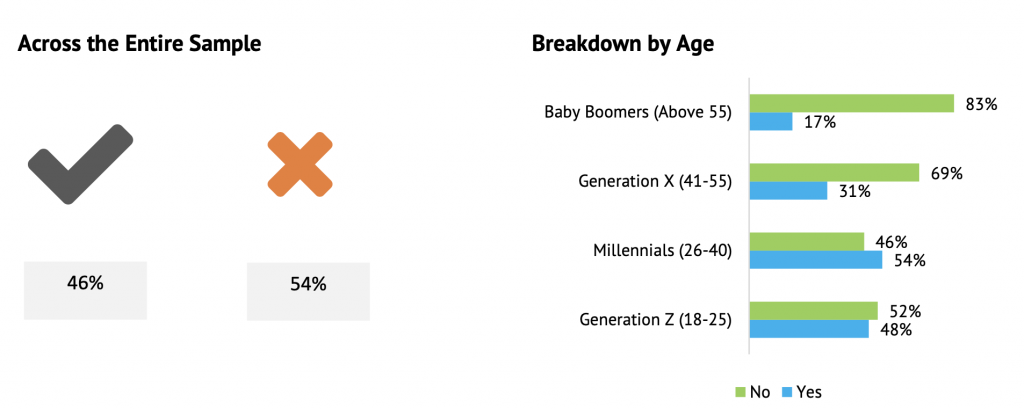

Approximately 46% of the survey respondents are knowledgeable about the services of the digital/neo banks. In fact, only 17% of respondents above the age of 55 years are aware of their services. For Generation X, the awareness rate stood at 31% while the Generation Z number stands at 48%.

However, the 26-40 age group had the highest level of awareness (54%). This indicates a huge knowledge market awareness gap for the players and an opportunity for the players to penetrate the retail space.

As seen above, the survey report further indicates that Piggyvest holds a huge majority of the market share with a significant 59% of account holders. The other leaders in space include V by VFD (V Bank) with 19%, Kuda Bank with 16% and Alat by Wema with 15%.

About the report

Agusto & Co.’s 2020 Consumer digital banking satisfaction index for Nigerian banks takes into account factors such as ease of navigation, range of services available on the platforms, the level of awareness, perceived security strength and transaction success rates on banking platforms.

These factors were embedded in the survey questions administered and then aggregated using various weightings, with responses benchmarked to expected performance indicators developed.

The report indicates the strengths, perceptions and perceived weaknesses of Nigerian banks and makes appropriate recommendations as well. This 2020 report shows that with increasing homogeneity in the services which banks provide across their digital channels, the ability to provide good customer service is a key differentiating factor and also essential to enhancing user experience.

Hence, there is a need for more dedicated investments in customer service and relationship management to support growing traffic across digital banking channels.

You can download the full report here.