Nigerian fintech startup, Paystack has launched a pilot phase in South Africa to offer payment solutions to businesses across the country.

According to a Paystack blog statement, the company had been working together with several South African local businesses and programmers in the past couple of months to tailor its solution to their specific needs.

We’d like to say a big thank you to the business owners and developers who’ve worked closely with us over the last many months to better understand the needs of South African makers. It’s still early days, so there are still a few rough edges, but we’re thrilled by the early results and excited to open our doors to more businesses who are eager to take Paystack for a spin.

Paystack

“And now during the pilot phase, we’ll continue to refine the payment experience, introduce more payment channels, and optimise our free business tools to support incredible growth for South African businesses,” the statement read.

The South African launch is still in its test phase, with Paystack stating that it will increase payment options and enhance available business tools as it prepares to fully go live in the country.

South Africa, after Nigeria and Ghana, becomes the third country in Africa where businesses can now accept online payments using Paystack.

Paystack’s launch in South Africa follows its recent $200 million record acquisition by global fintech giant, Stripe.

What You Need to Know

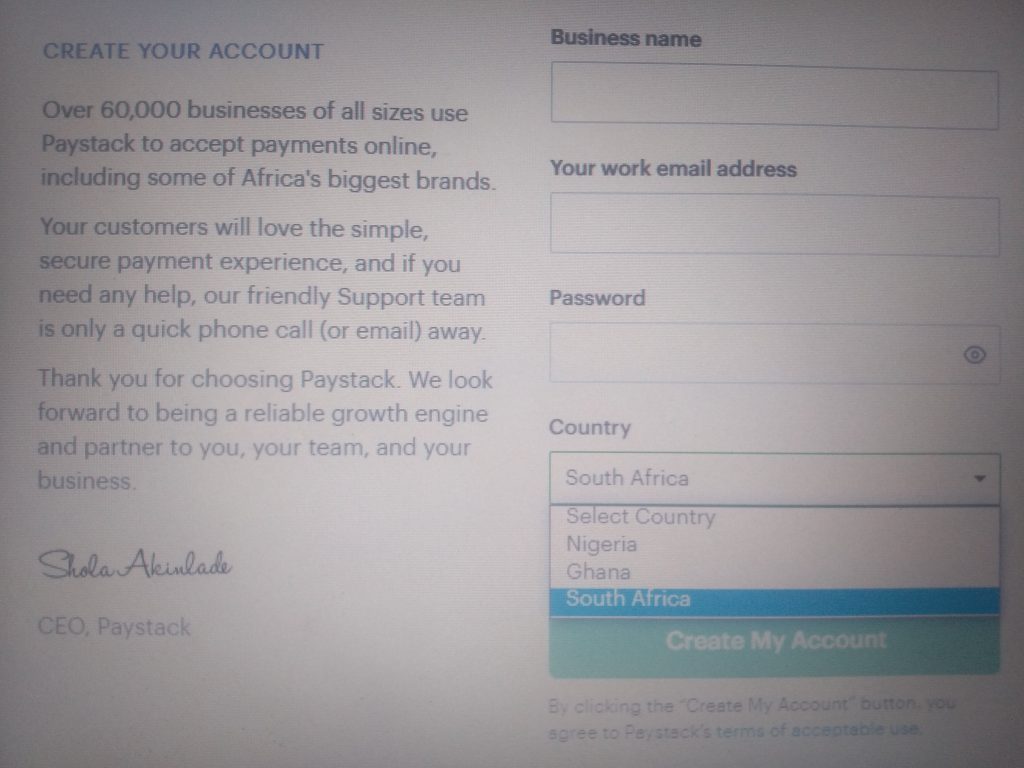

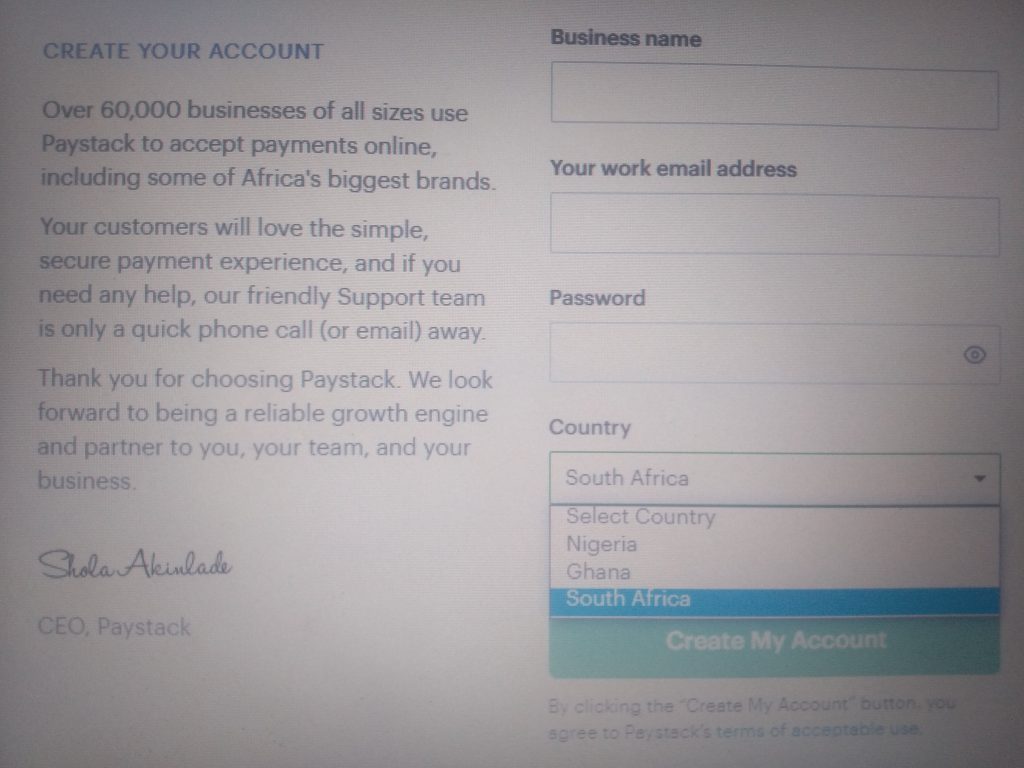

By creating an account, South African businesses can join the Paystack Pilot waitlist. South Africa has consequently been added to the list of countries on Paystack’s sign up page.

After creating an account, businesses can access plugins to e-commerce platforms including Shopify, WooCommerce and Wix. APIs and SDKs for custom payment and fraud detection tools will also be available.

While merchants can set up their accounts, they will not be able to receive real payments until they submit an activation request which, if approved, places them on the pilot waitlist.

After you submit your activation request, we’ll place you on the pilot waitlist. We’ll then review this waitlist every two weeks, and enable a small number of merchants to start accepting payments with Paystack after each review cycle.

Paystack

Paystack says that it will take about seven working days for approved businesses to receive payments during the pilot. But this is only before the platform goes live after which payments will be received within a shorter time.

For now, payments to South African businesses from customers will only be accepted via Visa, Mastercard and American Express cards.

With almost 3 million SMEs and a fintech adoption rate of 82% in 2019, South Africa represents a potentially huge market for Paystack.