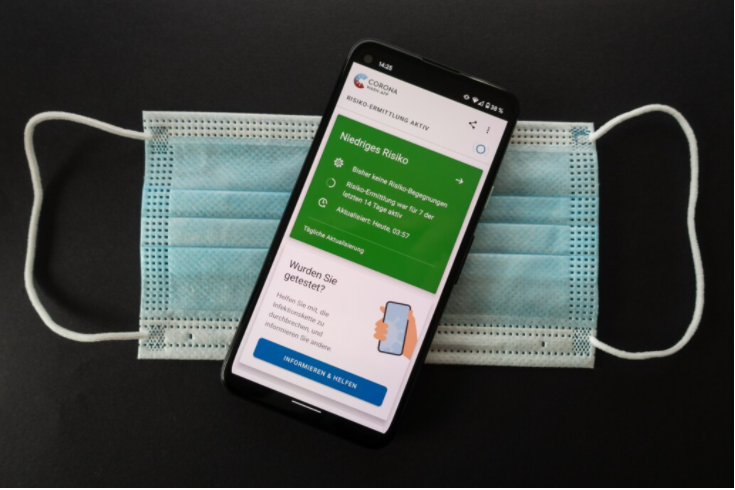

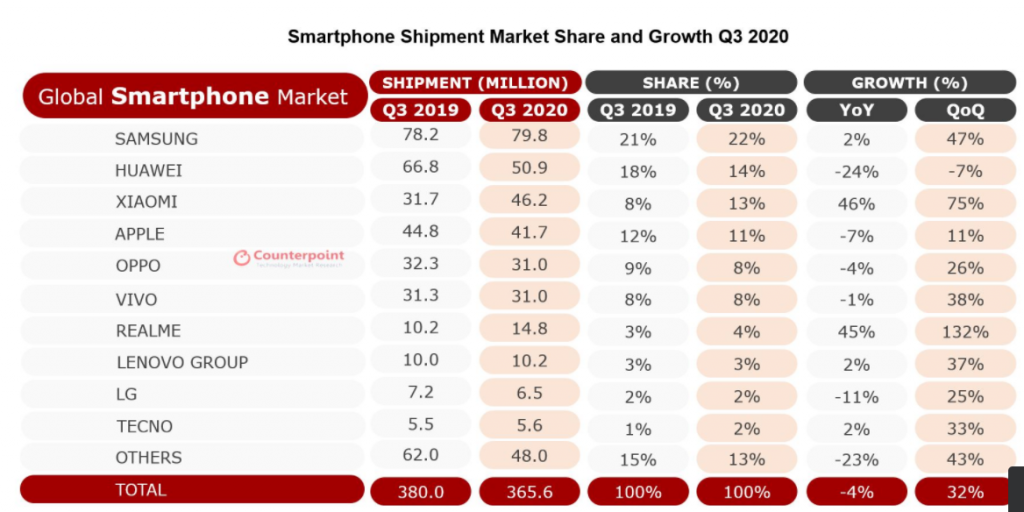

Global smartphone shipments have started showing great signs of recovery after the shock drop caused by the pandemic. According to Counterpoint, global market shipment grew by 23% Quarter on Quarter to reach 366 million units in Q3 2020.

While Canalys’ report differs slightly from Counterpoint’s, it also reports growth. Canalys’ research data shows that worldwide smartphone shipments reached 348 million units, representing a 22% rise from the total sales in the second quarter.

Tarun Pathak, Counterpoint’s Associate Director, attributed the recovery in global smartphone sales to the return to normal after the ease in lockdown conditions in major markets.

“Eased lockdown conditions in all key markets made way for exports and imports, thus streamlining the supply chain again. Also, the pent-up demand due to lockdowns helped the smartphone market take a recovery trajectory.”

Tarun Pathak, Counterpoint’s Associate Director

However, despite the growth, the total shipment recorded still falls short of last years number by about 4%. Pathak explained that while China and Vietnam have started operating at their normal levels, there are still some supply issues as some plants are still operating at low percentages.

Suggested read: Samsung Posts Record 25% Revenue Increase in Q3 2020 as Smartphone Sales Boom

Samsung Regains Top spot

After a massive drop in sales in Q2, Samsung has rebounded in Q3 to regain top spot in the smartphone market. The company shipped a whopping 79.8 million units during the quarter. This represents a 47% QoQ and 2% YoY growth. This is a huge climb from 27.1% YoY decline last quarter.

This is the highest shipment by Samsung in a quarter within the last three years.

Huawei fell to number 2 on the global market chart after its sales plunged during the third quarter. Counterpoint reported that its sales dropped by 24% YoY to 50.9million units.

Similarly, Canalys reported that Huawei shipped 51.7 million smartphones, a 23% year-on-year drop and a 7% drop from the previous quarter. The significant drop in numbers was most probably caused by the loss of Google services among other difficulties caused by the US sanctions.

Suggested read: Global Smartphone Shipment Suffers Huge Decline in Q1 2020 Due to Covid-19

Xiaomi displaces Apple in 3rd spot

Xiaomi has overtaken Apple for the first time on the global smartphone market. The company became 3rd biggest smartphone player after growing 75% QoQ to grab 13% of smartphone sales during the quarter.

In total, Xiaomi achieved its highest ever shipment with the sale of 46.2 million units in the quarter. Mo Jia, an analyst at Canalys explained that Xiaomi ‘aggressively’ picked up in the areas Hauwei was lacking in.

“Xiaomi executed with aggression to seize shipments from Huawei. There was symmetry in Q3, as Xiaomi added 14.5 million units and Huawei lost 15.1 million. In Europe, a key battleground, Huawei’s shipments fell 25%, while Xiaomi’s grew 88%.”

Mo Jia, an analyst at Canalys

Apple, now in fourth place, shipped 41.7 million iPhones during the quarter. This represented a 7% YoY decline but also shows good recovery as sales rose by 11% QoQ. Counterpoint explained that the drop in sales was due to shifting of iPhone 12 launch from Q3 to Q4.

Another firm IDC expects Apple to grow in the coming quarters with strong early demand for iPhone 12.

Oppo completes the top 5 list of smartphone market players. The company sold 31 million units, representing a 265 quarterly growth but a 4% YoY.

Realme Joins the big league

Another notable growth recorded in the market during the quarter was the steep rise of Realme. The smartphone company recorded a whopping growth of 132% QoQ in shipments volume.

This the strongest growth momentum among major smartphone players.

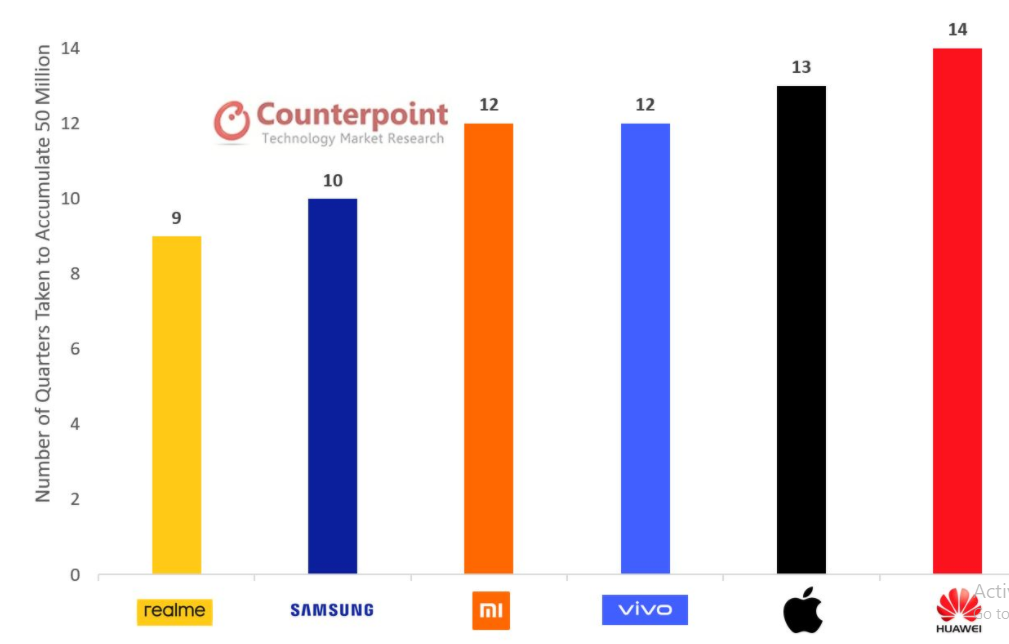

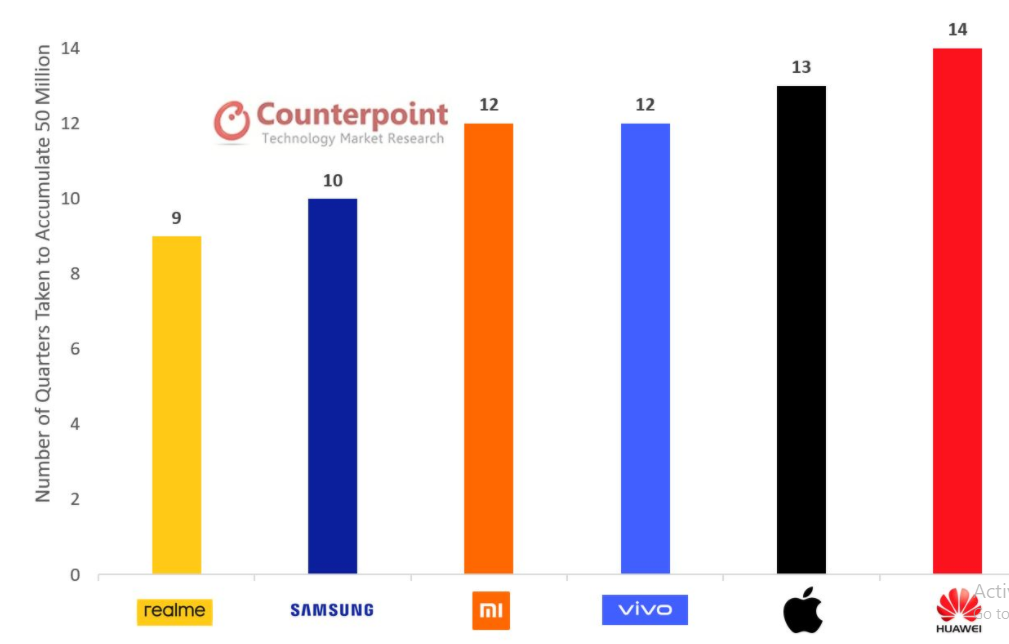

In total, Realme sold over 14.8 million units during the quarter. Kumar revealed that Realme is the fastest brand to hit an accumulated 50 million units in shipments since its inception, surpassing top players such as Samsung, Apple, Huawei and Xiaomi.

He added that having released a strong 5G smartphone portfolio during Q3, Realme also achieved remarkable growth in the Chinese market (90% QoQ in terms of sales volume).

Shipment of 5G smartphone booms

The total 5G smartphone shipments in Q3 exceeded the cumulative shipments of H1 2020. The reports show that 5G shipments grew 82% QoQ.

According to counterpoints, the growth was driven by 5G devices becoming cheaper with sub-$300 price band offerings from Huawei, Vivo, OPPO, Xiaomi and OnePlus.

Huawei accounted for 40% of the total 5G shipments, thanks to strong performance in China.

Aman Chaudhary, Research Analyst at Counterpoint explained that the launch of iPhone 12 series in Q4, Apple will be the key to driving 5G volumes in markets like the US, Canada and Western Europe.

Summary

All major smartphone players except Hauwei saw considerable quarterly growth as they recover slowly from the effect of the pandemic.

Overall, total smartphone sales during the quarter increased by about 23% and are expected to keep growing in the next quarter with the launch of the iPhone 12 and new growth sprout of Realme.